New Hampshire Guide for Protecting Deceased Persons from Identity Theft

Description

How to fill out Guide For Protecting Deceased Persons From Identity Theft?

US Legal Forms - one of the largest collections of legal documents in the United States - offers an extensive variety of legal template formats that you can download or print. By utilizing the site, you can access thousands of forms for business and personal use, organized by categories, states, or keywords.

You can obtain the most recent versions of forms such as the New Hampshire Guide for Protecting Deceased Persons from Identity Theft in just a few minutes. If you already have a monthly subscription, Log In and download the New Hampshire Guide for Protecting Deceased Persons from Identity Theft from your US Legal Forms library. The Download button will be visible on each form you view. You also have access to all previously downloaded forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are some simple tips to help you get started: Ensure you have selected the correct form for your specific city/state. Click the Review button to examine the content of the form. Read the form description to confirm that you have selected the correct document. If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does. If you are satisfied with the form, validate your selection by clicking the Buy now button. After that, choose the payment plan you prefer and provide your details to register for the account. Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the purchase. Select the format and download the form to your device. Make adjustments. Fill, edit, print, and sign the downloaded New Hampshire Guide for Protecting Deceased Persons from Identity Theft.

Avoid altering or deleting any HTML tags. Only synonymize plain text outside of the HTML tags.

- Every template you added to your account has no expiration date and is yours forever.

- So, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you desire.

- Access the New Hampshire Guide for Protecting Deceased Persons from Identity Theft with US Legal Forms, the most comprehensive collection of legal document formats.

- Utilize a multitude of professional and state-specific templates that meet your business or personal needs and requirements.

- Start managing your legal forms efficiently with ease.

- Enjoy the convenience and security of having all your legal templates at your fingertips.

Form popularity

FAQ

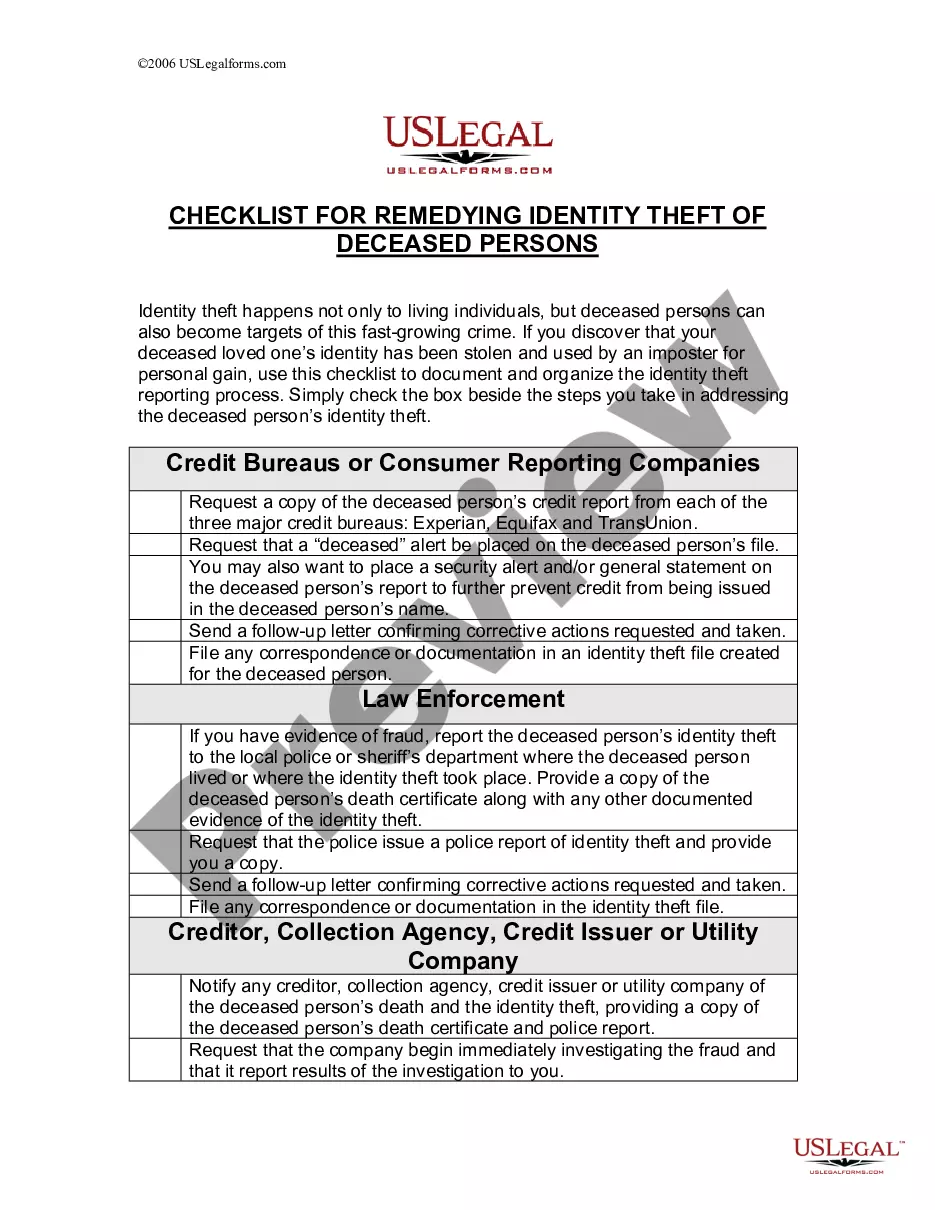

Although family members are not personally responsible for the debts of their deceased loved ones, it may take an effort to resolve the situation if a loved one's identity is stolen. You and your family can take action to prevent identity theft from happening.

A deceased person's social security number can no longer be used in transactions, which is why bank accounts in the deceased person's name are often frozen shortly after their passing.

If you are the spouse of a person who died, parent of a child under 18 who died, or a personal representative for someone's estate. Debt collectors can mention the debt to you, and you have the right to learn more about it. But this doesn't necessarily mean that you're personally responsible for paying it.

When someone dies, their debts are generally paid out of the money or property left in the estate. If the estate can't pay it and there's no one who shared responsibility for the debt, it may go unpaid. Generally, when a person dies, their money and property will go towards repaying their debt.

Contact banks, credit unions, credit card companies, and other financial institutions that hold accounts in your loved one's name, and notify those companies of your family member's death. This way, the system can flag any attempts to use the deceased person's identity via their financial accounts.

Identity thieves can strike even after death. An identity thief's use of a deceased person's Social Security number may create problems for family members. This type of identity theft also victimizes merchants, banks, and other businesses that provide goods and services to the thief.

Avoid listing birth date, maiden name, or other personal identifiers in obituaries as they could be useful to ID thieves. Report the death to the Social Security Administration by calling 800-772-1213. Order multiple certified copies of the death certificate with and without cause of death.

If you report your identity theft to the FTC within two business days of discovering it, you will only be liable to pay $50 of any unauthorized use of your bank and credit accounts (under federal law). The longer you leave it, the more that financial liability falls on your shoulders.