New Hampshire File Form for Family and Medical Leave

Description

How to fill out File Form For Family And Medical Leave?

It is feasible to dedicate time online searching for the legal document template that meets the federal and state regulations you require.

US Legal Forms offers thousands of legal templates that are evaluated by experts.

It is easy to download or print the New Hampshire Document Form for Family and Medical Leave from the service.

If provided, use the Preview button to review the document template as well.

- If you possess a US Legal Forms account, you can sign in and click the Obtain button.

- Then, you can complete, modify, print, or sign the New Hampshire Document Form for Family and Medical Leave.

- Every legal document template you purchase is yours permanently.

- To obtain an additional copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the appropriate document template for the state/city of your choice.

- Review the form description to confirm you have chosen the correct template.

Form popularity

FAQ

In order to be eligible to take leave under the FMLA, an employee must (1) work for a covered employer, (2) work 1,250 hours during the 12 months prior to the start of leave, (3) work at a location where 50 or more employees work at that location or within 75 miles of it, and (4) have worked for the employer for 12

In New Hampshire, employers are not required to provide employees with paid family or sick leave employees may be entitled to 12 weeks of job-protected family and medical leave under the federal Family and Medical Leave Act (FMLA), but that leave is unpaid.

Like employers in every state, New Hampshire employers must follow the federal Family and Medical Leave Act (FMLA), which allows eligible employees to take unpaid leave for certain reasons. Once an employee's FMLA leave is over, the employee has the right to be reinstated to his or her position.

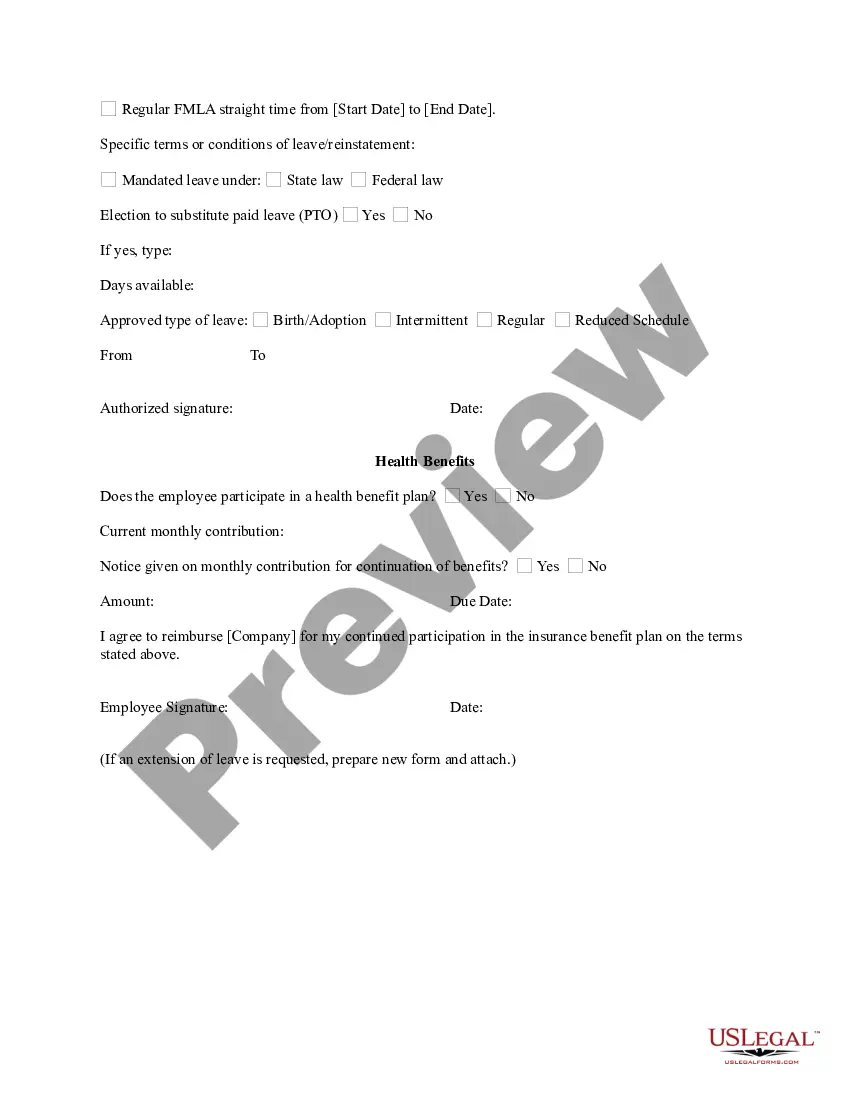

Though the FMLA itself is unpaid, it is sometimes possible under certain specific circumstances to use paid leave that you've accrued on the job as a way to get paid during your FMLA leave. The types of paid leave that might be considered include vacation days and sick days, as well as other types of paid leave.

Contact your Agency Human Resource representative as soon as you know you will be out due to a FMLA qualifying event. Human Resources will provide you with all the required forms needed to review your request. You will need to: Provide your agency Human Resources with certification of the need for leave.

What Are the State Plan Benefits? Eligible employees can receive: Up to six weeks a year with no minimum duration required. 60% of their average weekly wage, capped at the Social Security taxable wage maximum.

To care for the employee's spouse, child, or parent who has a serious health condition. A serious health condition that makes the employee unable to perform the essential functions of his or her job.