New Jersey General Partnership Agreement - version 2

Description

How to fill out General Partnership Agreement - Version 2?

Have you ever found yourself in a scenario where you require documents for business or personal reasons nearly every day.

There are many legal document templates accessible online, but locating ones you can trust isn't easy.

US Legal Forms offers thousands of form templates, such as the New Jersey General Partnership Agreement - version 2, that are crafted to comply with state and federal regulations.

When you discover the correct form, click Get now.

Select your preferred pricing plan, provide the necessary information to set up your payment, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Jersey General Partnership Agreement - version 2 template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and confirm it is for your correct locality/state.

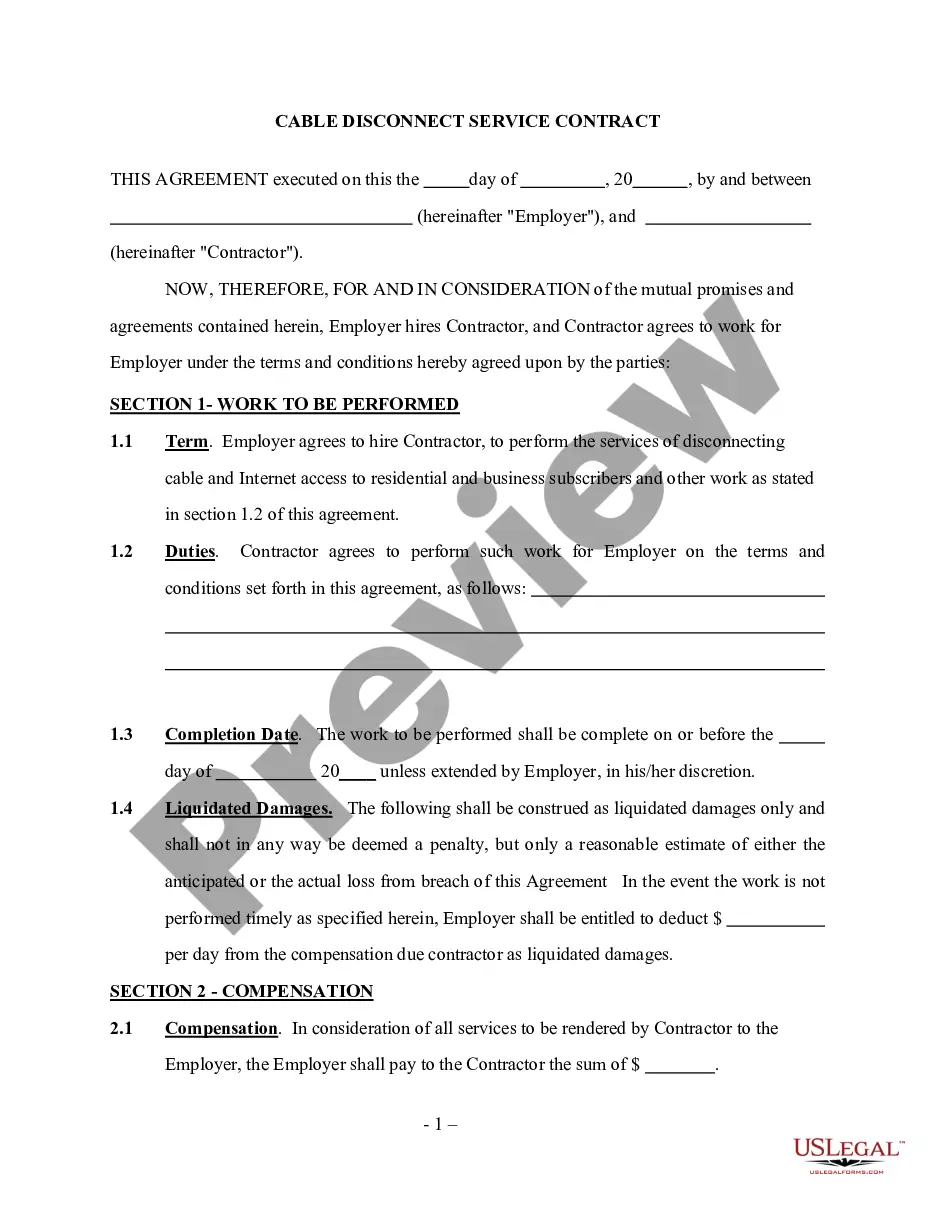

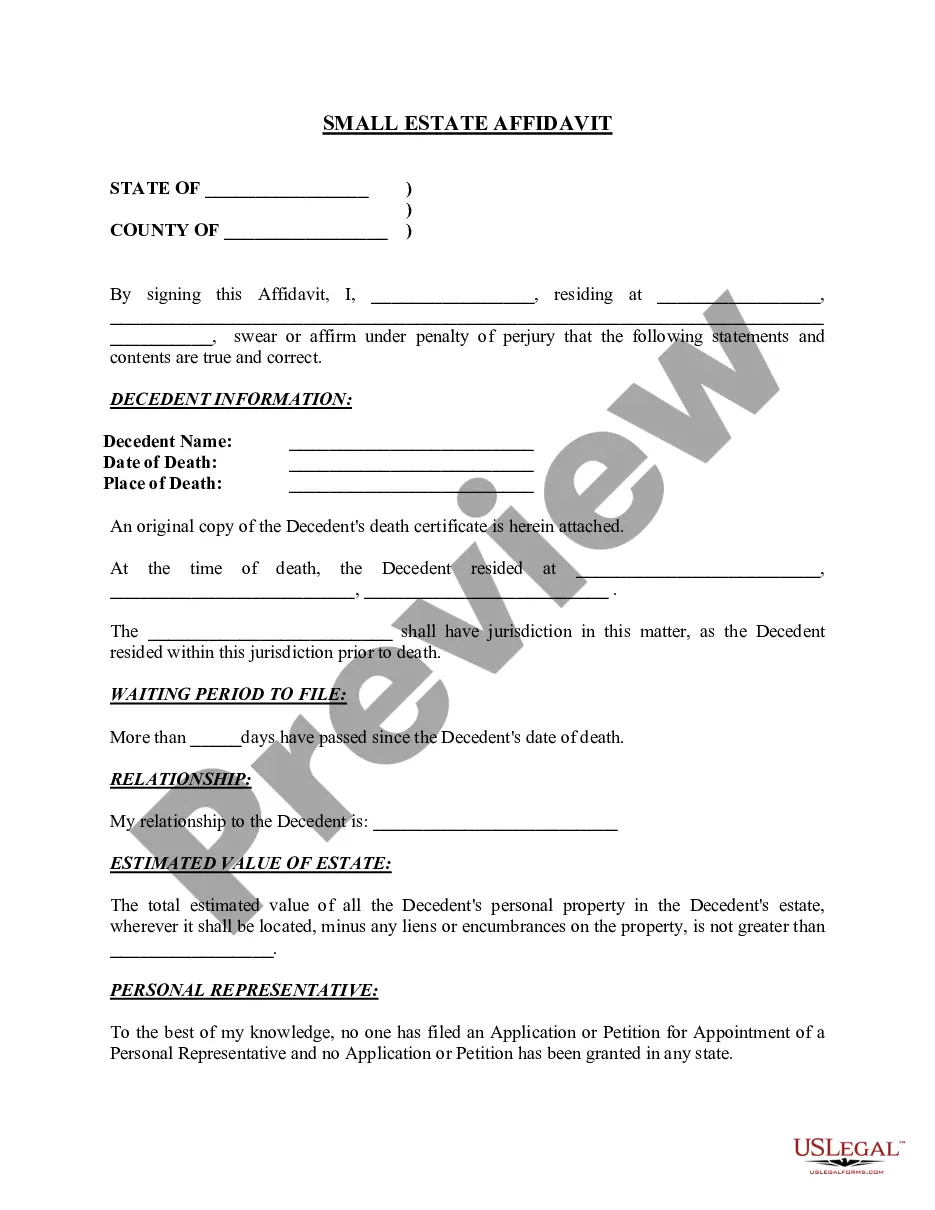

- Utilize the Preview button to examine the form.

- Check the description to ensure that you have selected the right document.

- If the document isn't what you're searching for, use the Search field to find the form that meets your requirements.

Form popularity

FAQ

Creating a partnership in New Jersey involves selecting a name, filing a Certificate of Partnership, and drafting a New Jersey General Partnership Agreement - version 2. This agreement outlines the terms, responsibilities, and profit-sharing arrangements among partners. This thorough preparation will set the foundation for a successful partnership.

Form 1065 is specifically for partnerships and cannot be used for S Corporations or C Corporations. Each type of business entity has distinct tax reporting requirements. To navigate these differences, your New Jersey General Partnership Agreement - version 2 can be an essential resource.

The CBT surcharge is an additional tax applied to businesses operating in New Jersey that exceed certain income thresholds. It is important to factor this surcharge into your financial planning, especially when reviewing your obligations as defined in the New Jersey General Partnership Agreement - version 2. Understanding these costs can aid in budgeting effectively.

Partnerships in New Jersey primarily need to complete form 1065 to report their income, along with potentially needing to include other tax forms based on their activities. Utilizing a New Jersey General Partnership Agreement - version 2 can guide you through this process, ensuring compliance and clarity in your reporting.

Form 1065 can apply to various types of entities, typically partnerships. These may include general partnerships, limited partnerships, and limited liability partnerships (LLPs). It’s important to reference the New Jersey General Partnership Agreement - version 2 for details on which type of entity best fits your business needs.

Schedule K-1 and form 1065 are linked but different. Form 1065 is filed by the partnership to report its income, while Schedule K-1 is provided to each partner, detailing their share of the income. Clear understanding of these forms, as outlined in the New Jersey General Partnership Agreement - version 2, is essential for accurate tax reporting.

To start a partnership business, you need several key documents, including the Certificate of Partnership and a comprehensive New Jersey General Partnership Agreement - version 2. Additionally, you might need an Employer Identification Number (EIN) and other local permits, depending on your business type. Proper documentation provides clarity and helps in establishing your partnership effectively.

NJ 1065 CBT refers to the New Jersey Corporate Business Tax return for partnerships. This form is necessary for reporting income if your partnership is taxed as a corporation. Referencing the New Jersey General Partnership Agreement - version 2 can help ensure your compliance with these tax obligations.

If you are waiting for your NJ CBT refund, you can check with the New Jersey Division of Taxation for updates. Sometimes, delays can occur due to processing times. Maintaining accurate records and following the guidelines from your New Jersey General Partnership Agreement - version 2 can aid in the smooth handling of your partnership’s finances.

NJ-1065 and NJ CBT 1065 serve different tax purposes in New Jersey. NJ-1065 is used for reporting partnership income, whereas the NJ CBT 1065 is the Corporate Business Tax return for partnerships taxed as corporations. Understanding the nuances can help you comply with New Jersey law, as highlighted in the New Jersey General Partnership Agreement - version 2.