New Hampshire Assignment and Conveyance of Net Profits Interest

Description

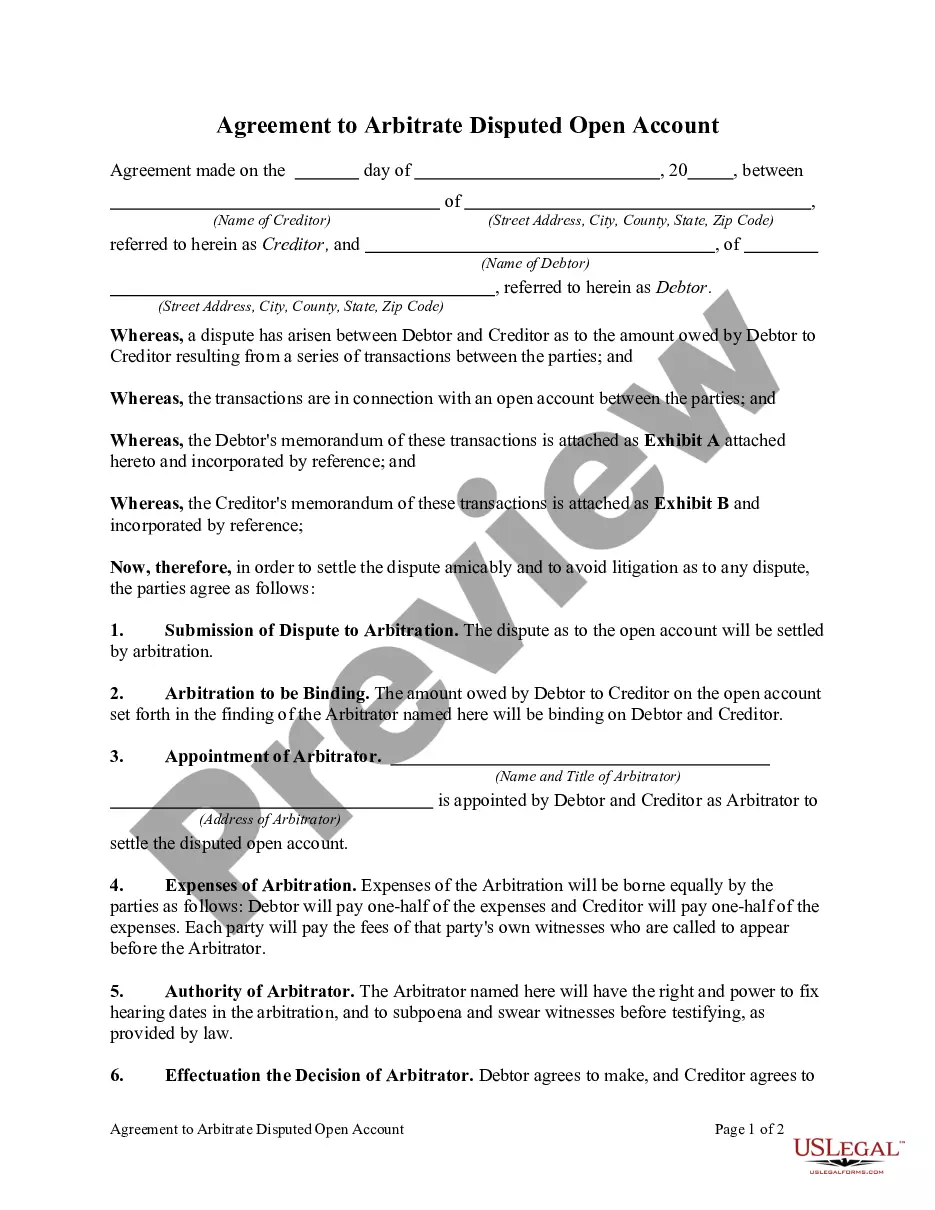

How to fill out Assignment And Conveyance Of Net Profits Interest?

If you wish to total, down load, or print out authorized document templates, use US Legal Forms, the biggest collection of authorized kinds, which can be found on the Internet. Make use of the site`s basic and convenient lookup to obtain the paperwork you need. Various templates for business and specific uses are categorized by groups and suggests, or key phrases. Use US Legal Forms to obtain the New Hampshire Assignment and Conveyance of Net Profits Interest in a couple of clicks.

If you are already a US Legal Forms consumer, log in for your account and click the Download option to have the New Hampshire Assignment and Conveyance of Net Profits Interest. You may also access kinds you formerly delivered electronically from the My Forms tab of your own account.

If you are using US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the shape for your appropriate metropolis/region.

- Step 2. Use the Review choice to check out the form`s content material. Do not overlook to learn the outline.

- Step 3. If you are not satisfied with all the develop, use the Research industry near the top of the display to find other types of your authorized develop format.

- Step 4. Once you have located the shape you need, click the Acquire now option. Opt for the rates program you prefer and include your credentials to register on an account.

- Step 5. Method the deal. You can utilize your charge card or PayPal account to finish the deal.

- Step 6. Pick the structure of your authorized develop and down load it on the product.

- Step 7. Total, change and print out or signal the New Hampshire Assignment and Conveyance of Net Profits Interest.

Each and every authorized document format you acquire is your own property forever. You may have acces to each develop you delivered electronically inside your acccount. Click the My Forms area and select a develop to print out or down load yet again.

Remain competitive and down load, and print out the New Hampshire Assignment and Conveyance of Net Profits Interest with US Legal Forms. There are millions of skilled and state-specific kinds you can utilize to your business or specific demands.

Form popularity

FAQ

New Hampshire does not tax individuals' earned income, so you are not required to file an individual New Hampshire tax return. The state only taxes interest and dividends at 5% on residents and fiduciaries whose gross interest and dividends income, from all sources, exceeds $2,400 annually ($4,800 for joint filers).

Tax-free states Alaska. Florida. Nevada. South Dakota. Texas. Washington. Wyoming.

Tax Year 2022 Filing Thresholds by Filing Status Filing StatusTaxpayer age at the end of 2022A taxpayer must file a return if their gross income was at least:singleunder 65$12,950single65 or older$14,700head of householdunder 65$19,400head of household65 or older$21,1506 more rows

The I&D Tax rate is 5% for taxable periods ending before December 31, 2023. That rate is 4% for taxable periods ending on or after December 31, 2023, and 3% for taxable periods ending on or after December 31, 2024. The I&D Tax shall be repealed for taxable periods beginning after December 31, 2024. Who pays it?

New Hampshire uses Form DP-10 for full or part-year residents. The DP-10 only has to be filed if the taxpayer received more than $2400 (single) or $4800 (joint) of interest and/or dividends.

New Hampshire derives 63.8 percent of its revenue from property tax money, the most of any U.S. state. Cost of living is also a prominent factor.

New Hampshire Income Taxes New Hampshire is a state that doesn't have a personal income tax. However, currently, the state has a 5% tax on dividends and interest. However, due to legislation, the tax on dividends and interest is being phased out. The rate will be 4% for 2023, 3% for 2024, 2% for 2025, and 1% for 2026.

Property taxes can also be surprisingly high in low-tax states such as Texas and New Hampshire. These states don't levy personal income taxes, so they rely more on property tax revenue to fund government services.