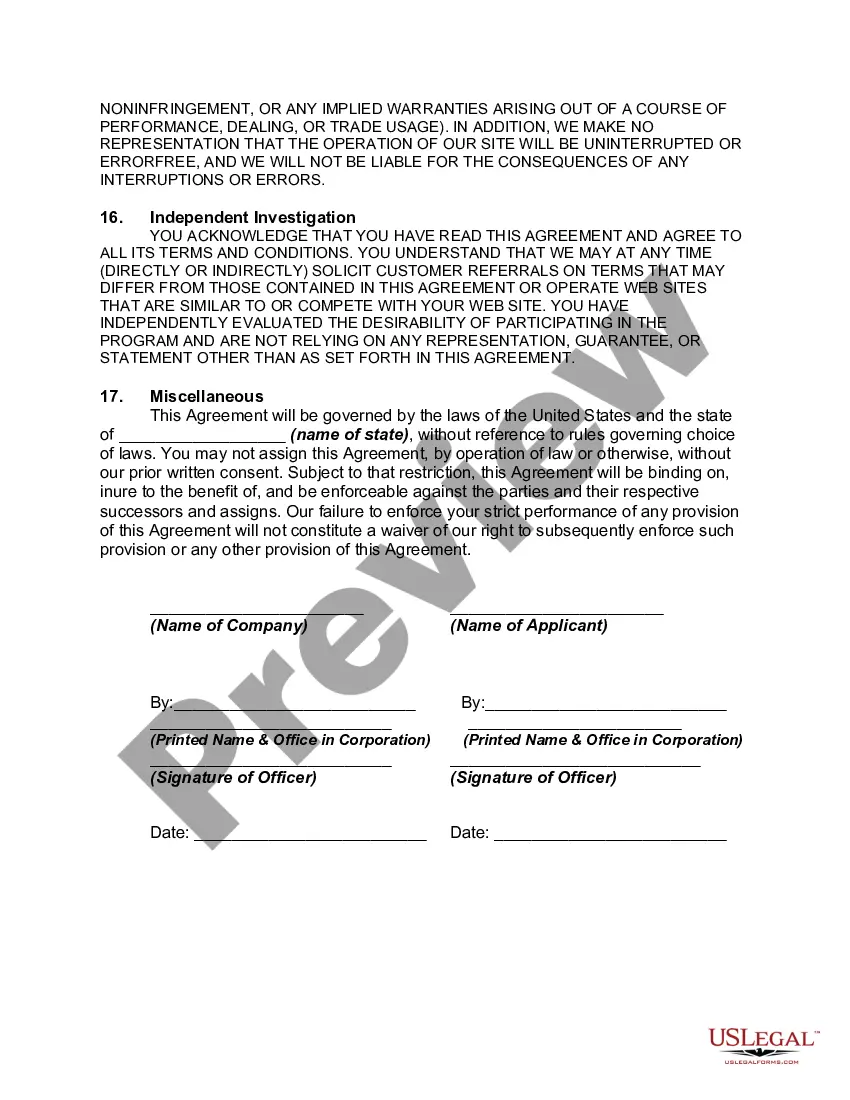

New Jersey Non-Exclusive Online Affiliate Program Agreement

Description

How to fill out Non-Exclusive Online Affiliate Program Agreement?

You can dedicate time online looking for the legitimate document template that satisfies the federal and state criteria you require.

US Legal Forms offers thousands of legal forms that are reviewed by professionals.

You can conveniently download or print the New Jersey Non-Exclusive Online Affiliate Program Agreement from the service.

If available, utilize the Review button to consult the document template as well. To find another version of the form, use the Search section to identify the template that fits your needs and requirements.

- If you already have a US Legal Forms account, you may Log In and then click the Download button.

- After that, you can complete, modify, print, or sign the New Jersey Non-Exclusive Online Affiliate Program Agreement.

- Each legal document template you purchase is yours permanently.

- To obtain another copy of a purchased form, visit the My documents tab and click the corresponding button.

- If you're using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/city of your choice. Review the form outline to verify that you've picked the right form.

Form popularity

FAQ

No, generally, you do not get double taxed if you work in New Jersey and live in Pennsylvania, thanks to the reciprocity agreement between the two states. Your income will primarily be taxed where you reside, which in this case is Pennsylvania. If you're managing income through a New Jersey Non-Exclusive Online Affiliate Program Agreement, this is a significant advantage that can enhance your overall earnings.

Yes, if you sell goods or services online to customers in New Jersey, you are generally required to collect sales tax. This requirement applies to businesses, including those operating under a New Jersey Non-Exclusive Online Affiliate Program Agreement. It’s critical to stay compliant with New Jersey's tax laws to avoid penalties, and using platforms like uslegalforms can help you understand your obligations better.

The New Jersey reciprocity agreement is a tax arrangement between New Jersey and other states. It allows residents from those states to work in New Jersey without incurring New Jersey's state income tax. This is particularly useful for individuals managing a New Jersey Non-Exclusive Online Affiliate Program Agreement, as it helps avoid dual taxation and promotes business opportunities across state lines.

As previously mentioned, a buyer agency agreement is not legally required in New Jersey, but it serves as a valuable tool for establishing clear roles and expectations. Engaging in this agreement fosters a professional relationship between the buyer and the agent, which helps guide the purchasing process. To ensure that you have comprehensive support, consider the New Jersey Non-Exclusive Online Affiliate Program Agreement for informed decisions.

The requirement for a buyer-agency agreement varies by state. While some states have regulations governing these agreements, others leave it to the discretion of the buyer and agent. It’s essential to consult local laws or resources to understand specific requirements, perhaps considering the New Jersey Non-Exclusive Online Affiliate Program Agreement for guidance.

In affiliate marketing, a contract is not legally required but is highly advisable to protect both parties' interests. This contract should define the terms of the partnership, including payment structures and promotional strategies. Utilizing a structured agreement, such as the New Jersey Non-Exclusive Online Affiliate Program Agreement, can provide clarity and accountability in the affiliate relationship.

NJ Realtors Form 118 is a standard form used to establish a buyer agency relationship in New Jersey. This form outlines the rights, responsibilities, and agency's obligations, ensuring both parties understand their commitments. Having a clear agreement can streamline communication and expectations, making it beneficial for both buyers and agents, as indicated in the New Jersey Non-Exclusive Online Affiliate Program Agreement.

Yes, you can terminate a buyer's agency agreement, but the process and requirements depend on the terms outlined in the contract. Typically, if both parties agree, the agreement can be dissolved without issues. For situations where you feel unsatisfied with your agent, having access to clear terms in a reliable agreement, like the New Jersey Non-Exclusive Online Affiliate Program Agreement, can help ease the process.

agency agreement should ideally be signed before the buyer begins viewing properties or seriously engages in negotiations. This ensures that both the agent and buyer are clear about their commitments and the scope of services provided. Establishing this agreement early also helps in documenting the relationship for future reference. The New Jersey NonExclusive Online Affiliate Program Agreement can provide additional details about this process.

In New Jersey, buyer agency agreements are not mandatory; however, they are highly recommended. These agreements establish a formal relationship between buyers and agents, helping clarify expectations and responsibilities. By signing an agreement, you protect your interests throughout the home-buying process. Explore resources like the New Jersey Non-Exclusive Online Affiliate Program Agreement for more insights.