New Jersey Convertible Note Financing

Description

Just like any other debt investment, senior convertible notes offer investors the ability to earn interest. Rather than cash payments, however, the interest payments typically will accrue and the amount the company owes the investor will increase over time.

Bothstartup companiesand well-established companies may opt to issue senior convertible notes to raise funds from investors. This type of company financing has the advantage of being fairly simple to execute. This means the process of issuing the notes is relatively inexpensive for companies and it allows them quicker access to investor funding."

How to fill out Convertible Note Financing?

US Legal Forms - one of many greatest libraries of legitimate varieties in the States - provides a wide range of legitimate file themes you are able to obtain or print. While using site, you can find a large number of varieties for company and person functions, sorted by categories, states, or keywords.You can find the newest models of varieties just like the New Jersey Convertible Note Financing within minutes.

If you already have a membership, log in and obtain New Jersey Convertible Note Financing through the US Legal Forms catalogue. The Obtain button will show up on each and every form you look at. You have access to all in the past acquired varieties within the My Forms tab of your respective accounts.

If you would like use US Legal Forms initially, allow me to share straightforward recommendations to obtain began:

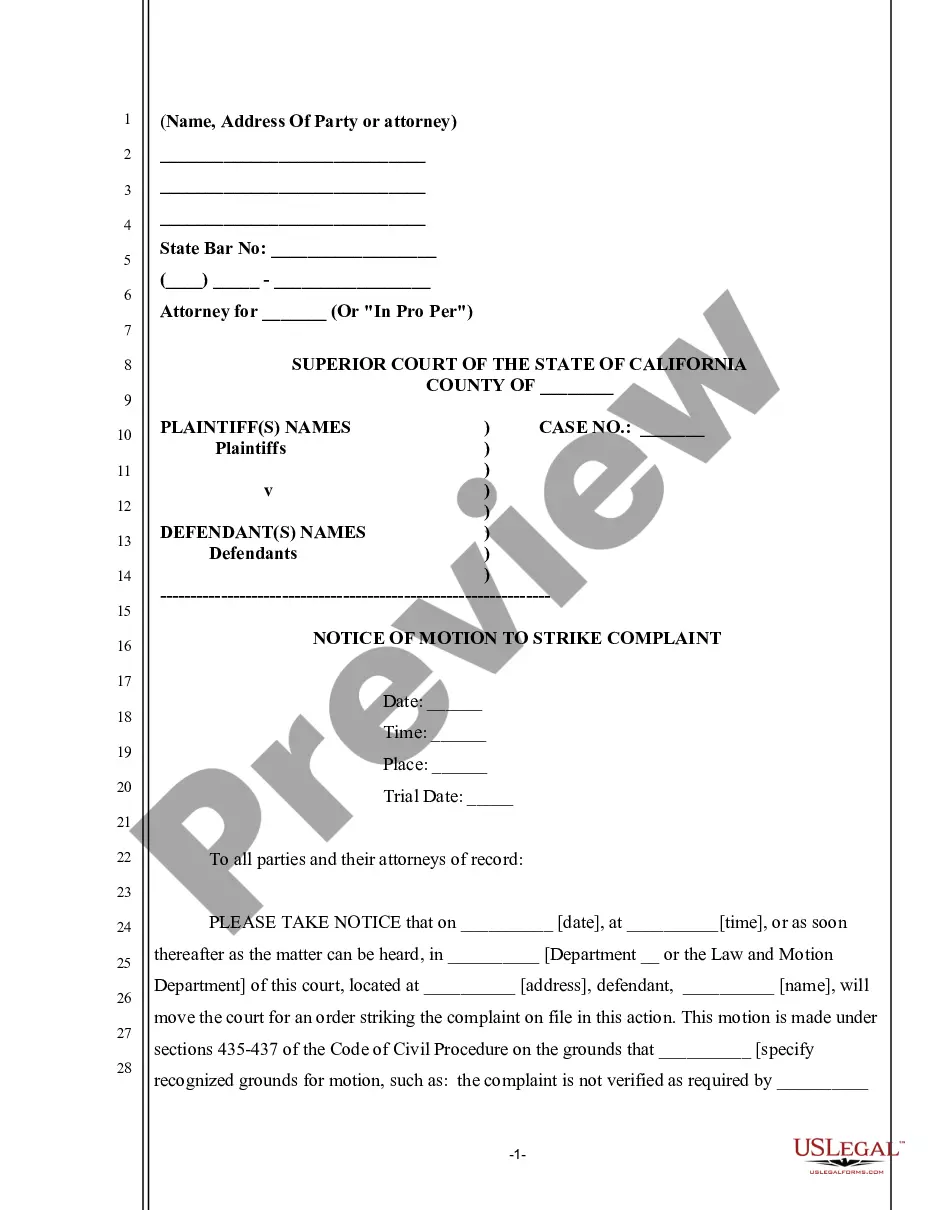

- Be sure you have chosen the best form for your metropolis/state. Select the Preview button to examine the form`s content material. Look at the form outline to ensure that you have chosen the right form.

- When the form does not suit your specifications, make use of the Search industry on top of the monitor to find the one who does.

- In case you are satisfied with the shape, verify your option by visiting the Purchase now button. Then, opt for the pricing strategy you want and supply your credentials to sign up to have an accounts.

- Approach the purchase. Make use of your Visa or Mastercard or PayPal accounts to complete the purchase.

- Pick the formatting and obtain the shape on your system.

- Make alterations. Fill up, modify and print and indication the acquired New Jersey Convertible Note Financing.

Each and every template you put into your account does not have an expiration time which is yours permanently. So, if you would like obtain or print another copy, just visit the My Forms portion and then click around the form you need.

Gain access to the New Jersey Convertible Note Financing with US Legal Forms, one of the most substantial catalogue of legitimate file themes. Use a large number of specialist and state-certain themes that fulfill your organization or person requires and specifications.

Form popularity

FAQ

The basic concept for valuing a convertible note is the same in theory as the valuation of any other financial asset. The value of the note is equal to the present value of the future income that the convertible note will receive, discounted to the present value based on its associated risk.

Even in the case of stated interest that is paid periodically, a holder of a convertible note may be taxed on interest that has accrued since the most recent interest payment date but has not yet been paid at the time of conversion.

So the cash coming in from your convertible note will generally equate to the liability that you add to the balance sheet. And, if your accounting is doing a good job, the accrued interest is a non-cash expense that flows through your income statement and impacts your accumulated net income in the equity section.

Simply multiply the convertible note's interest rate by the number of years that have passed since the convertible note was issued. In this case, we would multiply 6% by 5 to get an accrued interest of 30%.

Convertible loan notes are a hybrid form of debt finance, where funders offer a company an interest-bearing, repayable loan that's convertible into that company's shares at their discretion, or upon the occurrence of certain events.

Promissory Note. The Promissory Note (or Convertible Promissory Note) is the actual debt instrument in the deal. ... Note Purchase Agreement. ... Subscription Agreement. ... Note Holders Agreements and Voting Agreements. ... Subordination Agreement. ... Warrant to Purchase Stock.

Convertible Notes are loans ? so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).

Convertible loan notes can lead to dilution of existing shareholders' equity when the notes convert. This can be a disadvantage for start-ups that want to maintain control over their company.