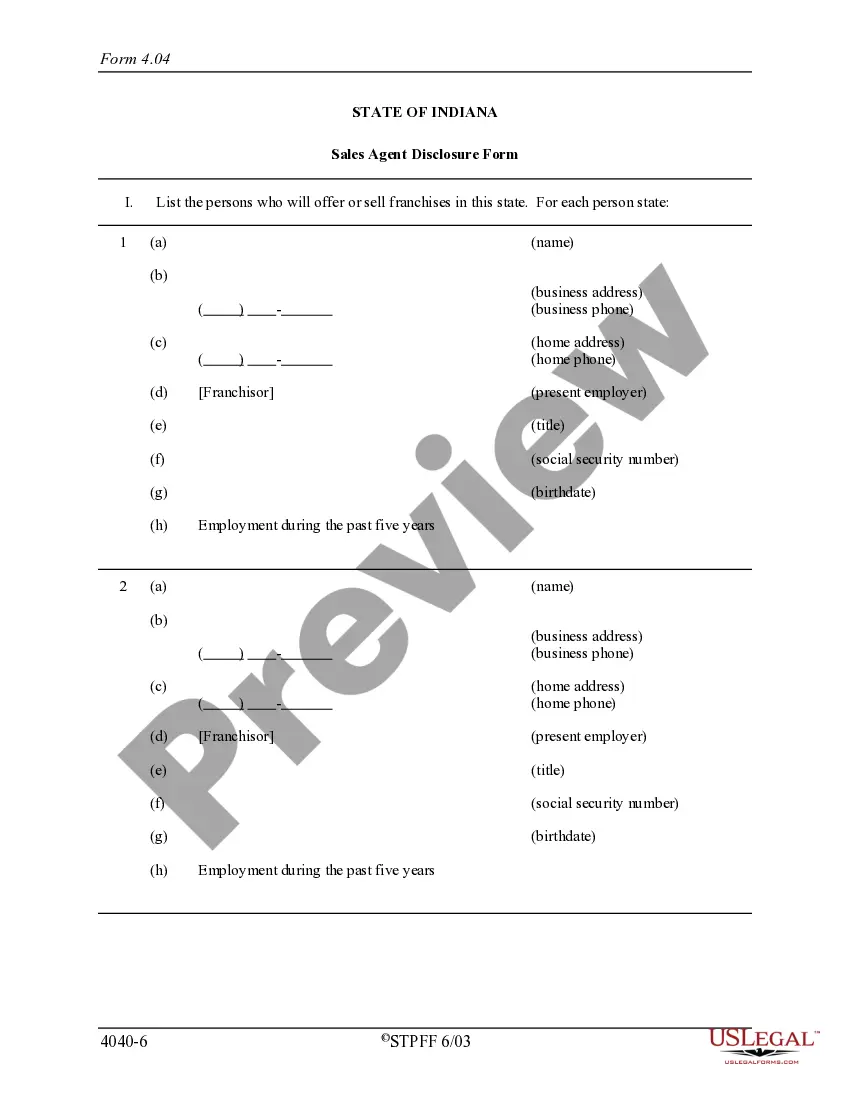

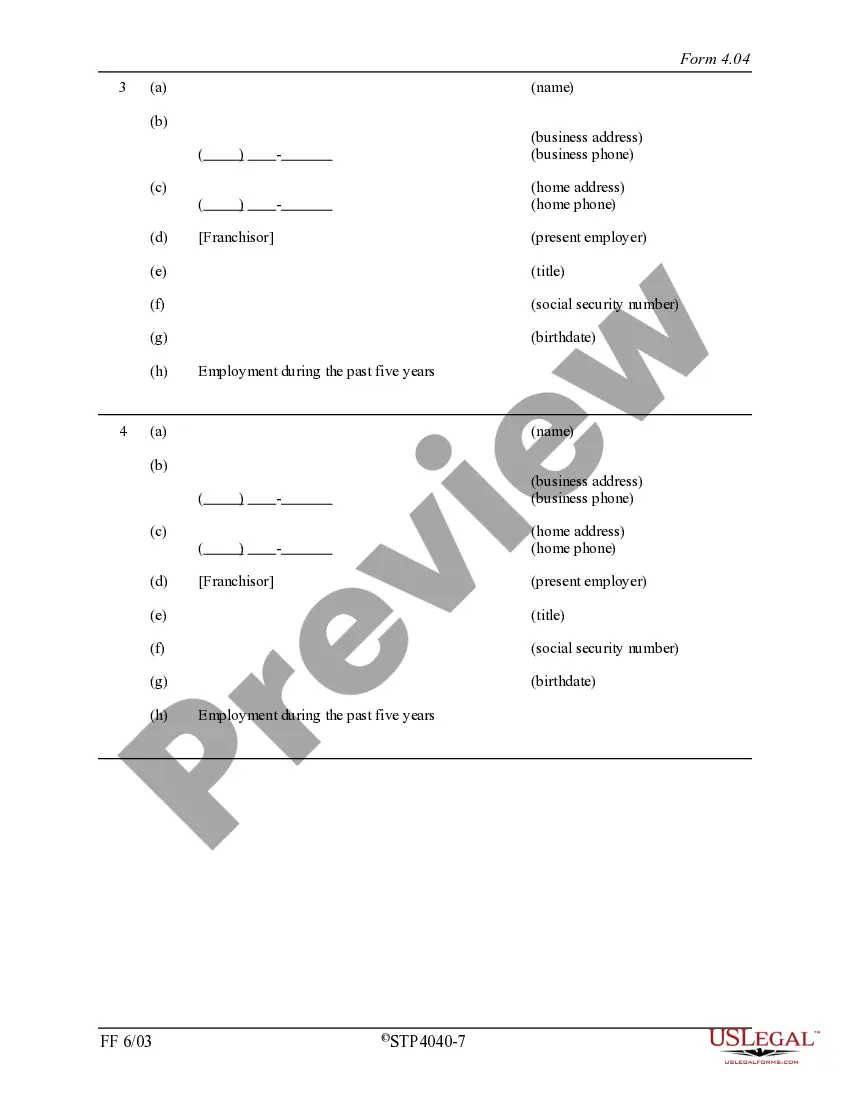

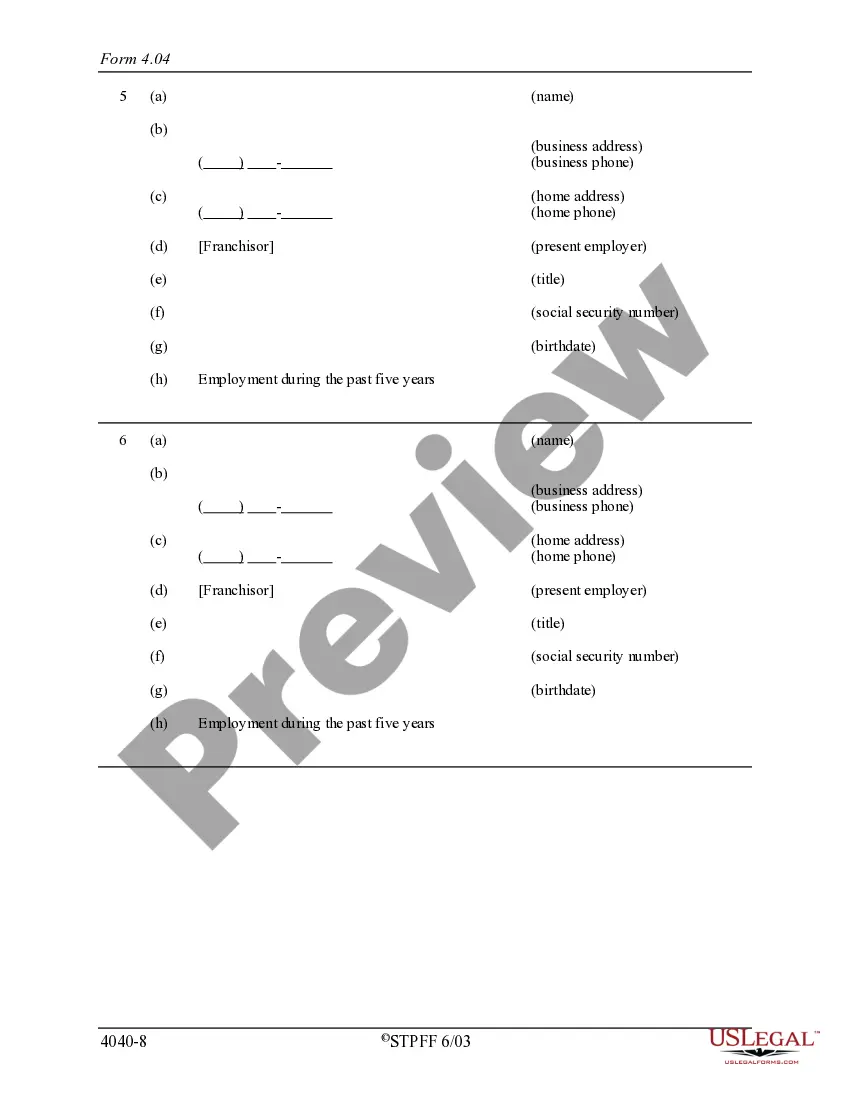

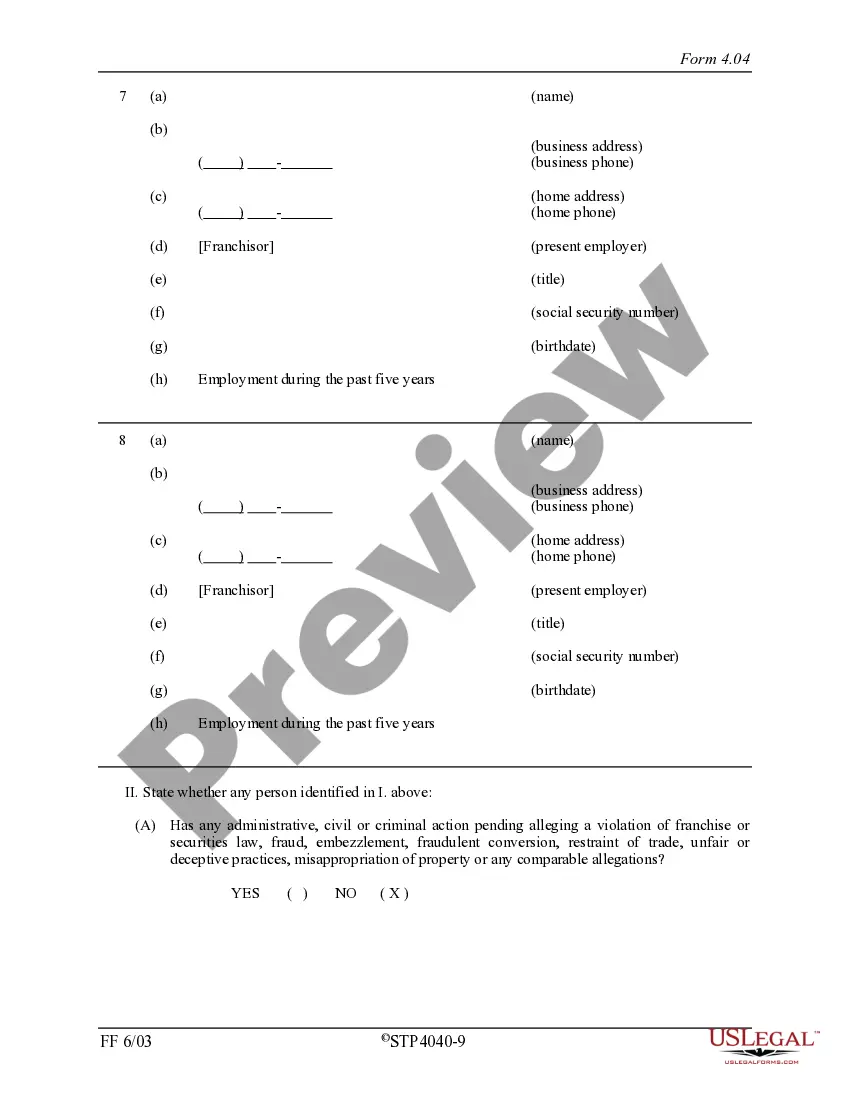

New Jersey Indiana Franchise Registration Application

Description

How to fill out Indiana Franchise Registration Application?

If you have to total, obtain, or print legitimate record web templates, use US Legal Forms, the most important assortment of legitimate types, which can be found on the web. Take advantage of the site`s simple and easy practical research to find the documents you want. Numerous web templates for company and specific functions are sorted by categories and states, or search phrases. Use US Legal Forms to find the New Jersey Indiana Franchise Registration Application with a number of click throughs.

If you are presently a US Legal Forms customer, log in to your profile and then click the Acquire switch to get the New Jersey Indiana Franchise Registration Application. Also you can access types you previously delivered electronically in the My Forms tab of your own profile.

If you work with US Legal Forms initially, refer to the instructions beneath:

- Step 1. Ensure you have chosen the form for your correct town/nation.

- Step 2. Utilize the Preview solution to look through the form`s content. Do not forget about to learn the information.

- Step 3. If you are unsatisfied with the type, utilize the Look for field at the top of the display to find other versions from the legitimate type design.

- Step 4. When you have identified the form you want, go through the Purchase now switch. Choose the rates prepare you choose and add your qualifications to sign up for an profile.

- Step 5. Method the deal. You can utilize your credit card or PayPal profile to complete the deal.

- Step 6. Pick the structure from the legitimate type and obtain it on your own gadget.

- Step 7. Complete, change and print or indicator the New Jersey Indiana Franchise Registration Application.

Every single legitimate record design you buy is yours eternally. You have acces to each type you delivered electronically with your acccount. Click the My Forms portion and decide on a type to print or obtain again.

Contend and obtain, and print the New Jersey Indiana Franchise Registration Application with US Legal Forms. There are many expert and condition-distinct types you can utilize for your personal company or specific requires.

Form popularity

FAQ

DC is considered a non-registration state meaning there is no need to register or file information in DC prior to offering or selling a franchise.

Indiana is a franchise registration state. So, you must register your FDD with the Securities Division of the Indiana Secretary of State prior to offering or selling franchises in the state.

Yes. California is a franchise registration state. The initial FDD registration fee is $675 and the FDD renewal fee is $450. Before offering or selling a franchise in the State of California franchisors must first register their FDD with the California Department of Financial Protection and Innovation.

To create a FDD, you need to collect and organize a lot of data about your franchise system, your financial statements, your operations manual, your marketing materials, and your legal documents. You may need to conduct market research, consult with experts, and update your records to ensure accuracy and completeness.

FLORIDA FRANCHISE LAWS There is no state franchise registration required in Florida. Business Opportunity Exemption Registration in Florida. The Florida Sale of Business Opportunities Act includes an exemption for franchises meeting the federal definition of a franchise under the FTC Franchise Rule.

Indiana charges an initial filing fee of $500 for franchise registration. The fee for renewals is reduced to $250, but renewals must be received before the previous registration expires in order to be accepted. Registrations remain valid for one year from the date the application is received.

Franchise registration states include California, Maryland, Michigan, Minnesota, New York, and North Dakota. Franchise filing states include Connecticut, Florida, Kentucky, South Carolina, and South Dakota.

New Jersey is classified as a non-registration state, as there are no currently enacted laws requiring franchisors to register with the state as a franchise or business opportunity, or to provide disclosures to franchisees beyond what is already required by the Federal Trade Commission Amended Franchise Rule, 16 C.F.R.

Texas has not enacted franchise specific laws and is not a franchise registration state. However, Texas has enacted Business Opportunity Laws and, before offering or selling a franchise in Texas, you must first file a one-time Business Opportunity Exemption Notice with the Texas Secretary of State.

Indiana is a franchise registration state. Under Indiana's Franchise Act, before you offer or sell a franchise in Indiana, you must file and register your FDD with the Securities Division of the Indiana Secretary of State. The initial FDD registration fee is $500 and the annual renewal fee is $250.