New Jersey Sample Letter to State Tax Commission concerning Decedent's Estate

Description

How to fill out Sample Letter To State Tax Commission Concerning Decedent's Estate?

If you need to finish, download, or print authentic document templates, utilize US Legal Forms, the largest selection of authentic forms, available online.

Take advantage of the site’s straightforward and user-friendly search to locate the documents you require. Various templates for business and personal purposes are categorized by groups and claims, or keywords.

Use US Legal Forms to obtain the New Jersey Sample Letter to State Tax Commission regarding Decedent's Estate in just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to every form you obtained in your account. Click on the My documents section and select a form to print or download again.

Complete, download, and print the New Jersey Sample Letter to State Tax Commission regarding Decedent's Estate with US Legal Forms. There are millions of professional and state-specific forms you can use for your personal business or individual needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to get the New Jersey Sample Letter to State Tax Commission regarding Decedent's Estate.

- You can also access forms you previously acquired in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions provided below.

- Step 1. Ensure you have selected the form for the correct city/region.

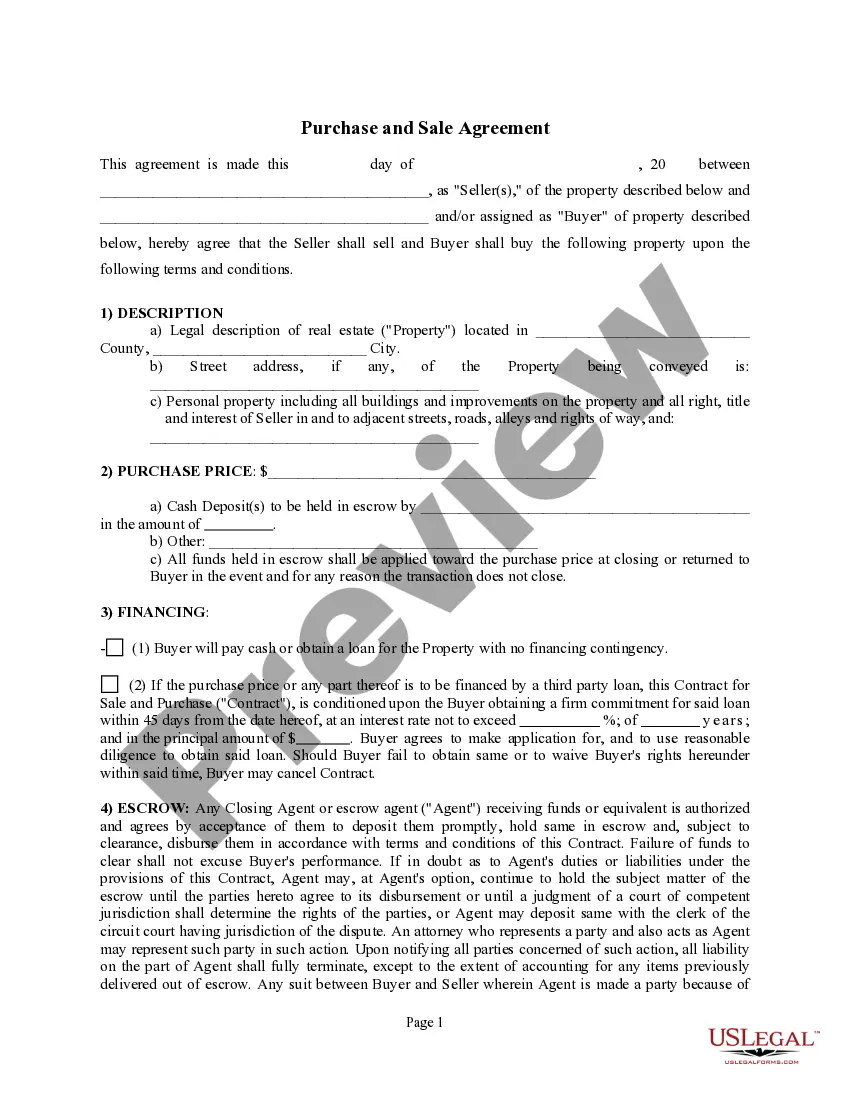

- Step 2. Use the Review option to browse through the form’s content. Don’t forget to check the details.

- Step 3. If you are dissatisfied with the form, utilize the Lookup field near the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have identified the form you need, click the Acquire now button. Choose the pricing plan you prefer and provide your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the New Jersey Sample Letter to State Tax Commission regarding Decedent's Estate.

Form popularity

FAQ

NJ Taxation The due date for filing is the same as for federal purposes. Use the same filing status that was used on the final federal income tax return, unless the decedent was a partner in a civil union. Joint Return. Write the name and address of the decedent and the surviving spouse in the name and address fields.

Inheritance Tax Rates Beneficiary or TransfereeTax Rate for Each Beneficiary or TransfereeClass ANo tax is dueClass CFirst $25,000 Next $1,075,000 Next $300,000 Next $300,000 Over $1,700,000No tax is due 11% 13% 14% 16%Class DFirst $700,000 Over $700,00015% 16%

In New Jersey, creditors have nine months after death to stake a claim against an estate. If the claim is not made within those nine months, the courts may dismiss the claim and leave the creditor empty-handed. This is why notice of death from the executor to the creditors is so important.

The personal representative of an estate is an executor, administrator, or anyone else in charge of the decedent's property. The personal representative is responsible for filing any final individual income tax return(s) and the estate tax return of the decedent when due.

If a person dies with assets but no will or trust, an administrator for his/her estate must be appointed by a court. If a person owns assets or property jointly with another person or in trust, then probate and estate administration is not necessary because ownership automatically goes to the surviving owner.

An estate can be closed in one of four fashions: (1) the mere release of funds by the Executor or Administrator to estate beneficiaries; (2) the release of estate distributions to estate beneficiaries after the execution of a Release and Refunding Bond upon which there is a waiver of any form of accounting; (3) ...

An estate can be closed in one of four fashions: (1) the funds can simply be distributed directly by the Executor or Administrator to estate beneficiaries; (2) the funds can be distributed to heir(s) after each signs a Release and Refunding Bond waiving his or her right to a formal accounting; (3) distribution can be ...

Regular New Jersey Probate: One Year or Less Closing an estate can take just a little over nine months if there's no litigation, no problems determining beneficiaries, and no creditor issues.