Nebraska Tree Surgeon Agreement - Self-Employed Independent Contractor

Description

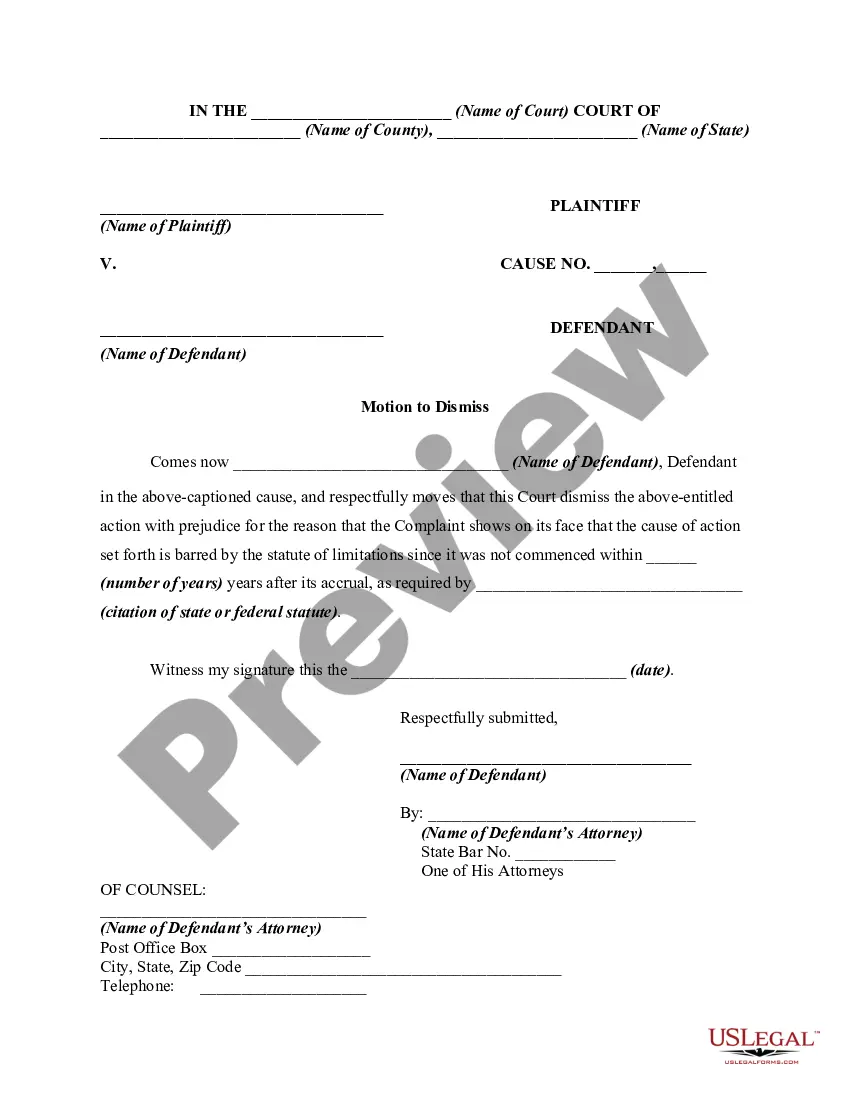

How to fill out Tree Surgeon Agreement - Self-Employed Independent Contractor?

You can spend numerous hours online searching for the legal document template that satisfies the state and federal standards you require.

US Legal Forms offers thousands of legal forms that are reviewed by professionals.

You can conveniently download or print the Nebraska Tree Surgeon Agreement - Self-Employed Independent Contractor from my services.

First, ensure you have chosen the correct document template for your desired county/town. Review the form description to confirm you have selected the right one.

- If you have a US Legal Forms account, you can Log In and click the Download button.

- Afterward, you can fill out, modify, print, or sign the Nebraska Tree Surgeon Agreement - Self-Employed Independent Contractor.

- Every legal document template you acquire is yours permanently.

- To receive an additional copy of the purchased form, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

There are a number of advantages to being a contractor. Contract work provides greater independence and, for many people, a greater perceived level of job security than traditional employment. Less commuting, fewer meetings, less office politics and you can work the hours that suit you and your lifestyle best.

Contractors can also be self-employed, but they perform tasks on a contractual basis, rather than selling any products or rolling, bookable services. For example, a plumber would work for a client according to an agreed, one-off contract.

Here's what you need to know to start and build a successful business as a self-employed contractor.Be Sure You Want to Be Self-Employed.Get Financing in Place Beforehand.Create a Business Plan.Name, Register, and Insure Your Contracting Business.Market Your Business.Be Your Own Accountant, for Starters.More items...?

The 5 personality traits that make a successful contractorConfidence. To become a successful contractor - it's important to have confidence in your own abilities.Personable.Flexibility.Problem Solving.Honesty.07-Mar-2018

Independent Contractor Responsibilities:Liaising with the client to elucidate job requirements, as needed.Gathering the materials needed to complete the assignment.Overseeing the assignment, from inception to completion.Tailoring your approach to work to suit the job specifications, as required.More items...

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

An independent contractor is a person employed by a corporation. He needs to complete a particular job or project rather than assigning that work to an employee. The business assigns the task to the independent contractor, i.e. it is not the business that determines whether the project or job is to be done.