US Legal Forms - one of the biggest libraries of authorized varieties in the USA - delivers a variety of authorized document themes you are able to download or print out. Using the web site, you can get thousands of varieties for organization and specific reasons, sorted by groups, says, or keywords.You will find the most up-to-date variations of varieties such as the New Jersey Agreement By Heirs to Substitute New Note for Note of Decedent within minutes.

If you currently have a subscription, log in and download New Jersey Agreement By Heirs to Substitute New Note for Note of Decedent from the US Legal Forms library. The Download switch can look on every single type you perspective. You gain access to all in the past downloaded varieties in the My Forms tab of your respective account.

If you would like use US Legal Forms initially, listed below are straightforward recommendations to get you began:

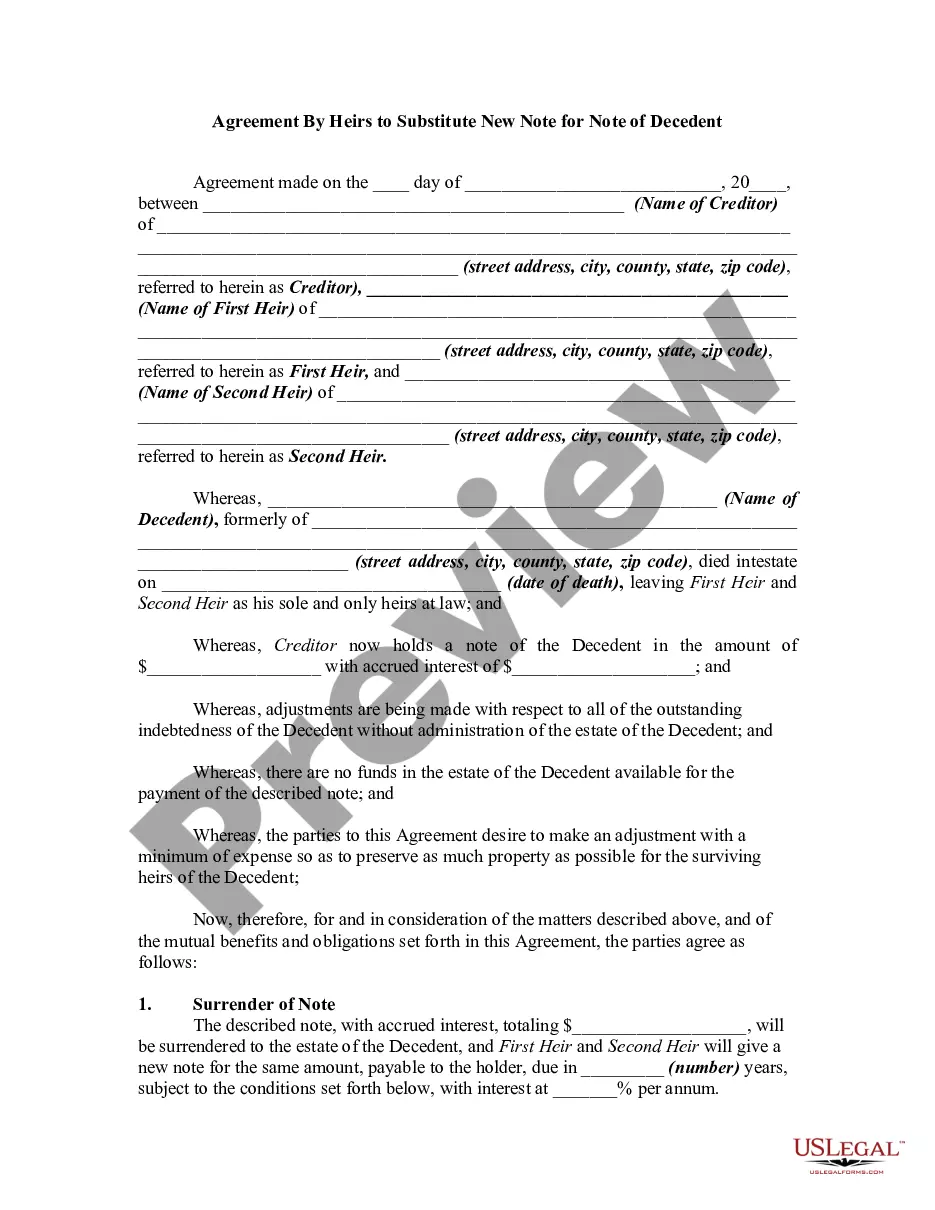

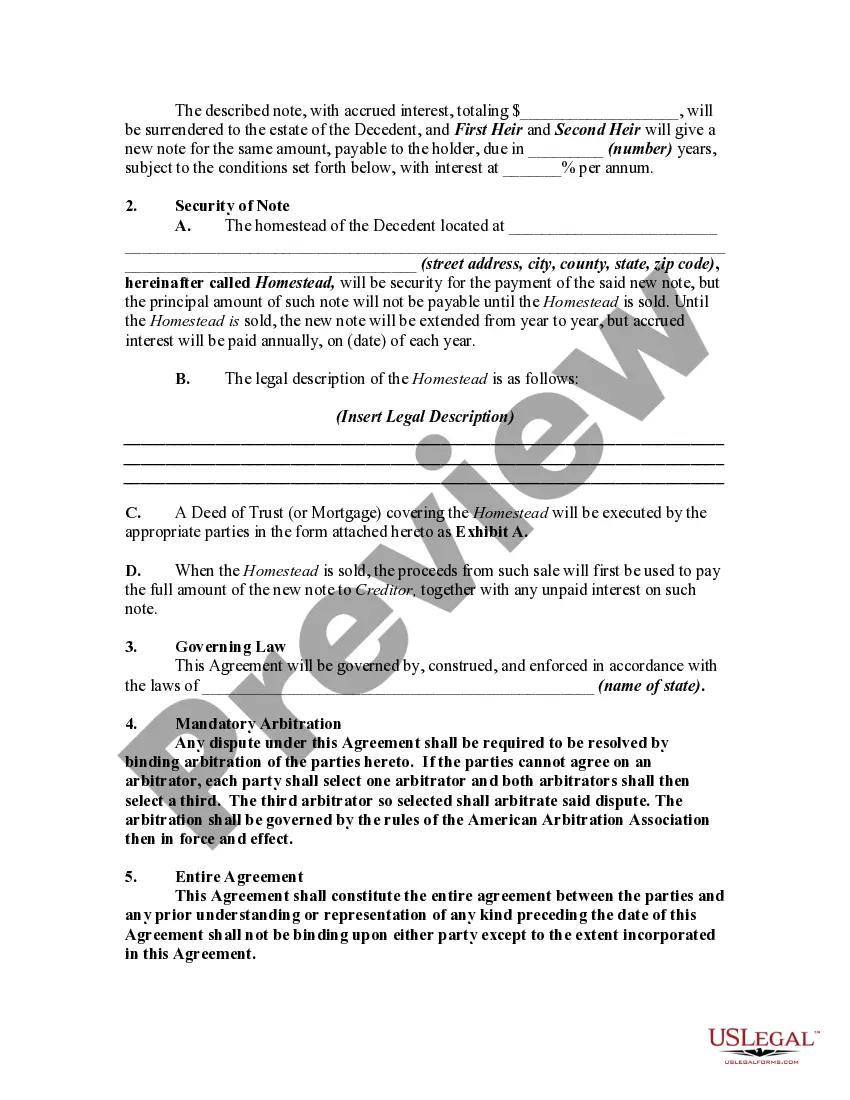

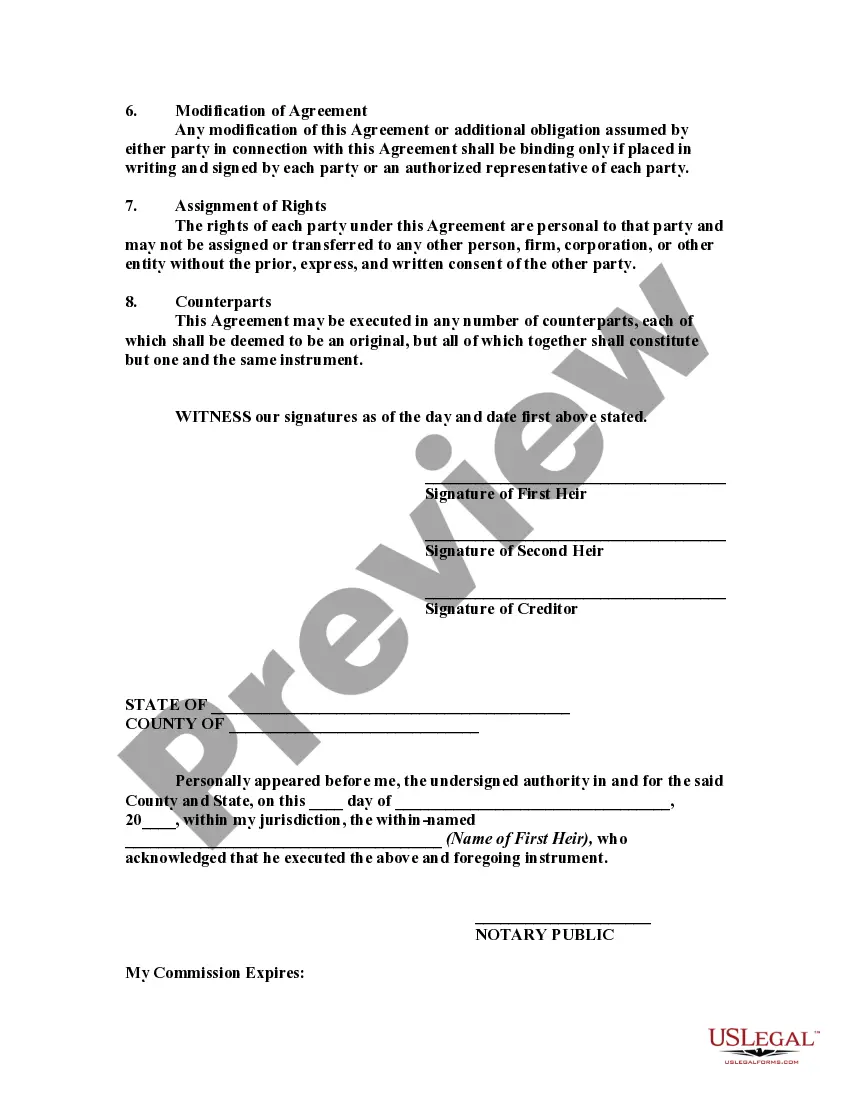

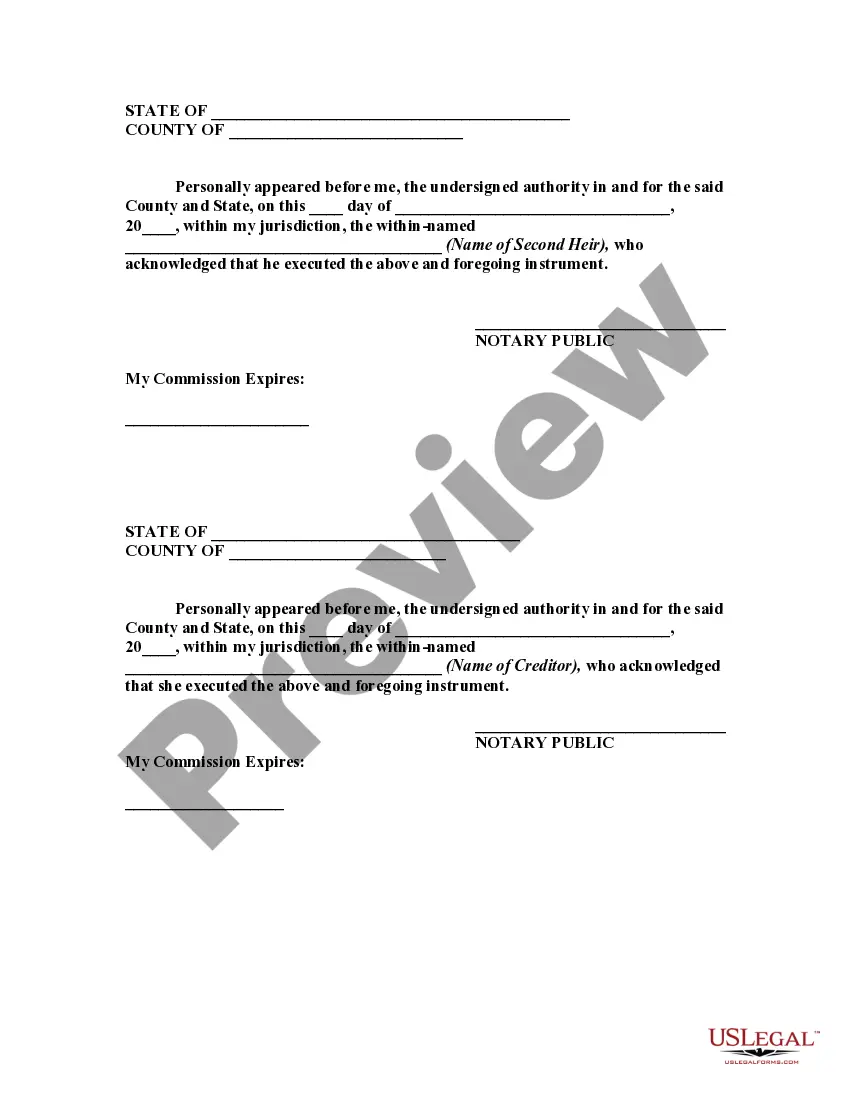

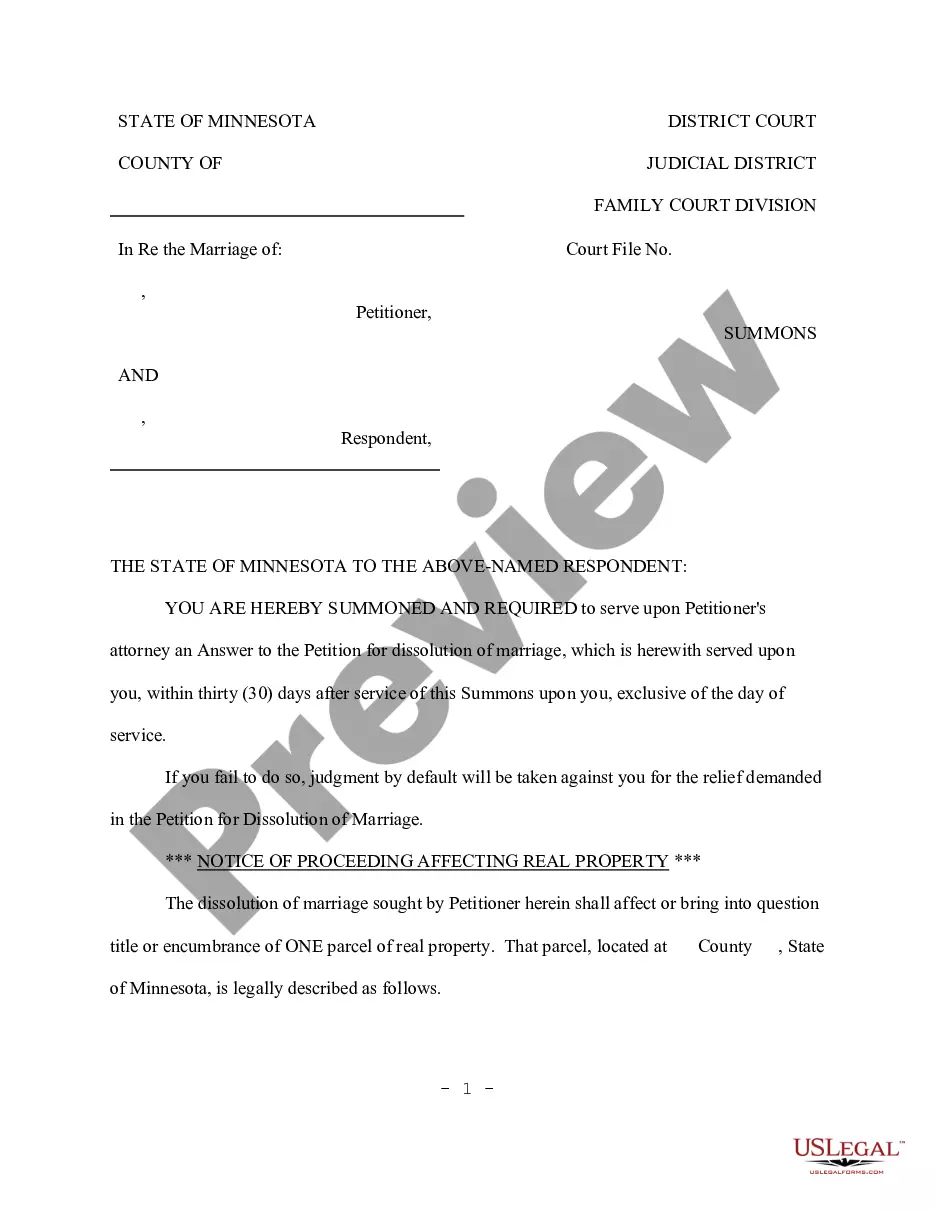

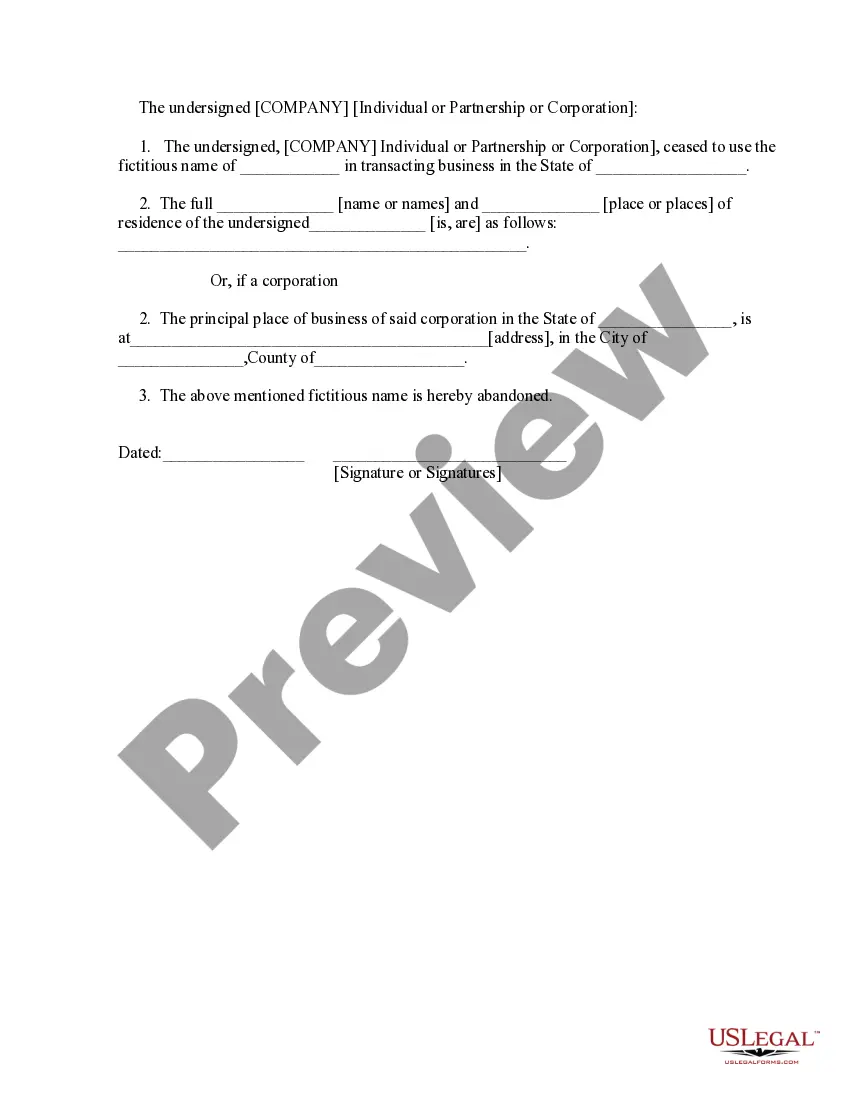

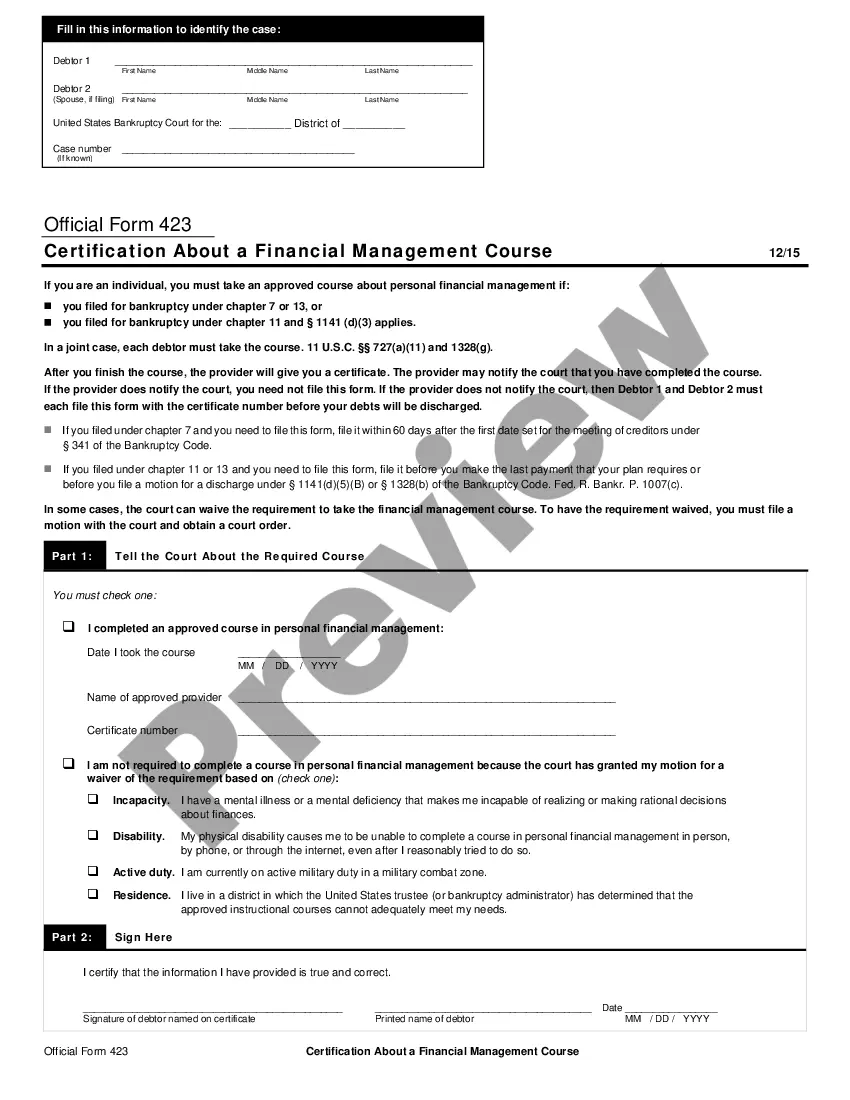

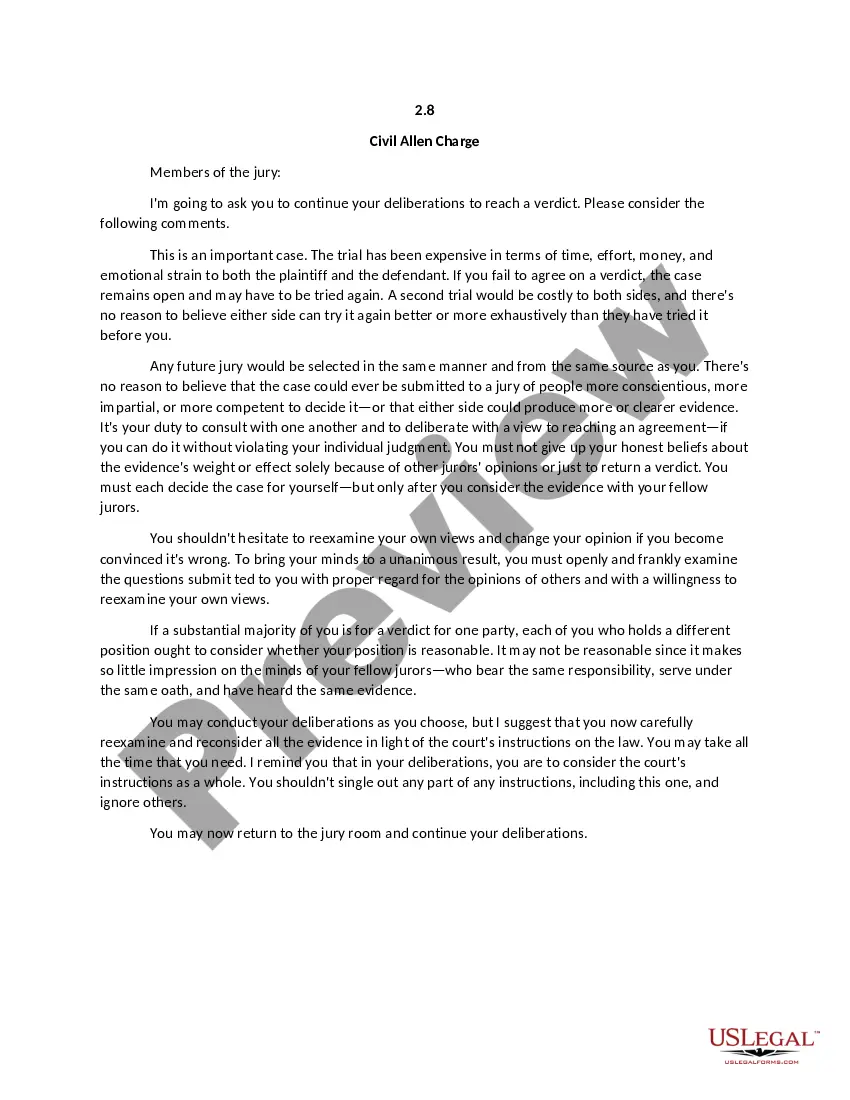

- Make sure you have picked the correct type to your metropolis/region. Select the Preview switch to examine the form`s articles. Read the type outline to ensure that you have selected the proper type.

- In case the type does not fit your demands, take advantage of the Lookup area at the top of the screen to find the one who does.

- In case you are pleased with the shape, affirm your selection by simply clicking the Purchase now switch. Then, select the costs program you prefer and provide your accreditations to sign up to have an account.

- Process the transaction. Use your credit card or PayPal account to finish the transaction.

- Find the file format and download the shape on your system.

- Make adjustments. Fill up, revise and print out and sign the downloaded New Jersey Agreement By Heirs to Substitute New Note for Note of Decedent.

Every template you put into your bank account lacks an expiration date which is your own property forever. So, if you wish to download or print out yet another duplicate, just check out the My Forms portion and click on around the type you want.

Gain access to the New Jersey Agreement By Heirs to Substitute New Note for Note of Decedent with US Legal Forms, probably the most extensive library of authorized document themes. Use thousands of specialist and condition-certain themes that meet up with your business or specific requires and demands.