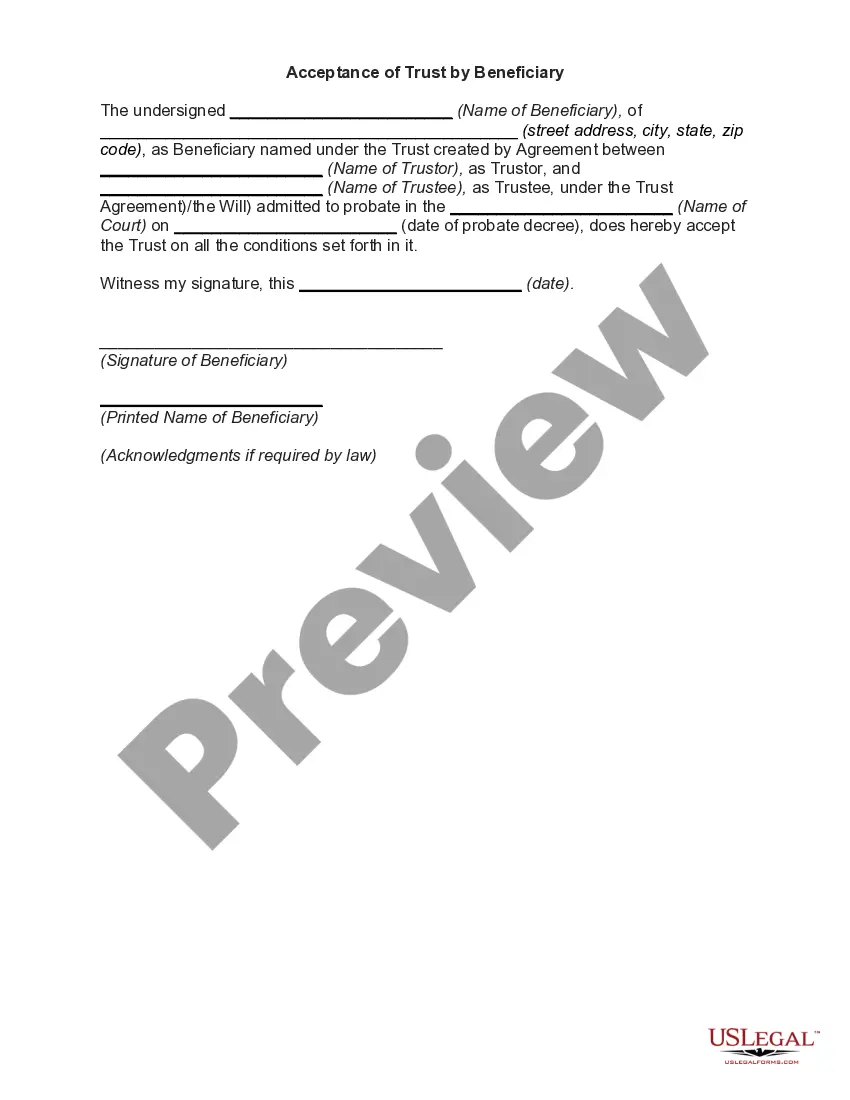

New Jersey Acceptance and Qualification of Succeeding Trustee is a process that must be completed when a trust changes trustees in the state of New Jersey. It involves the acceptance and qualification of the new trustee, and the appointment of the new trustee to the trust. The new trustee must accept the trust and sign a document that states that they agree to accept all the duties and responsibilities of the trust. The new trustee must also qualify to serve in the role, which involves providing proof of their identity and qualifications. There are two types of New Jersey Acceptance and Qualification of Succeeding Trustee. The first is a Trustee Acceptance and Qualification, which is used when a trust is created in New Jersey, or when an individual is appointed as a trustee of an existing trust. The second type is a Successor Trustee Acceptance and Qualification, which is used when an existing trustee resigns, or is removed from their role, and a new trustee is appointed to the trust.

New Jersey Acceptance and Qualification of Succeeding Trustee

Description

How to fill out New Jersey Acceptance And Qualification Of Succeeding Trustee?

Preparing official paperwork can be a real burden unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you find, as all of them correspond with federal and state laws and are checked by our experts. So if you need to complete New Jersey Acceptance and Qualification of Succeeding Trustee, our service is the best place to download it.

Obtaining your New Jersey Acceptance and Qualification of Succeeding Trustee from our library is as easy as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button once they find the correct template. Afterwards, if they need to, users can get the same document from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few moments. Here’s a brief instruction for you:

- Document compliance verification. You should attentively review the content of the form you want and make sure whether it satisfies your needs and fulfills your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library using the Search tab above until you find an appropriate template, and click Buy Now once you see the one you want.

- Account registration and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your New Jersey Acceptance and Qualification of Succeeding Trustee and click Download to save it on your device. Print it to fill out your papers manually, or use a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Sign up for our service now to get any official document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

A will must become public record when it is probated. A trust is also more secure than a will because it is more difficult to contest. While a living trust does not technically shield your assets from creditors, in practice, it can help avoid them.

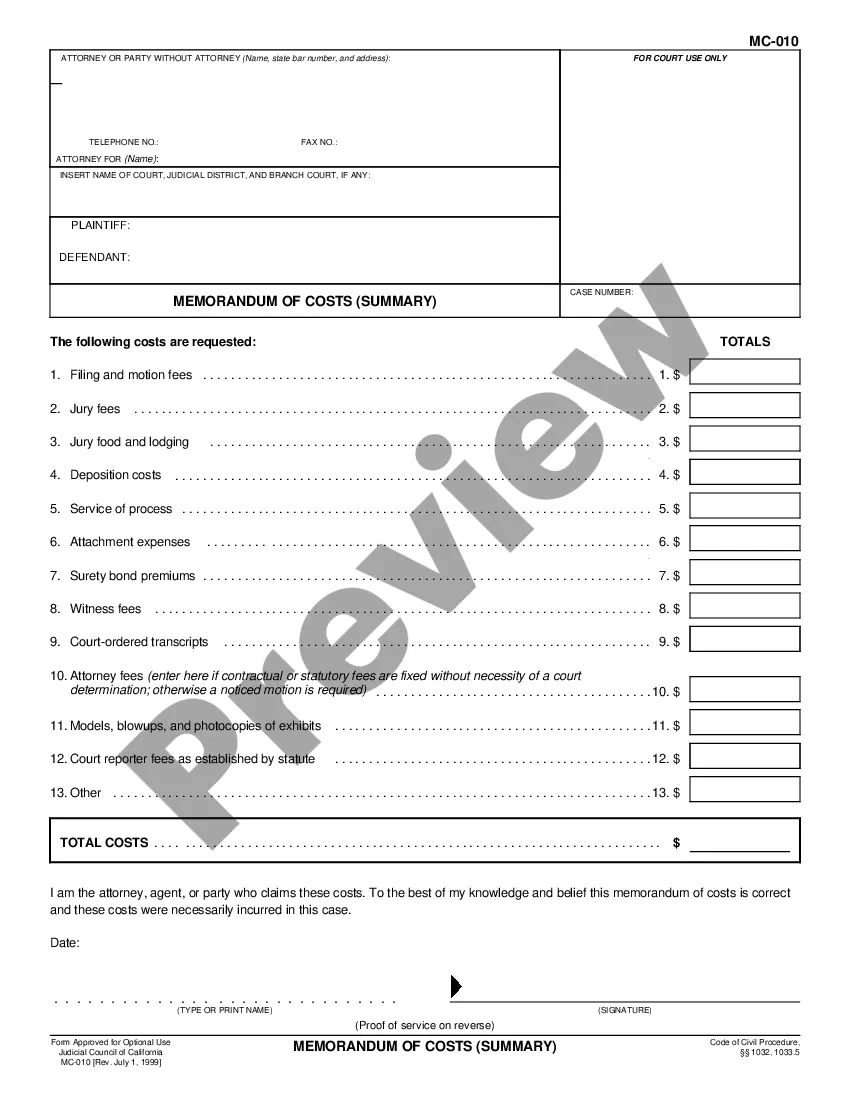

This will likely cost you around a few hundred dollars. You can also choose to hire an attorney. This option will probably cost you more than $1,000, though the exact cost will depend on the attorney's fees and the complexity of your estate. Clearly, it is cheaper to create your trust yourself.

Trustee Corpus Commission The statutory fee for a trust corpus is . 5% of the first $400,000 and . 3% on the value of the corpus that exceeds $400,000.

One of the primary disadvantages to using a trust is the cost necessary to establish it. It's generally more expensive to prepare a living trust than a will. You must create new deeds and other documents to transfer ownership of your assets into the trust after you form it.

The Administration cannot be issued until the sixth day from the date of death. The process can start before the sixth day; however, the Short Certificates or Affidavit's will not be issued until the sixth day after death.

New Jersey law requires that a trust be a written document. The trust must also appoint a trustee. For a trust to function, it needs to be funded with cash or other property of value. If a trust is not funded when it is signed or is not funded in the future by its creator it is a worthless trust.

Grantor trusts are required to file a New Jersey Gross Income Tax Fiduciary Return. If the grantor trust income is reportable by or tax- able to the grantor for Federal income tax purposes, it is also taxable to the grantor for New Jersey gross income tax purposes.

Create the trust document: You can use an online program or create one with a lawyer. Get the trust document notarized: Go to a notary public and sign the document. Fund the trust: This means transferring your property into the trust.