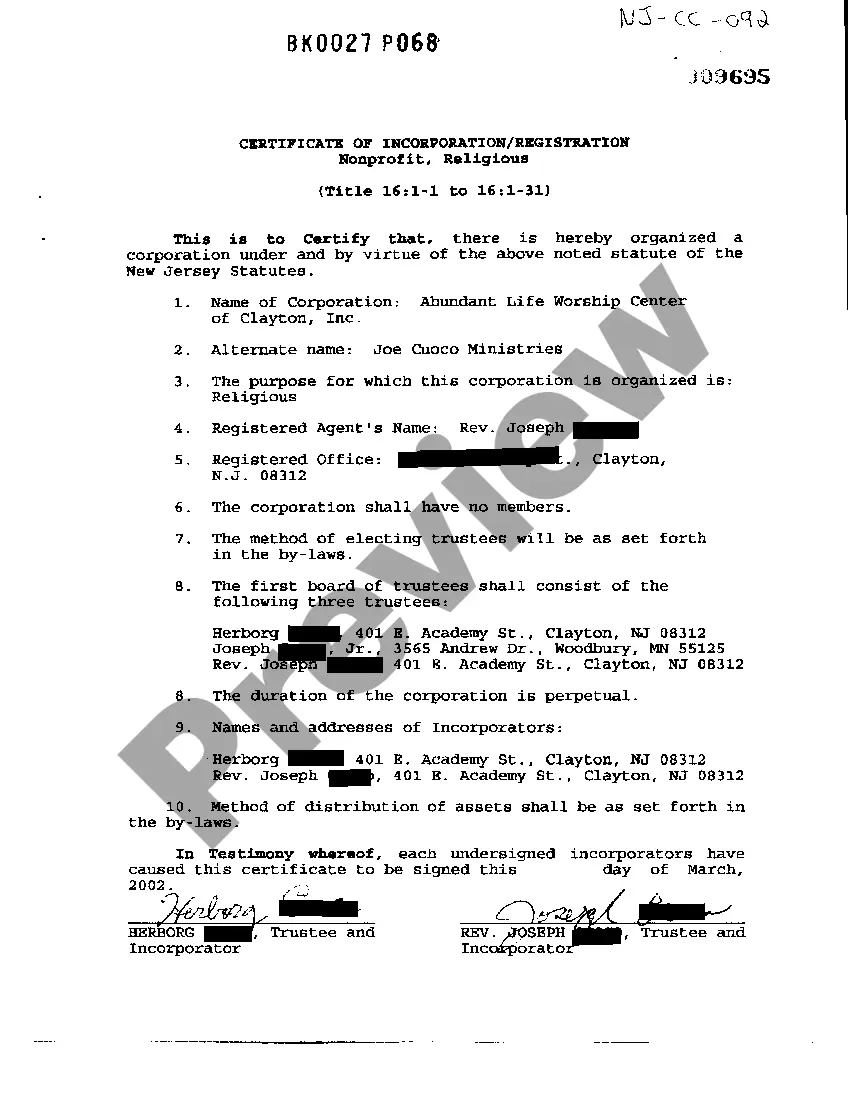

New Jersey Certificate Of Incorporation Registration for Nonprofit, Religious Organization

Description

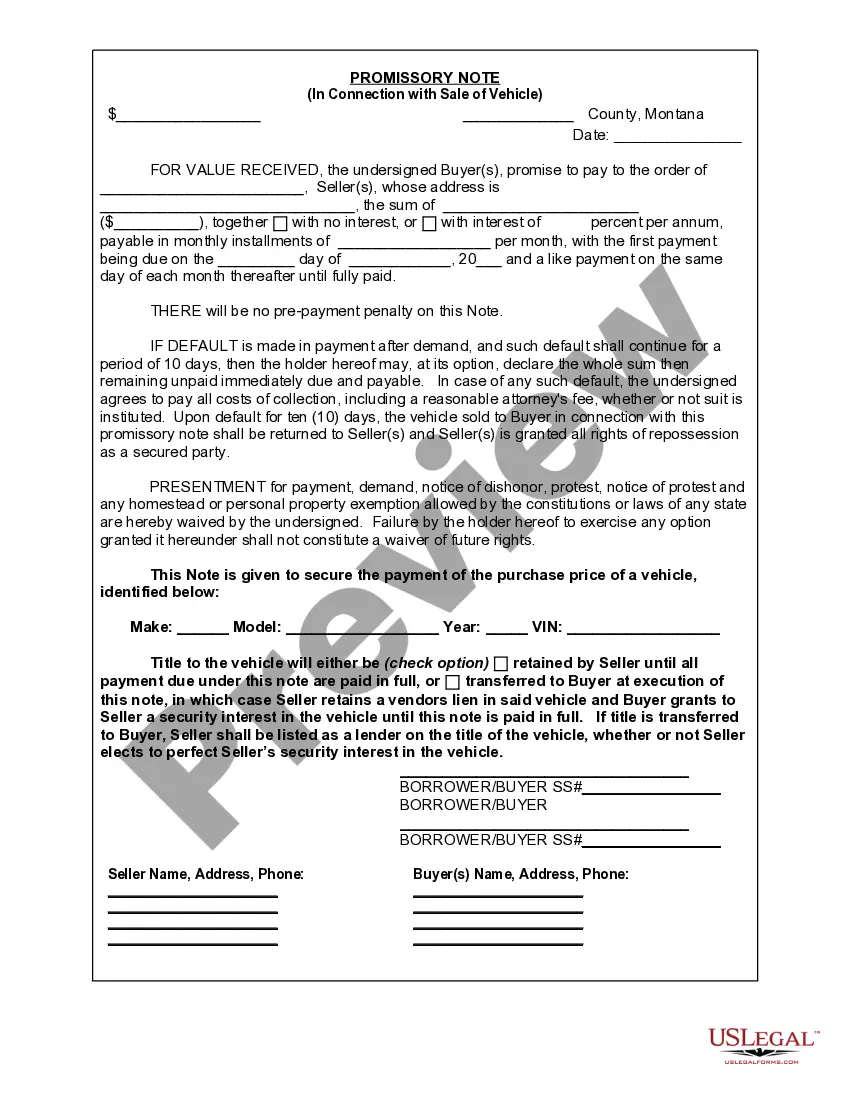

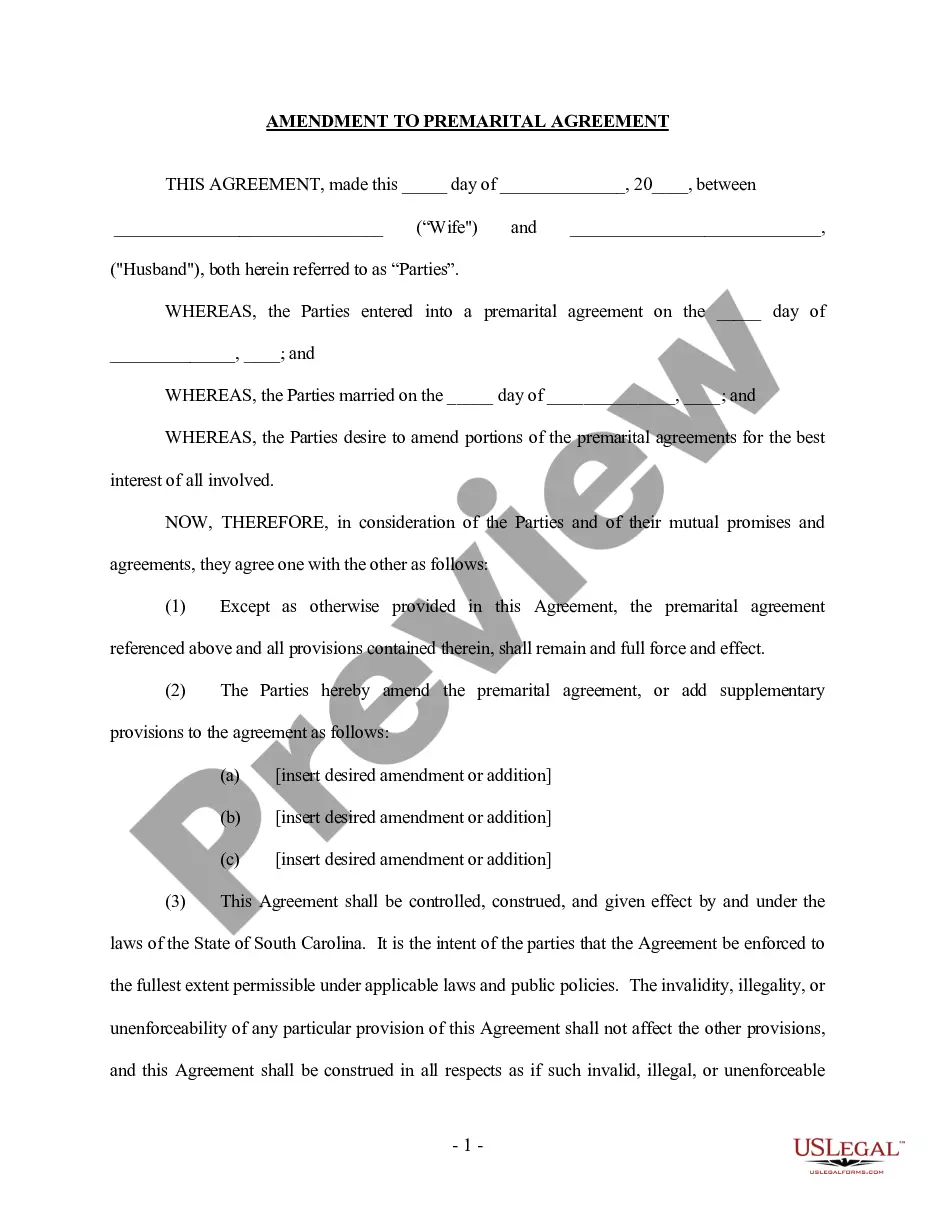

How to fill out New Jersey Certificate Of Incorporation Registration For Nonprofit, Religious Organization?

US Legal Forms is a unique platform where you can find any legal or tax form for submitting, such as New Jersey Certificate Of Incorporation Registration for Nonprofit, Religious Organization. If you’re fed up with wasting time seeking suitable examples and paying money on record preparation/legal professional charges, then US Legal Forms is precisely what you’re seeking.

To enjoy all of the service’s benefits, you don't need to install any software but just pick a subscription plan and create your account. If you have one, just log in and get a suitable sample, save it, and fill it out. Downloaded files are all stored in the My Forms folder.

If you don't have a subscription but need to have New Jersey Certificate Of Incorporation Registration for Nonprofit, Religious Organization, take a look at the instructions below:

- check out the form you’re looking at is valid in the state you need it in.

- Preview the form and read its description.

- Click Buy Now to access the register webpage.

- Select a pricing plan and proceed signing up by entering some information.

- Select a payment method to complete the registration.

- Download the file by choosing your preferred file format (.docx or .pdf)

Now, complete the file online or print it. If you are uncertain regarding your New Jersey Certificate Of Incorporation Registration for Nonprofit, Religious Organization template, contact a legal professional to examine it before you send out or file it. Begin without hassles!

Form popularity

FAQ

Name Your Organization. Recruit Incorporators and Initial Directors. Appoint a Registered Agent. Prepare and File Articles of Incorporation. File Initial Report. Obtain an Employer Identification Number (EIN) Store Nonprofit Records. Establish Initial Governing Documents and Policies.

Choose a business name. Incorporate online or by phone with incorporate.com. Apply for your IRS tax exemption. Apply for a state tax exemption. Draft bylaws. Appoint directors. Hold a meeting of the board. Obtain any necessary licenses and permits.

Information" on the Public Records Filing for New Business Entity Form. Is there a fee for becoming incorporated? Yes. The New Jersey fee for filing to become incorporated as a nonprofit corporation is $75 (or $5 for religious organizations following Title 16 procedures).

Legal Name of the Organization (Not taken by other companies in your State) Address of the Organization (Should be in the Incorporating State) Incorporator of the Nonprofit Organization. Registered Agent of the Organization (Should reside in the Incorporating State)

Summary. An NPO (non-profit organization) is an organization that focuses on a social cause, such as science, religion, research, or education. NPOs qualify for tax-exempt status in the United States, and they are not required to pay tax on the revenues they receive from donations.

Name Your Organization. Recruit Incorporators and Initial Directors. Appoint a Registered Agent. Prepare and File Articles of Incorporation. File Initial Report. Obtain an Employer Identification Number (EIN) Store Nonprofit Records. Establish Initial Governing Documents and Policies.

Churches, by definition, are already nonprofit organizations.Currently, because of the separation of church and state in the US, churches are not required to submit a 990; so registering with the IRS will change the church's status and the church will be required to follow the rules of all 501(c)(3) nonprofits.

Online. Website. Regular Mail. NJ Division of Revenue and Enterprise Services, Records Unit. PO Box 450. Over-the-Counter NJ Division of Revenue and Enterprise Services, Records Unit. 33 West State Street, 5th Floor. Trenton, NJ 08608. Fax 609-984-6855.

Churches (including integrated auxiliaries and conventions or associations of churches) that meet the requirements of section 501(c)(3) of the Internal Revenue Code are automatically considered tax exempt and are not required to apply for and obtain recognition of exempt status from the IRS.