New Hampshire Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust

Description

How to fill out Agreement And Plan Of Merger For Conversion Of Corporation Into Maryland Real Estate Investment Trust?

Choosing the right legal file template can be a have a problem. Obviously, there are tons of templates accessible on the Internet, but how can you get the legal develop you will need? Take advantage of the US Legal Forms website. The assistance delivers a huge number of templates, including the New Hampshire Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust, which you can use for organization and personal requires. All of the kinds are examined by experts and satisfy federal and state needs.

Should you be previously signed up, log in for your profile and then click the Down load button to find the New Hampshire Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust. Make use of your profile to look with the legal kinds you have ordered in the past. Check out the My Forms tab of your profile and obtain another duplicate of the file you will need.

Should you be a fresh end user of US Legal Forms, allow me to share easy directions that you should follow:

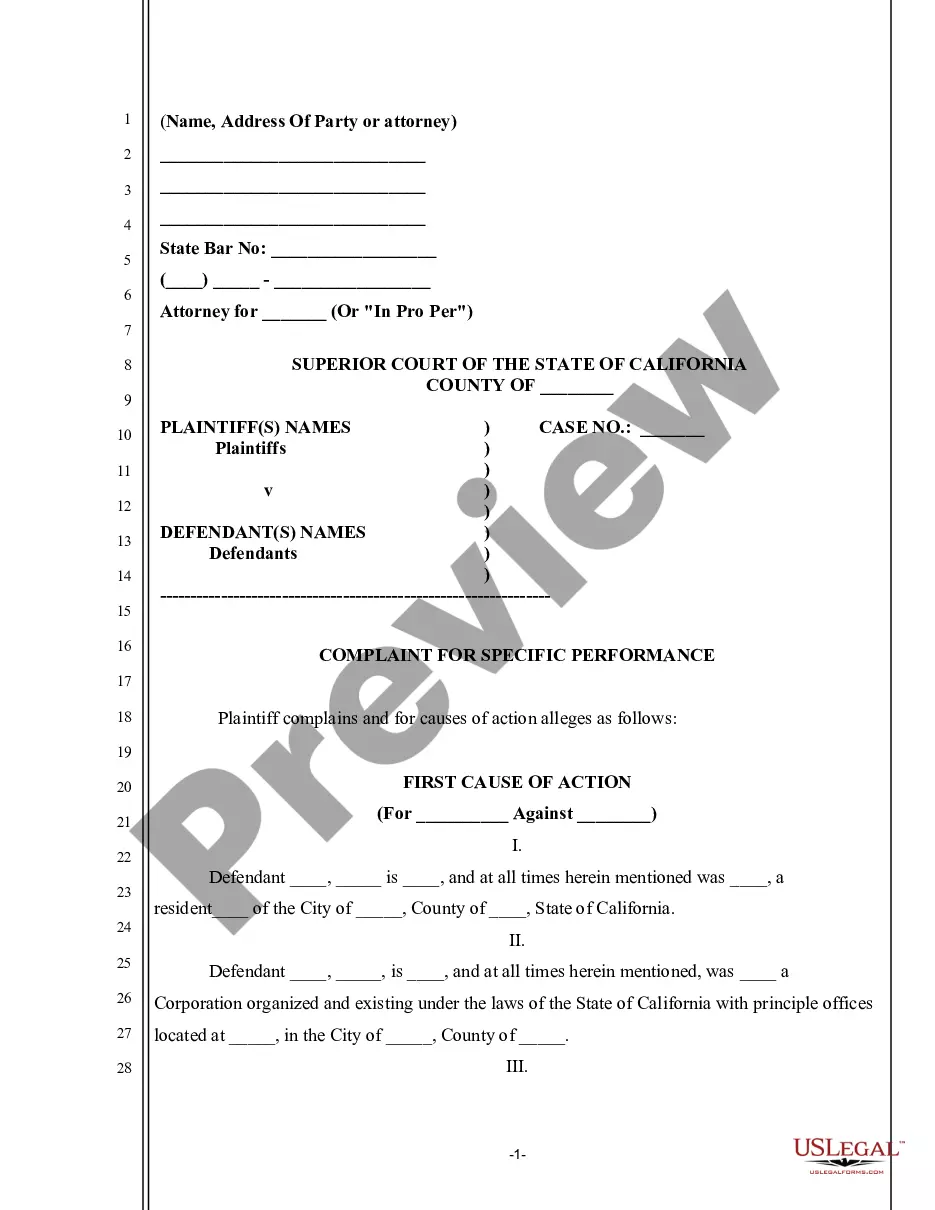

- Initially, make certain you have selected the correct develop for your personal metropolis/county. You may look through the form while using Review button and look at the form explanation to make sure this is the right one for you.

- In case the develop fails to satisfy your preferences, make use of the Seach field to discover the appropriate develop.

- When you are certain that the form is acceptable, go through the Acquire now button to find the develop.

- Select the costs program you desire and enter the essential details. Design your profile and buy the order with your PayPal profile or Visa or Mastercard.

- Opt for the file formatting and download the legal file template for your system.

- Full, edit and produce and indication the attained New Hampshire Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust.

US Legal Forms is the most significant local library of legal kinds where you can see different file templates. Take advantage of the service to download appropriately-manufactured papers that follow express needs.