Nebraska Oil and Gas Division Order

Description

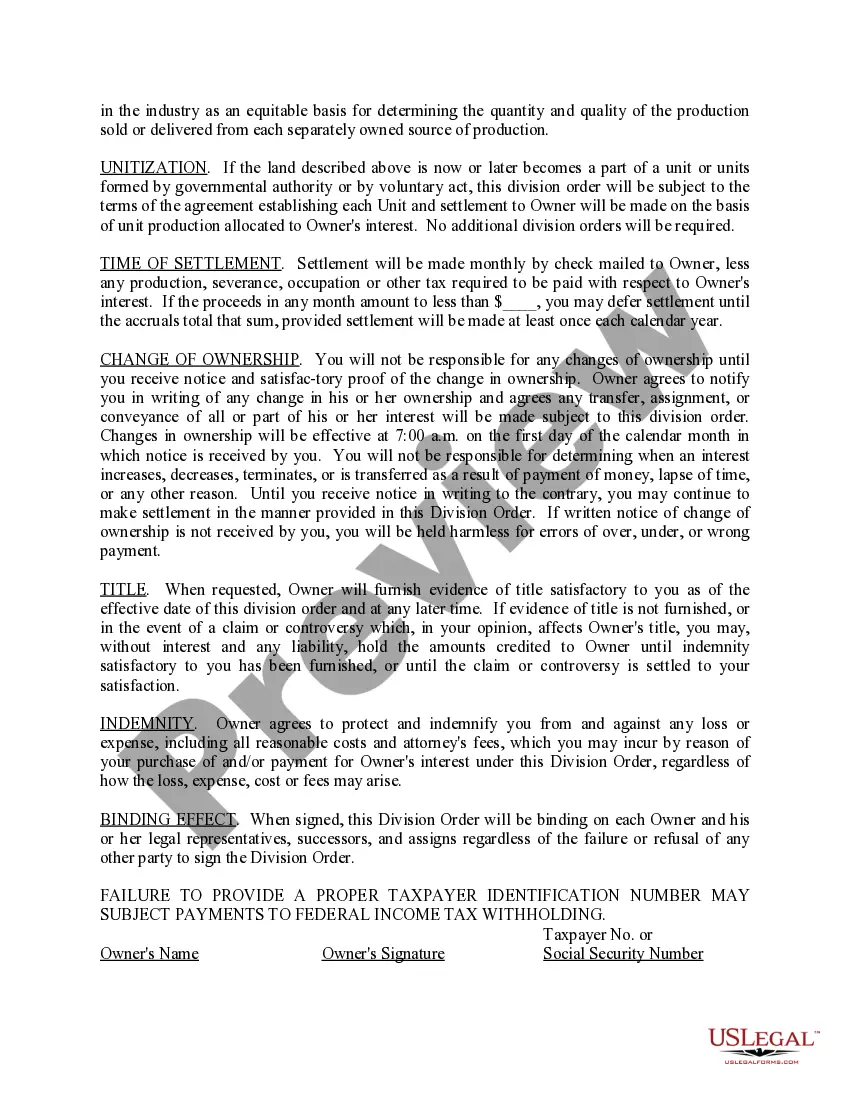

How to fill out Oil And Gas Division Order?

You may devote time on-line trying to find the lawful papers format that fits the federal and state requirements you need. US Legal Forms supplies 1000s of lawful types which are evaluated by pros. You can actually download or printing the Nebraska Oil and Gas Division Order from my support.

If you already have a US Legal Forms bank account, you may log in and click the Acquire button. Afterward, you may complete, edit, printing, or signal the Nebraska Oil and Gas Division Order. Every single lawful papers format you purchase is your own permanently. To have yet another backup for any purchased kind, proceed to the My Forms tab and click the related button.

If you use the US Legal Forms website the first time, stick to the easy directions beneath:

- First, make certain you have selected the right papers format for your area/metropolis that you pick. Browse the kind outline to make sure you have picked out the appropriate kind. If accessible, use the Review button to check throughout the papers format at the same time.

- If you wish to get yet another variation in the kind, use the Research field to get the format that suits you and requirements.

- Upon having discovered the format you need, click Buy now to proceed.

- Pick the prices prepare you need, key in your qualifications, and register for an account on US Legal Forms.

- Complete the financial transaction. You can use your bank card or PayPal bank account to purchase the lawful kind.

- Pick the format in the papers and download it to the gadget.

- Make modifications to the papers if necessary. You may complete, edit and signal and printing Nebraska Oil and Gas Division Order.

Acquire and printing 1000s of papers layouts making use of the US Legal Forms Internet site, which provides the largest assortment of lawful types. Use skilled and state-particular layouts to deal with your company or person requirements.

Form popularity

FAQ

The Nebraska Oil and Gas Conservation Commission was founded in 1959. Its mission is to permit the development of Nebraska's oil and natural gas resources up to the maximum efficient rate of production while promoting the health, safety, and environment of the residents of Nebraska. Nebraska Oil and Gas Conservation Commission - Nebraska.gov ne.gov ne.gov

Law Enforcement Nebraska Game and Parks Commission - Division of Law Enforcement (Conservation Officers)General natureCivilian policeOperational structureHeadquartersLincoln, NebraskaConservation Officers61 (as of 2023)10 more rows

member board of commissioners oversees the Nebraska Game and Parks Commission. The commissioners are appointed by the Nebraska Governor and confirmed by the Legislature. Eight of the commissioners serve each of eight districts across the state. The ninth serves at large.

The mission of the Nebraska Game and Parks Commission is stewardship of the state's fish, wildlife, park, and outdoor recreation resources in the best long-term interests of the people and those resources.

Exploration teams found their first successful well southeast of Gurley in Cheyenne County in 1949, pulling 225 barrels a day from a depth of 4,429 feet. Crude oil production in Nebraska in 10-year intervals shows the up and down production and market cycle of oil in the state.