New Jersey Property Claimed as Exempt - Schedule C - Form 6C - Post 2005

Description

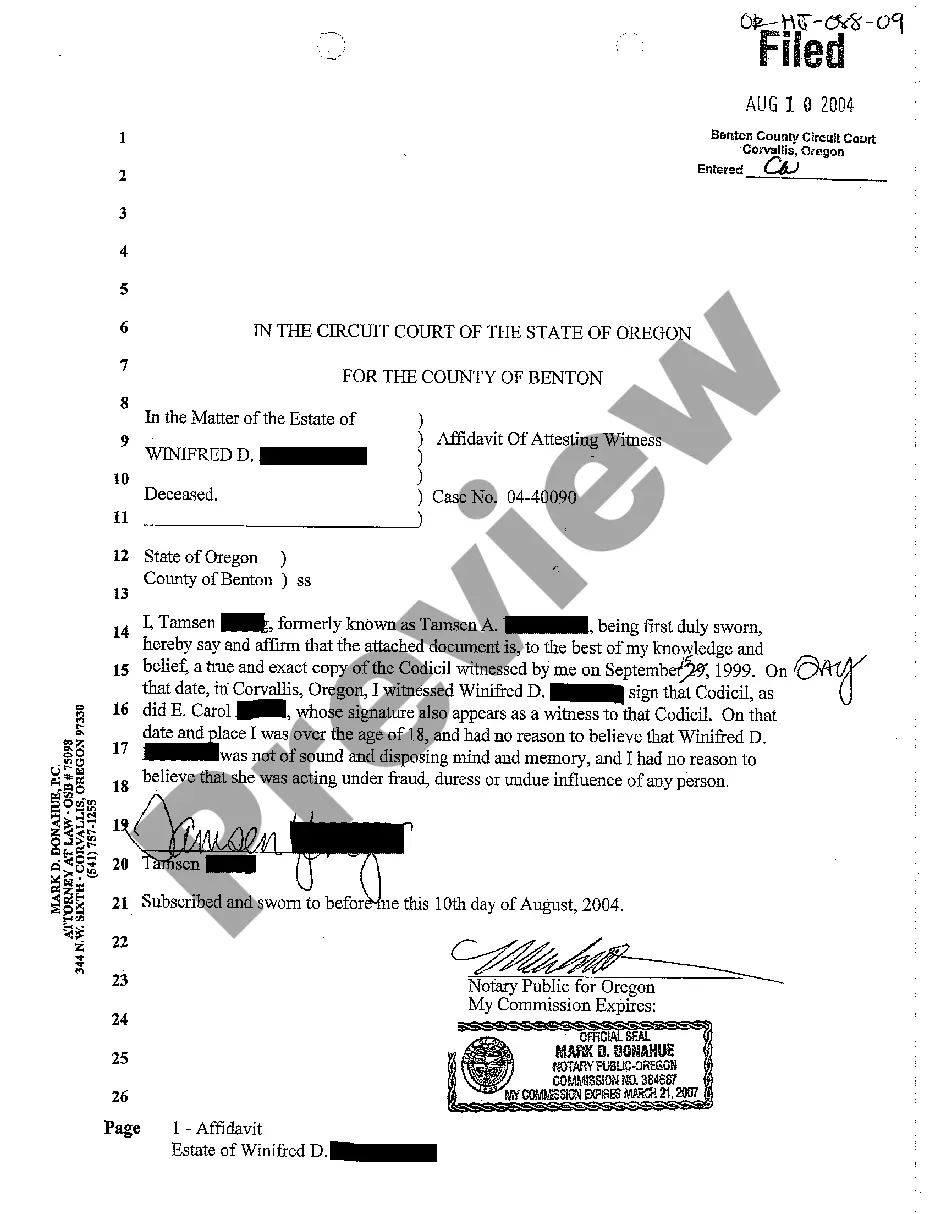

How to fill out Property Claimed As Exempt - Schedule C - Form 6C - Post 2005?

If you want to total, download, or printing lawful file web templates, use US Legal Forms, the biggest assortment of lawful kinds, which can be found on the Internet. Use the site`s simple and easy convenient research to discover the paperwork you will need. A variety of web templates for company and specific functions are categorized by categories and states, or search phrases. Use US Legal Forms to discover the New Jersey Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 in just a number of click throughs.

In case you are already a US Legal Forms buyer, log in for your profile and click the Down load option to find the New Jersey Property Claimed as Exempt - Schedule C - Form 6C - Post 2005. You can even access kinds you formerly acquired inside the My Forms tab of the profile.

Should you use US Legal Forms initially, refer to the instructions below:

- Step 1. Ensure you have chosen the shape for the proper town/country.

- Step 2. Utilize the Preview choice to examine the form`s information. Don`t neglect to read through the outline.

- Step 3. In case you are unhappy with the form, make use of the Search industry on top of the display screen to locate other models of the lawful form template.

- Step 4. Once you have discovered the shape you will need, go through the Acquire now option. Pick the prices prepare you choose and include your credentials to register for an profile.

- Step 5. Procedure the transaction. You may use your charge card or PayPal profile to perform the transaction.

- Step 6. Choose the format of the lawful form and download it on the system.

- Step 7. Comprehensive, revise and printing or indication the New Jersey Property Claimed as Exempt - Schedule C - Form 6C - Post 2005.

Every single lawful file template you acquire is the one you have forever. You possess acces to every single form you acquired in your acccount. Select the My Forms section and decide on a form to printing or download once again.

Compete and download, and printing the New Jersey Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 with US Legal Forms. There are millions of professional and condition-certain kinds you may use for the company or specific requirements.

Form popularity

FAQ

Other Exempt Properties Conservation or recreation land owned by non-profits. Dedicated pet cemeteries. Parsonages. Property owned by medical service corporations or dental service corporations or New Jersey School Boards Association. Those occupied by district superintendents of religious organizations.

A Chapter13 bankruptcy may be filed by individuals with regular income. Debtors must present a plan to repay all or part of their debts. The plan must provide for fixed monthly payments to be made to the Chapter 13 trustee for a period of three to five years, depending on income and other factors.

It's a Long Term Commitment ? Filing Chapter 13 bankruptcy requires you to make a long-term commitment to the process. Tough To Get Credit or a Mortgage for 7 Years ? Other impacts include the inability to get credit cards at a good rate, and filing Chapter 13 makes it tough to get a mortgage.

(Official Form 106C) lists the property that you believe you are entitled to keep. If you do not claim the property on this form, it will not be exempted, despite your rights under the law. Before filling out this form, you have to decide whether you will use your state exemptions or the federal exemptions.

Under all scenarios, a chapter 13 requires an individual to make monthly payments to a trustee, which is referred to as a trustee or plan payment. In general, the number of months of the plan is based on the debtor's ability to pay the total amount required.

Chapter 13 and debt Firstly, all Chapter 13 payment plans must repay all priority claims and administrative expenses in full. These types of debts include taxes, child support, alimony, attorneys' fees and court costs.

A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly.