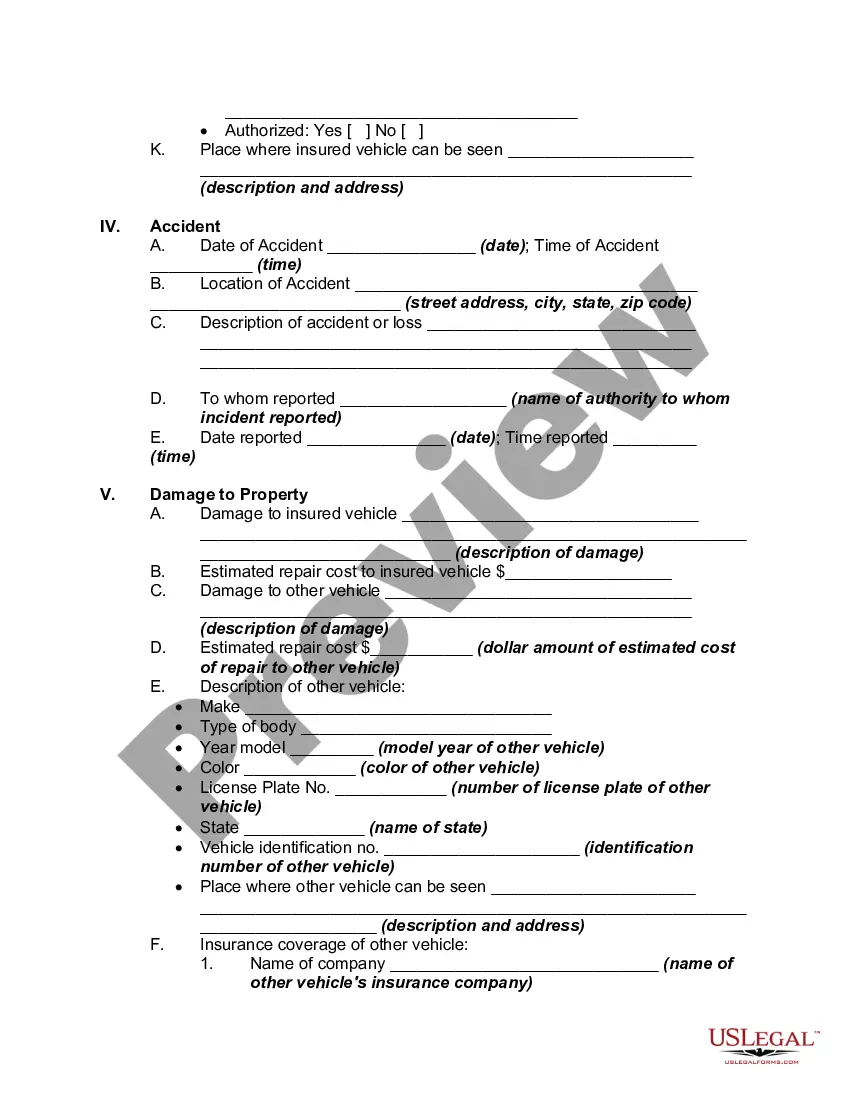

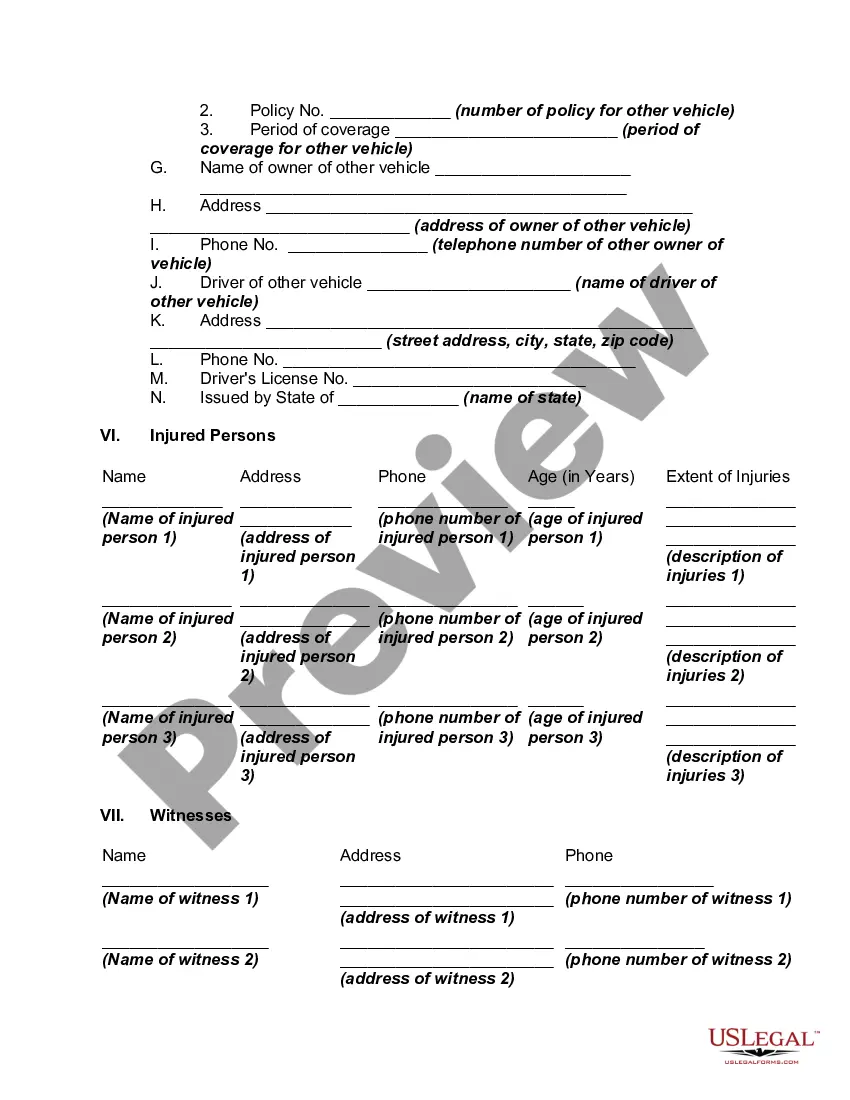

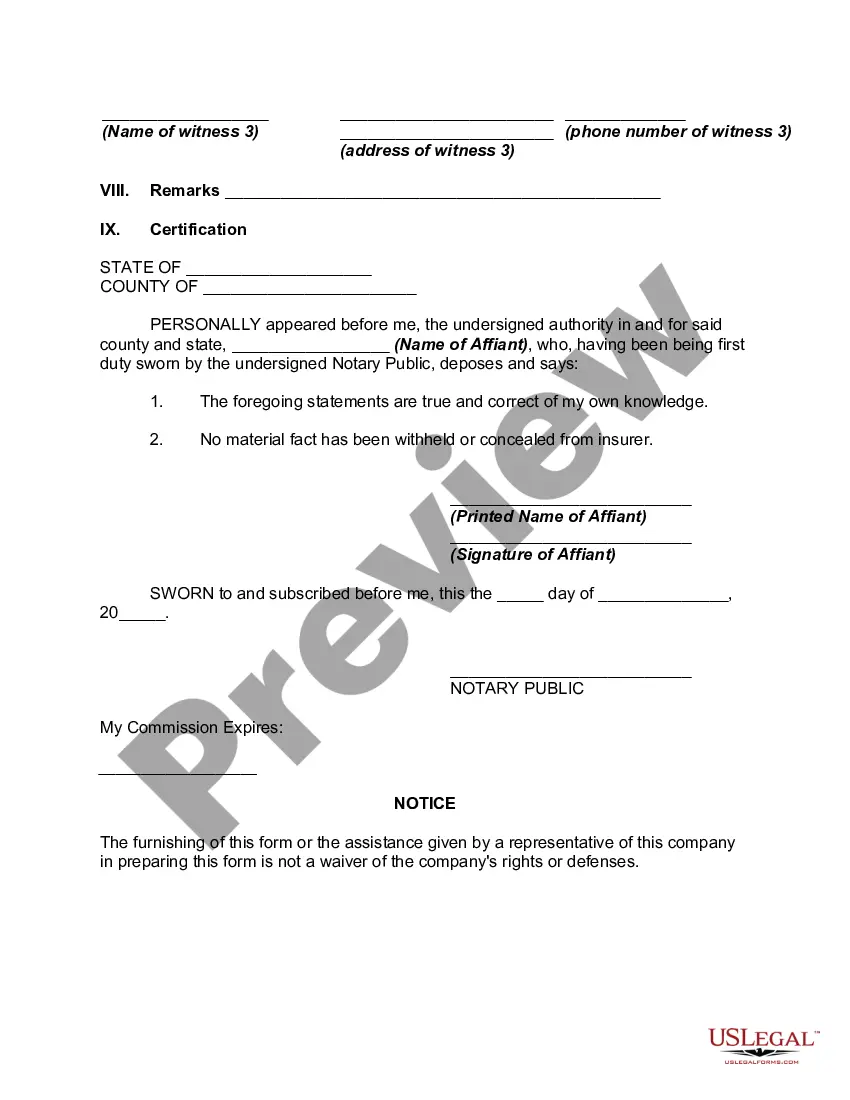

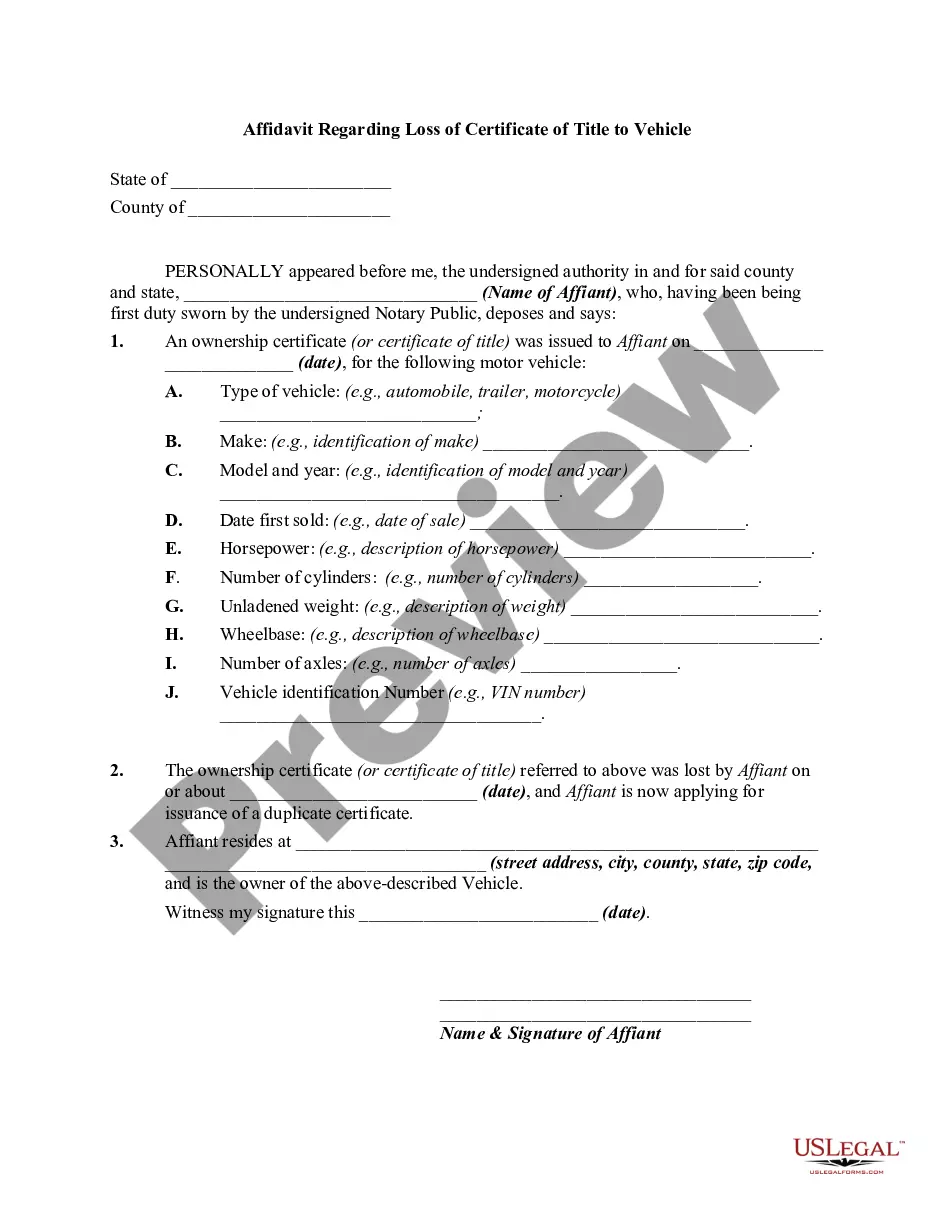

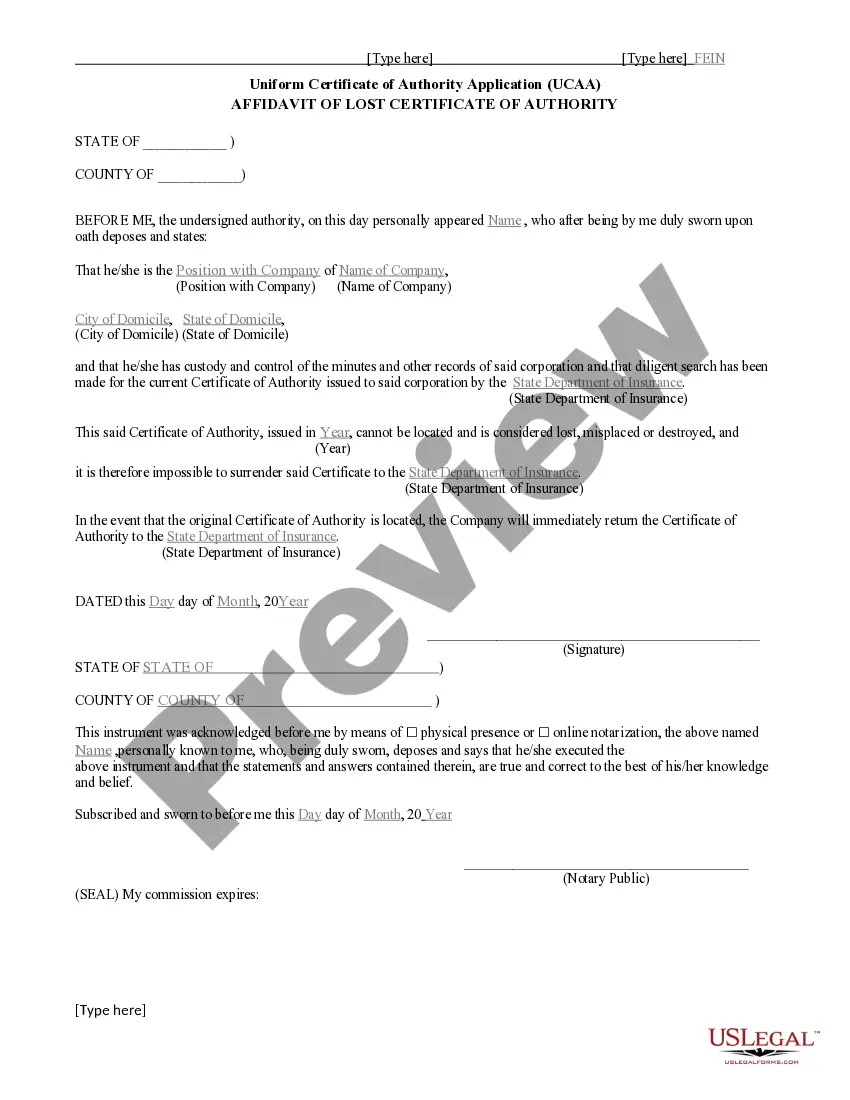

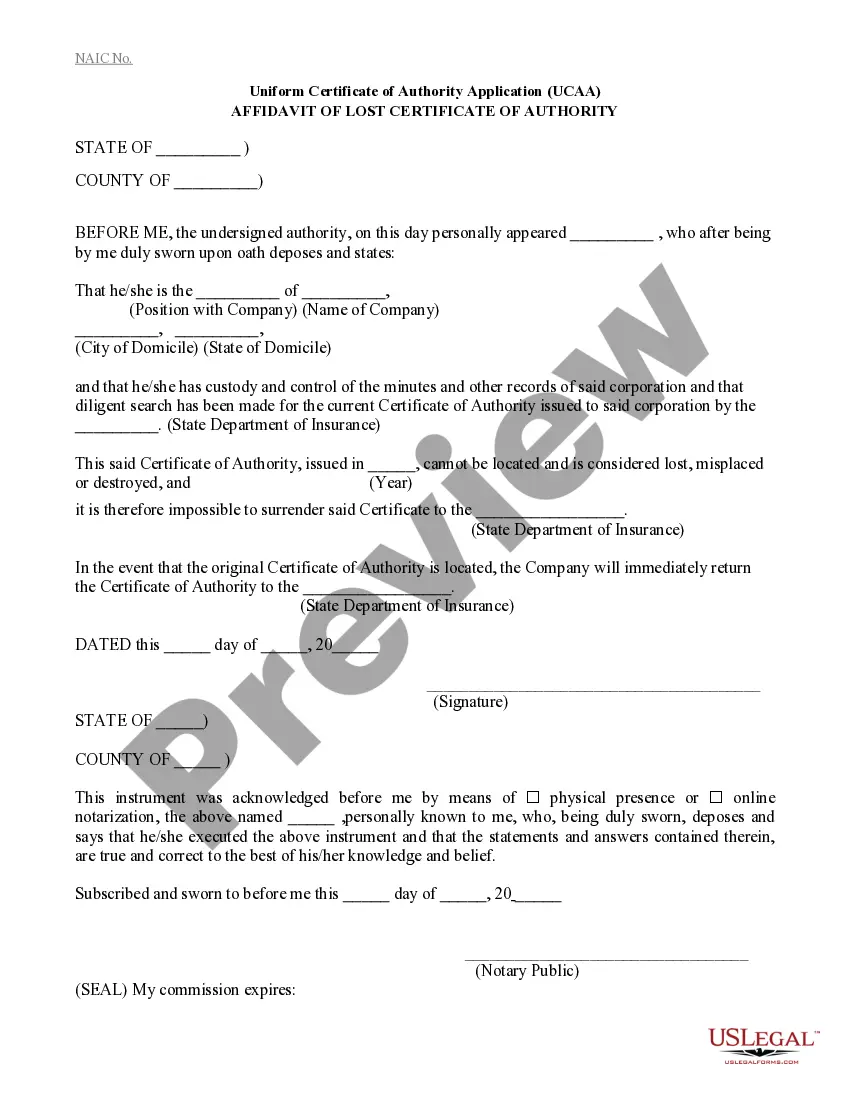

New Jersey Sworn Statement regarding Proof of Loss for Automobile Claim

Description

How to fill out Sworn Statement Regarding Proof Of Loss For Automobile Claim?

US Legal Forms - among the greatest libraries of legitimate forms in the USA - delivers an array of legitimate document templates you may obtain or print out. While using website, you will get thousands of forms for enterprise and individual purposes, sorted by types, claims, or search phrases.You can get the latest versions of forms like the New Jersey Sworn Statement regarding Proof of Loss for Automobile Claim in seconds.

If you already possess a monthly subscription, log in and obtain New Jersey Sworn Statement regarding Proof of Loss for Automobile Claim in the US Legal Forms local library. The Acquire button will appear on each form you look at. You have accessibility to all in the past delivered electronically forms in the My Forms tab of the bank account.

In order to use US Legal Forms the first time, listed here are straightforward directions to get you began:

- Make sure you have chosen the best form for your town/county. Click on the Preview button to check the form`s content. Browse the form information to actually have selected the proper form.

- If the form does not match your needs, take advantage of the Search field at the top of the display screen to find the one who does.

- If you are satisfied with the form, validate your choice by simply clicking the Get now button. Then, pick the rates prepare you like and supply your references to sign up for the bank account.

- Method the purchase. Utilize your charge card or PayPal bank account to perform the purchase.

- Choose the file format and obtain the form on your device.

- Make modifications. Load, change and print out and indicator the delivered electronically New Jersey Sworn Statement regarding Proof of Loss for Automobile Claim.

Every web template you added to your money lacks an expiry time and is your own property eternally. So, in order to obtain or print out an additional duplicate, just go to the My Forms portion and click on the form you need.

Gain access to the New Jersey Sworn Statement regarding Proof of Loss for Automobile Claim with US Legal Forms, one of the most extensive local library of legitimate document templates. Use thousands of professional and condition-distinct templates that meet your company or individual needs and needs.

Form popularity

FAQ

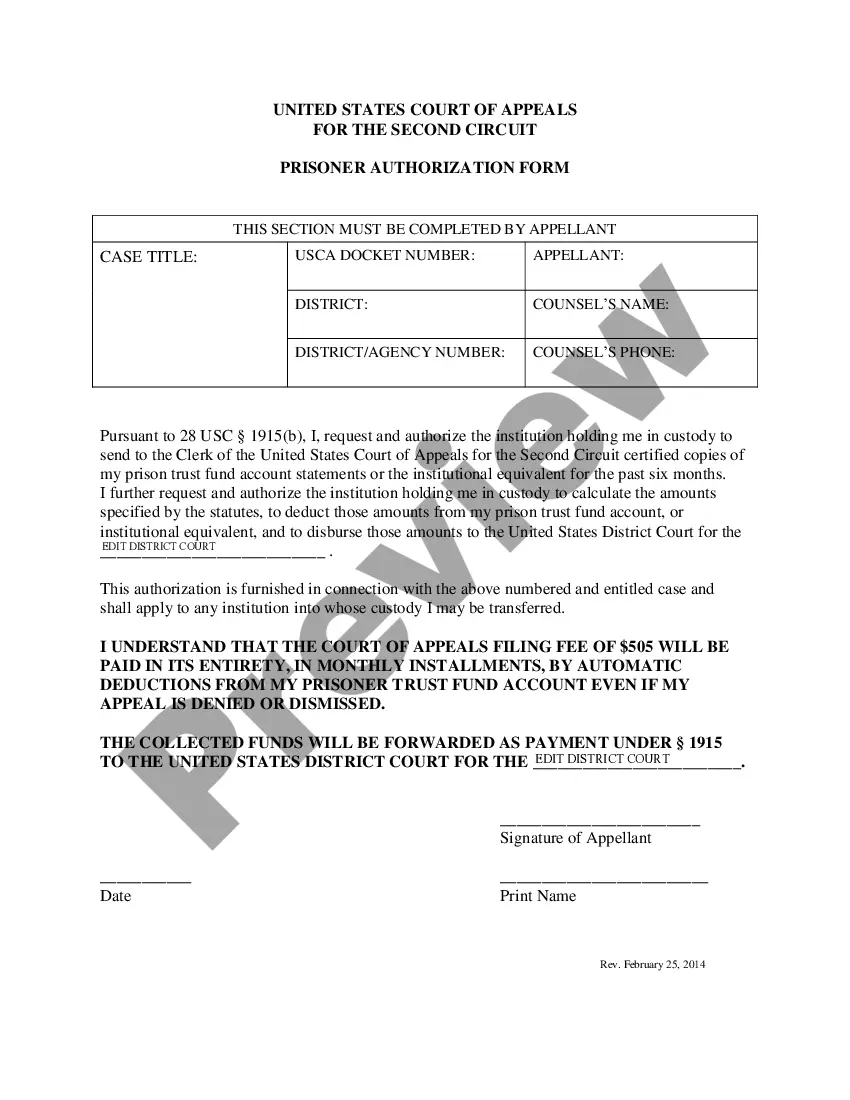

The insurer must supply claim forms to the insured for submitting proof of loss within 15 days of receiving notice of the claim, the insured may submit proof of loss on any piece of paper or in any manner the insured wishes. The insurer will be required to accept this as proof of loss.

Even if every insurance company does not mandate the submission of a Proof of Loss statement form following a covered event, there are certain circumstances in which one might be required. This includes suspected fraud, questionable causes of damage or high-claim amounts.

In most cases, the Proof of Loss must include the following: Amount of loss that the policyholder is claiming. Documentation that supports the amount of claimed loss. Date that the loss occurred.

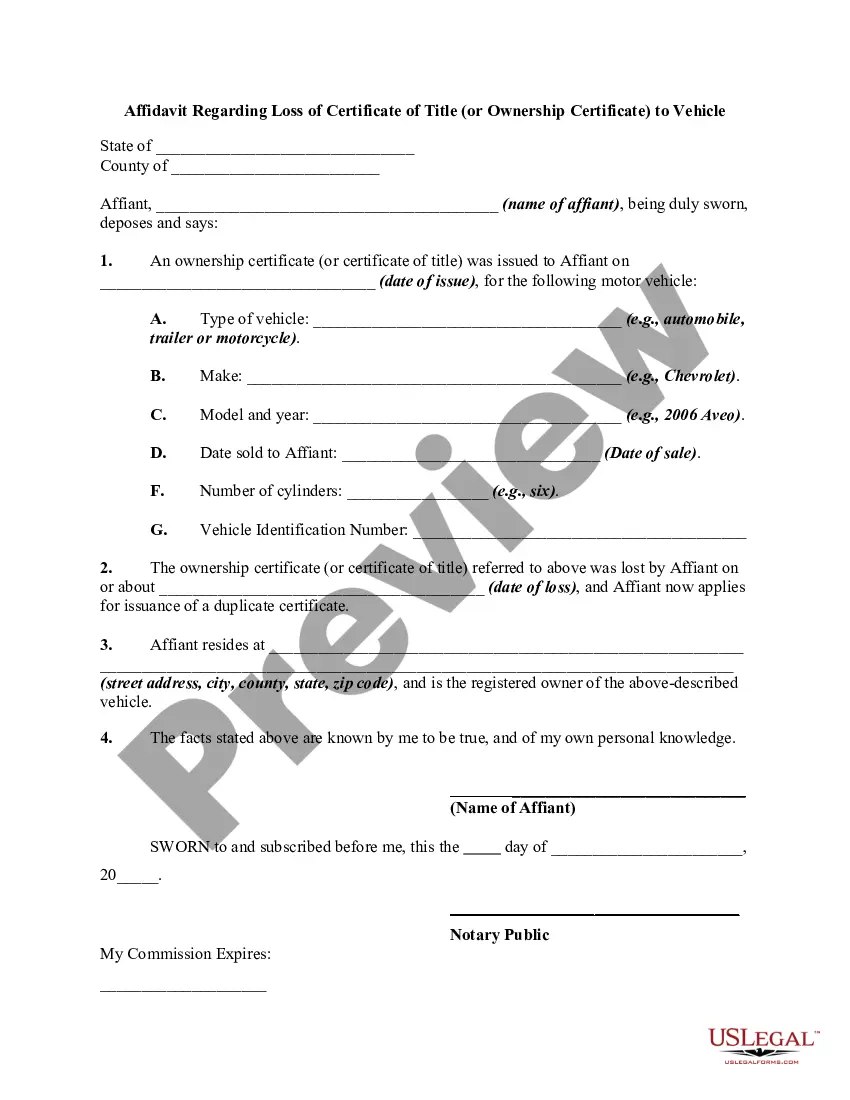

What is a Proof of Loss? A Sworn Statement in Proof of Loss outlines the basic details of your property damage claim and serves as a cover document for your supporting claim materials and documentation.

When any company under any insurance policy requires a written proof of loss after notice of such loss has been given by the insured or beneficiary, the company or its representative must furnish a blank form to be used for that purpose.

A Proof of Loss is a document filled out by the policyholder when property damage occurs resulting in an insurance claim. This form helps to substantiate the value of the insured's loss to the insurance company.

When required, you should file your Proof of Loss form as soon as possible but no later than the date specified in your insurance policy. It's typically required within 60 days after the incident that led to your insurance claim. If you won't be able to file it on time, ask for an extension in advance.

A proof of loss form is evidence of any damages from an accident. Without this form, your insurer would not be able to process your claim. This would put repairs on hold, and prevent you from receiving accident benefits.