This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

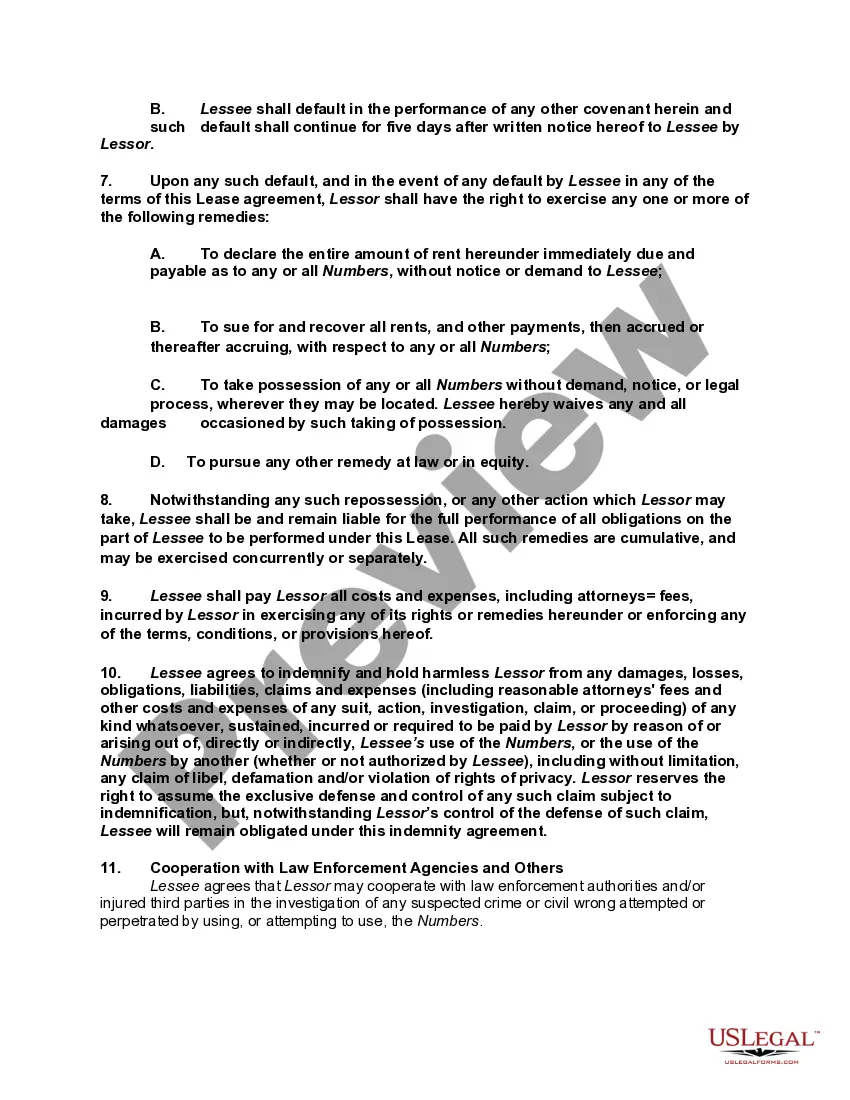

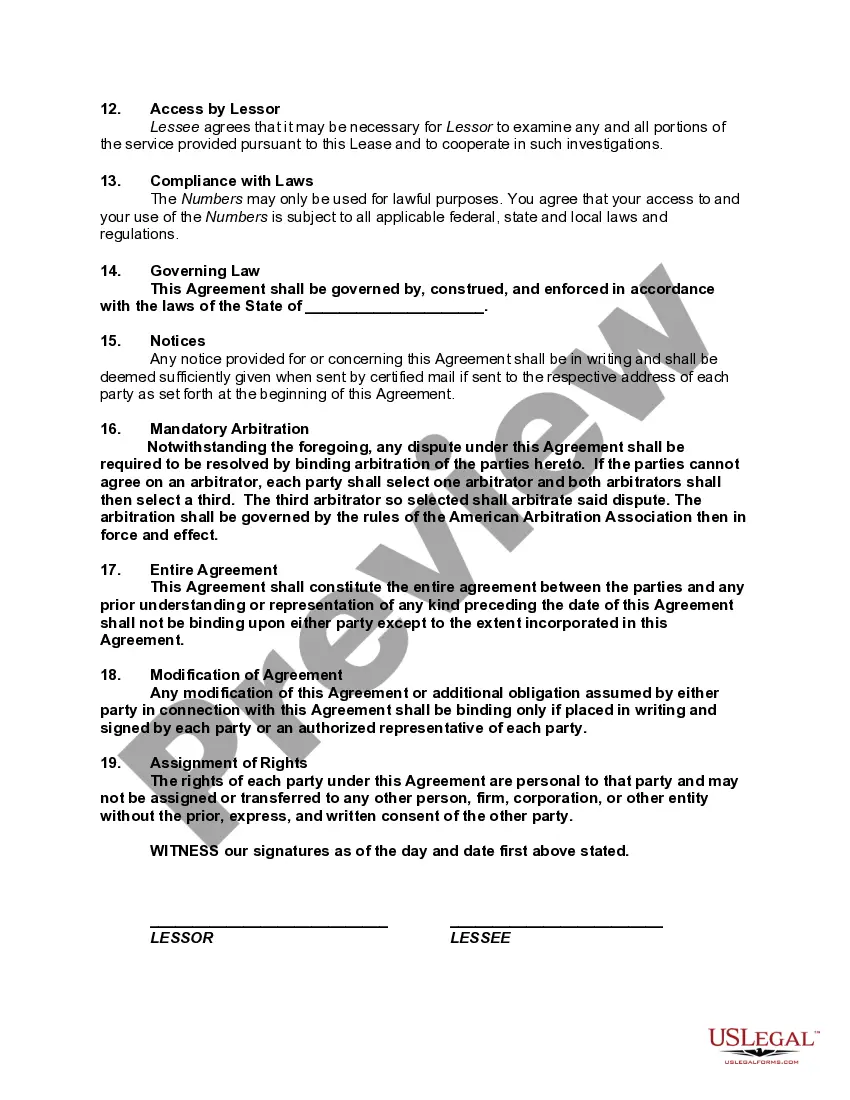

New Jersey Agreement to Rent Toll Free Numbers to Generate Loan Modification Leads

Description

How to fill out Agreement To Rent Toll Free Numbers To Generate Loan Modification Leads?

US Legal Forms - one of the most extensive collections of legal documents in the United States - offers a broad selection of legal form templates that you can download or print.

Through the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest form templates such as the New Jersey Agreement to Rent Toll Free Numbers to Generate Loan Modification Leads in minutes.

If you have a monthly subscription, Log In to download the New Jersey Agreement to Rent Toll Free Numbers to Generate Loan Modification Leads from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make edits. Fill in, modify, print, and sign the downloaded New Jersey Agreement to Rent Toll Free Numbers to Generate Loan Modification Leads. Each template you added to your account has no expiration date and is yours forever. Therefore, if you wish to download or print another copy, just go to the My documents section and click on the form you need. Access the New Jersey Agreement to Rent Toll Free Numbers to Generate Loan Modification Leads through US Legal Forms, one of the largest collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the form's details.

- Check the form description to confirm that you have selected the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, validate your choice by clicking the Buy Now button.

- Then, choose your preferred pricing plan and provide your details to register for an account.

Form popularity

FAQ

Eligibility for NJ property tax relief typically includes homeowners, particularly seniors, disabled residents, or those meeting income thresholds. To qualify, it’s essential to check the specific guidelines set by the New Jersey Division of Taxation. Staying informed about these criteria ensures you can reap the benefits available to you.

In New Jersey, there is no specific age at which seniors stop paying property taxes entirely. However, programs like the property tax freeze provide significant relief for seniors beyond a certain age, typically 65 and older. Understanding the available options can help you manage your property tax responsibilities.

In New Jersey, the anchor program primarily qualifies homeowners, especially seniors and disabled individuals, who meet certain income and residency requirements. It is designed to provide financial relief to eligible residents. To ensure you meet the qualifications, reviewing the specific requirements is essential.

Typically, NJ anchor rebates are issued in the summer months, following the tax filing season. However, the exact timing can vary based on your specific circumstances and the application processing time. For detailed updates, checking your application status online is highly recommended.

Yes, your NJ rebate can be directly deposited into your bank account if you provide your banking information during the application process. This option is often more convenient than receiving a check by mail. Always ensure your details are accurate to facilitate a smooth deposit.

The timing of your NJ anchor rebate can vary, but you can generally expect it within a few months after your application is processed. For timely updates, monitoring your status online is a great choice. Staying informed ensures you know exactly when to anticipate your rebate.

In New Jersey, the income limit for the property tax freeze program typically varies based on the year and specific guidelines issued by the state. Generally, it aims to assist seniors and disabled citizens, so checking the latest updates on the NJ Division of Taxation website is advisable for the most accurate figures.

Eligibility for the NJ anchor program generally includes homeowners who meet certain income thresholds. Specifically, you should have owned and occupied your home as your primary residence. It’s essential to review the detailed eligibility criteria on the state’s website for comprehensive information.

You can check your NJ anchor status online through the New Jersey Division of Taxation website. Simply navigate to the appropriate section and provide the required details, such as your social security number and date of birth. This straightforward method helps you stay updated on your anchor application.

To check the status of your New Jersey anchor rebate, visit the state’s official tax website. You will need to enter your personal information as requested on the site. This process ensures you can track your rebate status efficiently and stay informed about its progress.