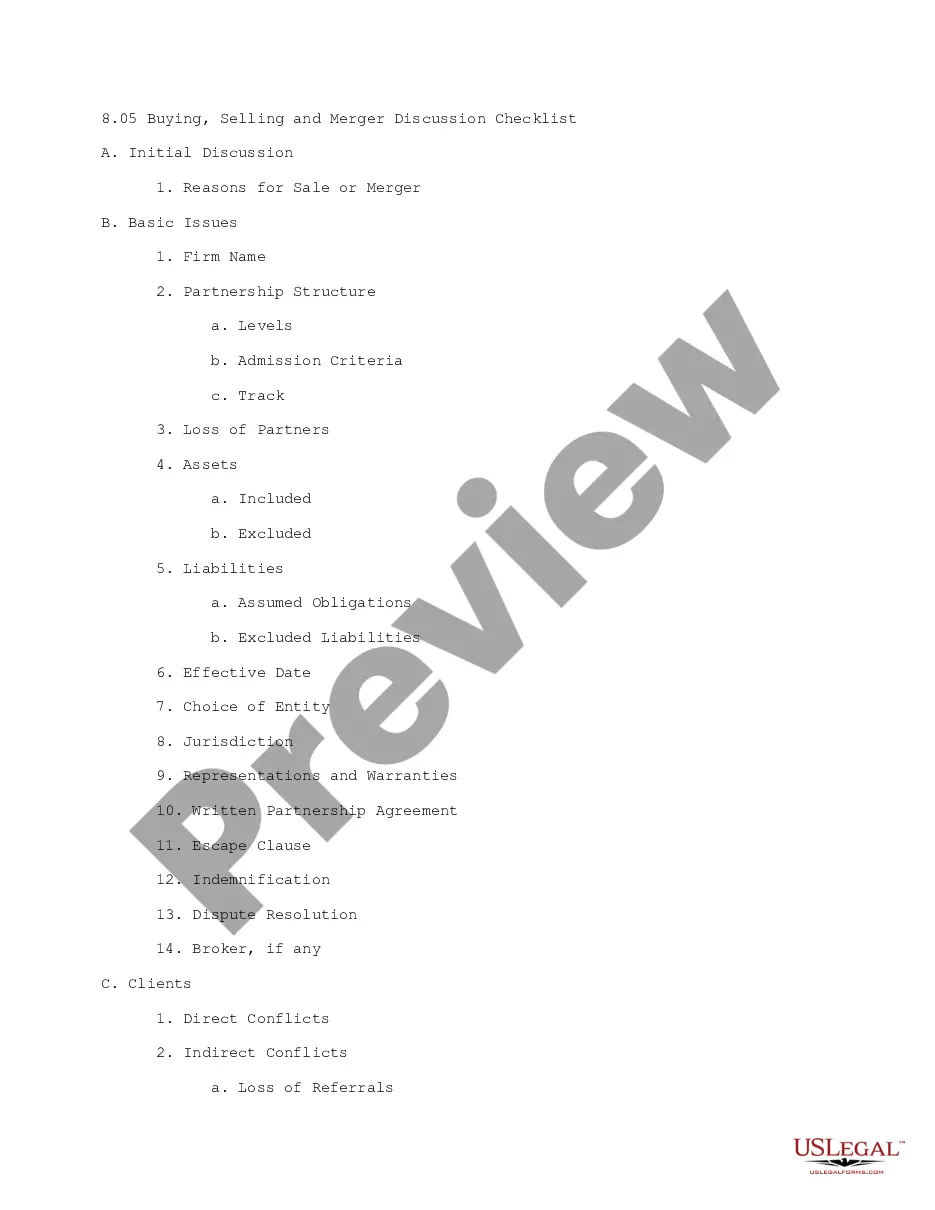

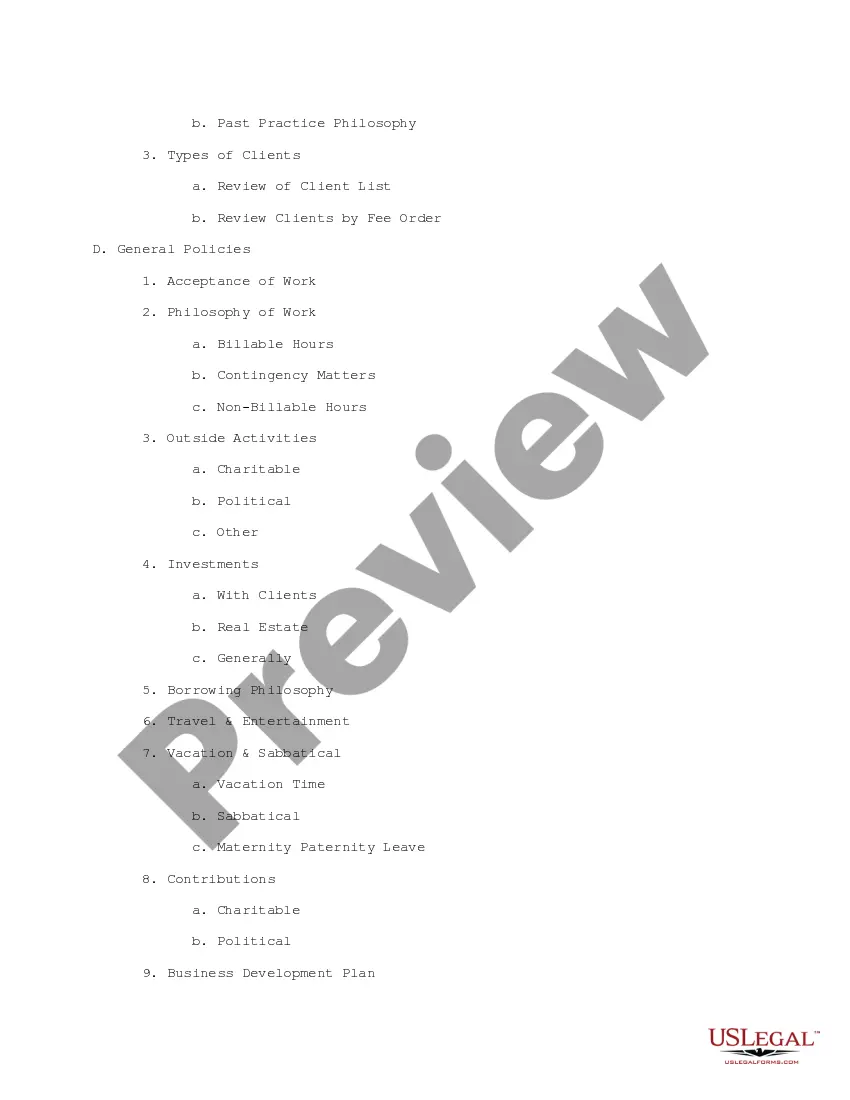

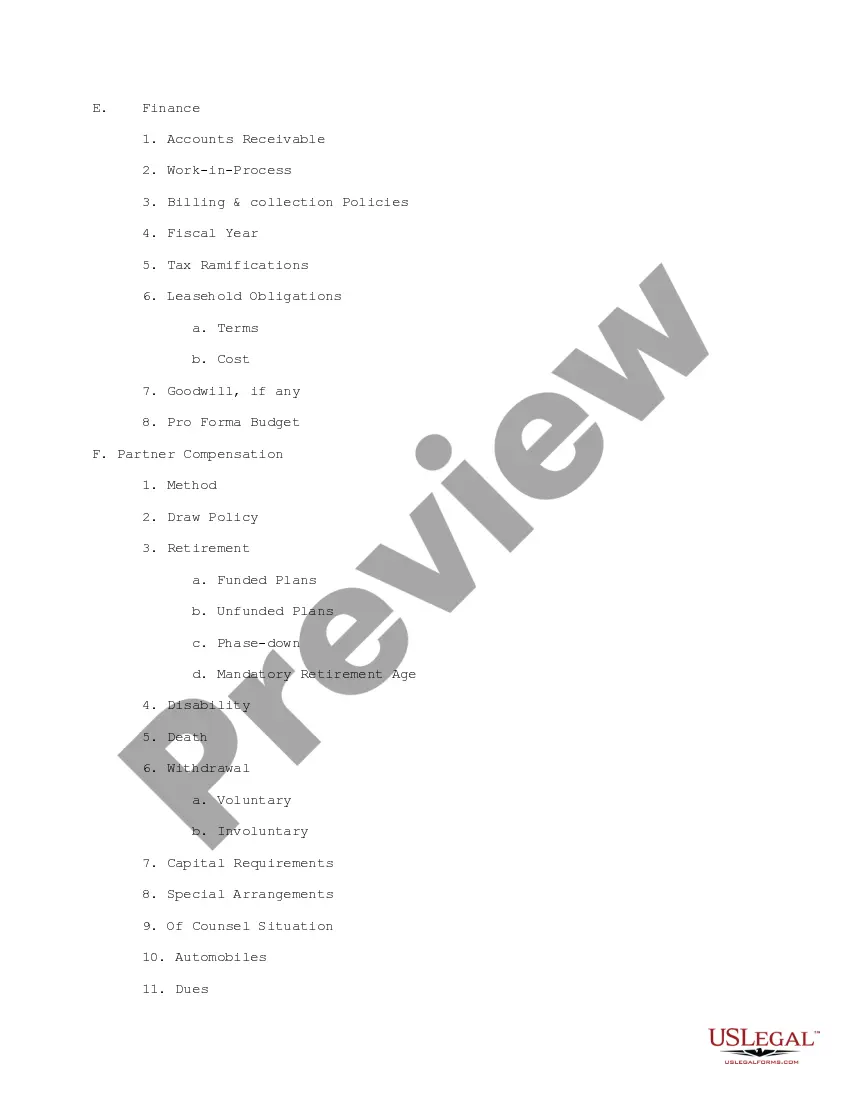

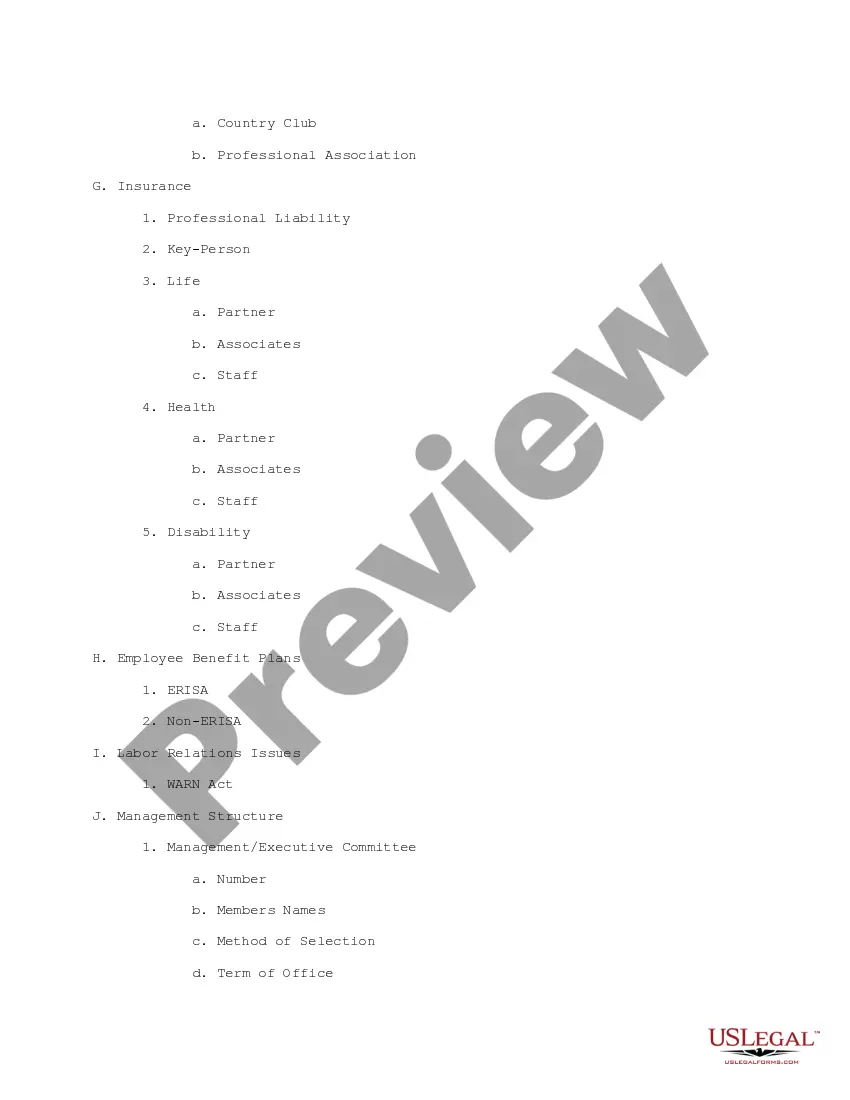

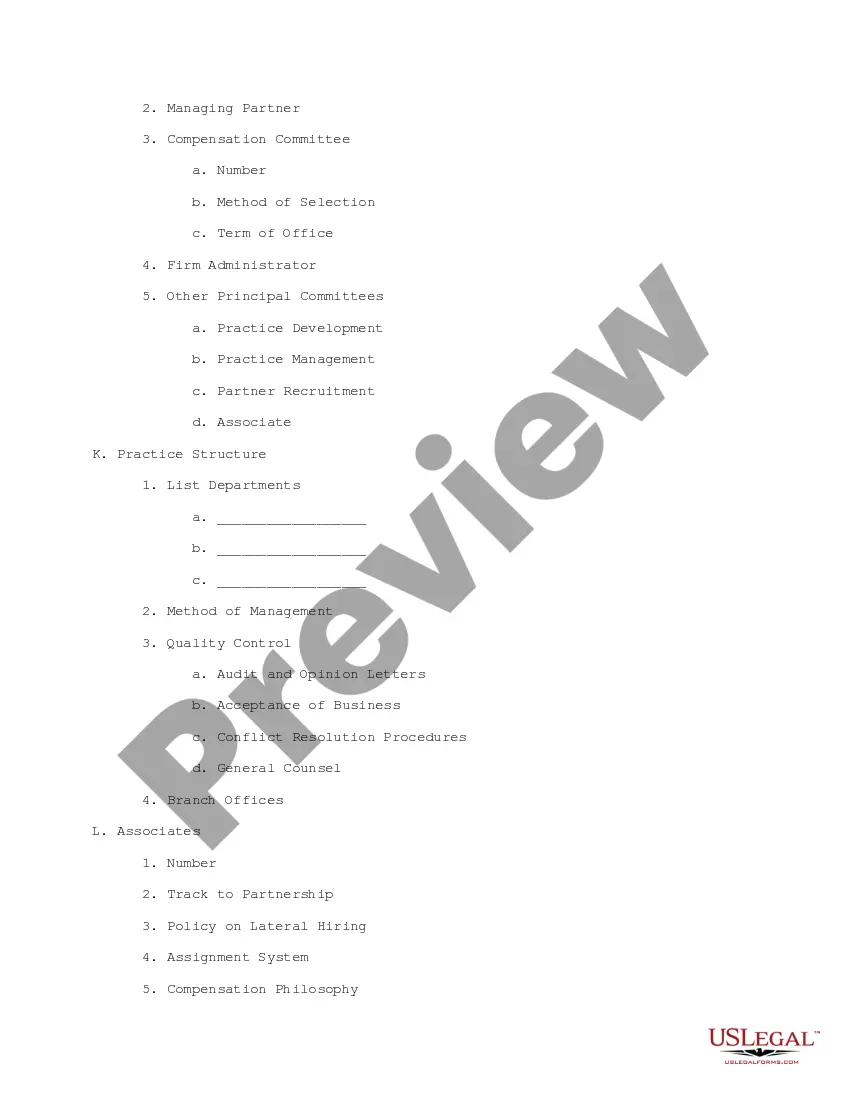

This is a checklist for the discussion of buying, selling, or merger of a law firm. Each category (clients, finance, partner compensation, etc.) is broken into sub-categories as a way of bringing to mind all issues to be discussed.

New Hampshire Buying, Selling and Merger Discussion Checklist

Description

How to fill out Buying, Selling And Merger Discussion Checklist?

You can spend hours on the Internet attempting to find the legitimate papers design that meets the state and federal requirements you want. US Legal Forms provides 1000s of legitimate types that happen to be reviewed by specialists. It is simple to download or printing the New Hampshire Buying, Selling and Merger Discussion Checklist from the service.

If you currently have a US Legal Forms profile, it is possible to log in and then click the Down load button. After that, it is possible to full, change, printing, or signal the New Hampshire Buying, Selling and Merger Discussion Checklist. Each legitimate papers design you purchase is the one you have for a long time. To obtain an additional backup for any acquired form, visit the My Forms tab and then click the corresponding button.

If you work with the US Legal Forms website the very first time, adhere to the easy guidelines under:

- Very first, ensure that you have chosen the correct papers design for the state/town of your liking. Look at the form explanation to make sure you have selected the proper form. If offered, make use of the Preview button to look through the papers design also.

- If you wish to discover an additional variation in the form, make use of the Search field to find the design that meets your needs and requirements.

- Once you have located the design you want, click Get now to move forward.

- Select the prices prepare you want, enter your references, and register for your account on US Legal Forms.

- Complete the purchase. You should use your credit card or PayPal profile to pay for the legitimate form.

- Select the structure in the papers and download it to the system.

- Make changes to the papers if necessary. You can full, change and signal and printing New Hampshire Buying, Selling and Merger Discussion Checklist.

Down load and printing 1000s of papers web templates using the US Legal Forms Internet site, which offers the most important assortment of legitimate types. Use professional and state-distinct web templates to take on your small business or specific needs.

Form popularity

FAQ

Approval of Shareholders: Before a merger or acquisition can take place, the proposal must be approved by the shareholders of each company involved. The Companies Act requires that at least 75% of the shareholders present and voting must approve the proposal.

What is HR due diligence? HR due diligence is where the target company's HR processes and human capital are put under the microscope. The culture of the company, as well as the roles, capabilities and attitudes of its people are investigated.

How Long is Due Diligence? Due diligence can take any period of time, as long as both you and the buyer agree. The typical due diligence period for most small to mid-sized businesses is 30 to 60 days.

A due diligence check involves careful investigation of the economic, legal, fiscal and financial circumstances of a business or individual. This covers aspects such as sales figures, shareholder structure and possible links with forms of economic crime such as corruption and tax evasion.

The due diligence process helps stakeholders understand the synergies and potential scalability of the businesses after the merger/acquisition. During the process, all internal and external factors that create risk in the acquisition are identified and focus is driven towards key factors that drive profitability.

Below, we take a closer look at the three elements that comprise human rights due diligence ? identify and assess, prevent and mitigate and account ?, quoting from the Guiding Principles.

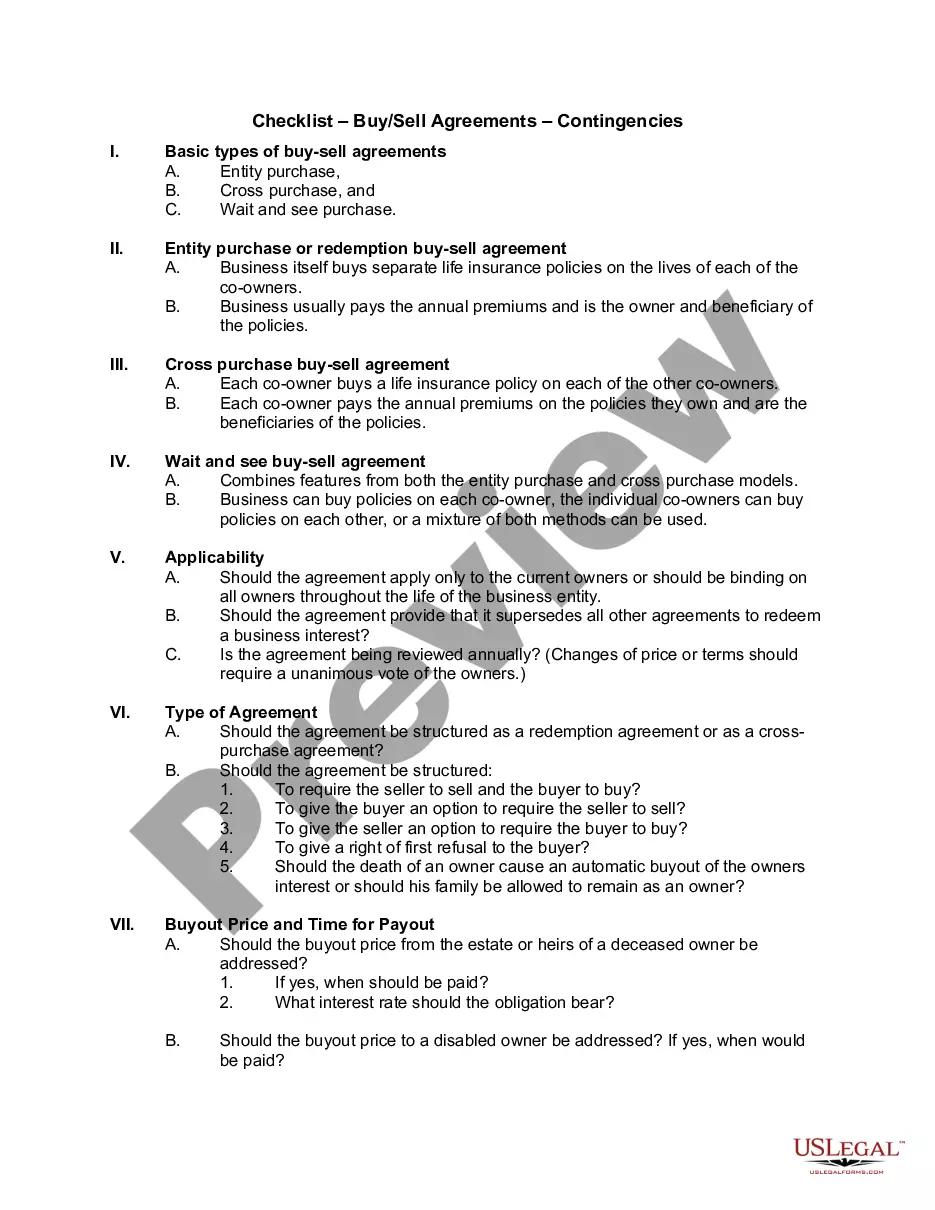

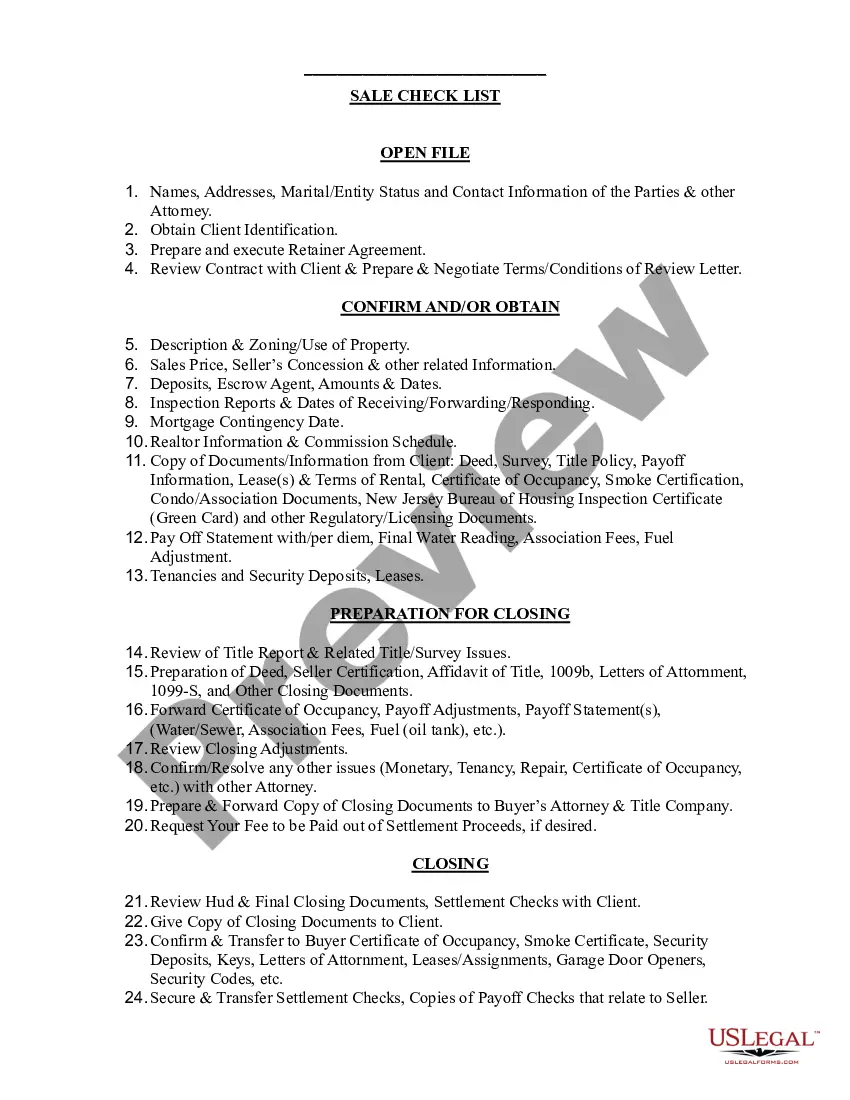

A due diligence checklist is an organized way to analyze a company. The checklist will include all the areas to be analyzed, such as ownership and organization, assets and operations, the financial ratios, shareholder value, processes and policies, future growth potential, management, and human resources.