An option is a contract to purchase the right for a certain time, by election, to purchase property at a stated price. An option may be a right to purchase property or require another to perform upon agreed-upon terms. By purchasing an option, a person is paying for the opportunity to elect or "exercise" the right for the property to be purchased or the performance of the other party to be required. "Exercise" of an option normally requires notice and payment of the contract price. The option will state when it must be exercised, and if not exercised within that time, it expires. If the option is not exercised, the amount paid for the option is not refundable.

New Jersey Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer

Description

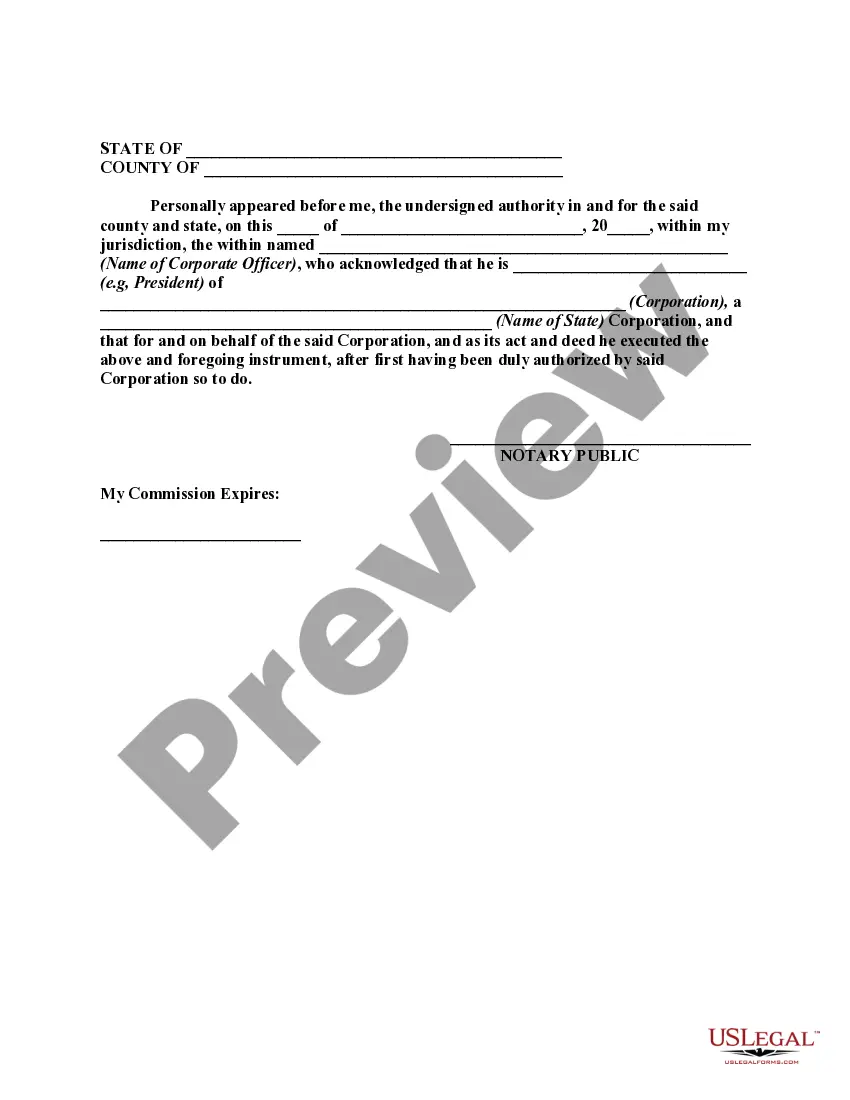

How to fill out Option To Sell Real Property If Option Executed Within Certain Period Of Time - Continuing Offer?

In case you require to complete, obtain, or print authentic document templates, utilize US Legal Forms, the most extensive collection of legal forms, accessible online.

Employ the site's straightforward and user-friendly search to find the documents you need.

A range of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to locate the New Jersey Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the New Jersey Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer.

- You may also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions provided below.

- Step 1. Ensure that you have selected the form for your specific city/state.

- Step 2. Use the Preview option to review the form's content. Don't forget to read through the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal document template.

Form popularity

FAQ

To avoid the New Jersey exit tax, you need to ensure you qualify for exemptions, such as becoming a non-resident for tax purposes. Provide accurate and complete documentation when selling property. Consulting a tax professional can also clarify your options. Understanding the New Jersey Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer may help you navigate these taxes correctly, especially during property transactions.

Yes, the NJ-1040NR can be filed electronically using approved tax software. E-filing can speed up processing times and make tracking your return easier. Make sure that the software you choose is compatible with New Jersey tax forms. This is especially useful if you are engaging in real estate transactions under the New Jersey Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer.

To amend your New Jersey state tax return, complete the NJ-1040X form. You will need to explain the changes you made and provide any necessary supporting documentation. Send the amended form to the correct tax office address indicated on the form. Awareness of the New Jersey Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer can help you navigate any relevant tax implications efficiently.

In New Jersey, backing out of a real estate contract can be possible, but it depends on the terms outlined in the contract. If you have contingencies, such as inspection results or financing, you may be able to exit without penalties. However, doing so can sometimes lead to legal complications. Understanding the terms of the New Jersey Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer can provide clarity in such situations.

You should mail your NJ-1040NR form to the appropriate New Jersey Division of Taxation address, which can be found on the form itself. Ensure to double-check if any specific guidelines apply based on your situation. Incorrect mailing can delay processing, so it’s essential to follow the instructions carefully. If you're dealing with real estate tax implications from the New Jersey Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer, proper submission is vital.

You can amend your New Jersey 1040NR by completing the NJ-1040X form. This form allows you to revise your original return to correct errors or provide additional information. Always include the reasons for your amendments. Knowing the New Jersey Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer can help you in determining how to report any related income or deductions.

To amend your 1040NR form, you need to file Form 1040X. This form allows you to correct any mistakes or change your filing status. Make sure to indicate the changes clearly and state the reason for each amendment. If you are considering a real estate transaction, understand the implications of the New Jersey Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer on your tax situation.

Yes, a seller can back out after the attorney review period in New Jersey, but it may come with legal and financial consequences. If the buyer has executed the agreement and the seller later decides to withdraw, the seller might be liable for damages or specific performance under the terms of the contract. If the agreement includes a New Jersey Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer, it is essential to review how this clause impacts the situation. It's advisable to consult with legal counsel before making any decisions.

In New Jersey, the timeframe to cancel a real estate contract typically depends on the circumstances and the specific contract terms. Generally, you have a three-day attorney review period after signing the contract, during which you can cancel without penalty. Additionally, if your contract includes a New Jersey Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer, it may provide additional cancellation rights based on specific conditions. Always consult with your attorney for personalized guidance.

An assignee is someone who receives the rights to a contract or lease from the original holder, while a purchaser directly buys the property. The assignee steps into the shoes of the original party and assumes their legal obligations, whereas the purchaser completes the transaction and becomes the new owner. Knowing these differences helps streamline processes like the New Jersey Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer.