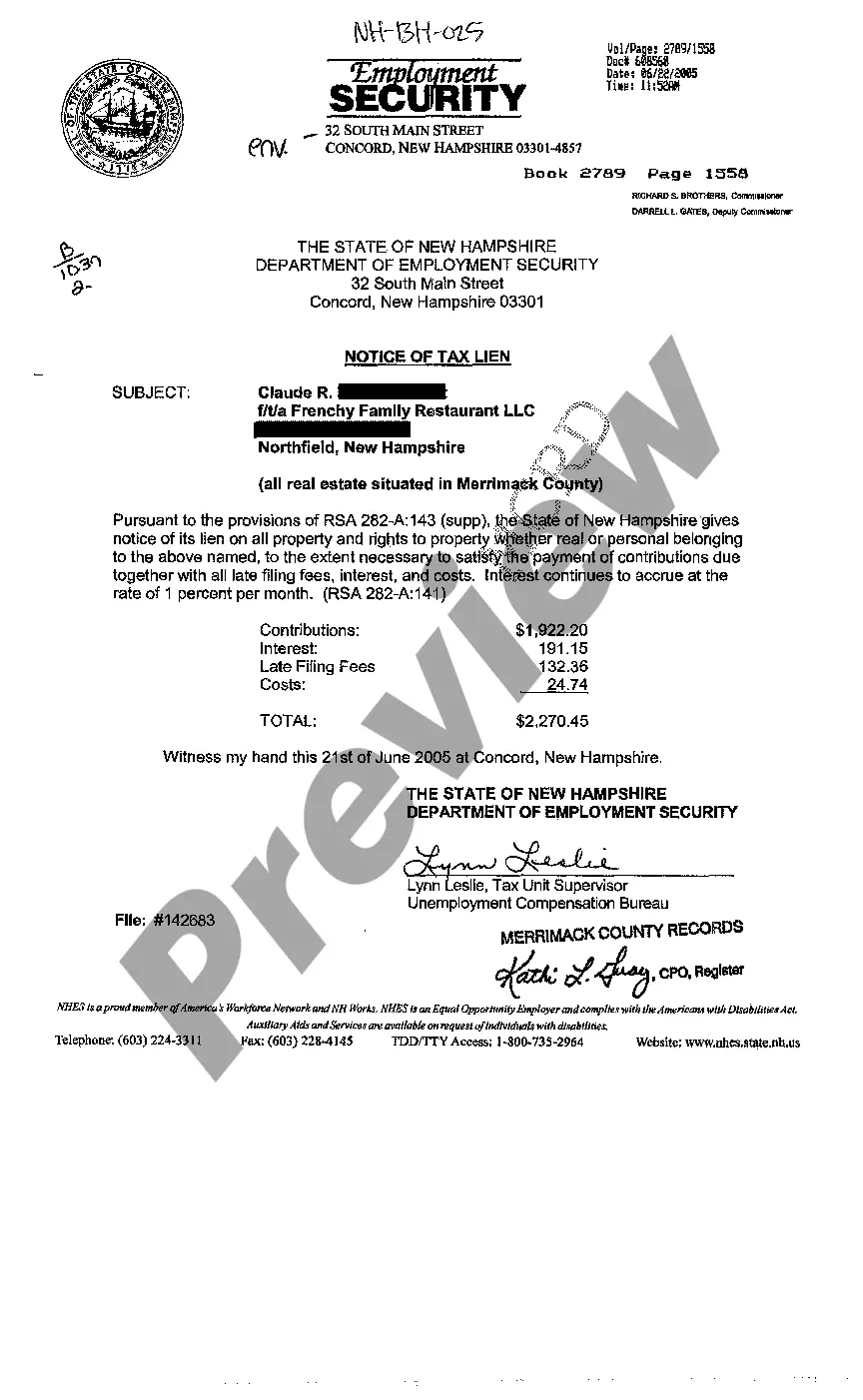

New Hampshire Notice of Tax Lien

Description

How to fill out New Hampshire Notice Of Tax Lien?

Avoid expensive attorneys and find the New Hampshire Notice of Tax Lien you need at a reasonable price on the US Legal Forms site. Use our simple categories function to search for and download legal and tax documents. Go through their descriptions and preview them before downloading. Moreover, US Legal Forms enables customers with step-by-step instructions on how to download and fill out each and every template.

US Legal Forms clients basically need to log in and get the particular document they need to their My Forms tab. Those, who haven’t got a subscription yet should follow the guidelines below:

- Make sure the New Hampshire Notice of Tax Lien is eligible for use in your state.

- If available, read the description and make use of the Preview option prior to downloading the sample.

- If you’re sure the document is right for you, click Buy Now.

- If the form is incorrect, use the search engine to get the right one.

- Next, create your account and select a subscription plan.

- Pay out by card or PayPal.

- Choose to download the form in PDF or DOCX.

- Just click Download and find your template in the My Forms tab. Feel free to save the template to the gadget or print it out.

After downloading, you may fill out the New Hampshire Notice of Tax Lien manually or with the help of an editing software. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

Tax liens put your assets at risk. To remove them you'll need to work with the IRS to pay your back taxes. Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page.

A lien is a legal claim against your property to secure payment of your tax debt, while a levy actually takes the property to satisfy the tax debt.When filed, the Notice of Federal Tax Lien is a public document that alerts other creditors that the IRS is asserting a secured claim against your assets.

A lien secures the government's interest in your property when you don't pay your tax debt. A levy actually takes the property to pay the tax debt. If you don't pay or make arrangements to settle your tax debt, the IRS can levy, seize and sell any type of real or personal property that you own or have an interest in.

If you do happen to find a paid tax lien on your report, and it's been more than seven years since satisfied the debt, you just need to dispute the item with the credit bureaus. Once they verify the date and status, they will typically remove it within 30 days.

Tax liens put your assets at risk. To remove them you'll need to work with the IRS to pay your back taxes.Tax liens (and their cousins, tax levies) are serious business if you owe back taxes.

Tax liens used to appear on your credit reports maintained by the three national credit bureaus (Experian, TransUnion and Equifax). Even if you paid the lien, it stayed on your reports for up to seven years, while unpaid liens remained on your reports for up to 10 years.

We may file a Notice of Federal Tax Lien in the public record to notify your creditors of your tax debt.The federal tax lien arises automatically when the IRS sends the first notice demanding payment of the tax debt assessed against you and you fail to pay the amount in full.

A lien secures the government's interest in your property when you don't pay your tax debt. A levy actually takes the property to pay the tax debt. If you don't pay or make arrangements to settle your tax debt, the IRS can levy, seize and sell any type of real or personal property that you own or have an interest in.