New Jersey Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

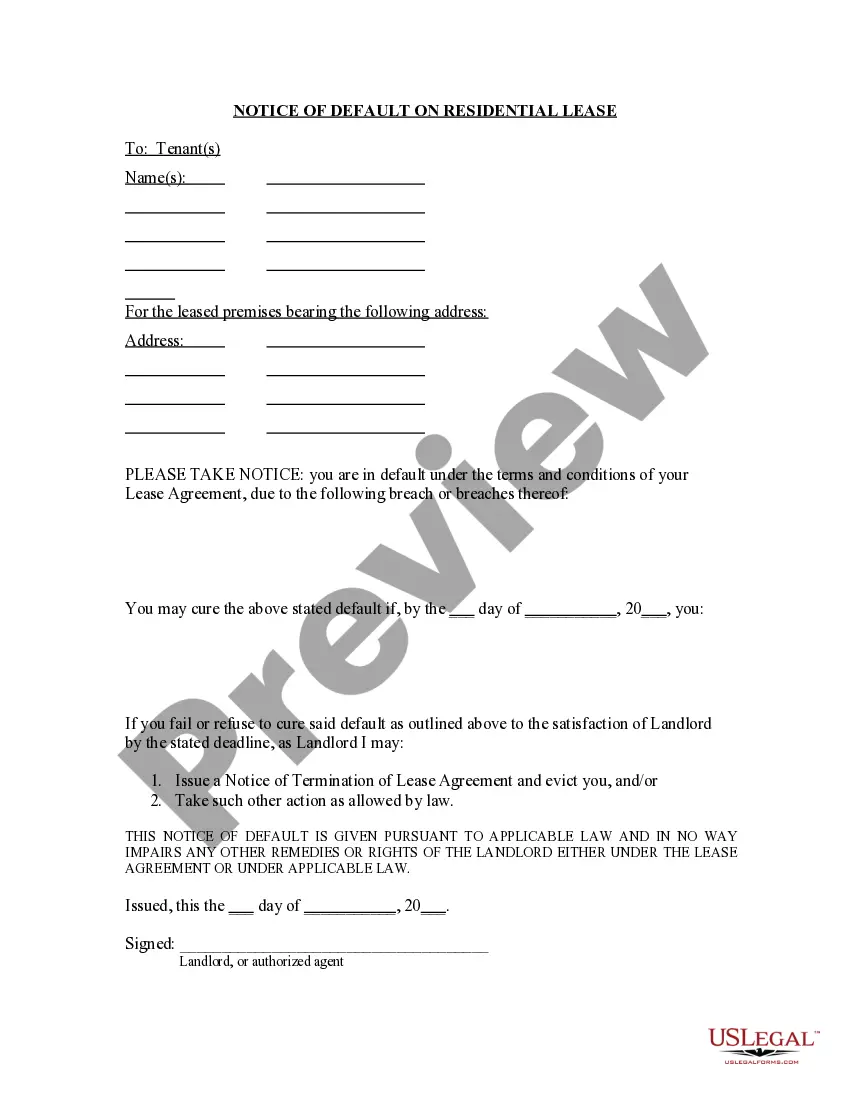

How to fill out Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

If you wish to complete, acquire, or print lawful papers layouts, use US Legal Forms, the largest variety of lawful kinds, that can be found online. Make use of the site`s easy and practical look for to get the papers you want. Numerous layouts for enterprise and person uses are sorted by categories and says, or key phrases. Use US Legal Forms to get the New Jersey Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse within a few click throughs.

In case you are presently a US Legal Forms client, log in in your profile and then click the Download option to get the New Jersey Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse. You may also entry kinds you previously acquired inside the My Forms tab of your profile.

If you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Make sure you have selected the shape for the appropriate town/region.

- Step 2. Make use of the Review solution to check out the form`s information. Do not forget about to learn the description.

- Step 3. In case you are not happy together with the form, utilize the Research industry towards the top of the screen to find other variations from the lawful form design.

- Step 4. After you have discovered the shape you want, select the Buy now option. Pick the prices strategy you favor and add your credentials to register for the profile.

- Step 5. Method the purchase. You may use your bank card or PayPal profile to finish the purchase.

- Step 6. Choose the formatting from the lawful form and acquire it in your device.

- Step 7. Complete, edit and print or indication the New Jersey Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse.

Every single lawful papers design you get is your own property eternally. You may have acces to each and every form you acquired in your acccount. Click the My Forms section and choose a form to print or acquire again.

Be competitive and acquire, and print the New Jersey Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse with US Legal Forms. There are millions of specialist and condition-distinct kinds you can use for your enterprise or person requirements.

Form popularity

FAQ

The ?unlimited marital deduction? refers to the fact that gifts to a spouse, made during your lifetime or after death, are always exempt from the gift and estate tax. Moreover, there is no limit to the marital deduction.

A marital deduction trust is a trust where transfers of property between married partners are free of federal transfer tax. A marital deduction trust can take one of two forms: A life estate coupled with a general power of appointment given to the spouse, or. A Qualified Terminable Interest Property (QTIP) trust.

Primary tabs A residuary beneficiary is a person who receives any property from a will or trust that is not specifically left to another designated beneficiary.

If the surviving spouse accepts the assets or tries to control what is done with those assets before or after they have been disclaimed, the tax exemption benefits are lost.

Terminable interests do not qualify for the marital deduction (Sec. 2056(b)(1)). An example of a terminable interest is where the decedent leaves property to a surviving spouse for the spouse's lifetime, with a remainder interest to the decedent's children.

The unlimited marital deduction is a provision in the U.S. Federal Estate and Gift Tax Law that allows an individual to transfer an unrestricted amount of assets to their spouse at any time, including at the death of the transferor, free from tax.

Property interests passing to a surviving spouse that are not included in the decedent's gross estate do not qualify for the marital deduction. Expenses, indebtedness, taxes, and losses chargeable against property passing to the surviving spouse will reduce the marital deduction.

The first trust (the ?marital? trust) is for the surviving spouse, and the second trust (the ?bypass? or ?residual? trust) is typically for the couple's heirs. The surviving spouse can access the residual trust or receive income from it during their lifetime, but it does not belong to them.