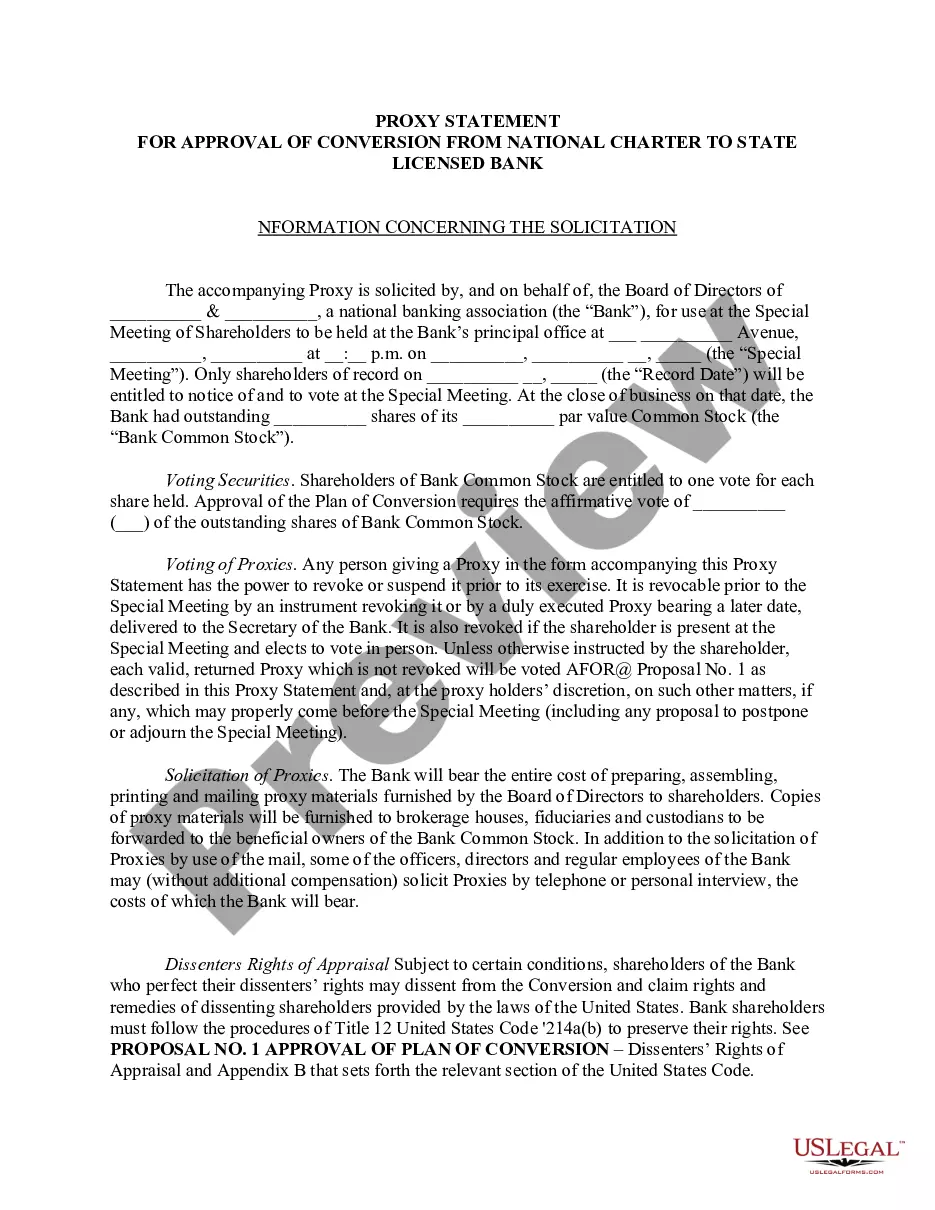

New Hampshire Proposal Approval of Nonqualified Stock Option Plan

Description

How to fill out Proposal Approval Of Nonqualified Stock Option Plan?

Are you in a placement the place you require papers for both company or individual functions nearly every working day? There are a variety of legal papers web templates available on the Internet, but discovering ones you can trust isn`t straightforward. US Legal Forms offers a large number of develop web templates, much like the New Hampshire Proposal Approval of Nonqualified Stock Option Plan, that are created to satisfy federal and state demands.

In case you are currently informed about US Legal Forms internet site and possess a merchant account, just log in. Next, you are able to obtain the New Hampshire Proposal Approval of Nonqualified Stock Option Plan format.

Unless you come with an account and wish to begin to use US Legal Forms, abide by these steps:

- Discover the develop you want and make sure it is for that right area/county.

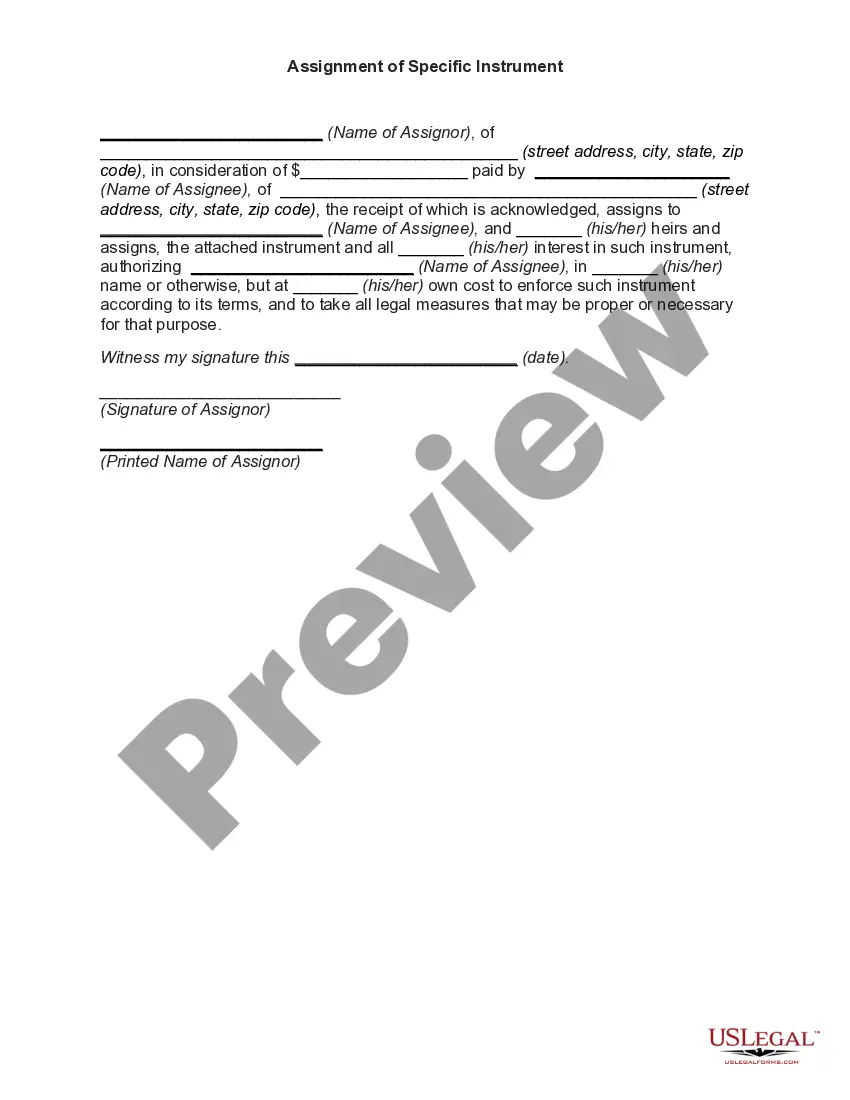

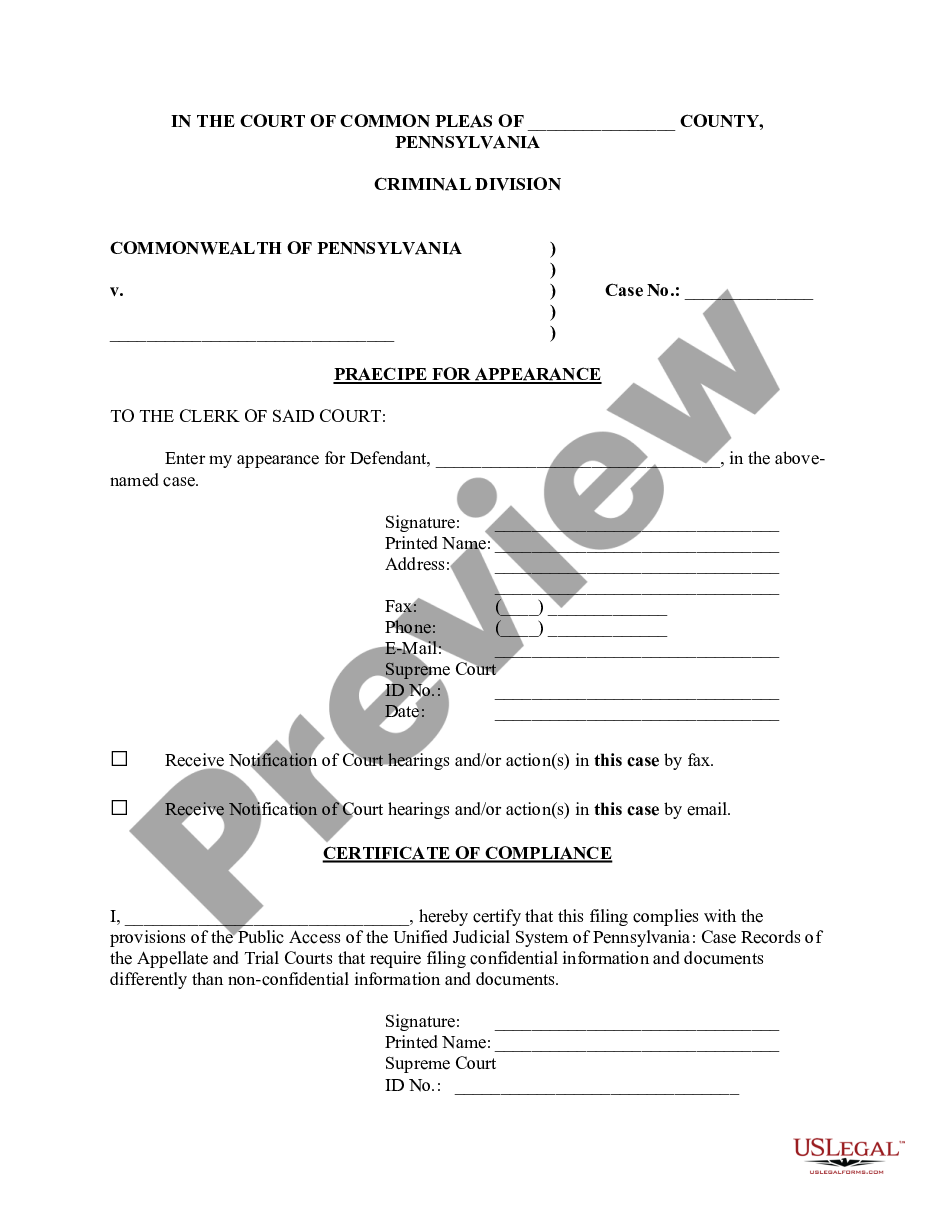

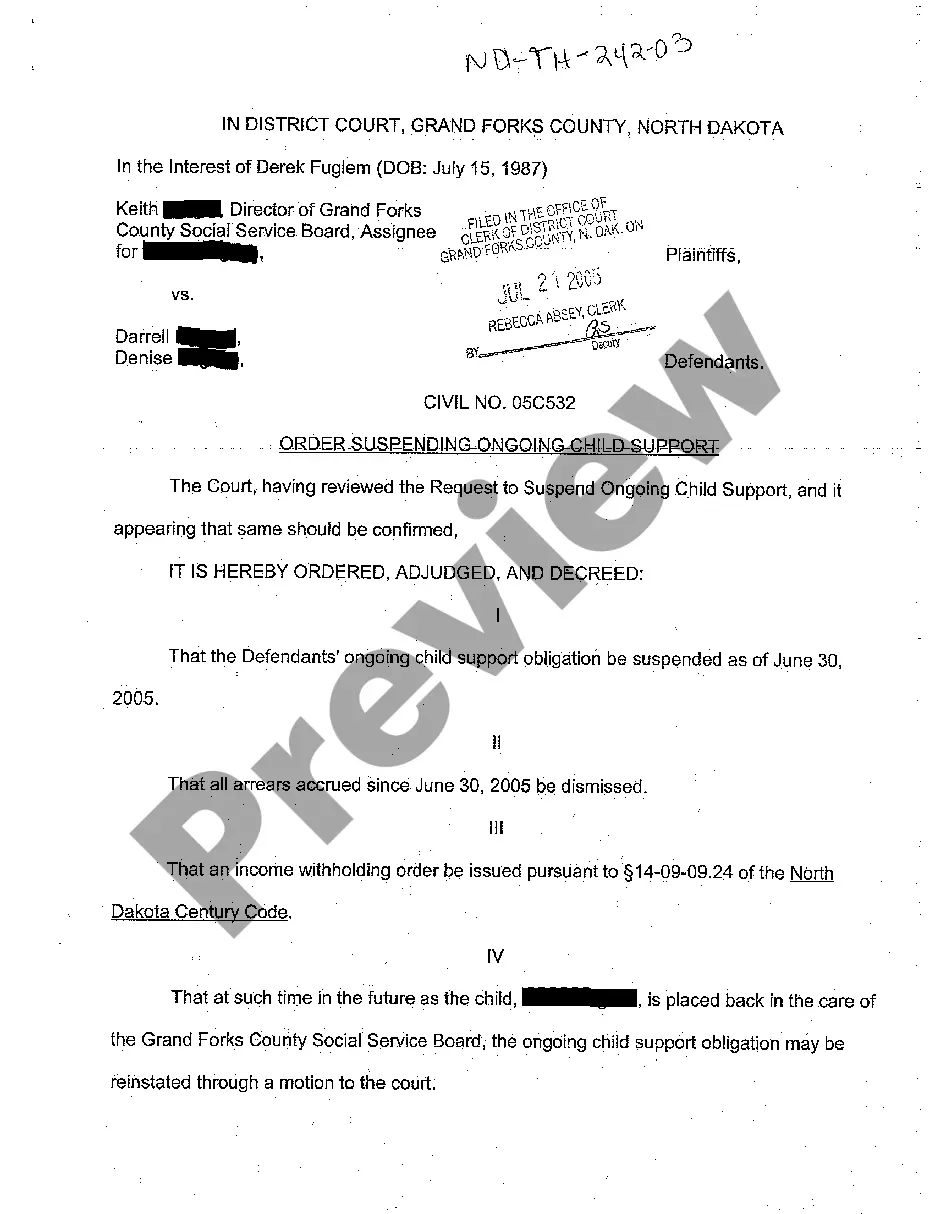

- Utilize the Review button to review the shape.

- Browse the explanation to actually have chosen the correct develop.

- In case the develop isn`t what you are seeking, utilize the Look for discipline to obtain the develop that meets your requirements and demands.

- Whenever you get the right develop, just click Acquire now.

- Opt for the rates strategy you need, fill out the specified info to generate your bank account, and pay for your order with your PayPal or bank card.

- Pick a practical paper formatting and obtain your duplicate.

Discover each of the papers web templates you may have bought in the My Forms food selection. You can obtain a more duplicate of New Hampshire Proposal Approval of Nonqualified Stock Option Plan anytime, if necessary. Just select the necessary develop to obtain or print out the papers format.

Use US Legal Forms, by far the most substantial collection of legal varieties, in order to save efforts and avoid faults. The support offers professionally made legal papers web templates which you can use for an array of functions. Make a merchant account on US Legal Forms and begin generating your way of life a little easier.

Form popularity

FAQ

You calculate the compensation element by subtracting the exercise price from the market value. The market value of the stock is the stock price on the day you exercise your options to buy the stock. You can use the average of the high and low prices that the stock trades for on that day. Non-Qualified Stock Options - TurboTax Tax Tips & Videos TurboTax ? ... ? Investments and Taxes TurboTax ? ... ? Investments and Taxes

The income related to the option exercise should be included in the Form W-2 you receive from your employer or 1099-NEC from the company if you are a non-employee. Any capital gain or loss amount may also be reportable on your US Individual Income Tax Return (Form 1040), Schedule D and Form 8949 in the year of sale.

Form W-2 (or 1099-NEC if you are a nonemployee) Your W-2 (or 1099-NEC) includes the taxable income from your award and, on the W-2, the taxes that have been withheld. This form is provided by your employer. Form 1099-B This IRS form has details about your stock sale and helps you calculate any capital gain/loss.

The Cost Basis of Your Non-Qualified Stock Options The cost basis, generally speaking, is equal to the exercise price, multiplied by the number of shares exercised. In our example above, the cost basis is equal to 2,000 shares times $50/share, or $100,000.

Regarding how to how to calculate cost basis for stock sale, you calculate cost basis using the price you paid to exercise the option if both of these are true: The plan was an incentive stock option or statutory stock option. The stock is disposed of in a qualifying disposition. Calculate Cost Basis For Stock Options - H&R Block H&R Block ? income ? investments ? cal... H&R Block ? income ? investments ? cal...

Non-qualified stock options require payment of income tax of the grant price minus the price of the exercised option. NSOs might be provided as an alternative form of compensation. Prices are often similar to the market value of the shares.

Good places to start for finding your missing cost basis are trade confirmations or other financial records from your prior custodian. If you do not have any good records, then you can strive to recreate the cost basis using historical data. What To Do With Missing Cost Basis - Marotta On Money marottaonmoney.com ? what-to-do-with-mi... marottaonmoney.com ? what-to-do-with-mi...

In general terms, the price you paid plus the taxable benefit you received will be the adjusted cost base (ACB) of your shares. Calculating the ACB can be difficult when you've received the shares through multiple plans, over multiple dates, and frequently the shares are quoted in a foreign currency. Paying Tax on Stock Options: a Guide for Canadians | Stern Cohen sterncohen.com ? insights ? paying-tax-on-s... sterncohen.com ? insights ? paying-tax-on-s...