Nebraska Incentive and Nonqualified Share Option Plan

Description

How to fill out Incentive And Nonqualified Share Option Plan?

If you want to total, down load, or printing authorized papers web templates, use US Legal Forms, the most important variety of authorized forms, that can be found on the web. Utilize the site`s basic and hassle-free search to get the papers you require. A variety of web templates for organization and person reasons are categorized by categories and states, or key phrases. Use US Legal Forms to get the Nebraska Incentive and Nonqualified Share Option Plan in just a number of mouse clicks.

When you are previously a US Legal Forms consumer, log in for your accounts and then click the Obtain button to get the Nebraska Incentive and Nonqualified Share Option Plan. You can even gain access to forms you earlier saved inside the My Forms tab of the accounts.

If you are using US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Make sure you have chosen the shape for the correct area/land.

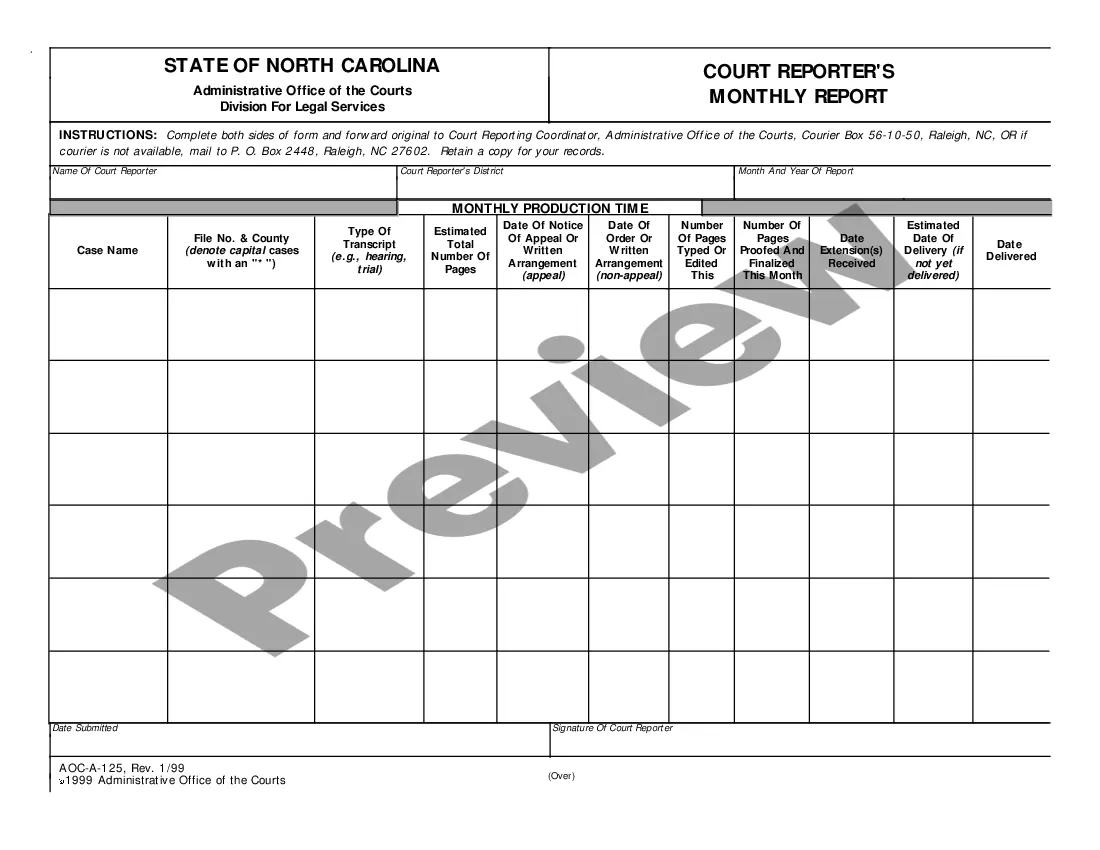

- Step 2. Utilize the Review option to check out the form`s content. Never forget about to read the outline.

- Step 3. When you are not happy with all the kind, utilize the Research discipline towards the top of the monitor to discover other versions of the authorized kind template.

- Step 4. When you have found the shape you require, click the Purchase now button. Select the rates strategy you prefer and add your accreditations to sign up on an accounts.

- Step 5. Approach the deal. You should use your Мisa or Ьastercard or PayPal accounts to finish the deal.

- Step 6. Choose the format of the authorized kind and down load it in your device.

- Step 7. Full, change and printing or sign the Nebraska Incentive and Nonqualified Share Option Plan.

Each authorized papers template you buy is your own property permanently. You have acces to each and every kind you saved inside your acccount. Go through the My Forms segment and decide on a kind to printing or down load yet again.

Compete and down load, and printing the Nebraska Incentive and Nonqualified Share Option Plan with US Legal Forms. There are thousands of skilled and express-distinct forms you can utilize to your organization or person needs.

Form popularity

FAQ

What Is a Non-Qualified Stock Option (NSO)? A non-qualified stock option (NSO) is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option.

The Cost Basis of Your Non-Qualified Stock Options The cost basis is necessary because it is used to calculate capital gain/loss upon a subsequent sale of the exercised stock. The cost basis, generally speaking, is equal to the exercise price, multiplied by the number of shares exercised.

Taxation. The main difference between ISOs and NQOs is the way that they are taxed. NSOs are generally taxed as a part of regular compensation under the ordinary federal income tax rate. Qualifying dispositions of ISOs are taxed as capital gains at a generally lower rate.

NQOs are unrestricted. As such, they can be offered to anyone. That means that you can extend them to not just standard employees, but also directors, contractors, vendors, and even other third parties. ISOs, on the other hand, can only be issued to standard employees.

NSOs vs. RSUs NSOs give you the option to buy stock, but you might decide to never exercise them if the company's valuation falls below your strike price. In comparison, restricted stock units (RSUs) are actual shares that you acquire as they vest. You don't have to pay to exercise RSUs; you simply receive the shares.

Stock options grant employees the right to purchase shares, but it's not an obligation for them to do so. ISOs have the potential for favorable tax treatment. If a stock option isn't an ISO, it's typically referred to as a nonqualified stock option. NQOs don't qualify for special tax treatment.

Income tax upon exercise When you exercise NSOs and opt to purchase company shares, the difference between the market price of the shares and your NSO strike price is called the ?bargain element.? The bargain element is taxed as compensation, which means you'll need to pay ordinary income tax on that amount.

Incentive stock options (ISOs) are a form of equity compensation that allows you to buy company shares for a specific exercise price. ISOs are a type of stock option?they are not actual shares of stock; you must exercise (buy) your options to become a shareholder.