New Jersey Self-Employed Business Development Executive Agreement

Description

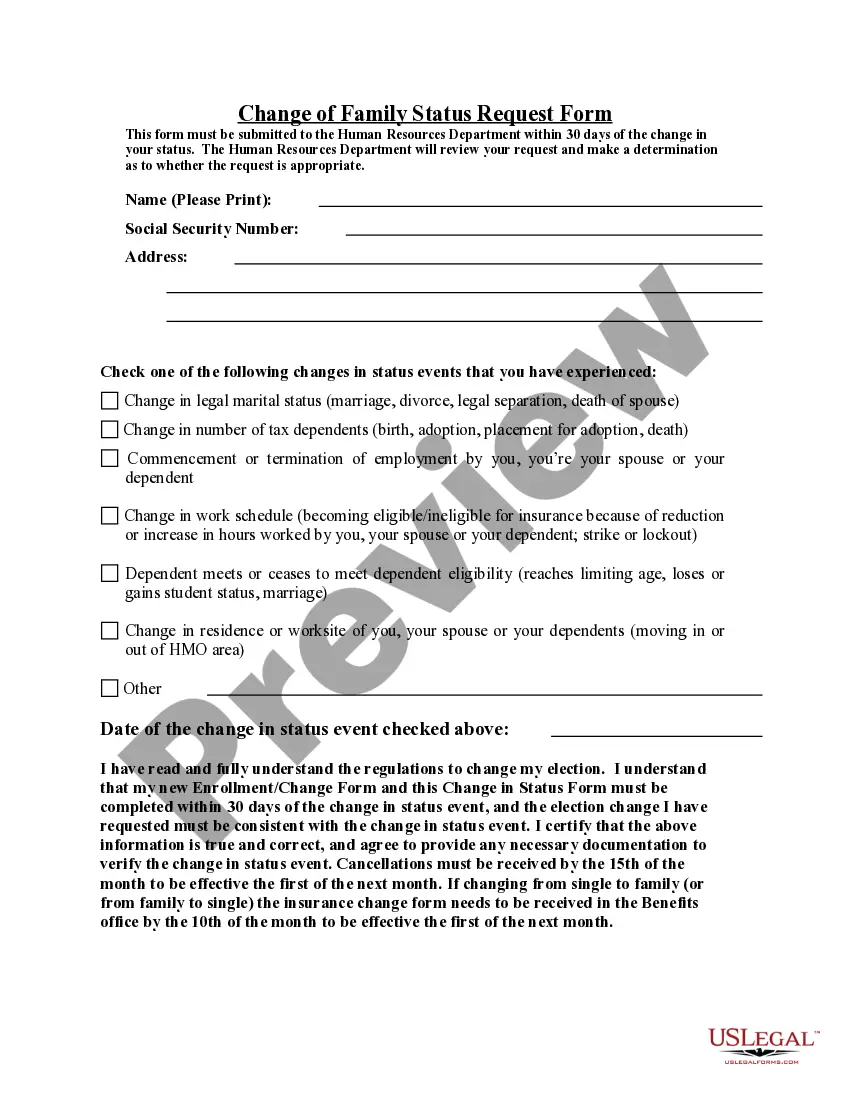

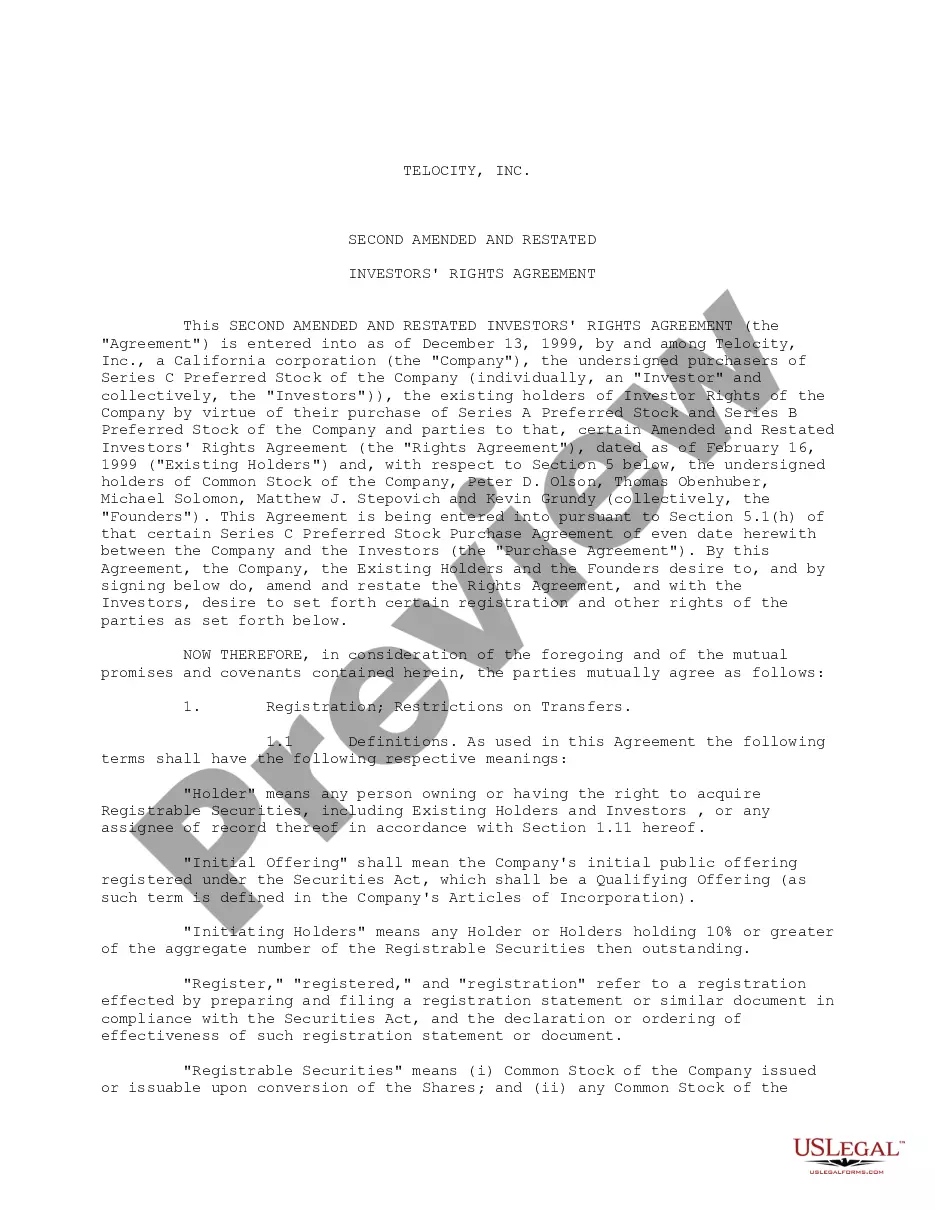

How to fill out Self-Employed Business Development Executive Agreement?

Have you faced a scenario where you need documents for either organizational or personal reasons almost daily.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of template options, including the New Jersey Self-Employed Business Development Executive Agreement, designed to comply with federal and state regulations.

Once you find the correct form, click Purchase now.

Choose your preferred pricing plan, complete the necessary details to create your account, and process the payment using PayPal or credit card. Select a convenient document format and download your copy. Access all the document templates you have purchased from the My documents section. You can download or print another copy of the New Jersey Self-Employed Business Development Executive Agreement whenever needed. Use US Legal Forms, the most extensive selection of legal documents, to save time and minimize errors. This service offers professionally crafted legal document templates suitable for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can download the New Jersey Self-Employed Business Development Executive Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/county.

- Utilize the Review option to examine the form.

- Read the description to confirm that you have selected the right form.

- If the form isn't what you're looking for, use the Search field to find the form that fits your requirements.

Form popularity

FAQ

The NJ CBT-100S is specifically for S Corporations operating in New Jersey. Only S Corporations that elect this status must file this return, providing information about their income and expenses. If you are engaged in a New Jersey Self-Employed Business Development Executive Agreement as an S Corporation, it's critical to meet these filing obligations.

The NJ CBT-100 is required to be filed by corporations that are subject to the Corporation Business Tax in New Jersey. This includes both domestic and foreign corporations operating in the state. If your business operates under a New Jersey Self-Employed Business Development Executive Agreement, ensuring timely filing of this form is essential to avoid penalties.

In New Jersey, self-employed individuals can take certain tax deductions which may reduce taxable income. These deductions can include business expenses that are necessary and ordinary for your trade. If you are involved in a New Jersey Self-Employed Business Development Executive Agreement, understanding these deductions can significantly benefit your overall tax strategy.

Yes, the New Jersey Corporation Business Tax (CBT) is primarily based on your business income. The tax rate varies depending on your income level and business type. If you're filing under a New Jersey Self-Employed Business Development Executive Agreement, it's crucial to calculate your taxable income accurately to ensure you're complying with NJ tax laws.

New Jersey imposes a corporate minimum tax on all businesses that are structured as corporations. This minimum tax applies to various entities, including those entering into a New Jersey Self-Employed Business Development Executive Agreement. Understanding this tax can help you plan better and avoid unexpected liabilities.

Yes, in New Jersey, LLCs must file an annual report to maintain good standing. This report includes necessary information about your business and ensures your compliance with state regulations. If you're establishing a New Jersey Self-Employed Business Development Executive Agreement, make sure to stay on top of your annual filing requirements.

To file a self-employment form in New Jersey, you will need to complete the appropriate forms, such as the NJ-1040 for individuals. It's important to include your self-employment income and any deductions you qualify for. Utilizing a service like USLegalForms can help simplify the process, especially when you're entering into a New Jersey Self-Employed Business Development Executive Agreement.

For a contract to be legally binding in New Jersey, it must contain certain elements such as mutual consent, legal purpose, and consideration. Additionally, all parties involved should have the capacity to understand the agreement. When you enter into a New Jersey Self-Employed Business Development Executive Agreement, ensuring these elements are satisfied can help secure enforceable agreements that protect your business interests.

In New Jersey, the standard cancellation period for most contracts is three days. However, specific types of contracts, such as real estate agreements or certain purchases, may have different cancellation terms. If you're navigating a New Jersey Self-Employed Business Development Executive Agreement, it's crucial to review the cancellation policy included in your contract to understand your rights.

A business development contract is a formal document that outlines the terms and conditions under which business development activities will take place. This contract typically details project scopes, deliverables, timelines, and compensation, ensuring both parties are aligned. For individuals working under a New Jersey Self-Employed Business Development Executive Agreement, having a solid business development contract protects your interests and enhances professional credibility.