New Hampshire Contribution Agreement Form

Description

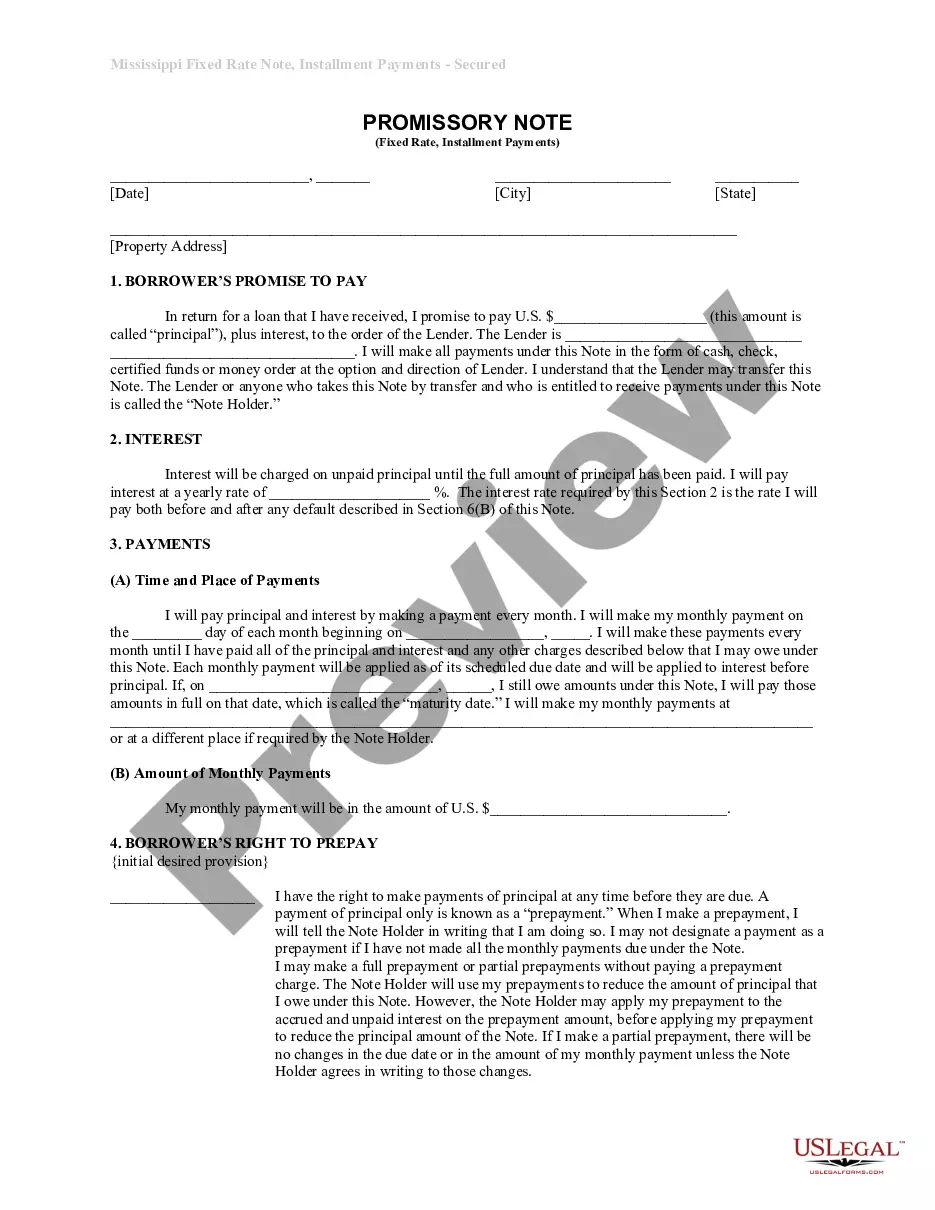

How to fill out Contribution Agreement Form?

Are you presently in a position that you require documents for both business or individual purposes virtually every time? There are plenty of lawful papers layouts accessible on the Internet, but locating types you can rely isn`t simple. US Legal Forms provides 1000s of form layouts, such as the New Hampshire Contribution Agreement Form, which can be created in order to meet state and federal requirements.

If you are already familiar with US Legal Forms website and get a merchant account, basically log in. Next, you are able to download the New Hampshire Contribution Agreement Form design.

If you do not provide an accounts and need to begin using US Legal Forms, adopt these measures:

- Get the form you need and make sure it is for your appropriate town/county.

- Utilize the Preview button to examine the shape.

- See the information to ensure that you have selected the appropriate form.

- In the event the form isn`t what you are trying to find, utilize the Look for area to get the form that meets your needs and requirements.

- When you discover the appropriate form, click Acquire now.

- Choose the pricing program you desire, submit the necessary info to create your account, and buy an order with your PayPal or charge card.

- Pick a handy file structure and download your duplicate.

Discover each of the papers layouts you have bought in the My Forms menus. You can aquire a extra duplicate of New Hampshire Contribution Agreement Form anytime, if possible. Just go through the needed form to download or produce the papers design.

Use US Legal Forms, by far the most considerable selection of lawful varieties, to save time and steer clear of blunders. The services provides professionally produced lawful papers layouts which can be used for a range of purposes. Make a merchant account on US Legal Forms and initiate making your daily life a little easier.

Form popularity

FAQ

The maximum weekly benefit amount is currently $427; the minimum amount is currently $32. You may receive benefits for a maximum of 26 weeks. (In times of very high unemployment, additional weeks of benefits may be available.)

New Hampshire State Unemployment Tax & Rate Employers are also charged a surcharge tax called the Administrative Contribution (AC) rate, which is 0.4% for a total contribution of 2.7%. Rates can be reduced by any Fund Reduction or increased from any Emergency Power Surcharge in place for the applicable quarter.

New Hampshire is an employment-at-will state. This means that either party may terminate the employment relationship at any time, with or without cause, and with or without notice.

How much will I get? Your weekly benefit amount is based on how much you earned in the last 15 to 18 months. New Hampshire looks at your ?base period?, which is normally the first 4 of the last 5 completed calendar quarters prior to the effective date of the claim.

The New Hampshire new employer tax rate is 2.7 % Minus any Fund Reduction or Plus any Emergency Power Surcharge in place for the applicable quarter.