New Jersey Sample Letter for Notice of Change of Address - Awaiting Refund

Description

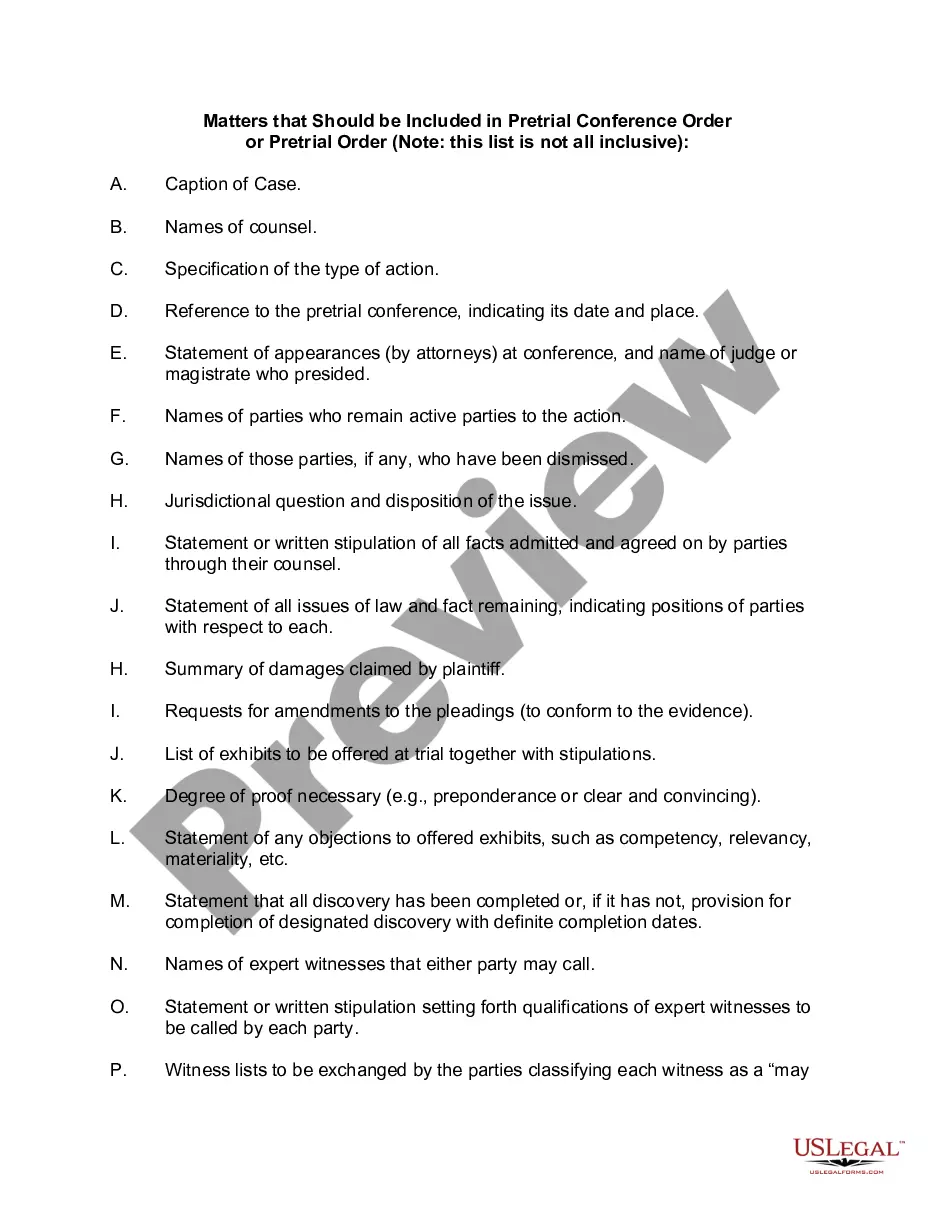

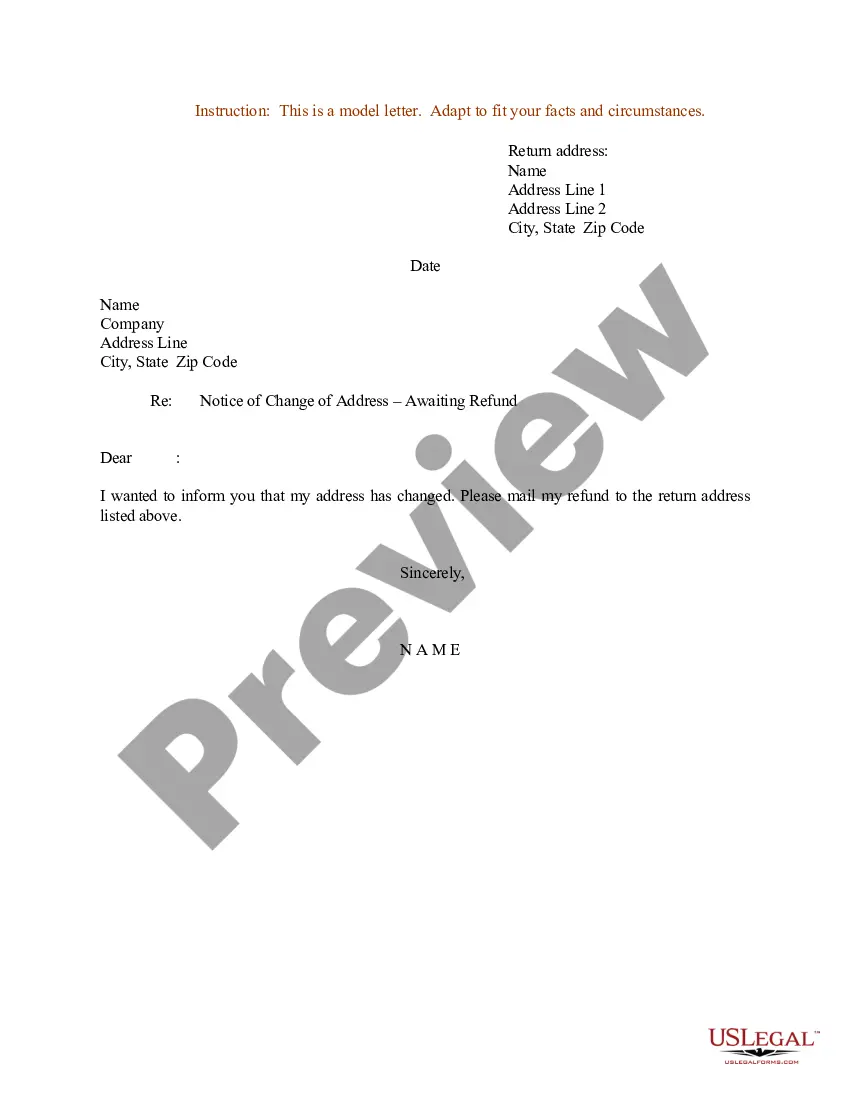

How to fill out Sample Letter For Notice Of Change Of Address - Awaiting Refund?

US Legal Forms - one of the most prominent repositories of legal documents in the United States - offers a vast selection of legal document templates that you can download or print.

By utilizing the website, you can discover thousands of forms for business and personal use, categorized by type, state, or keywords.

You can find the most recent versions of forms like the New Jersey Sample Letter for Notice of Change of Address - Awaiting Refund in just seconds.

Read the form description to ensure that you have selected the right form.

If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you have a subscription, Log In and download the New Jersey Sample Letter for Notice of Change of Address - Awaiting Refund from the US Legal Forms library.

- The Download button will appear on each form you view.

- You gain access to all previously saved forms in the My documents section of your account.

- If you are new to using US Legal Forms, here are simple steps to help you get started.

- Ensure you have selected the correct form for your region/county.

- Click the Preview button to review the form's details.

Form popularity

FAQ

The Division of Taxation estimates it takes three weeks to process refunds for returns filed electronically compared with six to eight weeks for those filed by mail. Electronic filers can also choose to receive their refunds by direct deposit, an option that is not available to those who file paper returns.

Returns that require manual processing may take longer regardless of whether the return was filed electronically or by paper. To mitigate the spread of COVID-19, staffing is extremely limited and may delay the timeframe to review refund requests. Please allow additional time for processing and review of refunds.

Returns that require manual processing may take longer regardless of whether the return was filed electronically or by paper. To mitigate the spread of COVID-19, staffing is extremely limited and may delay the timeframe to review refund requests. Please allow additional time for processing and review of refunds.

All such inquiries should go through the New Jersey Division of Taxation Call Center - 609.292. 6400. Calls regarding automated refund information should use the following number: 800. 323.4400.

Yes. New Jersey residents who work in New York State must file a New York Nonresident Income Tax return (Form IT-203) as well as a New Jersey Resident Income Tax Return (Form NJ-1040). Your employer will have withheld New York state taxes throughout the year but you'll need to file in New Jersey as well.

By Form. To change your address with the IRS, you may complete a Form 8822, Change of Address (For Individual, Gift, Estate, or Generation-Skipping Transfer Tax Returns) and/or a Form 8822-B, Change of Address or Responsible Party Business and send them to the address shown on the forms.

4 weeks or more after you file electronically; At least 12 weeks after you mail your return; 15 weeks or more for additional processing requirements or paper returns sent by certified mail.

The Division of Taxation estimates it takes three weeks to process refunds for returns filed electronically compared with six to eight weeks for those filed by mail. Electronic filers can also choose to receive their refunds by direct deposit, an option that is not available to those who file paper returns.

Address ChangeUpload. Upload a completed New Jersey Division of Taxation Change of Address Form to the Tax Correspondence Manager.Fax. Fax a completed New Jersey Division of Taxation Change of Address Form to 609-292-4276.U.S. Mail.