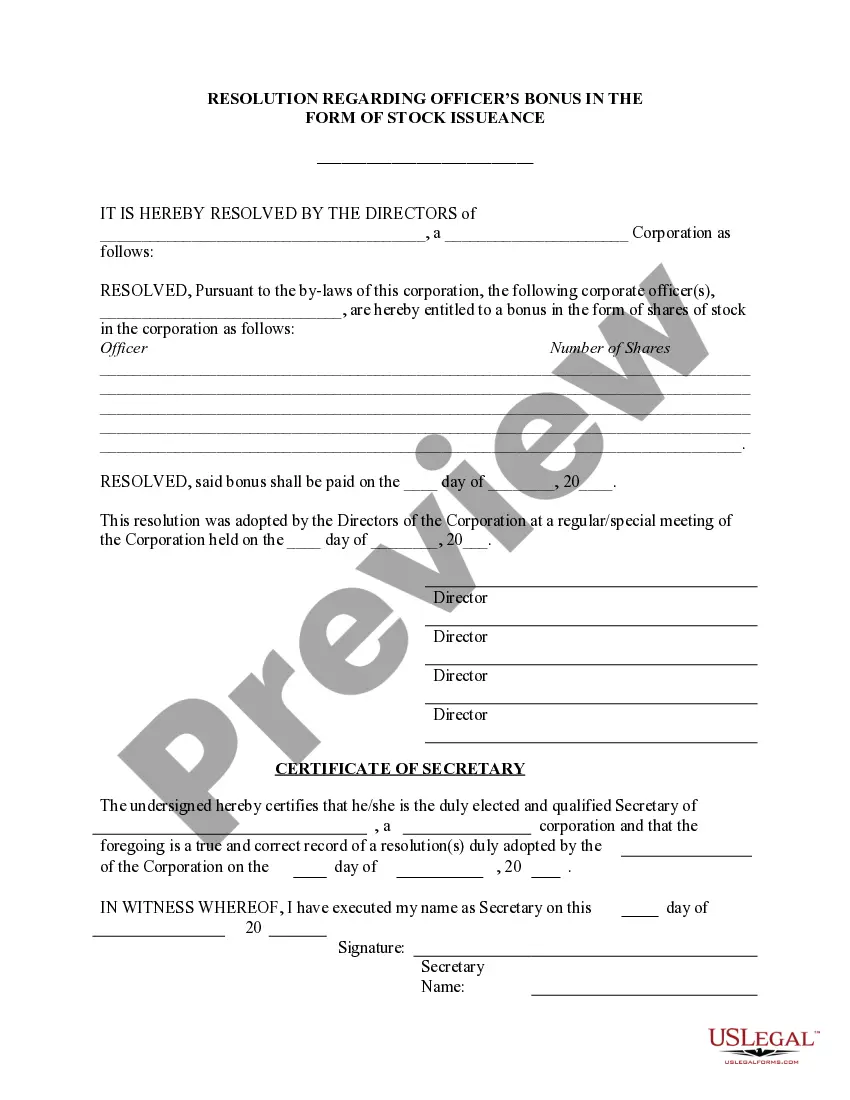

New Jersey Officers Bonus in form of Stock Issuance - Resolution Form

Description

How to fill out Officers Bonus In Form Of Stock Issuance - Resolution Form?

If you need to complete, download, or create legal document formats, utilize US Legal Forms, the largest selection of legal templates available online.

Employ the site's straightforward and convenient search to locate the documents you need.

Various templates for business and personal purposes are categorized by types and jurisdictions, or keywords.

Step 4. Once you have identified the form you want, select the Purchase now option. Choose the pricing plan you prefer and provide your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to find the New Jersey Officers Bonus in the form of Stock Issuance - Resolution Form in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and then click the Buy option to obtain the New Jersey Officers Bonus in the form of Stock Issuance - Resolution Form.

- You can also access forms you previously downloaded from the My documents section of your account.

- If this is your first time using US Legal Forms, refer to the steps outlined below.

- Step 1. Ensure you have chosen the form for the correct city/state.

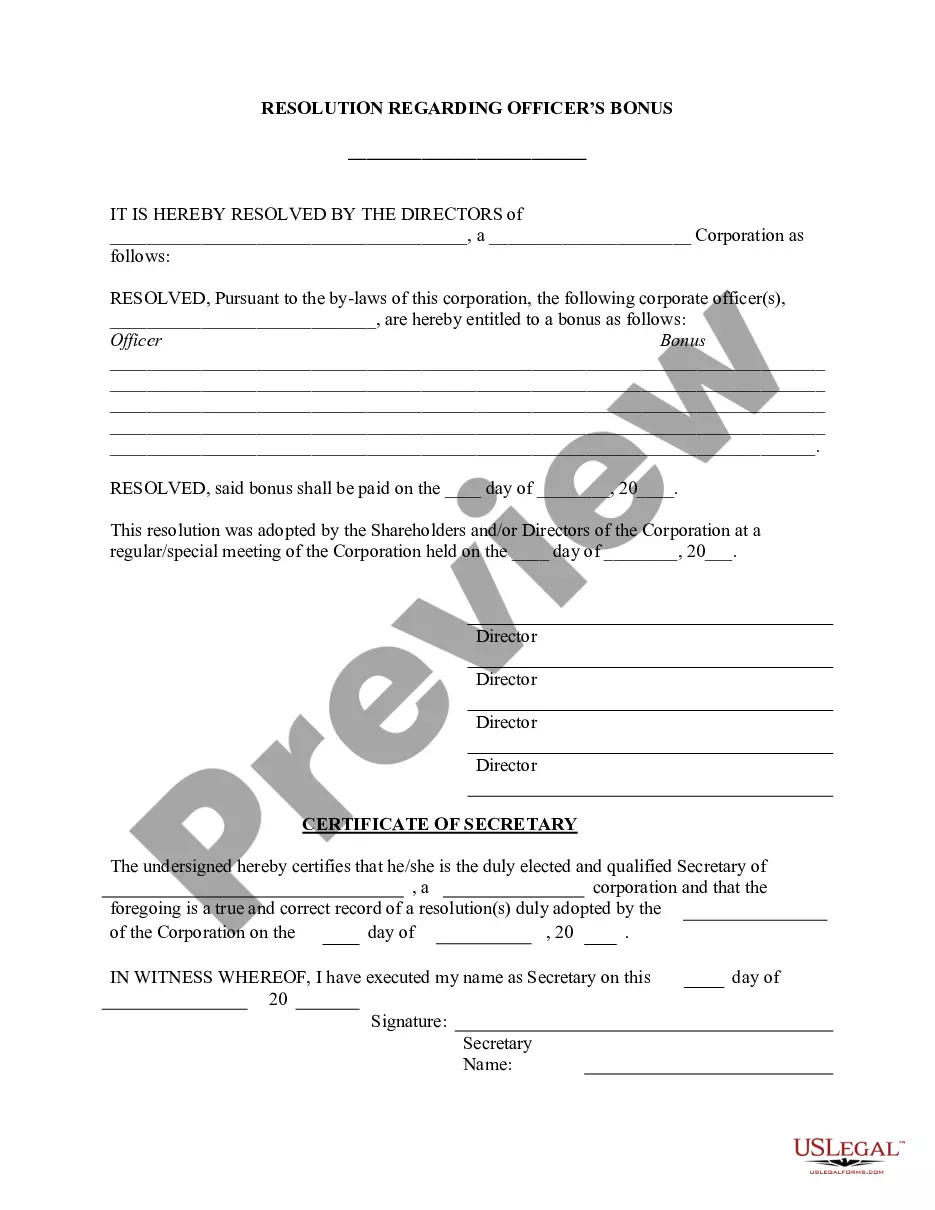

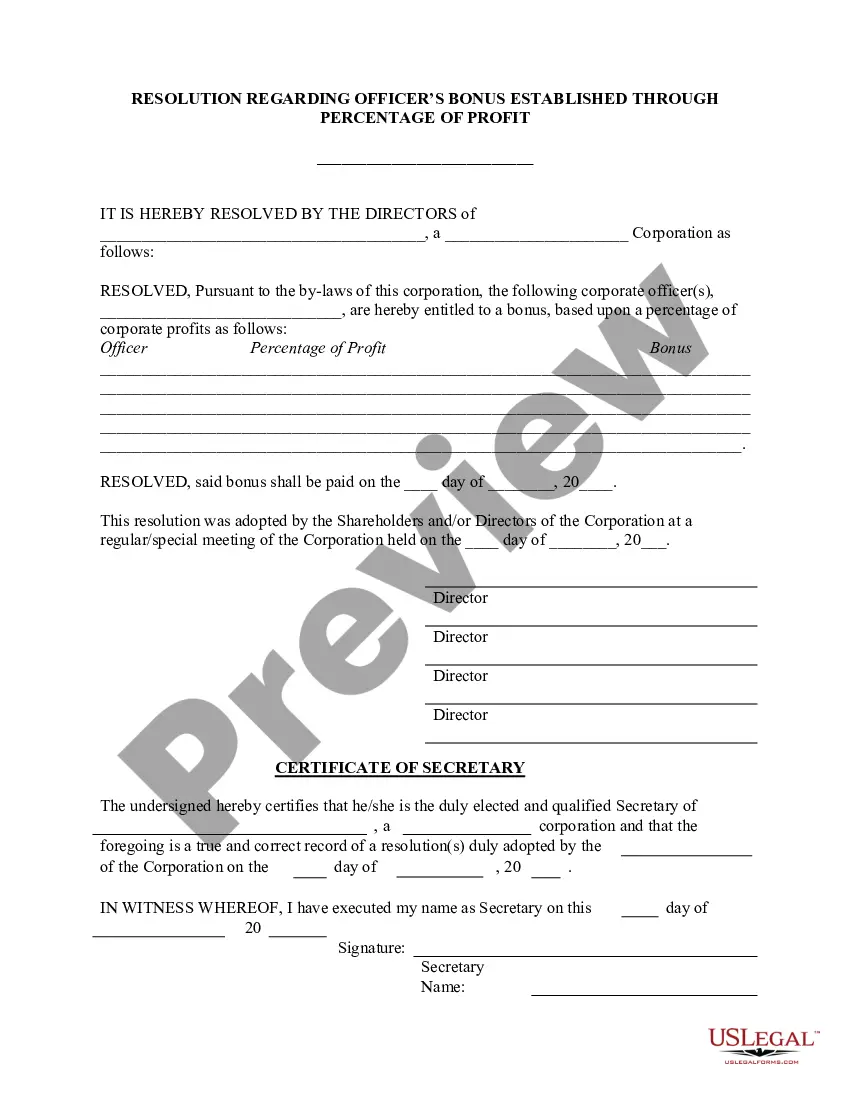

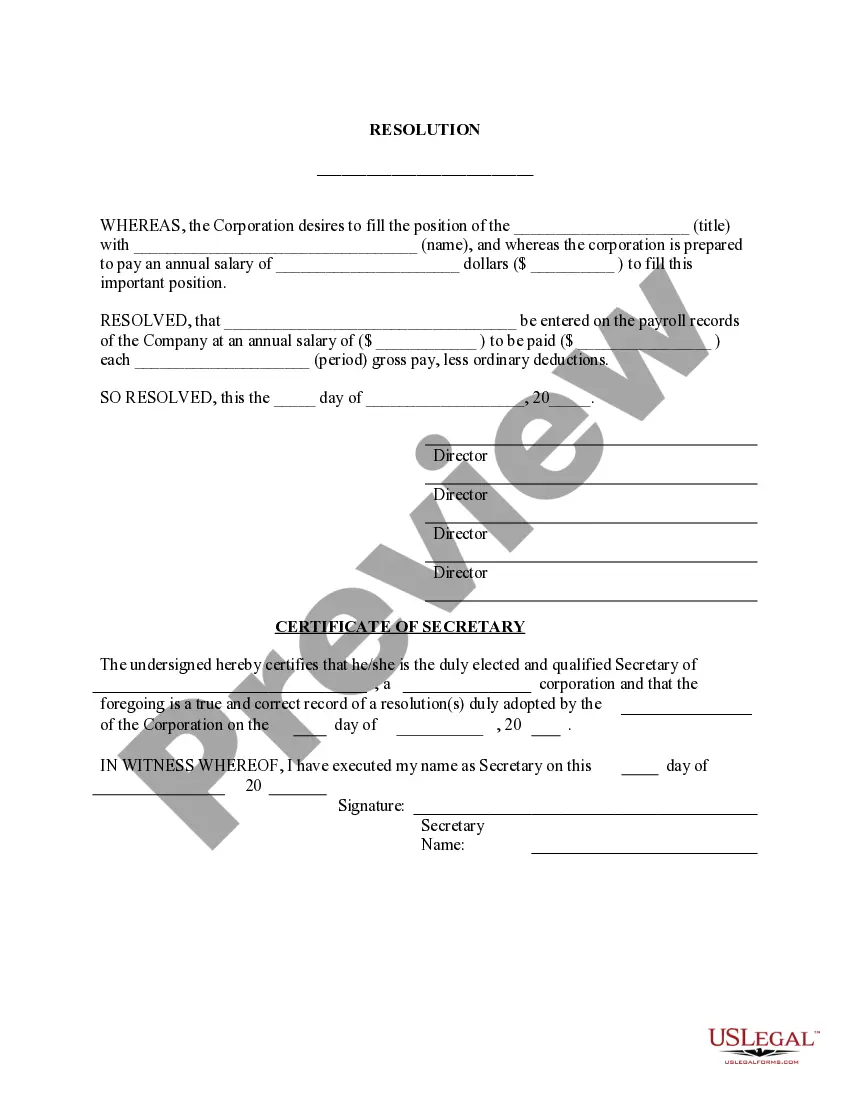

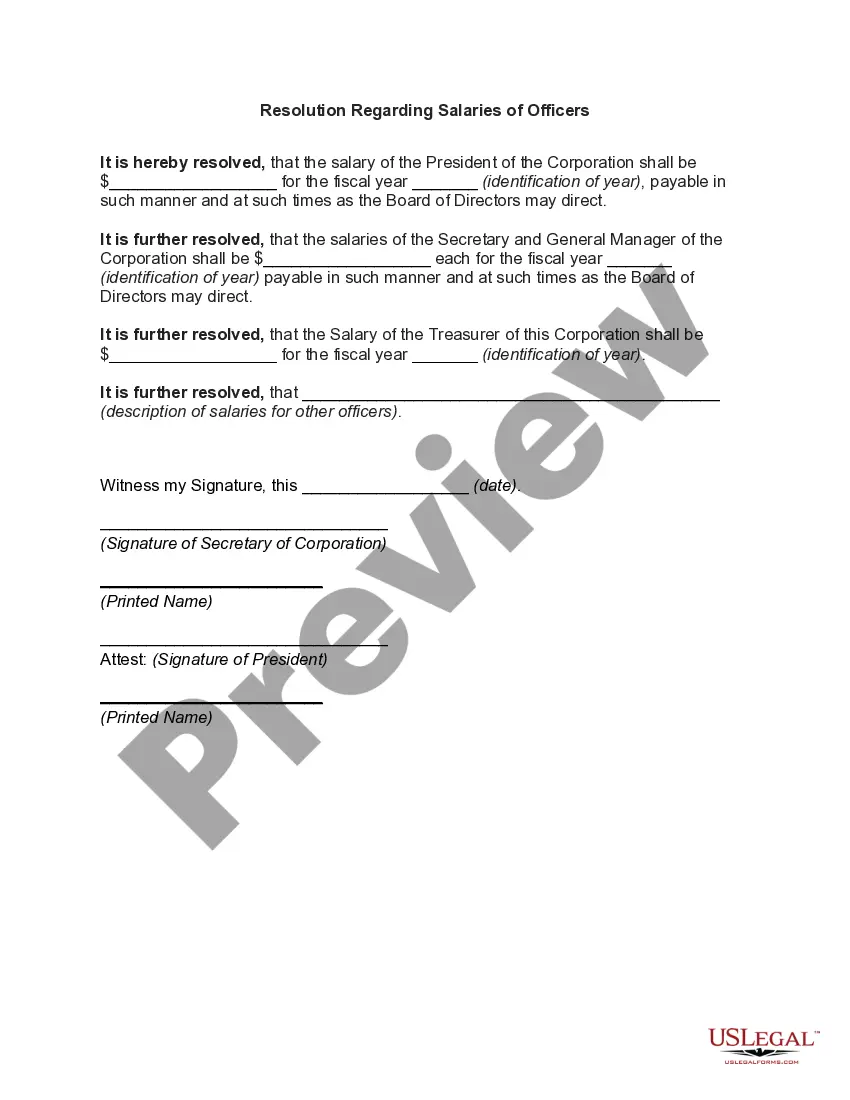

- Step 2. Use the Preview option to review the contents of the form. Remember to read through the description.

- Step 3. If you are not satisfied with the form, utilize the Search bar at the top of the screen to find alternative templates in the legal form catalog.

Form popularity

FAQ

In New Jersey, employers typically can collect overpayments within a specific time frame, usually up to six years. This period aligns with New Jersey’s statute of limitations on wage claims. Employers should act promptly to recover the overpayment to avoid complications. Utilizing the New Jersey Officers Bonus in form of Stock Issuance - Resolution Form can ensure all necessary information is properly documented.

Statute 34-11 4.4 in New Jersey pertains to wage payment regulations, addressing how and when employees should receive their wages. This statute outlines the employer's responsibilities regarding wage payments and rectifications. Understanding this statute is crucial for both employers and employees to ensure compliance with state laws. The New Jersey Officers Bonus in form of Stock Issuance - Resolution Form can help navigate these regulations effectively.

Yes, employers in New Jersey can recover overpaid wages if the overpayment was made in error. However, they must follow proper legal procedures to seek repayment. Clear communication with employees regarding the overpayment can facilitate the recovery process. Consider using the New Jersey Officers Bonus in form of Stock Issuance - Resolution Form to document the resolution effectively.

Yes, if a company mistakenly overpays an employee, it generally has the right to request a refund. Employees should be informed of the overpayment details, including the amount and reason. This process helps maintain financial integrity within organizations. Utilizing the New Jersey Officers Bonus in form of Stock Issuance - Resolution Form can streamline this refund process and ensure compliance.

The overpayment law in New Jersey addresses situations where an employee receives more compensation than entitled. Under New Jersey law, employers must notify employees of any overpayment and seek recovery. It is crucial to understand the rights and obligations of both parties in such cases. For specific situations, utilizing the New Jersey Officers Bonus in form of Stock Issuance - Resolution Form can provide clarity and structure.

Yes, you can take unpaid time off in New Jersey, but certain conditions apply. Employees may be eligible for unpaid leave under specific laws, such as the Family Leave Act. It’s important to know your rights and responsibilities, particularly when examining how it might affect compensation or bonuses, including the New Jersey Officers Bonus in form of Stock Issuance - Resolution Form.

Statute 34-11-4.4 in New Jersey pertains to the regulations surrounding non-payment of wages. This law emphasizes the rights of employees to receive their wages and outlines the recourse available if those wages remain unpaid. Understanding this statute is crucial, especially when handling compensation discussions like the New Jersey Officers Bonus in form of Stock Issuance - Resolution Form, as it ensures compliance with local regulations.

The 7 minute rule in New Jersey provides guidance for employers on how to manage employee time. Essentially, it suggests that if an employee works for less than seven minutes, the employer does not need to compensate them for that time. This principle helps employers streamline payroll and manage minor time discrepancies, especially when dealing with bonuses or stock issuance, such as the New Jersey Officers Bonus in form of Stock Issuance - Resolution Form.

Yes, bonuses are taxable in New Jersey. This means that when you distribute a New Jersey Officers Bonus in form of Stock Issuance - Resolution Form, taxes will apply and should be withheld accordingly. Properly managing these withholdings ensures compliance and prevents issues during tax season.

Statute 34-11 4.2 in New Jersey relates to wage payments and defines regulations surrounding compensation. This statute impact various aspects of how bonuses, such as the New Jersey Officers Bonus in form of Stock Issuance - Resolution Form, should be handled in terms of payment timelines and methods. Being aware of this statute is essential for compliance.