New Hampshire Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan

Description

How to fill out Approval Of Grant Of Security Interest In All Of Assets To Secure Obligations Pursuant To Terms Of Informal Creditor Workout Plan?

Finding the right legal papers format can be a have difficulties. Needless to say, there are plenty of web templates available on the Internet, but how would you find the legal develop you require? Take advantage of the US Legal Forms internet site. The support offers a huge number of web templates, including the New Hampshire Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan, that can be used for business and personal requirements. Each of the kinds are checked out by professionals and fulfill federal and state specifications.

When you are previously authorized, log in for your accounts and then click the Acquire button to obtain the New Hampshire Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan. Utilize your accounts to appear from the legal kinds you may have ordered previously. Visit the My Forms tab of your accounts and get an additional version in the papers you require.

When you are a new user of US Legal Forms, allow me to share basic guidelines that you should adhere to:

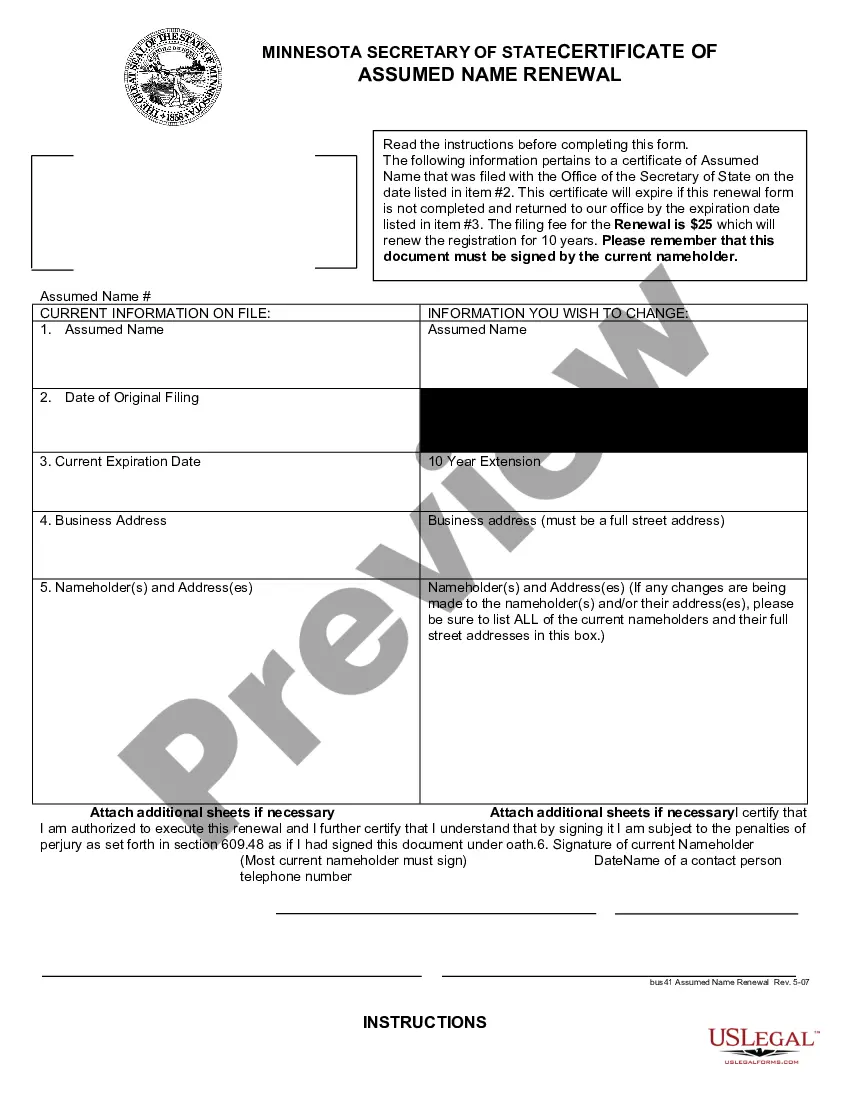

- Initial, be sure you have selected the proper develop for your town/county. You are able to look over the shape using the Review button and browse the shape explanation to make sure it is the right one for you.

- In the event the develop fails to fulfill your requirements, take advantage of the Seach industry to obtain the right develop.

- When you are certain that the shape is suitable, go through the Buy now button to obtain the develop.

- Choose the pricing strategy you desire and enter the necessary info. Design your accounts and buy your order with your PayPal accounts or Visa or Mastercard.

- Opt for the file structure and down load the legal papers format for your device.

- Complete, edit and produce and signal the obtained New Hampshire Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan.

US Legal Forms will be the biggest library of legal kinds where you will find various papers web templates. Take advantage of the company to down load professionally-made paperwork that adhere to condition specifications.

Form popularity

FAQ

Transfer of Cases. (1) When any party files a motion in any superior court requesting the transfer of a case, or of a proceeding therein, to another superior court, the presiding judge may, after giving notice and an opportunity for a hearing to all parties, order such transfer.

Appeal from Administrative Agency. (1) The supreme court may, in its discretion, decline to accept an appeal, or any question raised therein, from an order of an administrative agency, or may summarily dispose of such an appeal, or any question raised therein, as provided in Rule 25.

Considerations Governing Review on Writ of Certiorari. Review on a writ of certiorari is not a matter of right, but of judicial discretion. A petition for a writ of certiorari will be granted only for compelling reasons.

Rule 7 - Pleadings, Motions and Objections, General (a) Every Complaint shall contain in the caption, or in the body of the Complaint, the names and addresses of all parties to the proceedings. (b) No filing which is contained in a letter, will be accepted by the clerk, as such, or acted on by the court.

(4) Any indigent defendant who wishes to be represented in the supreme court by court-appointed counsel, including indigent defendants who were represented in the trial court by court-appointed counsel, must file a current Request for a Lawyer form with the supreme court.

Petition for Original Jurisdiction. (1) Petitions requesting this court to exercise its original jurisdiction shall be granted only when there are special and important reasons for doing so.

Interlocutory Appeal From Ruling. (1) The supreme court may, in its discretion, decline to accept an interlocutory appeal, or any question raised therein, from a trial court order or ruling.

Rule 9. Answers; Defenses; Forms of Denials. (a) An Answer or other responsive pleading shall be filed with the court within 30 days after the person filing said pleading has been served with the pleading to which the Answer or response is made.