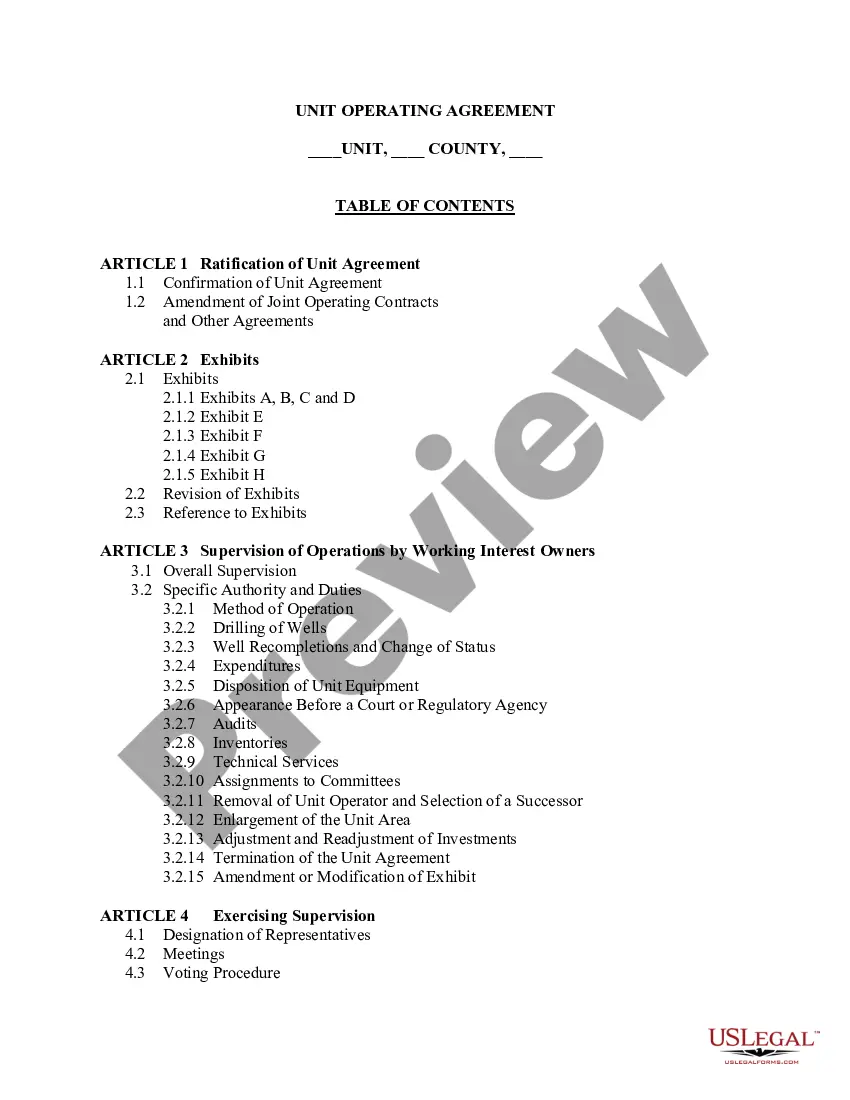

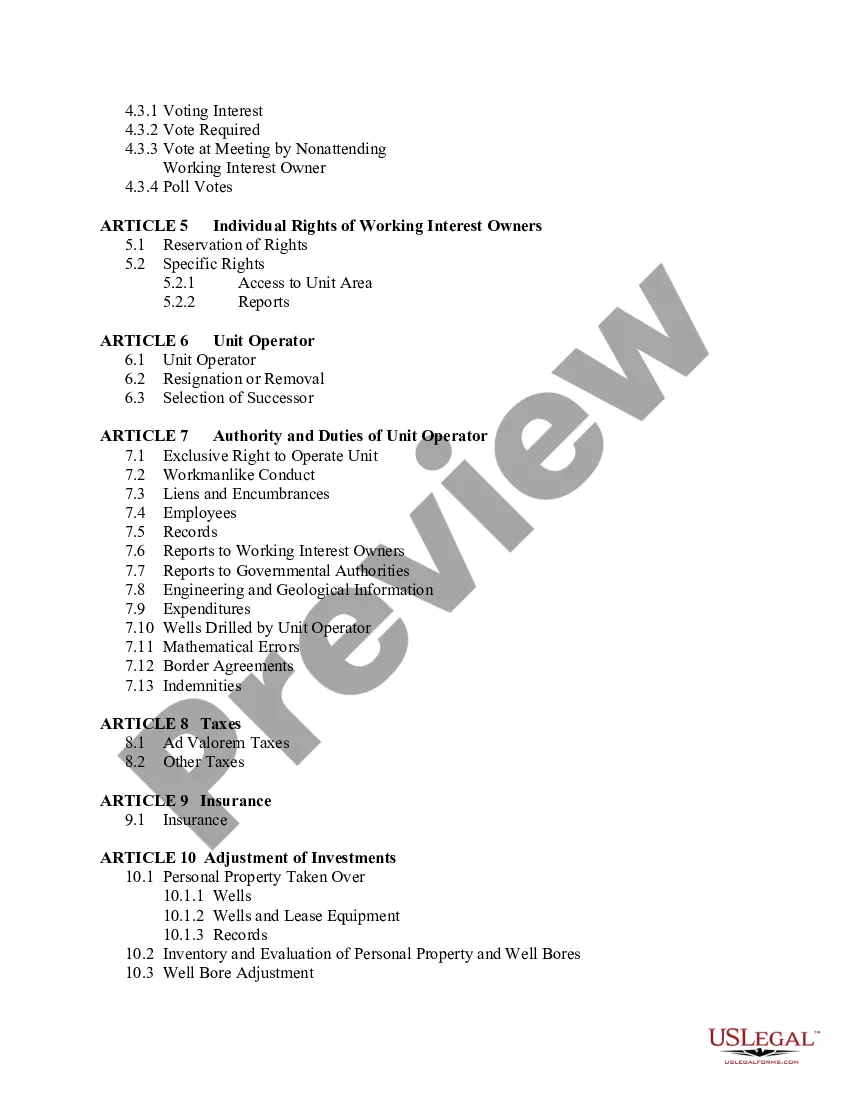

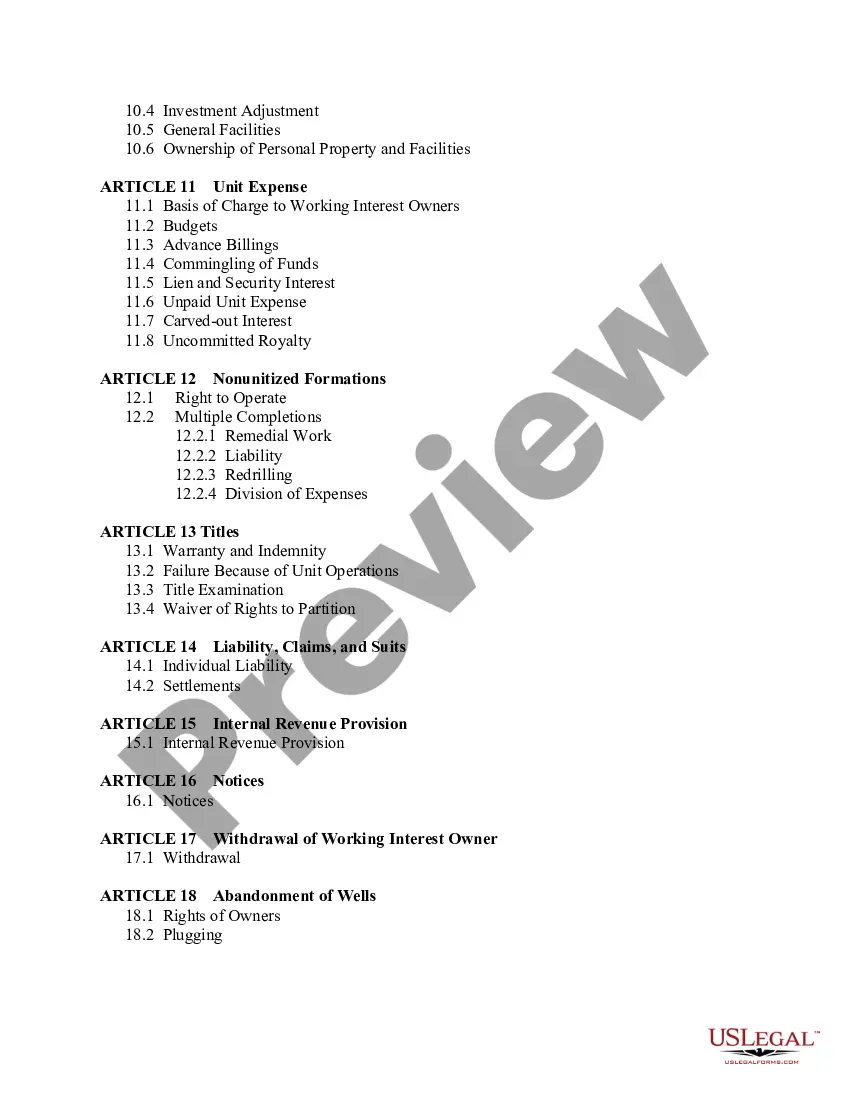

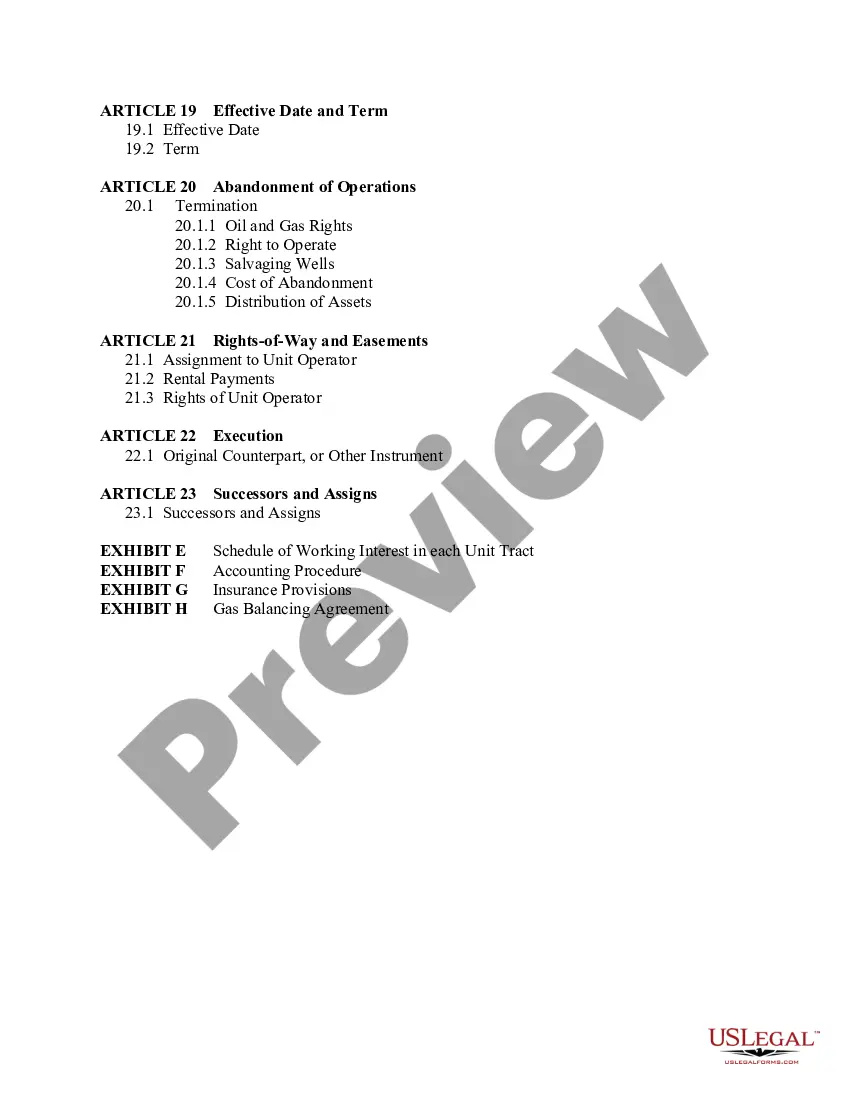

Nebraska Unit Operating Agreement

Description

How to fill out Unit Operating Agreement?

US Legal Forms - among the most significant libraries of legitimate types in America - gives a wide range of legitimate document web templates it is possible to download or printing. Utilizing the web site, you will get a huge number of types for organization and individual functions, sorted by types, says, or search phrases.You will discover the most up-to-date types of types like the Nebraska Unit Operating Agreement within minutes.

If you have a membership, log in and download Nebraska Unit Operating Agreement in the US Legal Forms library. The Down load option can look on each and every type you see. You gain access to all earlier delivered electronically types from the My Forms tab of your profile.

If you would like use US Legal Forms for the first time, here are easy guidelines to help you get started out:

- Ensure you have chosen the right type for your city/state. Go through the Review option to review the form`s articles. Browse the type information to ensure that you have selected the correct type.

- In case the type does not satisfy your requirements, use the Lookup industry at the top of the display screen to find the one that does.

- In case you are pleased with the shape, confirm your option by clicking the Purchase now option. Then, pick the rates prepare you favor and give your credentials to register for an profile.

- Approach the purchase. Use your charge card or PayPal profile to complete the purchase.

- Choose the file format and download the shape on your own device.

- Make modifications. Complete, modify and printing and signal the delivered electronically Nebraska Unit Operating Agreement.

Every single web template you included in your bank account lacks an expiry day and is yours for a long time. So, in order to download or printing one more backup, just visit the My Forms area and then click around the type you need.

Gain access to the Nebraska Unit Operating Agreement with US Legal Forms, the most considerable library of legitimate document web templates. Use a huge number of specialist and state-specific web templates that meet your business or individual needs and requirements.

Form popularity

FAQ

Another important part of the Operating Agreement is the provision that describes how profit is distributed to the members. Operating Agreements will also address the term of the LLC, how the initial capital is contributed, the tax status of the LLC, and other miscellaneous items such as the governing law.

A Nebraska LLC should have an operating agreement because a company cannot act for itself. In order to operate, LLCs require real humans (and other entities) to carry out company operations.

Many LLC owners ask, "How do I make a simple LLC operating agreement?" It's a legal document, but you don't necessarily need a lawyer to help you, although legal expertise is a good idea.

An operating agreement, also known in some states as a limited liability company (LLC) agreement, is a contract that describes how a business plans to operate. Think of it as a legal business plan that reads like a prenup.

Although writing an operating agreement is not a mandatory requirement for most states, it is nonetheless considered a crucial document that should be included when setting up a limited liability company. The document, once signed by each member (owner), acts as a binding set of rules for them to adhere to.

Colorado does not require you to submit an Operating Agreement to form your LLC. However, it is important for every LLC to have an Operating Agreement, establishing the rules and structure of the business.

An LLC operating agreement should contain provisions to cover: Basic information about the LLC. ... A profit and loss allocation plan. ... The LLC's purpose. The management structure. ... Ownership percentages of each member. ... Voting rights and procedures. ... Meeting frequency. Procedures for bringing in new members.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.