New Jersey Statement to Add to Credit Report

Description

How to fill out Statement To Add To Credit Report?

Are you in a situation where you frequently require documents for both business or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can rely on is not easy.

US Legal Forms provides a vast selection of form templates, such as the New Jersey Statement to Add to Credit Report, which can be customized to comply with federal and state regulations.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes.

The service offers professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the New Jersey Statement to Add to Credit Report template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct state/region.

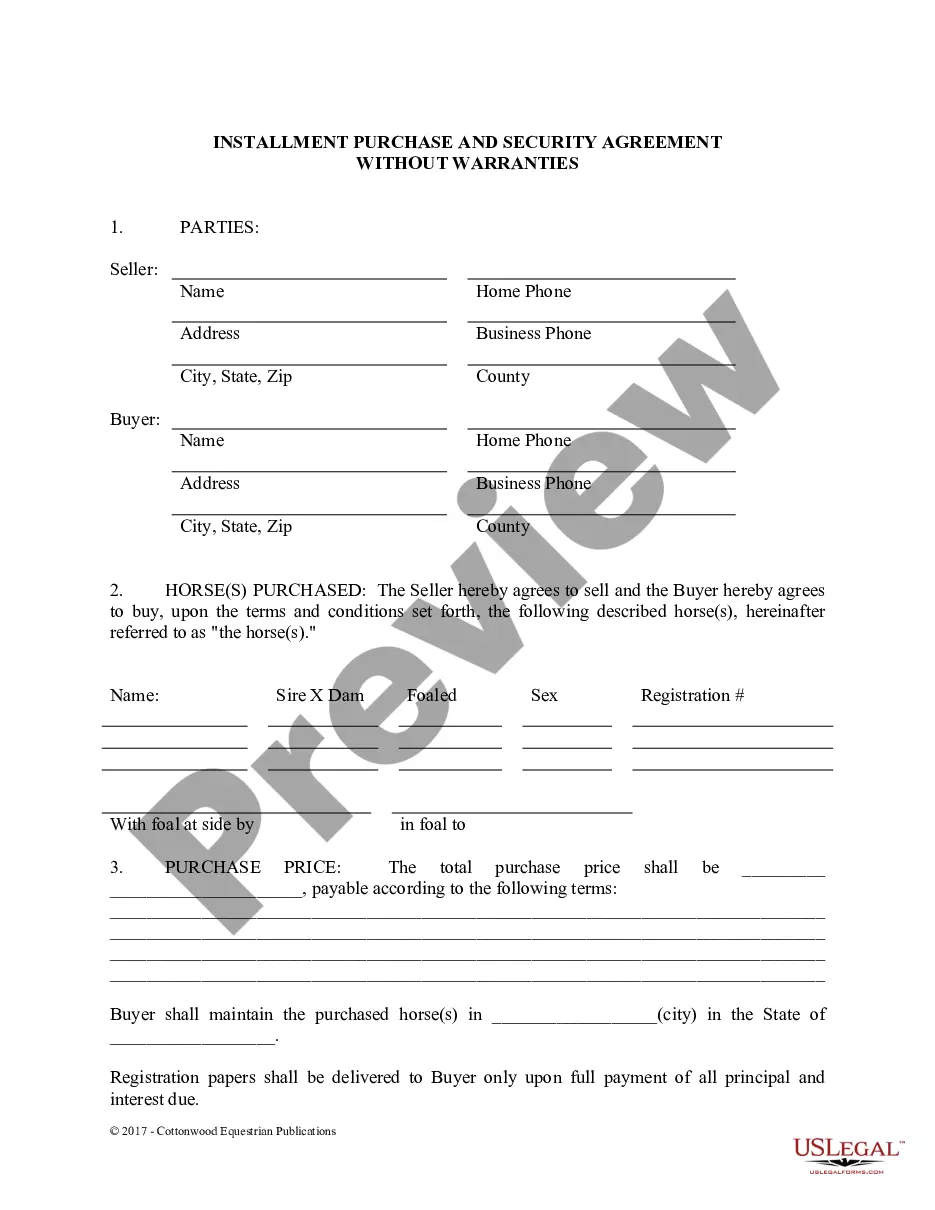

- Use the Preview button to review the form.

- Read the description to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and requirements.

- Once you find the correct form, click on Get now.

- Select the pricing plan you prefer, provide the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- Choose a suitable document format and download your copy.

- Access all the document templates you have purchased in the My documents list. You can obtain another copy of the New Jersey Statement to Add to Credit Report at any time. Click the desired form to download or print the document template.

Form popularity

FAQ

To add a statement to your credit report, you first need to contact the credit reporting agencies directly. You will typically need to provide a written statement explaining your situation or the reason for the statement. Using a New Jersey Statement to Add to Credit Report can be a straightforward way to communicate your circumstances. Platforms like uslegalforms offer guidance and resources to help you create and submit your statement effectively.

Building credit from 500 to 700 is a journey that typically takes several months to a few years, depending on your credit habits. Consistently making on-time payments, reducing your credit utilization, and maintaining a mix of credit accounts can significantly improve your score. Additionally, adding a New Jersey Statement to Add to Credit Report can help clarify your financial situation to creditors. Therefore, by following a solid plan and using resources like uslegalforms, you can achieve your credit goals.

You file an annual report for your LLC in New Jersey with the Division of Revenue and Enterprise Services, typically online. This ensures that your business remains compliant with state regulations. Keeping your reports current is crucial for maintaining a favorable New Jersey Statement to Add to Credit Report, which can enhance your business’s credibility.

In New Jersey, you can file a UCC statement with the Division of Revenue and Enterprise Services. This can be done online, which simplifies the submission process. By ensuring your filings are accurate and timely, you contribute positively to your New Jersey Statement to Add to Credit Report.

Yes, you can file a UCC (Uniform Commercial Code) statement yourself in New Jersey. The process is designed to be user-friendly, allowing you to submit the necessary documents without needing a lawyer. By using online resources, you can efficiently manage your filings and ensure your New Jersey Statement to Add to Credit Report reflects accurate information.

To file your annual report for an LLC in New Jersey, you can do so online through the New Jersey Division of Revenue and Enterprise Services website. This platform provides a straightforward process to complete your filing efficiently. Keeping your annual report current is vital to maintain your New Jersey Statement to Add to Credit Report in good standing.

If you do not file an annual report for your LLC in New Jersey, you may face penalties such as fines and late fees. Additionally, your LLC may become inactive, which can complicate your business operations. It's essential to maintain compliance to ensure your New Jersey Statement to Add to Credit Report remains positive and reflects your responsible business practices.

To add an account to your credit report, you should first contact the creditor or lender in question. Request that they report your account details to the major credit bureaus. Utilizing the New Jersey Statement to Add to Credit Report can also help you formally document this request and ensure it's processed. Consider using uslegalforms to access the necessary forms and guidance for a smooth process.

Yes, you can add a statement to your credit report. This is often referred to as a New Jersey Statement to Add to Credit Report, and it provides you the opportunity to explain any derogatory marks or issues that may appear on your report. It is important to write your statement clearly and keep it succinct to ensure it is taken seriously by lenders. If you need help, uslegalforms offers templates and guidance for creating effective statements.

The New Jersey Fair Credit Reporting Act is legislation designed to protect consumers by ensuring fair and accurate credit reporting. This law includes provisions that allow you to dispute inaccuracies in your credit report and add a New Jersey Statement to Add to Credit Report. Understanding this act can help you take control of your credit information and safeguard your financial reputation. For assistance, consider using resources from uslegalforms.