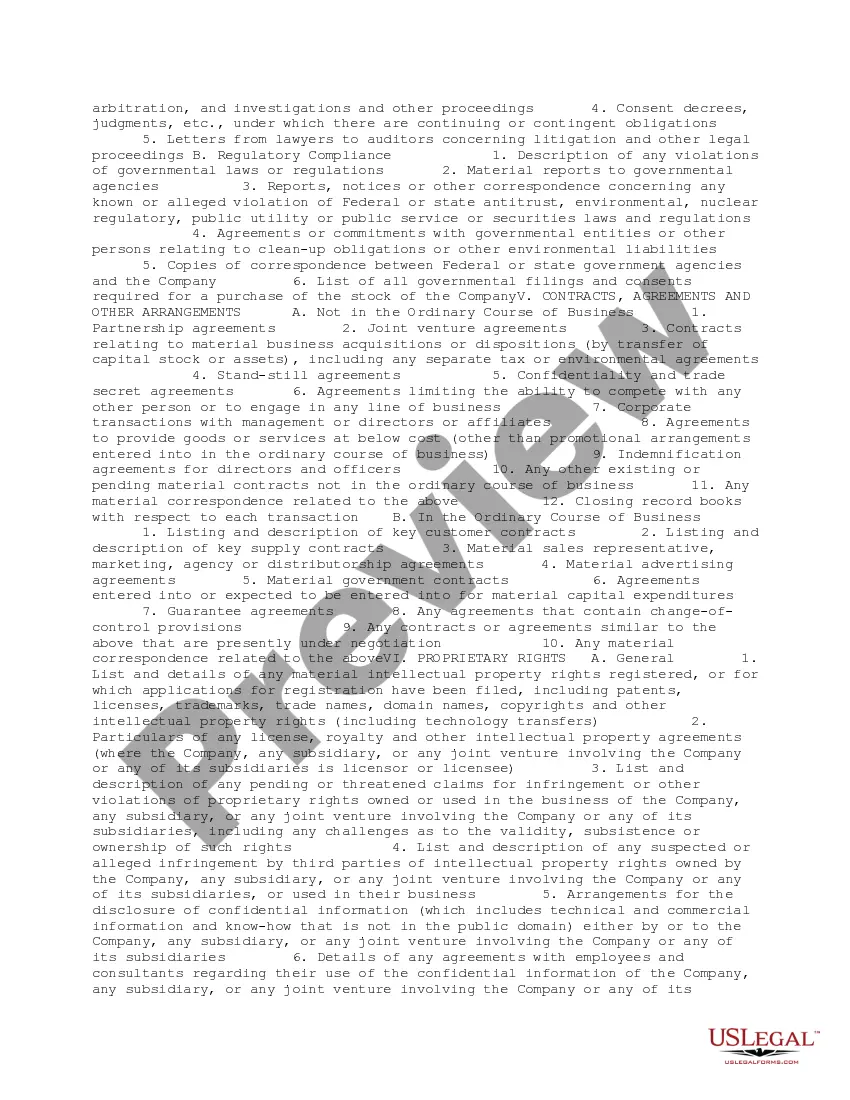

This form is a list of requested due diligence documents from a technology company for the purchase of shares of stock. The list consists of documents and information to be submitted to the due diligence team.

New Jersey Request for Due Diligence Documents from a Technology Company

Description

How to fill out Request For Due Diligence Documents From A Technology Company?

If you desire to sum up, obtain, or print official document templates, utilize US Legal Forms, the largest collection of official forms available online.

Make use of the site’s straightforward and user-friendly search to find the documents you need.

Many templates for business and personal purposes are categorized by types and states, or keywords.

Every official document format you purchase is your property indefinitely.

You will have access to every form you downloaded in your account. Select the My documents area and choose a form to print or download again. Stay competitive and acquire, and print the New Jersey Request for Due Diligence Documents from a Technology Company with US Legal Forms. There are millions of professional and state-specific templates you can use for your business or personal needs.

- Utilize US Legal Forms to locate the New Jersey Request for Due Diligence Documents from a Technology Company within a few clicks.

- If you are already a US Legal Forms user, Log In to your account and hit the Download button to acquire the New Jersey Request for Due Diligence Documents from a Technology Company.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps provided below.

- Step 1. Ensure that you have selected the form for the appropriate city/state.

- Step 2. Use the Preview feature to review the contents of the form. Don’t forget to check the details.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the page to find other versions of the official form template.

- Step 4. Once you have found the form you desire, click the Buy now button. Select the pricing plan you prefer and enter your information to register for an account.

- Step 5. Process the purchase. You can use your Visa or Mastercard or PayPal account to complete the transaction.

- Step 6. Choose the format of the official form and download it to your device.

- Step 7. Complete, modify, and print or sign the New Jersey Request for Due Diligence Documents from a Technology Company.

Form popularity

FAQ

When you are handling a New Jersey Request for Due Diligence Documents from a Technology Company, focus on essential materials that shed light on the business's operations and compliance. You should ask for financial statements, contracts, intellectual property details, and information about pending litigation. Additionally, it's wise to request documentation supporting the company's regulatory compliance, as this information reveals the risks involved. Utilizing tools like USLegalForms can simplify the process, ensuring you acquire all necessary documents efficiently.

A good example of due diligence occurs when a company reviews financial records, customer contracts, and employee agreements before acquiring another business. By making a New Jersey Request for Due Diligence Documents from a Technology Company, you can uncover vital information that reveals the business's financial health and operational viability. This diligent review process can prevent costly mistakes and foster confidence in your business decisions.

The 4 P's of due diligence consist of People, Process, Product, and Performance. Each aspect plays a crucial role when making a New Jersey Request for Due Diligence Documents from a Technology Company. Evaluating these elements ensures that you have a comprehensive understanding of the company's operational capabilities and sustainability, leading to informed decision-making.

Technology due diligence is a specific assessment focused on the technological aspects of a company, particularly in the context of mergers or acquisitions. When submitting a New Jersey Request for Due Diligence Documents from a Technology Company, you evaluate the company's technology landscape, including software, hardware, and IT processes. This analysis helps in identifying potential risks, opportunities, and overall compatibility with your organization.

The 3 P's of due diligence include People, Process, and Product. When you make a New Jersey Request for Due Diligence Documents from a Technology Company, it is vital to evaluate the team involved, the processes in place, and the products offered. This holistic approach ensures that you fully understand the company's capabilities and any associated challenges.

Due diligence refers to the thorough process of investigating and assessing a company prior to making a decision, such as a merger, acquisition, or investment. In the context of a New Jersey Request for Due Diligence Documents from a Technology Company, it involves gathering essential information that ensures transparency and reduces risks. This process helps stakeholders understand the potential benefits and liabilities associated with a business deal.

In New Jersey, the due diligence period usually spans a negotiated timeframe specified in contracts, often lasting between 30 and 90 days. During this period, buyers assess risks and gather necessary information to finalize agreements. This is especially crucial when you are making a New Jersey Request for Due Diligence Documents from a Technology Company, as it allows ample time to mitigate any potential issues.

The timeframe for due diligence typically ranges from a few weeks to several months, depending on the complexity of the transactions involved. Factors such as the amount of information needed and the responsiveness of the parties can affect this timeline. Understanding the timeframe can enhance your approach when making a New Jersey Request for Due Diligence Documents from a Technology Company.

Due diligence in technology refers to the systematic evaluation of technical assets, risks, and compliance within a company. It helps in assessing software, infrastructure, and data security. The importance of a comprehensive approach is reinforced when you make a New Jersey Request for Due Diligence Documents from a Technology Company, ensuring all tech-related aspects are thoroughly evaluated.

When dealing with Jersey property, due diligence involves researching ownership, zoning laws, and local regulations. This process ensures that there are no undisclosed liabilities that could affect property value or usage. By focusing your efforts on a New Jersey Request for Due Diligence Documents from a Technology Company, you can enhance your understanding of associated IT systems managing property data.