As a result of the public offering of securities by the company, the company will be obligated to file various periodic reports with the SEC. This memorandum lists all those reports (10-K, 10-Q, 8-K, etc.), what each report is, and the filing guidelines for each one.

New Hampshire Selected Consequences of Public Company Status Memorandum

Description

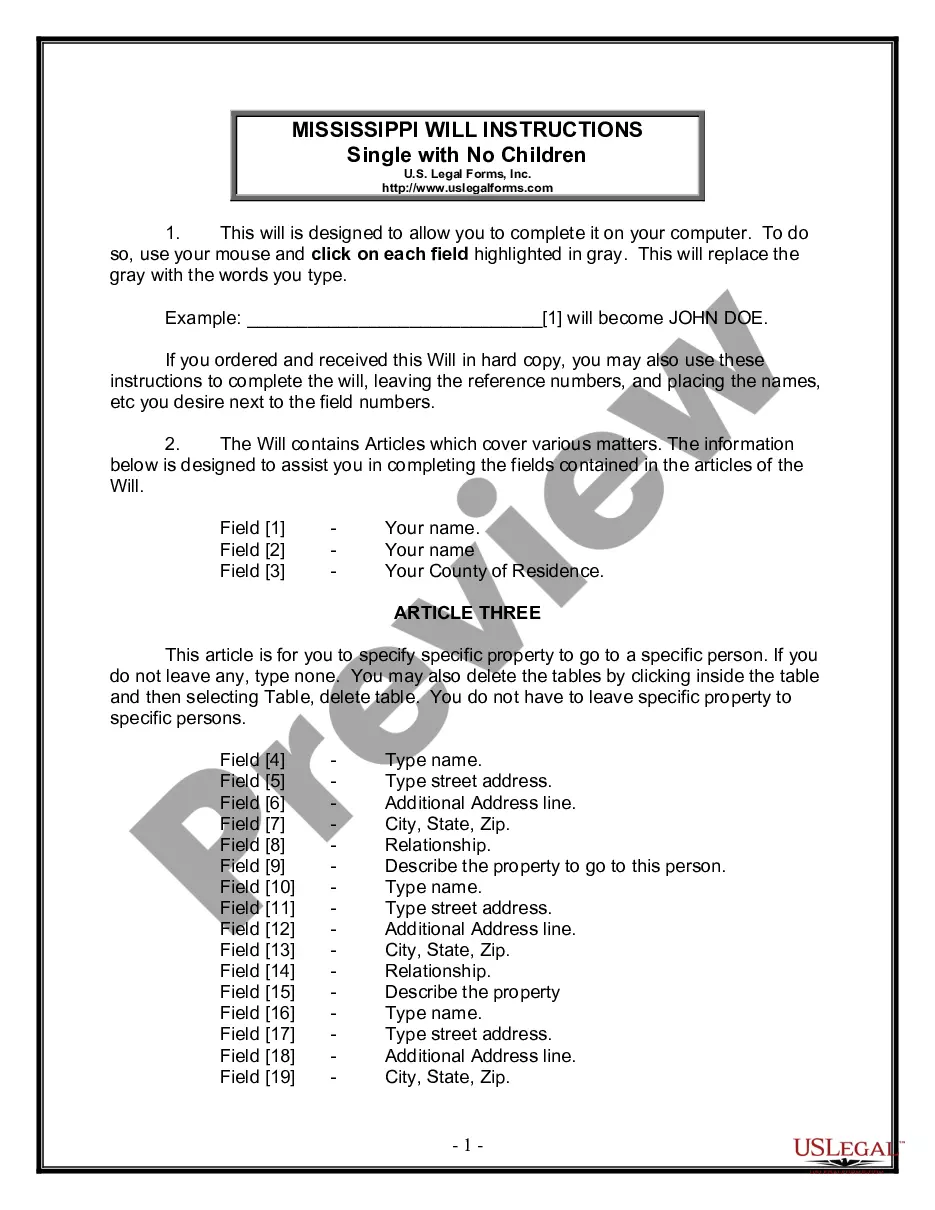

How to fill out Selected Consequences Of Public Company Status Memorandum?

Are you currently within a place the place you need files for possibly enterprise or person uses almost every day? There are plenty of lawful papers themes available on the Internet, but getting versions you can rely is not straightforward. US Legal Forms provides thousands of develop themes, like the New Hampshire Selected Consequences of Public Company Status Memorandum, which can be written in order to meet federal and state demands.

Should you be previously informed about US Legal Forms site and possess an account, just log in. Afterward, it is possible to obtain the New Hampshire Selected Consequences of Public Company Status Memorandum design.

If you do not offer an account and need to start using US Legal Forms, adopt these measures:

- Find the develop you need and ensure it is for your proper city/county.

- Make use of the Review key to analyze the form.

- Read the description to actually have chosen the right develop.

- In the event the develop is not what you are looking for, make use of the Search field to find the develop that fits your needs and demands.

- Once you obtain the proper develop, click Buy now.

- Select the prices program you desire, submit the required details to generate your money, and buy the transaction making use of your PayPal or bank card.

- Choose a convenient document formatting and obtain your duplicate.

Locate all the papers themes you might have purchased in the My Forms food list. You can obtain a further duplicate of New Hampshire Selected Consequences of Public Company Status Memorandum any time, if needed. Just click the necessary develop to obtain or print the papers design.

Use US Legal Forms, probably the most comprehensive collection of lawful kinds, in order to save efforts and avoid errors. The service provides expertly produced lawful papers themes that you can use for a range of uses. Produce an account on US Legal Forms and begin producing your daily life easier.

Form popularity

FAQ

The Right-to-Know Law promotes government transparency and discourse with the public by ensuring public access to information created, accepted, or obtained by any public agency.

Part 1, Article 8 of the N.H. Constitution provides that ?the public's right of access to governmental proceedings and records shall not be unreasonably restricted.? This applies to all three branches of government, including the judicial branch.

Public records are any information created, accepted, or obtained by, or on behalf of, any public body. The New Hampshire Right to Know Law indicates that all ?citizens? have a right to access New Hampshire's records. However the law does not specify whether it is citizens of New Hampshire or the United States.

RSA 91-A:1-a. BASIC RULE: Governmental records must be made available to the public upon request unless they are exempt from disclosure under RSA 91-A:5 or another statute. Electronic records are treated the same way as paper records in this respect.

The New Hampshire Right to Know Law is a series of statutes designed to guarantee that the public has access to public records of governmental bodies. Public records are any information created, accepted, or obtained by, or on behalf of, any public body.

?Open to the public?: Anyone, not just local residents, may attend, take notes, record and photograph the meeting. However, except as required in a public hearing, the public has no guaranteed right to speak. RSA 91-A:2.

After the completion of a meeting of a public body, every citizen, during the regular or business hours of such public body, and on the regular business premises of such public body, has the right to inspect all notes, materials, tapes, or other sources used for compiling the minutes of such meetings, and to make ...

The public's right to know what its government is doing is a fundamental part of New Hampshire's democracy. New Hampshire's Constitution and the Right-to-Know law ensure that the public has reasonable access to meetings of public bodies and to governmental records.