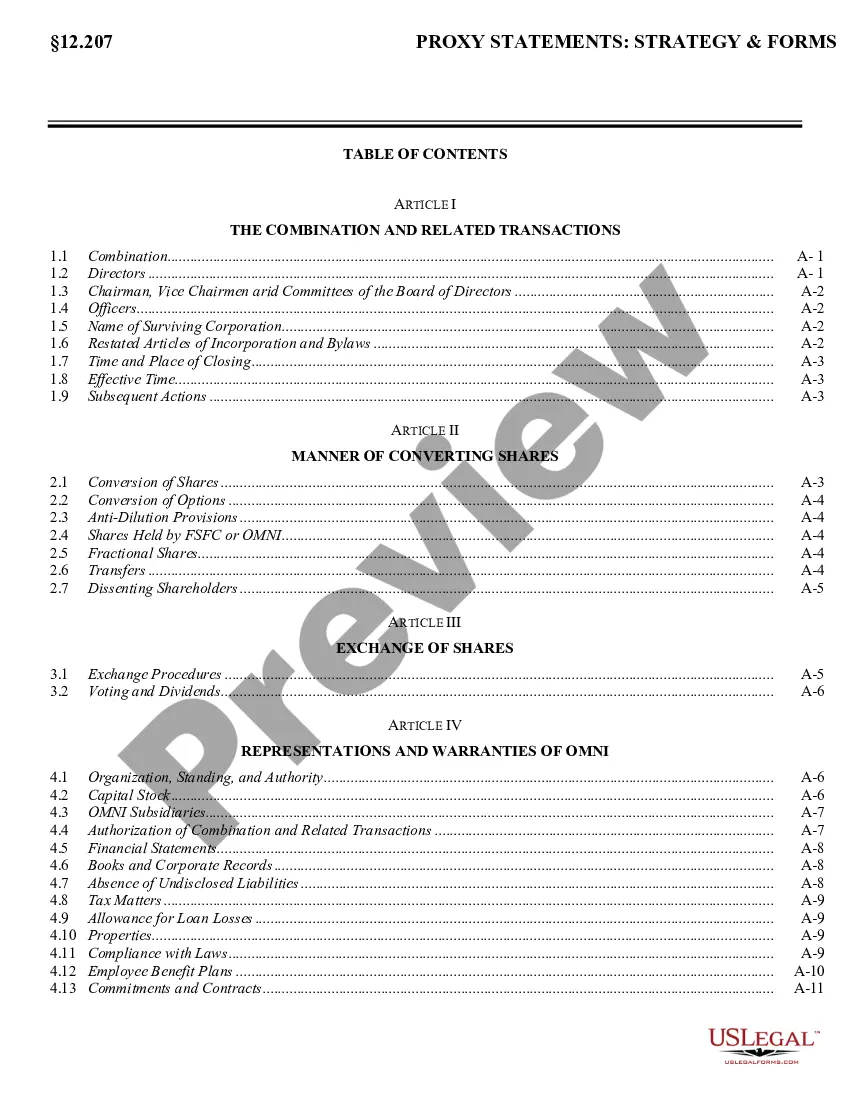

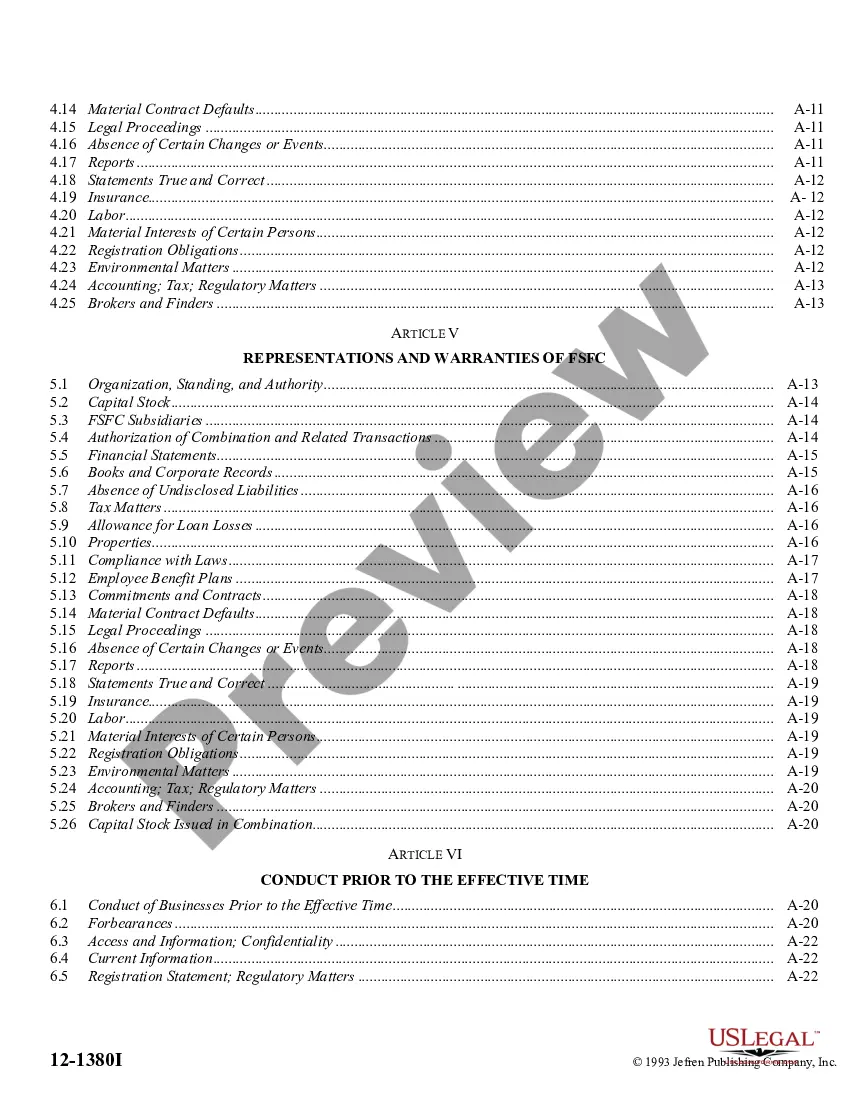

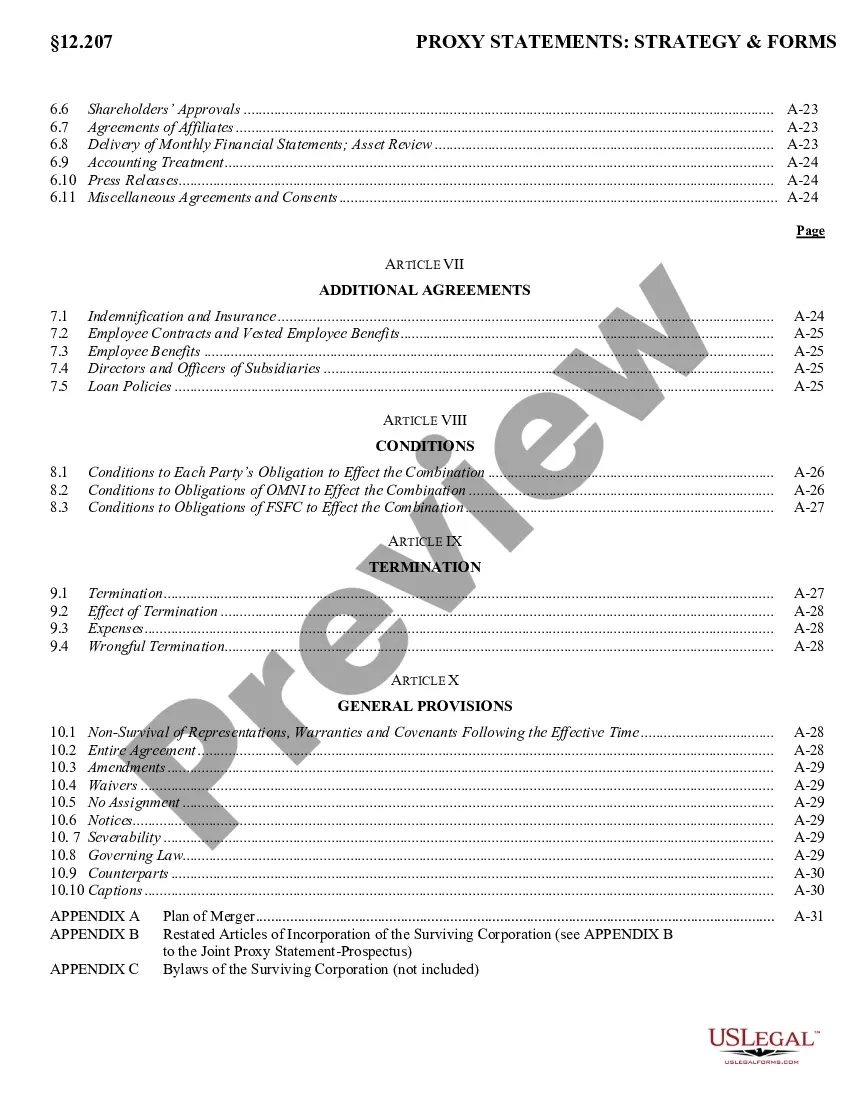

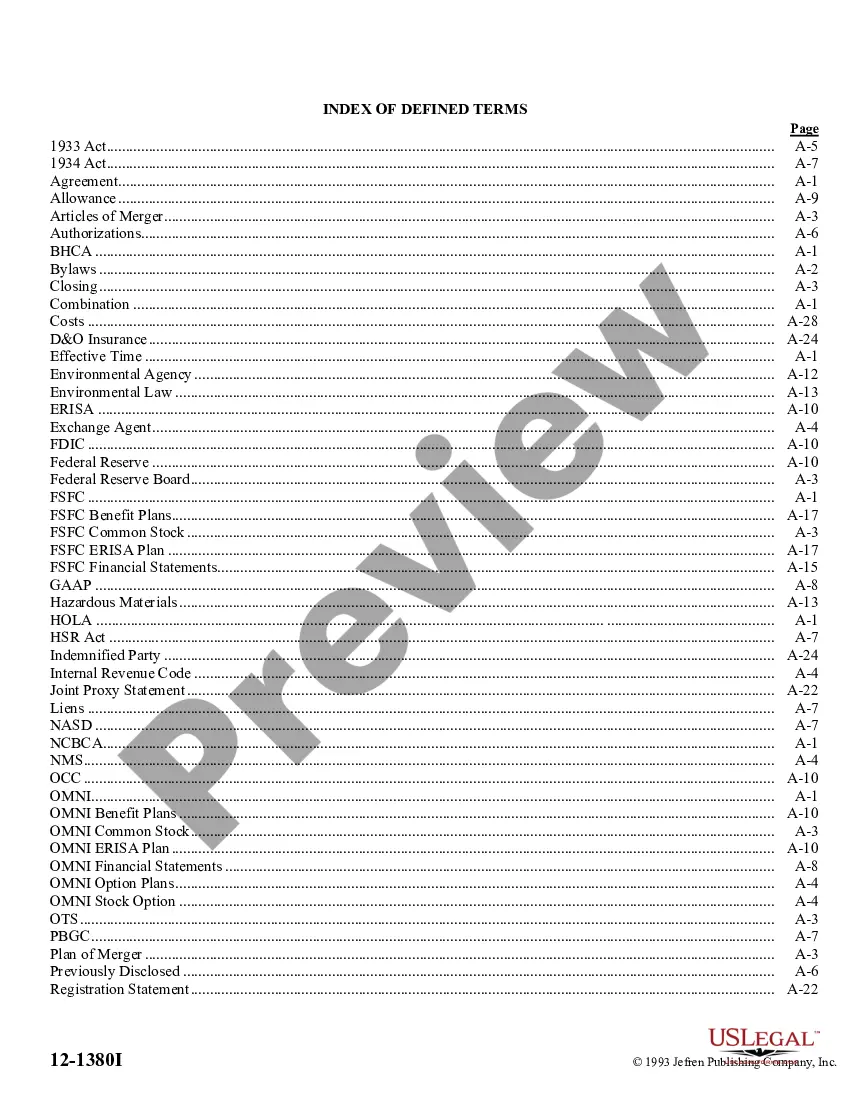

New Hampshire Agreement of Combination

Description

How to fill out Agreement Of Combination?

US Legal Forms - among the most significant libraries of legal kinds in America - provides an array of legal document templates you may download or printing. While using website, you can get a large number of kinds for business and personal reasons, categorized by types, claims, or key phrases.You can find the most up-to-date models of kinds like the New Hampshire Agreement of Combination within minutes.

If you have a registration, log in and download New Hampshire Agreement of Combination through the US Legal Forms collection. The Obtain switch can look on every single form you see. You gain access to all previously saved kinds within the My Forms tab of your account.

If you wish to use US Legal Forms initially, listed below are basic recommendations to help you get started off:

- Be sure to have picked out the proper form for your metropolis/area. Select the Review switch to analyze the form`s content. Read the form description to actually have chosen the appropriate form.

- In case the form doesn`t fit your demands, take advantage of the Research industry on top of the display screen to obtain the the one that does.

- When you are happy with the shape, affirm your option by clicking the Purchase now switch. Then, select the rates program you prefer and supply your references to sign up for the account.

- Approach the transaction. Make use of charge card or PayPal account to complete the transaction.

- Find the structure and download the shape on your own gadget.

- Make changes. Fill out, edit and printing and indicator the saved New Hampshire Agreement of Combination.

Each template you included with your bank account lacks an expiration date and is your own property for a long time. So, in order to download or printing one more backup, just go to the My Forms portion and then click around the form you need.

Obtain access to the New Hampshire Agreement of Combination with US Legal Forms, the most extensive collection of legal document templates. Use a large number of specialist and condition-particular templates that meet up with your small business or personal needs and demands.

Form popularity

FAQ

All New Hampshire LLCs need to pay $100 per year for Annual Reports. These state fees are paid to the Secretary of State. And this is the only state-required annual fee. You have to pay this to keep your LLC in good standing.

The New Hampshire Red was bred to be a dual-purpose breed, suitable for production of both meat and eggs. It adapts well to either intensive or extensive management, and yields a meaty carcass. Hens lay approximately 220 brown eggs per year, with an average weight of about 55 g; they sit well, and are good mothers.

A Limited Liability Company (LLC) is an entity created by state statute. Depending on elections made by the LLC and the number of members, the IRS will treat an LLC either as a corporation, partnership, or as part of the owner's tax return (a disregarded entity).

For 2021 and earlier, businesses with $50,000 or less in New Hampshire gross receipts are not required to pay the BPT tax or a BPT return. For 2022 and later, this filing threshold is increased to $92,000. BPT returns for partnerships are due on the 15th day of the 3rd month following the end of the taxable period.

All business organizations, including Limited Liability Companies (LLC), taxed as a partnership federally must file Form NH-1065 return provided they have conducted business activity in New Hampshire and their gross business income from everywhere is in excess of $92,000.

New Hampshire also has a 7.50 percent corporate income tax rate. New Hampshire does not have a state sales tax and does not levy local sales taxes. New Hampshire's tax system ranks 6th overall on our 2023 State Business Tax Climate Index.

All of the profits and losses of the LLC "pass through" the business to the LLC owners (called members), who report this information on their personal tax returns. The LLC itself doesn't pay federal income taxes, although some states impose an annual tax on LLCs.

Single-member LLCs (SMLLCs) are taxed like sole proprietors by default, and multi-member LLCs are taxed as general partnerships. Unless members elect to choose different status, LLCs are pass-through entities, meaning revenue passes through and is paid by members on personal income tax returns.