New Hampshire Exhibit A to Operating Agreement - Contract Area and Parties - Form 1

Description

How to fill out Exhibit A To Operating Agreement - Contract Area And Parties - Form 1?

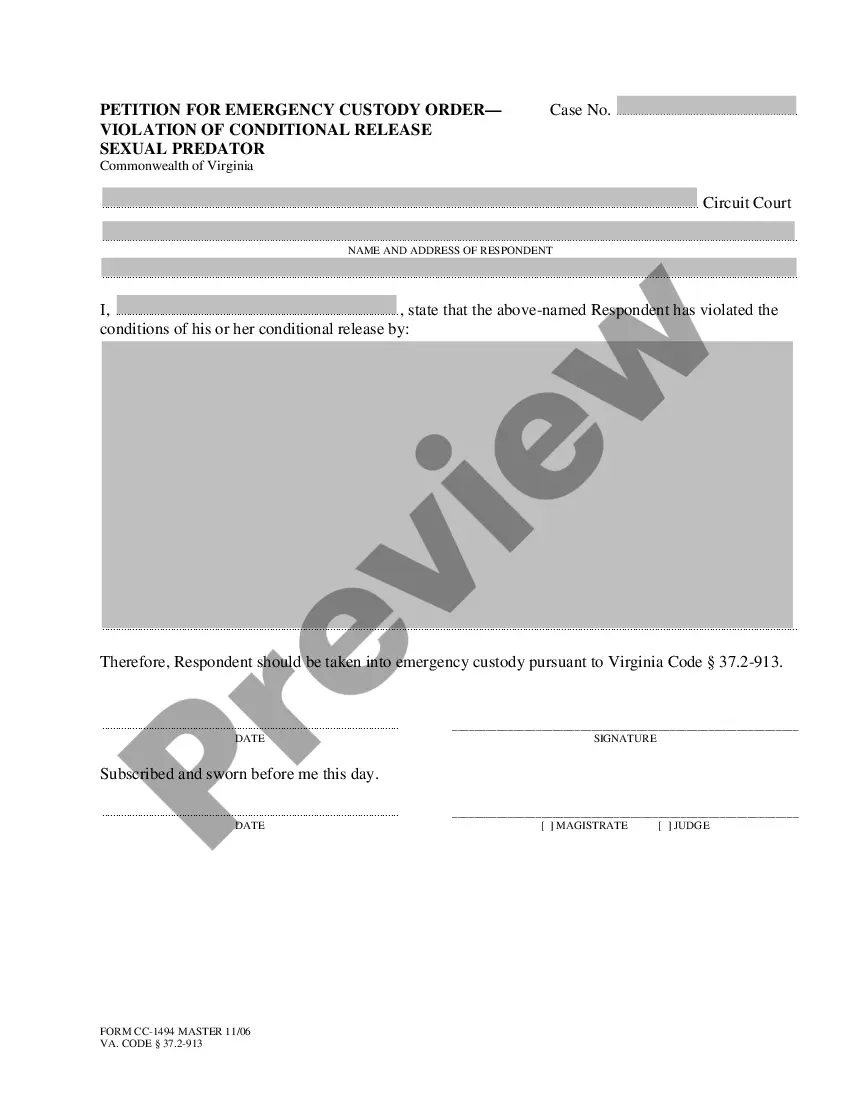

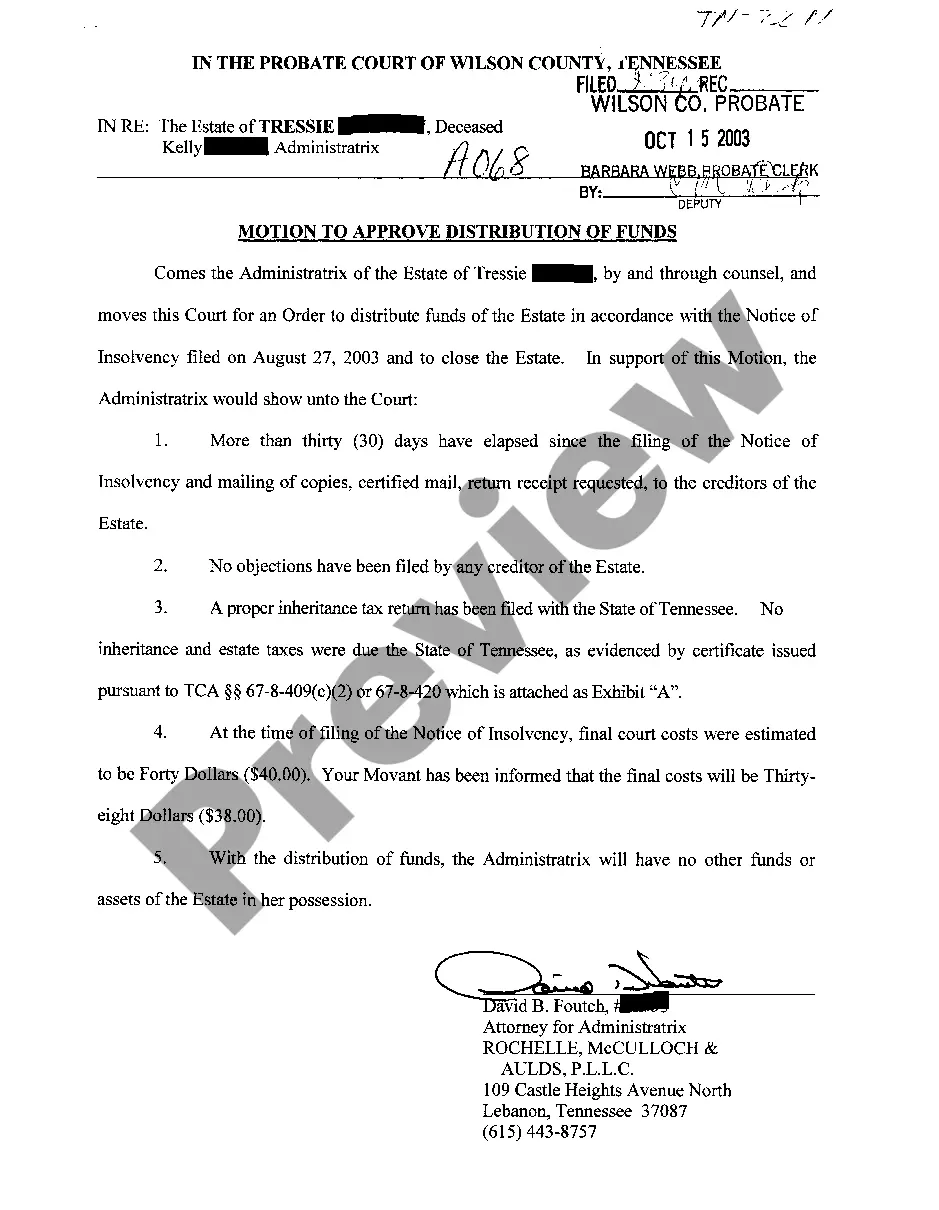

You may devote hours on the web searching for the legitimate papers design that suits the federal and state specifications you need. US Legal Forms gives a large number of legitimate forms which can be reviewed by experts. You can easily down load or produce the New Hampshire Exhibit A to Operating Agreement - Contract Area and Parties - Form 1 from your assistance.

If you already possess a US Legal Forms bank account, you can log in and click on the Download option. Next, you can total, change, produce, or signal the New Hampshire Exhibit A to Operating Agreement - Contract Area and Parties - Form 1. Every legitimate papers design you purchase is your own property for a long time. To have yet another version associated with a purchased develop, proceed to the My Forms tab and click on the corresponding option.

If you work with the US Legal Forms website initially, stick to the easy guidelines listed below:

- Initial, make certain you have selected the best papers design for that state/city of your liking. Read the develop outline to make sure you have picked the proper develop. If offered, take advantage of the Preview option to check throughout the papers design as well.

- In order to find yet another edition from the develop, take advantage of the Research discipline to obtain the design that suits you and specifications.

- When you have found the design you want, click on Buy now to proceed.

- Find the costs prepare you want, key in your accreditations, and register for a merchant account on US Legal Forms.

- Full the financial transaction. You can use your bank card or PayPal bank account to purchase the legitimate develop.

- Find the formatting from the papers and down load it in your system.

- Make modifications in your papers if required. You may total, change and signal and produce New Hampshire Exhibit A to Operating Agreement - Contract Area and Parties - Form 1.

Download and produce a large number of papers layouts using the US Legal Forms web site, that provides the greatest collection of legitimate forms. Use professional and status-specific layouts to tackle your business or personal requirements.

Form popularity

FAQ

New Hampshire LLC Processing Times Normal LLC processing time:Expedited LLC:New Hampshire LLC by mail:7-10 business days (plus mail time)Not availableNew Hampshire LLC online:7-10 business daysNot available

How to start an LLC in New Hampshire Name your New Hampshire LLC. Create a business plan. Get a federal employer identification number (EIN) Choose a registered agent in New Hampshire. File for your New Hampshire Certificate of Formation. Obtain business licenses and permits. Understand New Hampshire tax requirements.

An operating agreement should include the following: Percentage of members' ownership. Meeting provisions and voting rights. Powers and duties of members and management. Distribution of profits and losses. Tax treatment preference. A liability statement. Management structure. Operating procedures.

No, New Hampshire statutes don't explicitly require LLCs to have operating agreements. However, you'll need an operating agreement for several important tasks, including opening a business bank account.

Create an operating agreement An operating agreement is a document that outlines the way your LLC will conduct business. New Hampshire doesn't require an operating agreement, but it is an essential component of your business.

How to start an LLC in New Hampshire Name your New Hampshire LLC. Create a business plan. Get a federal employer identification number (EIN) Choose a registered agent in New Hampshire. File for your New Hampshire Certificate of Formation. Obtain business licenses and permits. Understand New Hampshire tax requirements.

The fee for a corporation is $125. The fee for a partnership is $50. The fees for starting a business in New Hampshire also vary depending on the number of employees. For example, the fee for a sole proprietorship with one employee is $25, while the fee for a sole proprietorship with more than one employee is $50.

All New Hampshire LLCs need to pay $100 per year for Annual Reports. These state fees are paid to the Secretary of State. And this is the only state-required annual fee. You have to pay this to keep your LLC in good standing.