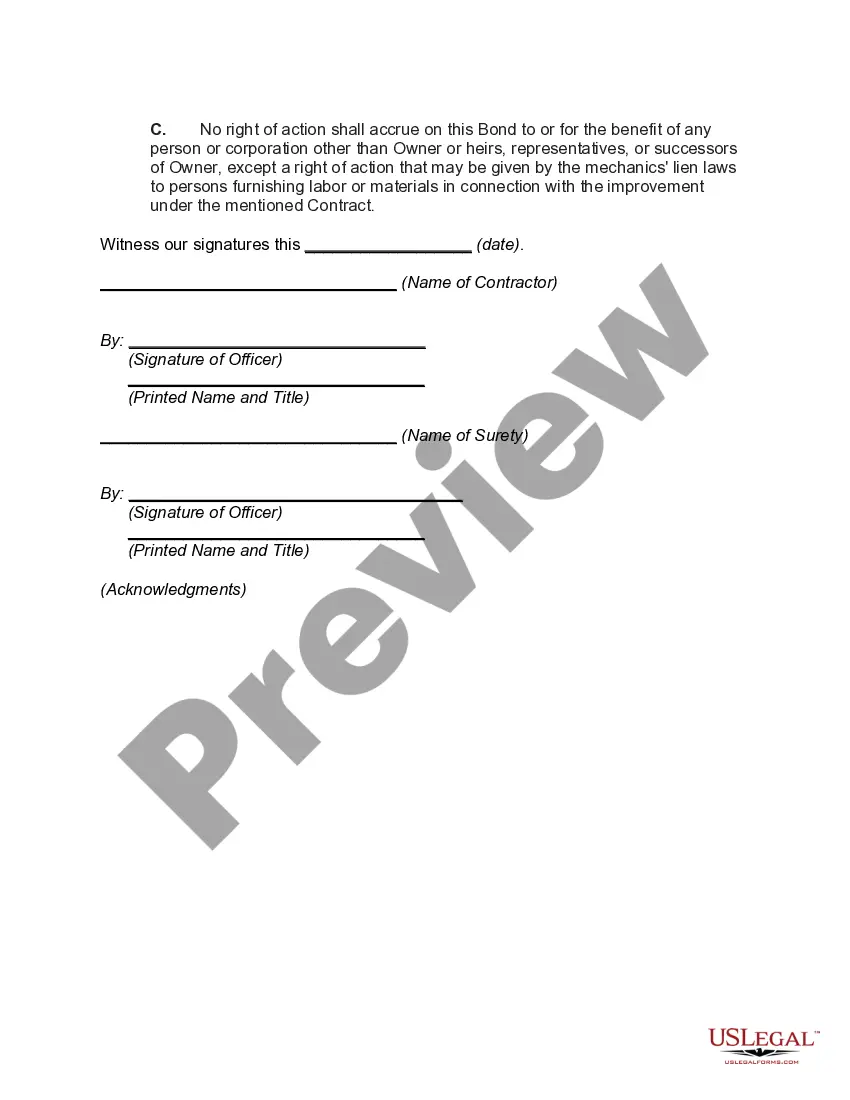

New Hampshire Contractor's Performance Bond with Limitation of Right of Action

Description

How to fill out Contractor's Performance Bond With Limitation Of Right Of Action?

If you wish to complete, download, or print lawful file templates, use US Legal Forms, the greatest selection of lawful varieties, that can be found on-line. Use the site`s simple and convenient search to obtain the files you require. A variety of templates for business and personal reasons are sorted by classes and suggests, or key phrases. Use US Legal Forms to obtain the New Hampshire Contractor's Performance Bond with Limitation of Right of Action in a handful of clicks.

In case you are already a US Legal Forms client, log in in your accounts and then click the Obtain option to have the New Hampshire Contractor's Performance Bond with Limitation of Right of Action. You may also accessibility varieties you in the past saved within the My Forms tab of your respective accounts.

If you use US Legal Forms initially, follow the instructions listed below:

- Step 1. Be sure you have selected the form for your right city/land.

- Step 2. Make use of the Review option to examine the form`s content. Never forget to learn the description.

- Step 3. In case you are unsatisfied using the kind, use the Search discipline near the top of the screen to locate other variations from the lawful kind web template.

- Step 4. Upon having discovered the form you require, go through the Get now option. Select the pricing program you choose and put your credentials to register for an accounts.

- Step 5. Procedure the transaction. You can use your bank card or PayPal accounts to complete the transaction.

- Step 6. Select the formatting from the lawful kind and download it on your system.

- Step 7. Comprehensive, edit and print or indicator the New Hampshire Contractor's Performance Bond with Limitation of Right of Action.

Every lawful file web template you purchase is yours forever. You may have acces to each kind you saved within your acccount. Click the My Forms portion and decide on a kind to print or download yet again.

Compete and download, and print the New Hampshire Contractor's Performance Bond with Limitation of Right of Action with US Legal Forms. There are many professional and condition-specific varieties you can use for the business or personal requirements.

Form popularity

FAQ

How Long Does a Performance Bond Last? The time limit for claiming a performance bond will be spelled out in the bond contract. However, most performance bonds have a duration of twelve months, with some lasting for 36 months. In addition, your bond may be renewable or non-renewable.

Bonds are issued by governments and corporations when they want to raise money. By buying a bond, you're giving the issuer a loan, and they agree to pay you back the face value of the loan on a specific date, and to pay you periodic interest payments along the way, usually twice a year.

A performance bond is a financial guarantee that the terms of a contract will be honored. If one party to a contract cannot complete their obligations, the bond is paid out to the other party to compensate for their damages or costs.

A payment bond is a type of surety bond issued to contractors which guarantee that all entities involved with the project will be paid. A payment surety bond is a legal contract, a type of bond, that guarantees certain employees, subcontractors, and suppliers are protected against non-payment.

For example, a construction payment bond may need to cover the entire construction contract amount for a $5 million project, but a $50 million project only requires a bond of 50% of the total contract value. The required bond amounts are set out in the specific statutes of the state in which the project takes place.

If the surety does not voluntarily pay the claim, a lawsuit must be filed against the payment bond surety as follows: (a) if the public entity files a notice of completion or cessation notice, thirty (30) days six plus (6) months after the notice is filed or (b) if neither a notice of completion or cessation is filed, ...

Performance bonds, which are secured by a contractor before the beginning of a project, provide a guarantee to the project owner that contract obligations will be fulfilled. If the contractor fails to complete work ing to the contract terms, the property owner may be financially compensated.

Here's how to distinguish them: As mentioned, a completion bond guarantees that a contractor will complete a project regardless if they get paid. A performance bond guarantees that a contractor will perform the work specified in the contract.