New Hampshire Unrestricted Charitable Contribution of Cash

Description

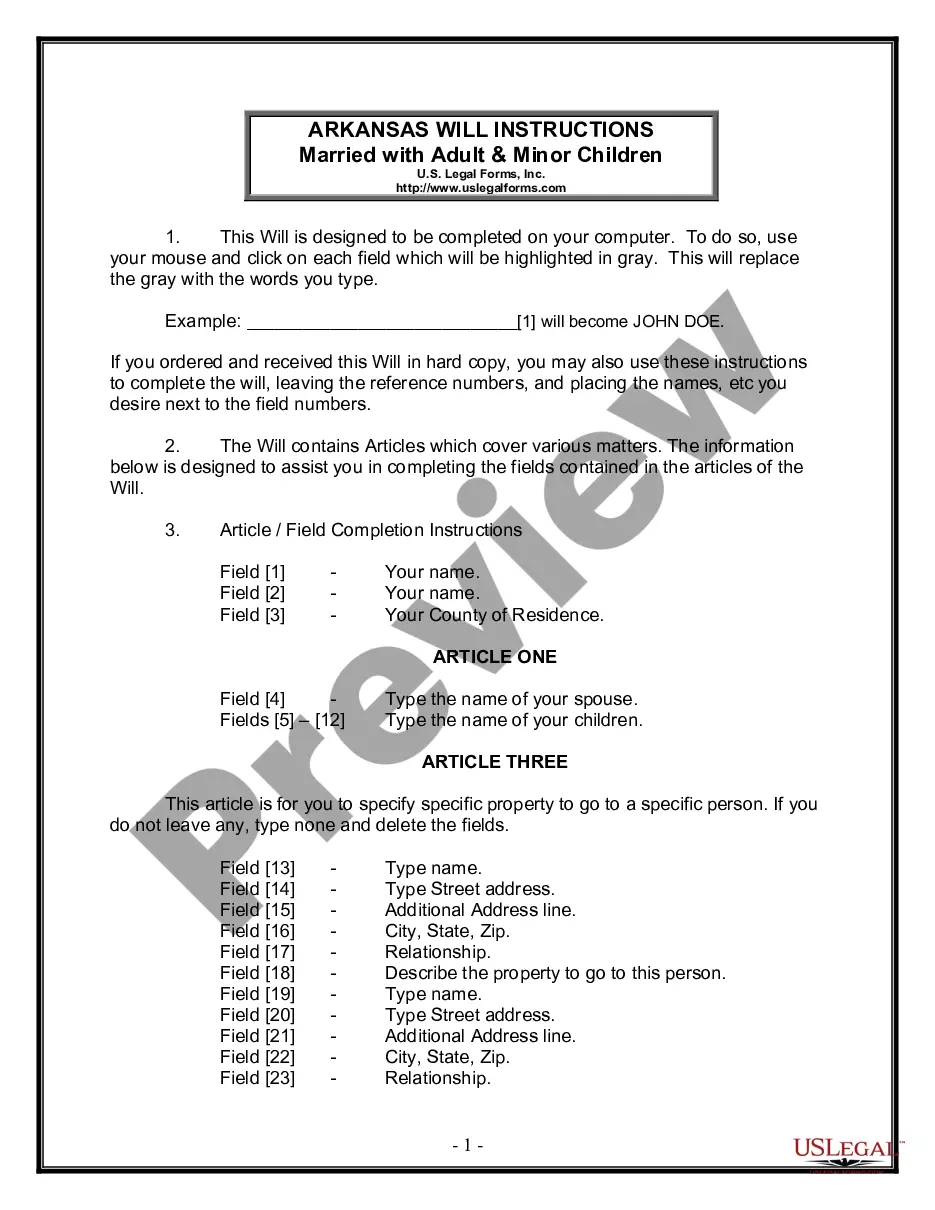

How to fill out Unrestricted Charitable Contribution Of Cash?

If you have to full, acquire, or printing authorized record web templates, use US Legal Forms, the largest assortment of authorized types, that can be found on the Internet. Make use of the site`s simple and easy hassle-free look for to get the paperwork you will need. Various web templates for organization and specific functions are sorted by classes and claims, or key phrases. Use US Legal Forms to get the New Hampshire Unrestricted Charitable Contribution of Cash within a couple of mouse clicks.

In case you are currently a US Legal Forms client, log in to the profile and then click the Download switch to have the New Hampshire Unrestricted Charitable Contribution of Cash. You may also accessibility types you in the past delivered electronically in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, refer to the instructions under:

- Step 1. Ensure you have selected the form to the right town/nation.

- Step 2. Utilize the Preview solution to look through the form`s content material. Don`t neglect to learn the information.

- Step 3. In case you are unsatisfied with the kind, use the Lookup industry at the top of the display screen to discover other models from the authorized kind design.

- Step 4. Once you have discovered the form you will need, select the Get now switch. Pick the prices plan you like and include your accreditations to sign up on an profile.

- Step 5. Process the deal. You may use your charge card or PayPal profile to perform the deal.

- Step 6. Choose the formatting from the authorized kind and acquire it on your system.

- Step 7. Total, revise and printing or signal the New Hampshire Unrestricted Charitable Contribution of Cash.

Every authorized record design you acquire is your own forever. You may have acces to every kind you delivered electronically in your acccount. Click the My Forms section and pick a kind to printing or acquire once again.

Remain competitive and acquire, and printing the New Hampshire Unrestricted Charitable Contribution of Cash with US Legal Forms. There are millions of specialist and status-specific types you may use to your organization or specific demands.

Form popularity

FAQ

Exempt Purposes - Internal Revenue Code Section 501(c)(3) The exempt purposes set forth in section 501(c)(3) are charitable, religious, educational, scientific, literary, testing for public safety, fostering national or international amateur sports competition, and preventing cruelty to children or animals.

Non-profit charities get revenue from donations, grants, and memberships. They may also get revenue from selling branded products. A non-profit organization's expenses may include: Rent or mortgage payments.

Learn more about why we're making this change. Organizations serving New Hampshire and selected communities in Maine and Vermont within the Foundation's eight regions: Capital, Lakes, Manchester, Monadnock, Nashua, North Country, Piscataqua and Upper Valley.

How to Start a Nonprofit in New Hampshire Name Your Organization. ... Recruit Incorporators and Initial Directors. ... Appoint a Registered Agent. ... Prepare and File Articles of Incorporation. ... File Initial Report. ... Obtain an Employer Identification Number (EIN) ... Store Nonprofit Records. ... Establish Initial Governing Documents and Policies.

An endowment can be structured as a trust, private foundation, or charitable organization. Within this, there are restricted endowments, with the principal held in perpetuity while investment earnings are granted per the donor's recommendations.

profit organization whose mission is of a religious, educational or charitable nature, may qualify for a property tax exemption. The property must be owned, used and occupied by the organization (RSA ) as of April 1 of the year the application is made.

How to start a nonprofit in 9 easy steps Incorporate your nonprofit. ... Secure an Employer Identification Number (EIN) ... Elect a board of directors. ... Create your bylaws. ... Develop a conflict of interest policy. ... Apply for federal tax-exempt status. ... File for state tax exemptions. ... Register to fundraise where required.

How to Start a Nonprofit in New Hampshire Name Your Organization. ... Recruit Incorporators and Initial Directors. ... Appoint a Registered Agent. ... Prepare and File Articles of Incorporation. ... File Initial Report. ... Obtain an Employer Identification Number (EIN) ... Store Nonprofit Records. ... Establish Initial Governing Documents and Policies.