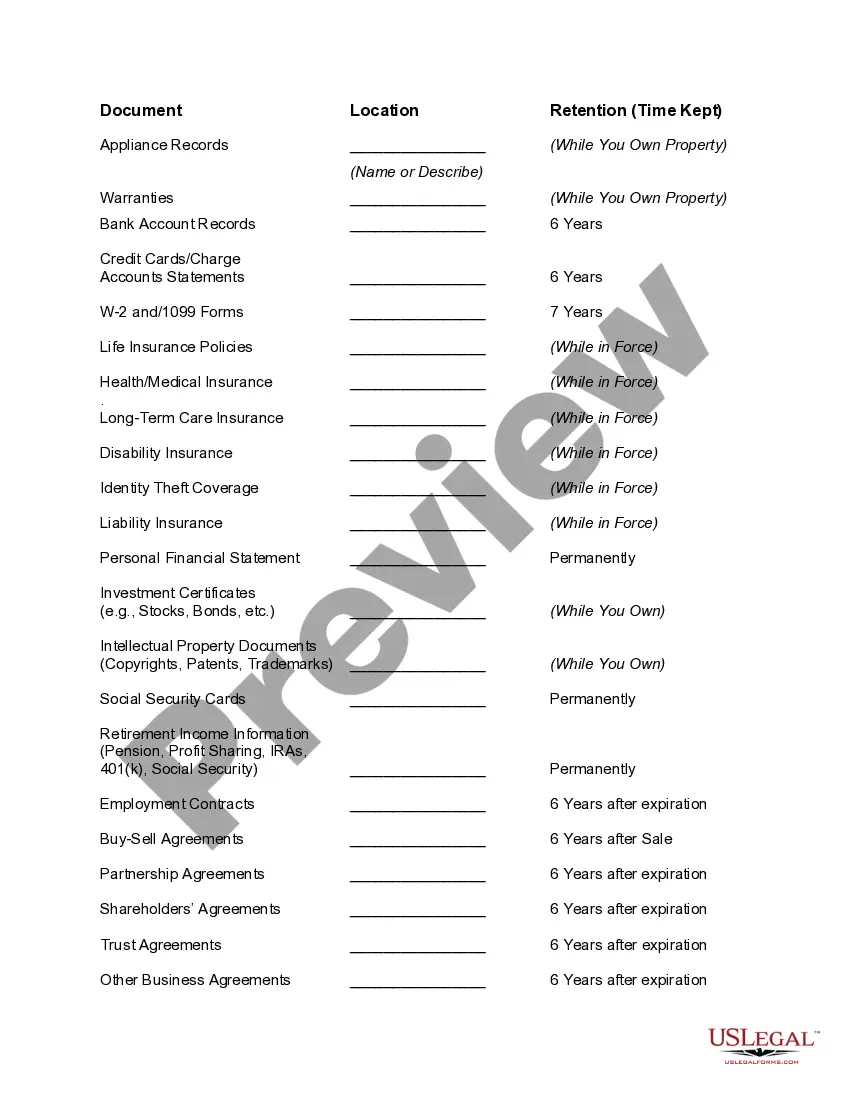

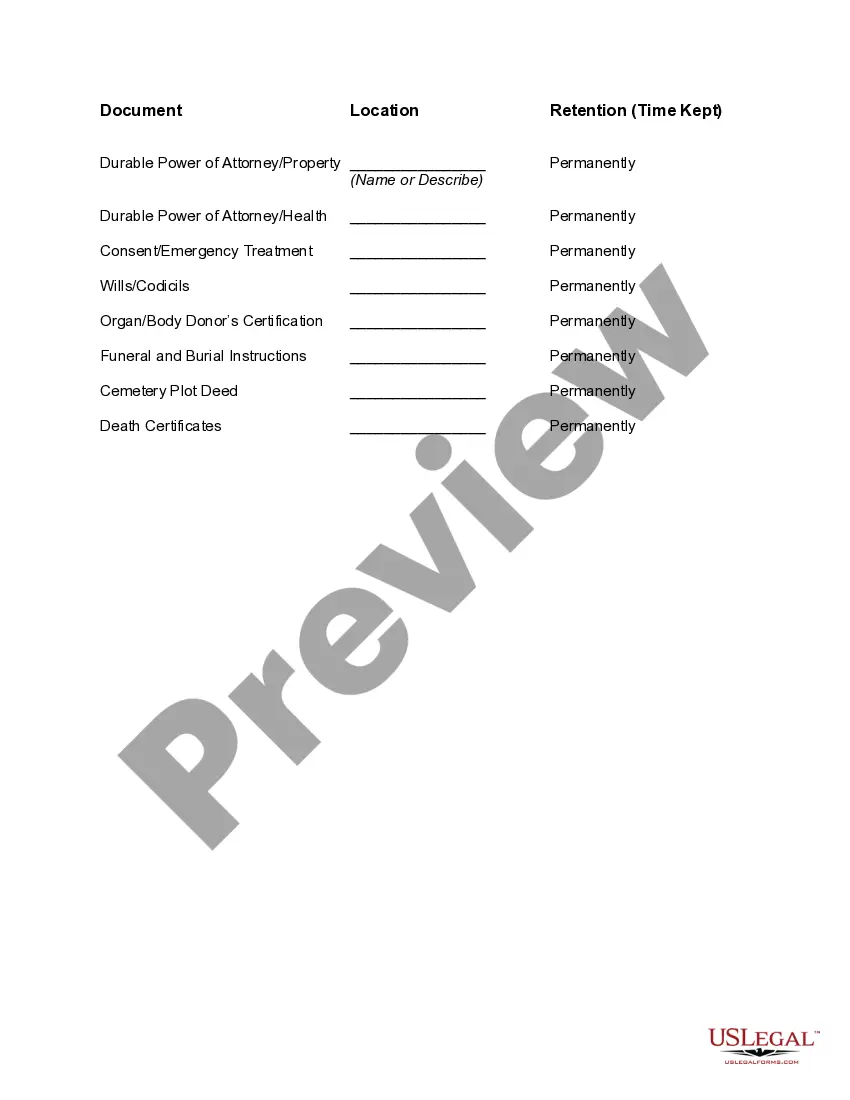

New Hampshire Document Organizer and Retention

Description

How to fill out Document Organizer And Retention?

US Legal Forms - one of the most extensive collections of legal forms in the USA - offers a broad assortment of legal document samples you can obtain or print. By using the website, you will access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can discover the latest versions of forms such as the New Hampshire Document Organizer and Retention in just seconds.

If you possess a membership, Log In and obtain the New Hampshire Document Organizer and Retention from the US Legal Forms catalog. The Download button will appear on each form you view. You have access to all previously acquired forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form onto your device. Edit. Fill out, change, print, and sign the downloaded New Hampshire Document Organizer and Retention. Every template you add to your account has no expiration date and belongs to you forever. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the New Hampshire Document Organizer and Retention through US Legal Forms, one of the most comprehensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/region.

- Click the Preview button to review the form's content.

- Check the description of the form to confirm you have selected the right one.

- If the form does not meet your requirements, utilize the Search section at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking on the Buy now button.

- Then, choose the payment plan you prefer and provide your details to sign up for an account.

Form popularity

FAQ

Period of Limitations that apply to income tax returns Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction. Keep records for 6 years if you do not report income that you should report, and it is more than 25% of the gross income shown on your return.

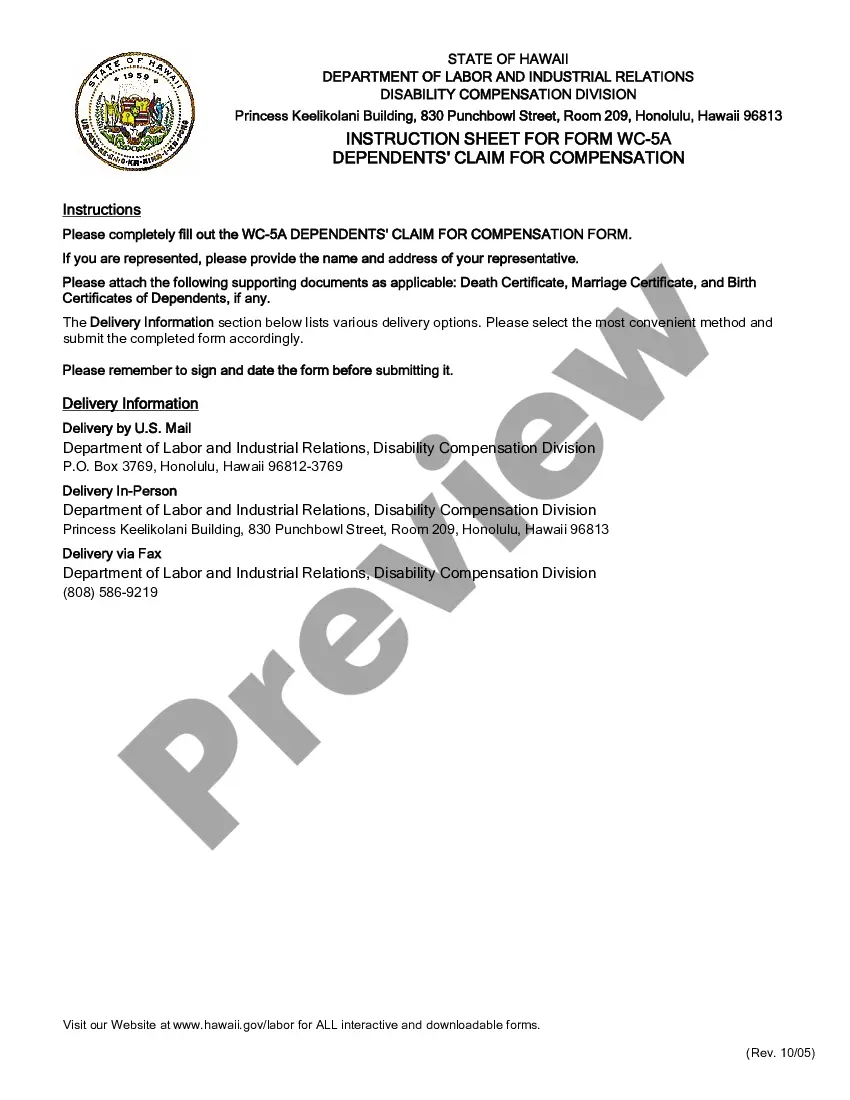

Benefits of a Document Retention PolicyServe as a safety measure in audits or litigation. Improve the organization of documents. Destroy sensitive data that is no longer needed. Eliminate clutter by destroying or archiving unused documents.

26 of 2005, implicitly requires that documents should be retained for 3 years. Section 47 requires the regulatory board, or any person authorised by it, to inspect or review the practice of a registered auditor at least every three years.

To be on the safe side, McBride says to keep all tax records for at least seven years. Keep forever. Records such as birth and death certificates, marriage licenses, divorce decrees, Social Security cards, and military discharge papers should be kept indefinitely.

Document retention guidelines typically require businesses to store records for one, three or seven years. In some cases, you will need to keep the records forever. If you're unsure what to keep and what to shred, your accountant, lawyer and state record-keeping agency may provide guidance.

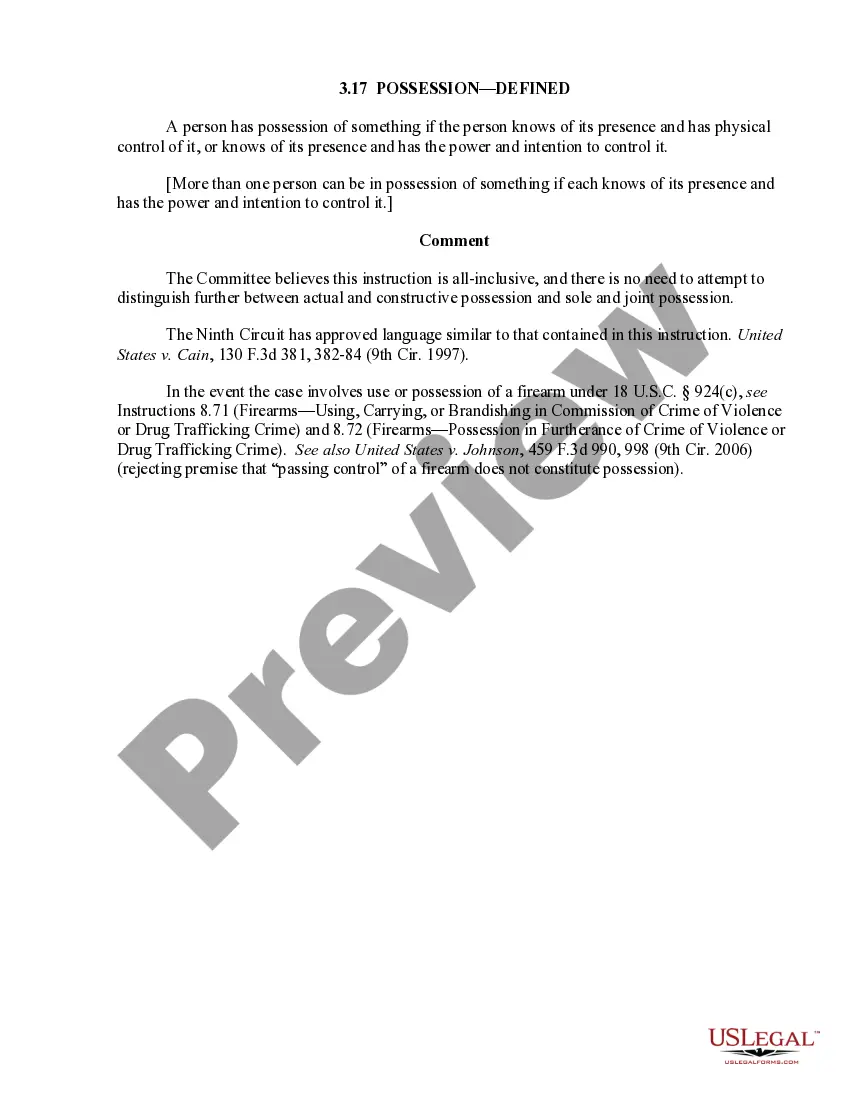

A comprehensive document retention policy would have directed the company to its relevant documents. Any policy should also state the names of the custodian(s) of the information and should list the types of servers and backup tapes that are used.

Records Retention Guideline # 1: Some items should never be thrown outIncome tax returns and payment checks.Important correspondence.Legal documents.Vital records (birth / death / marriage / divorce / adoption / etc.)Retirement and pension records.More items...

A document retention policy (also known as a records and information management policy, recordkeeping policy, or a records maintenance policy) establishes and describes how a company expects its employees to manage company data from creation through destruction.

As a general rule of thumb, tax returns, financial statements and accounting records should be retained for a minimum of six years.