New Jersey Hauling Services Contract - Self-Employed

Description

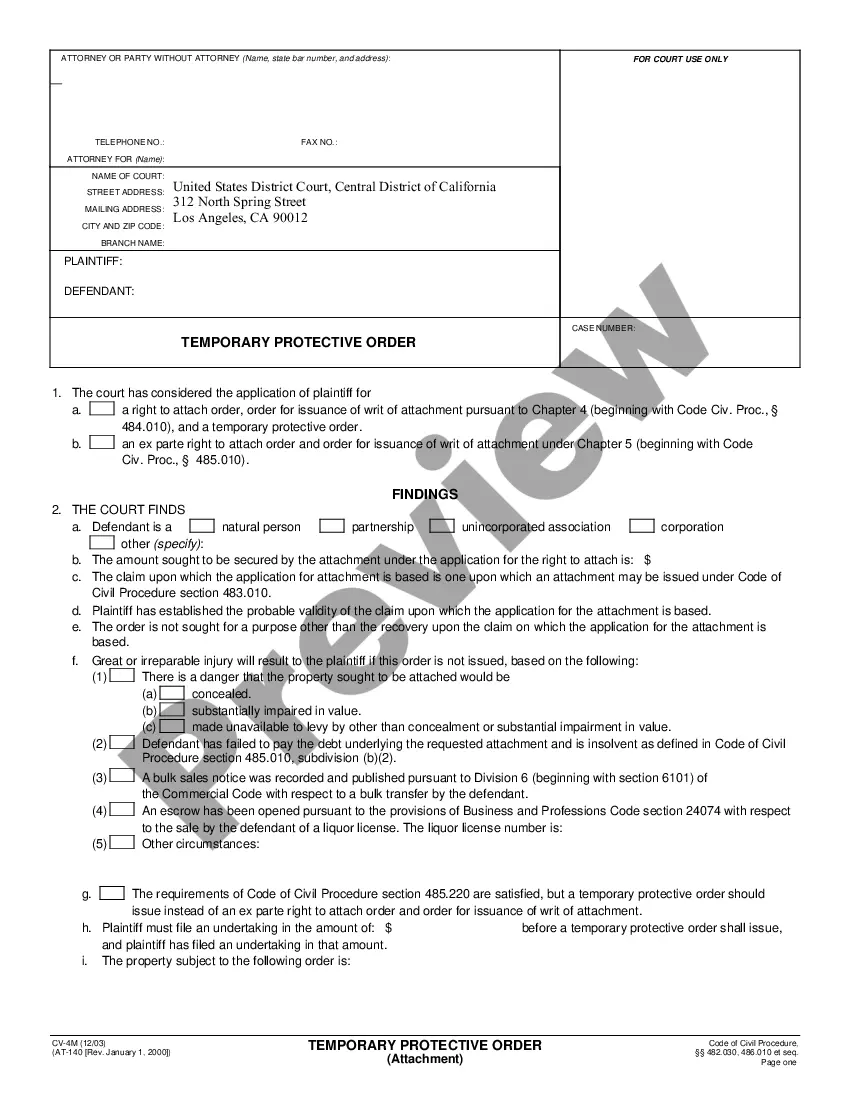

How to fill out Hauling Services Contract - Self-Employed?

If you desire to be thorough, obtain, or produce authorized document templates, utilize US Legal Forms, the most extensive assortment of legal forms available online. Take advantage of the site’s straightforward and convenient search to find the documents you require. Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to acquire the New Jersey Hauling Services Contract - Self-Employed with just a few clicks.

If you are currently a US Legal Forms user, Log In to your account and click the Download button to locate the New Jersey Hauling Services Contract - Self-Employed. You can also access forms you previously obtained from the My documents tab of your account.

If you are using US Legal Forms for the first time, follow the steps below: Step 1. Ensure you have selected the form for the correct city/state. Step 2. Utilize the Review option to examine the form’s details. Don’t forget to read the description. Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template. Step 4. Once you have identified the form you wish to obtain, select the Acquire now button. Choose the pricing plan you prefer and enter your information to register for an account. Step 5. Process the transaction. You can use your credit card or PayPal account to complete the payment. Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the New Jersey Hauling Services Contract - Self-Employed.

- Every legal document template you purchase is yours indefinitely.

- You have access to each form you acquired with your account.

- Visit the My documents section and select a form to print or download again.

- Be proactive and download, and print the New Jersey Hauling Services Contract - Self-Employed with US Legal Forms.

- There are numerous professional and state-specific forms you can use for your business or personal needs.

Form popularity

FAQ

Yes, New Jersey does not require an operating agreement for an LLC, but having one is highly recommended. This agreement sets out the management structure and operating procedures for your LLC. If you are a self-employed contractor in the hauling services industry, a clear New Jersey Hauling Services Contract - Self-Employed can serve as a complement to your operating agreement.

You can show proof of self-employment through invoices, a business license, or a copy of your filed tax returns. Additionally, maintaining a detailed financial record or a valid New Jersey Hauling Services Contract - Self-Employed also serves as helpful documentation that demonstrates your self-employed status.

To set up as a self-employed contractor, begin by obtaining any necessary licenses and registrations required in your state. Next, consider creating a professional website to showcase your services. Also, taking the time to draft a comprehensive New Jersey Hauling Services Contract - Self-Employed can help clarify your offerings and establish credibility with potential clients.

When writing a contract for a 1099 employee, you should emphasize the details of the job, payment structure, and tax responsibilities. A well-structured contract protects both parties and establishes clear guidelines. For a streamlined experience, use a New Jersey Hauling Services Contract - Self-Employed as a reference to cover all your bases.

To write a self-employed contract, start by detailing your services, fees, and work schedule. Additionally, include terms regarding termination and modification of the contract. For optimal results, look at a reliable New Jersey Hauling Services Contract - Self-Employed to ensure you include all necessary elements.

Writing a self-employment contract involves clearly defining the scope of work, payment terms, and project deadlines. You should also include essential clauses regarding confidentiality and liability. To make this task easier, consider using a New Jersey Hauling Services Contract - Self-Employed template from uslegalforms, which fully meets legal requirements and simplifies the process.

Yes, you can write your own legally binding contract as a self-employed individual. It's essential to ensure that your contract is clear, concise, and covers the necessary legal aspects to protect your interests. Utilizing a New Jersey Hauling Services Contract - Self-Employed template can simplify this process and provide a solid foundation.

Yes, subcontracting can be viewed as a form of self-employment. When you subcontract your services, you essentially operate as an independent contractor, which aligns with the concept of being self-employed. Therefore, it is important to have a solid New Jersey Hauling Services Contract - Self-Employed to outline the terms of your relationship with the primary contractor.

Yes, contract work is considered a form of self-employment. When you work on a contract basis, you essentially operate your own business. Understanding how this relates to your New Jersey Hauling Services Contract - Self-Employed can provide clarity on your rights and responsibilities.

Indeed, a self-employed individual can sign contracts, which serve as legal agreements for the services offered. These contracts are crucial for defining the working relationship and ensuring that both parties are on the same page. Utilizing a New Jersey Hauling Services Contract - Self-Employed will help in establishing clear terms.