New Hampshire Employee Evaluation Form for Farmer

Description

How to fill out Employee Evaluation Form For Farmer?

If you want to accumulate, acquire, or print official document templates, utilize US Legal Forms, the largest selection of legal forms, available online.

Take advantage of the site’s straightforward and convenient search to obtain the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you desire, click the Get now button. Choose the pricing plan you prefer and enter your credentials to register for the account.

Step 5. Complete the transaction. You can use your Мisa or Ьastercard or PayPal account to finalize the payment.

- Use US Legal Forms to obtain the New Hampshire Employee Evaluation Form for Farmer with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Obtain button to download the New Hampshire Employee Evaluation Form for Farmer.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

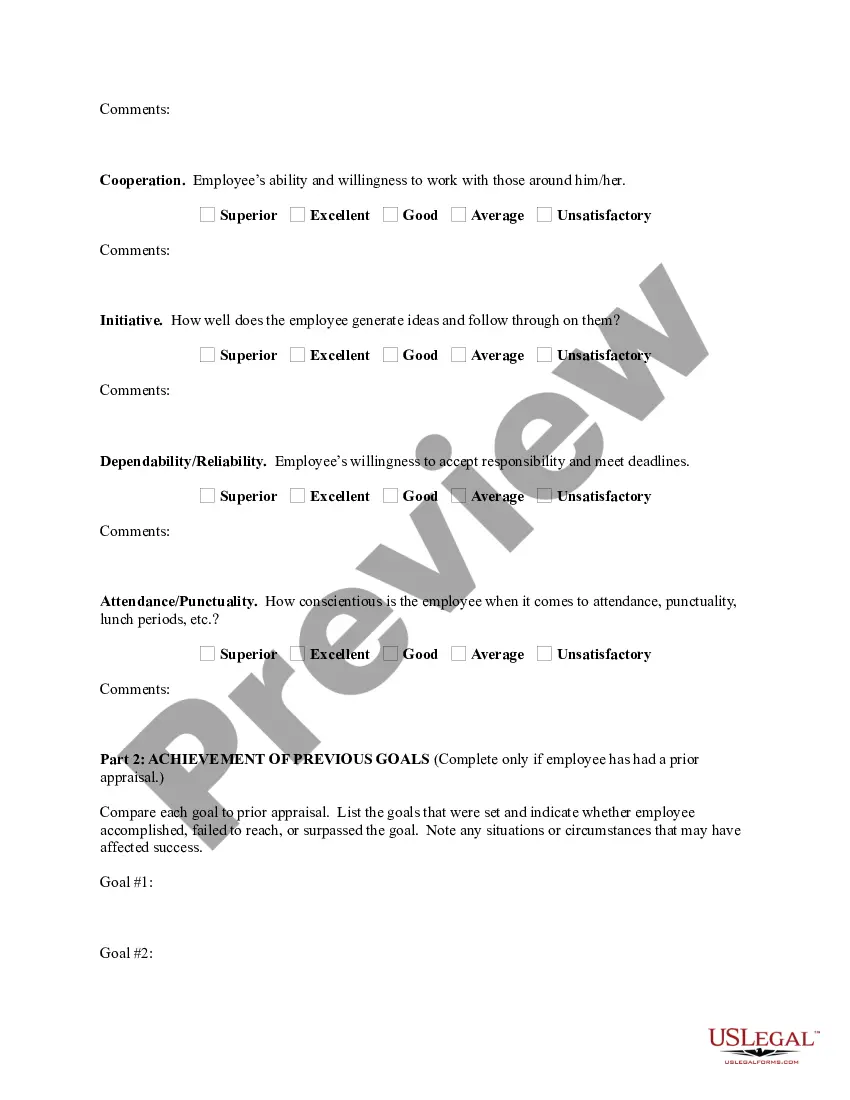

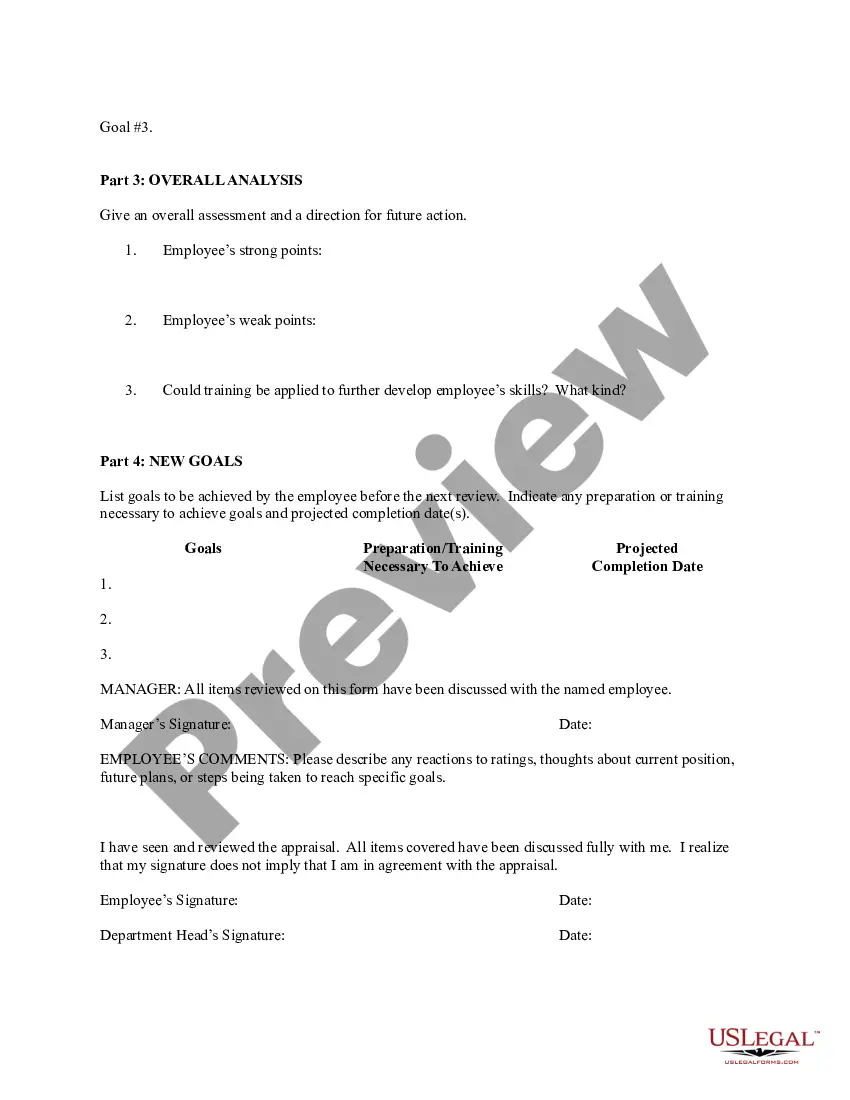

- Step 2. Use the Review option to browse through the form’s content. Don’t forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Q: Is there a statutory definition of farm? A: Yes, RSA -a defines farm as any land, buildings, or structures on or in which agriculture and farming activities are carried out or conducted and shall include the residence or residences of owners, occupants, or employees located on such land.

--An agricultural assessment provides for a reduction in property taxes for land used in agricultural production. --The farmer must apply to the town assessor on an annual basis.

Taxpayers are qualifying farmers for purposes of this special rule if: the individual's gross income from farming is at least 662154 percent of their total gross income from all sources for the taxable year or.

GETTING OUT OF CURRENT USE other criteria. PENALTY: The land use change tax due to the town is 10% of the full and true value (non-current use value) of the changed portion as assessed by the town at the time of the change.

Land assessed under current use may be posted No Trespassing or other signs, unless landowner applies for the 20% recreational adjustment. Receiving current use assessment does not require a landowner to open the property to public use, unless landowner also receives the 20% recreational adjustment.

What is Current Use? Current Use is a tax assessment law that taxes land at its productive capacity. This means the land is taxed at its income-producing capability as forest, farmland or undeveloped land, rather than at its real estate value as a building site.

What is an agricultural assessment? An agricultural assessment allows land utilized for agricultural purposes to be assessed based on its agricultural value as opposed to its commercial value. An agricultural assessment applies to school, country and town property taxes and is based on the soil types on the farm.

To be eligible for Farmland Assessment, land actively devoted to an agricultural or horticultural use must have not less than 5 acres devoted to the production of crops; livestock or their products; and/or forest products under a woodland management plan.

You are in the business of farming if you cultivate, operate, or manage a farm for profit, either as owner or tenant. A farm includes livestock, dairy, poultry, fish, fruit, and truck farms. It also includes plantations, ranches, ranges, and orchards.

Under the program:An applicant for a farmland assessment must own the land and file an application with the municipal tax assessor.Land must be devoted to agricultural and/or horticultural uses for at least two years prior to the tax year the applicant is applying for an assessment.More items...?