New Hampshire Direction For Payment of Royalty to Trustee by Royalty Owners

Description

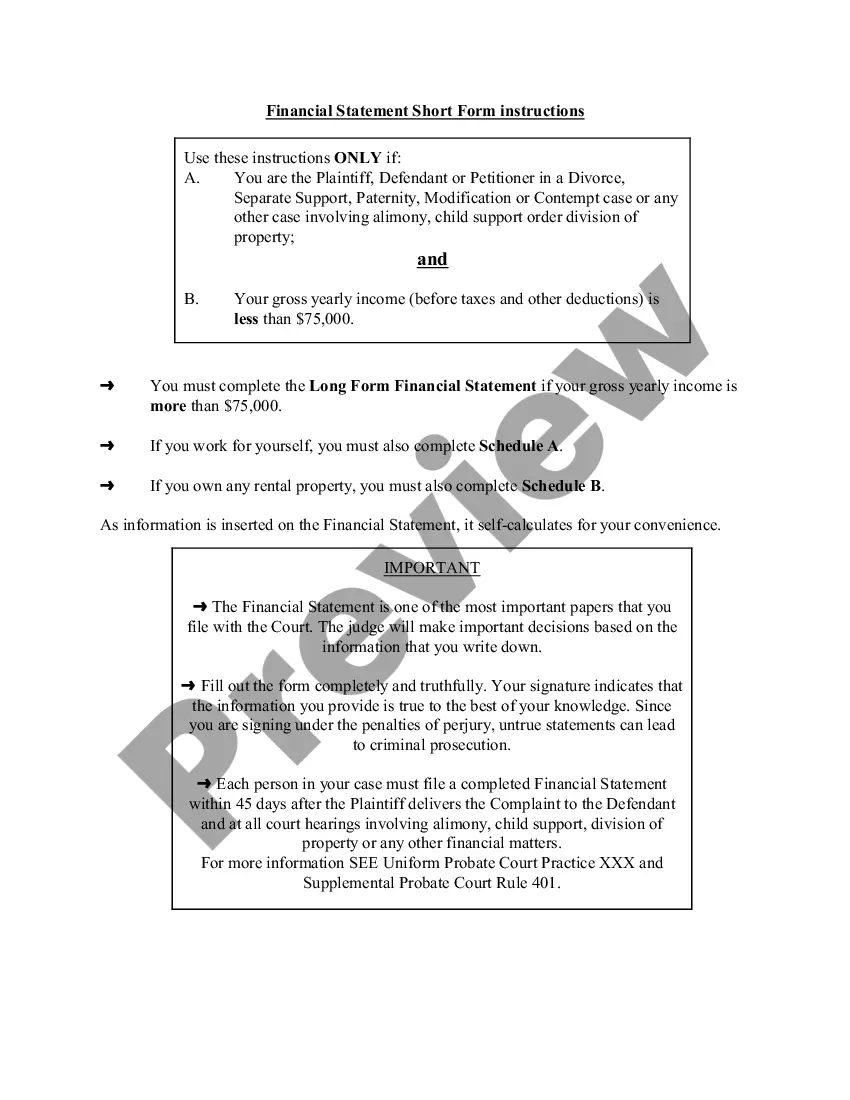

How to fill out Direction For Payment Of Royalty To Trustee By Royalty Owners?

If you have to complete, acquire, or printing legitimate file themes, use US Legal Forms, the largest selection of legitimate kinds, which can be found online. Use the site`s simple and practical research to find the files you require. A variety of themes for business and personal purposes are categorized by categories and states, or keywords and phrases. Use US Legal Forms to find the New Hampshire Direction For Payment of Royalty to Trustee by Royalty Owners in a number of clicks.

If you are currently a US Legal Forms buyer, log in for your bank account and click the Obtain key to find the New Hampshire Direction For Payment of Royalty to Trustee by Royalty Owners. You may also entry kinds you in the past delivered electronically in the My Forms tab of your own bank account.

Should you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Make sure you have chosen the shape to the appropriate city/region.

- Step 2. Utilize the Review method to check out the form`s information. Do not forget to see the outline.

- Step 3. If you are not satisfied with all the type, take advantage of the Lookup industry near the top of the monitor to locate other variations of the legitimate type template.

- Step 4. Upon having identified the shape you require, click on the Get now key. Opt for the rates program you like and include your references to register for an bank account.

- Step 5. Process the transaction. You may use your bank card or PayPal bank account to finish the transaction.

- Step 6. Select the format of the legitimate type and acquire it on your own gadget.

- Step 7. Comprehensive, revise and printing or indication the New Hampshire Direction For Payment of Royalty to Trustee by Royalty Owners.

Each legitimate file template you purchase is your own property permanently. You may have acces to each and every type you delivered electronically inside your acccount. Click on the My Forms portion and select a type to printing or acquire yet again.

Remain competitive and acquire, and printing the New Hampshire Direction For Payment of Royalty to Trustee by Royalty Owners with US Legal Forms. There are thousands of expert and condition-distinct kinds you may use for your personal business or personal requirements.

Form popularity

FAQ

All business organizations, including single member Limited Liability Companies (SMLLC), taxed as a proprietorship federally must file a NH-1040 Business Profits Tax (BPT) return provided they have conducted business activity in New Hampshire and their gross business income from everywhere is in excess of $92,000.

New Hampshire does not tax individuals' earned income, so you are not required to file an individual New Hampshire tax return. The state only taxes interest and dividends at 5% on residents and fiduciaries whose gross interest and dividends income, from all sources, exceeds $2,400 annually ($4,800 for joint filers). New Hampshire, NH State Income Taxes - eFile.com eFile.com ? efile-new-hampshire-income-t... eFile.com ? efile-new-hampshire-income-t...

Royalties from copyrights, patents, and oil, gas and mineral properties are taxable as ordinary income. You generally report royalties in Part I of Schedule E (Form 1040 or Form 1040-SR), Supplemental Income and Loss.

All business organizations, including corporations, fiduciaries, partnerships, proprietorships, single member limited liability companies (SMLLC), and homeowners' associations which are part of a group of related business organizations operating a unitary business as defined in RSA 77-A:1, XIV engaged in business ... 2020 NH-1120-WE nh.gov ? forms ? documents ? nh-1... nh.gov ? forms ? documents ? nh-1...

New Hampshire, however, is different: It does require sole proprietorships to pay both the business profits tax and the business enterprise tax. The sole proprietor, however, does not owe state tax on the income they ultimately receive from the business. New Hampshire State Business Income Tax | Nolo Nolo ? legal-encyclopedia ? new-ha... Nolo ? legal-encyclopedia ? new-ha...

No Income or Capital Gains Tax One potential benefit to administering a trust in New Hampshire is income and capital gains tax savings. Generally, irrevocable trusts that are administered in New Hampshire (and which are not taxed to the grantor) are not subject to state income or capital gains tax.

Federal tax must be withheld at the rate of 30% of gross royalties unless an IRS tax treaty is applicable.

New Hampshire has no income tax on wages and salaries. However, there is a 5% tax on interest and dividends. The state also has no sales tax. Homeowners in New Hampshire pay some of the highest average effective property tax rates in the country. New Hampshire Income Tax Calculator - SmartAsset smartasset.com ? taxes ? new-hampshire-tax-calcu... smartasset.com ? taxes ? new-hampshire-tax-calcu...