New Jersey Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc.

Description

How to fill out Nonemployee Directors Nonqualified Stock Option Plan Of Cucos, Inc.?

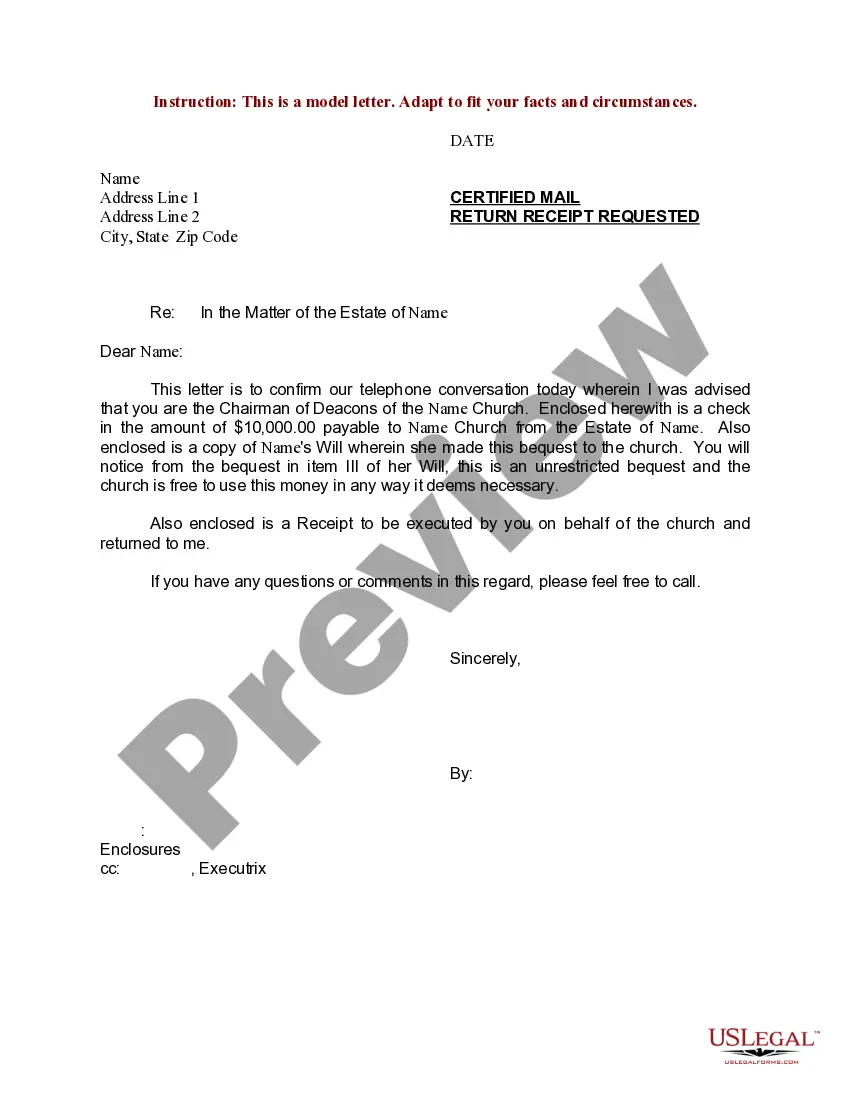

US Legal Forms - one of the greatest libraries of lawful kinds in the United States - delivers a variety of lawful record web templates it is possible to down load or printing. Using the website, you can get 1000s of kinds for company and personal reasons, sorted by categories, suggests, or keywords and phrases.You will discover the most up-to-date variations of kinds much like the New Jersey Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc. within minutes.

If you have a membership, log in and down load New Jersey Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc. from the US Legal Forms catalogue. The Obtain switch will show up on each and every kind you perspective. You gain access to all earlier delivered electronically kinds from the My Forms tab of your own accounts.

If you want to use US Legal Forms the first time, listed below are simple directions to get you started off:

- Be sure to have picked out the proper kind for your personal town/area. Click on the Preview switch to examine the form`s information. Browse the kind description to actually have selected the proper kind.

- In the event the kind doesn`t suit your demands, make use of the Search discipline at the top of the screen to get the one which does.

- If you are pleased with the shape, affirm your option by clicking on the Get now switch. Then, pick the pricing program you like and offer your qualifications to sign up for an accounts.

- Procedure the financial transaction. Make use of charge card or PayPal accounts to accomplish the financial transaction.

- Find the file format and down load the shape in your product.

- Make adjustments. Fill out, modify and printing and indicator the delivered electronically New Jersey Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc..

Every single web template you put into your money lacks an expiration time and it is yours eternally. So, in order to down load or printing one more version, just go to the My Forms portion and click on in the kind you want.

Get access to the New Jersey Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc. with US Legal Forms, the most considerable catalogue of lawful record web templates. Use 1000s of skilled and status-particular web templates that fulfill your business or personal demands and demands.

Form popularity

FAQ

If not, you must add it to Form 1040, Line 7 when you fill out your 2023 tax return. Because you sold the stock, you must report the sale on your 2023 Schedule D. The stock sale is considered a short-term transaction because you owned the stock less than a year.

The income related to the option exercise should be included in the Form W-2 you receive from your employer or 1099-NEC from the company if you are a non-employee. Any capital gain or loss amount may also be reportable on your US Individual Income Tax Return (Form 1040), Schedule D and Form 8949 in the year of sale.

Since you'll have to exercise your option through your employer, your employer will usually report the amount of your income on line 1 of your Form W-2 as ordinary wages or salary and the income will be included when you file your tax return.

Non-qualified stock options give employees the right, within a designated timeframe, to buy a set number of shares of their company's shares at a preset price. It may be offered as an alternative form of compensation to workers and also as a means to encourage their loyalty with the company. 1?

Non-qualified stock options give employees the right, within a designated timeframe, to buy a set number of shares of their company's shares at a preset price. It may be offered as an alternative form of compensation to workers and also as a means to encourage their loyalty with the company.

Form W-2 (or 1099-NEC if you are a nonemployee) Your W-2 (or 1099-NEC) includes the taxable income from your award and, on the W-2, the taxes that have been withheld. This form is provided by your employer. Form 1099-B This IRS form has details about your stock sale and helps you calculate any capital gain/loss.

How are NSOs taxed when exercised? In short: You pay ordinary income tax rates on the difference between the strike price and the 409A valuation. Your employer already withholds a part, but it's the bare minimum (usually 25%)

The income related to the option exercise should be included in the Form W-2 you receive from your employer or 1099-NEC from the company if you are a non-employee. Any capital gain or loss amount may also be reportable on your US Individual Income Tax Return (Form 1040), Schedule D and Form 8949 in the year of sale.