In a compilation engagement, the accountant presents in the form of financial statements information that is the representation of management (owners) without undertaking to express any assurance on the statements. In other words, using management's records, the accountant creates financial statements without gathering evidence or opining about the validity of those underlying records. Because compiled financial statements provide the reader no assurance regarding the statements, they represent the lowest level of financial statement service accountants can provide to their clients. Accordingly, standards governing compilation engagements require that financial statements presented by the accountant to the client or third parties must at least be compiled.

New Jersey Report from Review of Financial Statements and Compilation by Accounting Firm

Description

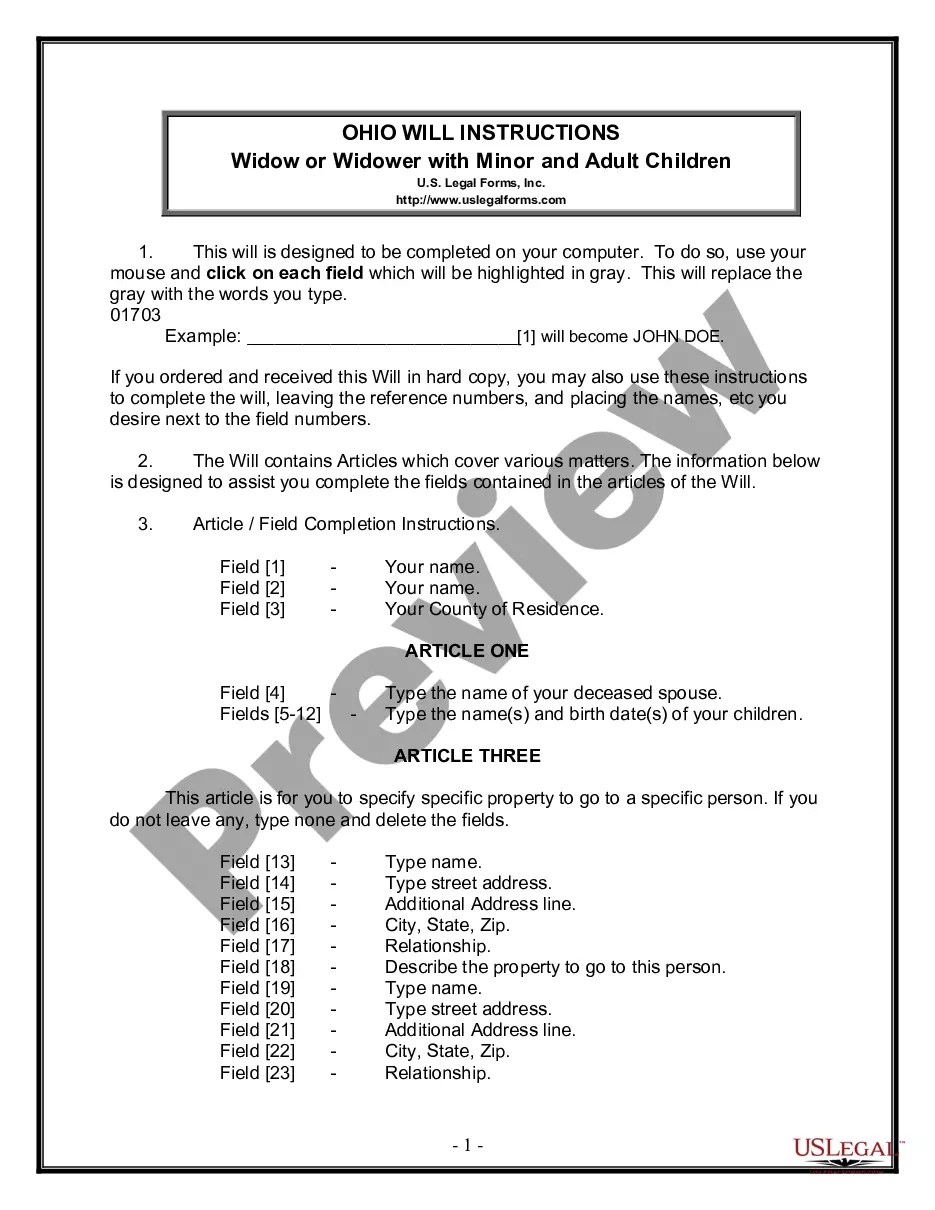

How to fill out Report From Review Of Financial Statements And Compilation By Accounting Firm?

Are you currently facing a scenario where you need documentation for both professional or personal reasons almost every day? There are numerous legal document templates available online, but finding templates you can rely on can be challenging.

US Legal Forms offers a vast array of form templates, including the New Jersey Report from Review of Financial Statements and Compilation by Accounting Firm, which can be tailored to meet federal and state requirements.

If you are already acquainted with the US Legal Forms website and have an account, simply Log In. Then, you can download the New Jersey Report from Review of Financial Statements and Compilation by Accounting Firm template.

You can find all the document templates you have purchased in the My documents section. You can download an additional copy of the New Jersey Report from Review of Financial Statements and Compilation by Accounting Firm at any time if you need it. Just click on the necessary form to download or print the document template.

Use US Legal Forms, the most extensive collection of legal templates, to save time and prevent errors. The service provides professionally designed legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it is for your specific area/state.

- Utilize the Preview button to review the document.

- Check the summary to confirm that you have selected the correct form.

- If the form does not meet your needs, use the Search field to find the document that fulfills your requirements.

- Once you locate the correct form, click on Get now.

- Select the pricing package you prefer, enter the necessary information to create your account, and complete your purchase using your PayPal or credit card.

- Choose a suitable paper format and download your copy.

Form popularity

FAQ

A financial review report summarizes the findings from the financial review process, providing an opinion on the accuracy of the financial statements. This report is significantly less extensive than an audit report, yet it serves an important purpose for businesses and organizations seeking to demonstrate financial integrity. Utilizing the New Jersey Report from Review of Financial Statements and Compilation by Accounting Firm permits stakeholders to make informed decisions about your organization.

A financial review is a process where an accounting firm analyzes your financial statements to ensure they are accurate and conform to generally accepted accounting principles. This review provides some assurance, though it is not as thorough as an audit. Organizations often seek a New Jersey Report from Review of Financial Statements and Compilation by Accounting Firm to fulfill their financial reporting obligations efficiently.

A financial review generally provides a limited assurance on the financial statements, while an audit offers the highest level of assurance through comprehensive testing and verification. In short, a review is less extensive than an audit and is a way to ensure accuracy without diving into all details. The New Jersey Report from Review of Financial Statements and Compilation by Accounting Firm helps clarify which option is best suited for your organization’s needs.

Reviewed financial statements offer a higher level of assurance compared to compiled financial statements. A review involves analytical procedures applied to financial data, providing a moderate level of assurance. On the other hand, a compilation involves assembling financial information without providing any assurance. Thus, the New Jersey Report from Review of Financial Statements and Compilation by Accounting Firm is vital for understanding these distinctions.

In New Jersey, various entities, such as corporations and certain nonprofits, are required to submit an Audited Financial Statement (AFS). This requirement often depends on the size, revenue, and type of the organization. Essentially, if your organization falls under specific criteria established by the state, the New Jersey Report from Review of Financial Statements and Compilation by Accounting Firm becomes essential for compliance.

No, a compilation is not the same as a review. A compilation presents financial information without assessing its reliability, while a review includes analytical procedures to offer a moderate level of assurance. By utilizing the New Jersey Report from Review of Financial Statements and Compilation by Accounting Firm, you can better grasp these differences and their implications for your business reports.

A review by a CPA entails a limited examination of financial statements to provide a conclusion about their fairness. This process includes analytical procedures and inquiries, allowing the CPA to offer moderate assurance compared to a compilation. The New Jersey Report from Review of Financial Statements and Compilation by Accounting Firm helps users understand the benefits of engaging a CPA for reviews to enhance their financial reliability.

A financial compilation report is a document that presents a company’s financial data in a structured manner, based solely on information provided by management. This report offers no assurance regarding the accuracy of the data, making it essential for certain business contexts. The New Jersey Report from Review of Financial Statements and Compilation by Accounting Firm helps clarify when a financial compilation is appropriate for your business.

Yes, a CPA can perform a compilation without undergoing a peer review, as the compilation process does not require the same level of scrutiny as a review. However, having a peer review can enhance the credibility of the CPA's work. When using the New Jersey Report from Review of Financial Statements and Compilation by Accounting Firm, you can gain insights into the importance of CPA standards in assurance services.

The main difference lies in the level of scrutiny applied to the financial statements. In a review, the CPA performs analytical procedures and inquiries to provide limited assurance. Conversely, a compilation simply organizes financial data without assessing authenticity. The New Jersey Report from Review of Financial Statements and Compilation by Accounting Firm aids in differentiating these services for your needs.