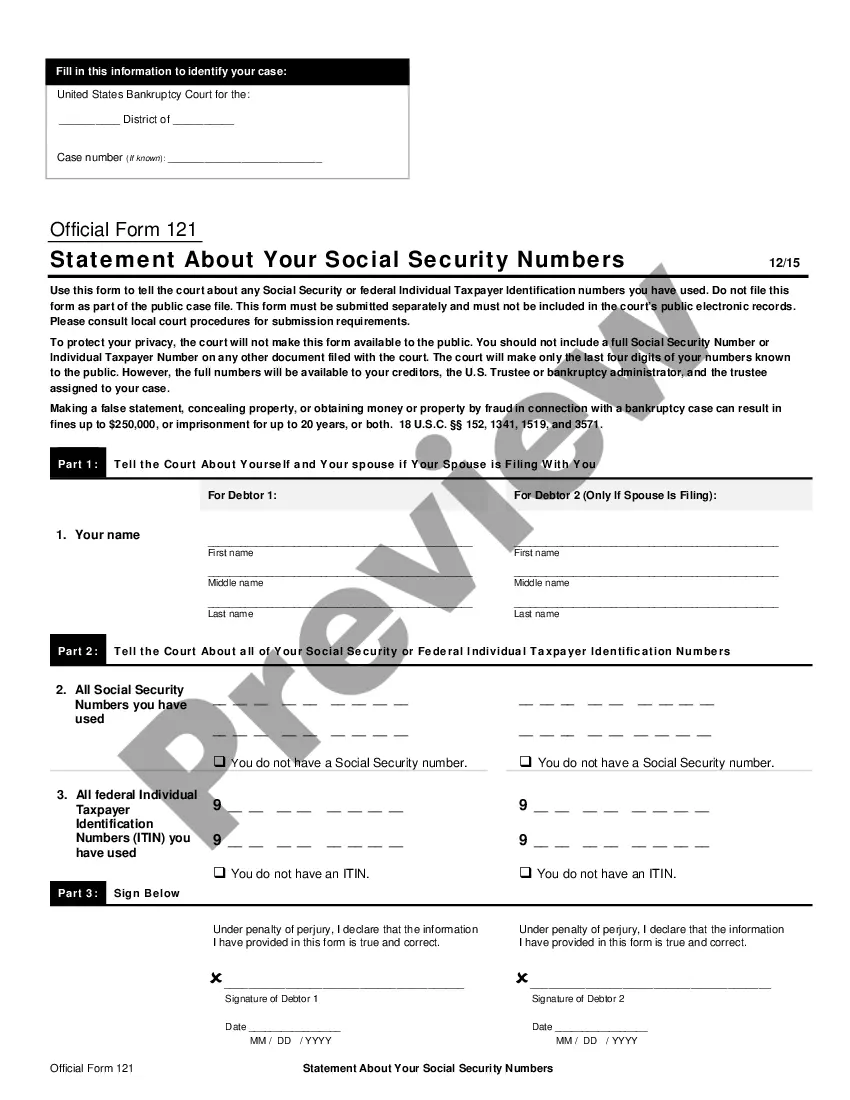

Nebraska Statement of Social Security Number

Description

How to fill out Statement Of Social Security Number?

US Legal Forms - among the most significant libraries of legitimate varieties in America - gives a variety of legitimate papers web templates you can down load or print out. While using site, you will get 1000s of varieties for organization and specific purposes, categorized by classes, suggests, or key phrases.You can find the latest versions of varieties such as the Nebraska Statement of Social Security Number within minutes.

If you already have a membership, log in and down load Nebraska Statement of Social Security Number from the US Legal Forms collection. The Obtain button can look on each form you view. You have accessibility to all formerly acquired varieties in the My Forms tab of your respective profile.

In order to use US Legal Forms for the first time, listed below are basic instructions to get you started out:

- Be sure to have picked out the proper form for your personal area/region. Click on the Preview button to analyze the form`s information. See the form information to actually have selected the proper form.

- If the form doesn`t satisfy your demands, utilize the Look for area on top of the display to get the one who does.

- When you are satisfied with the form, affirm your choice by simply clicking the Purchase now button. Then, pick the rates strategy you favor and provide your references to sign up to have an profile.

- Process the purchase. Make use of your Visa or Mastercard or PayPal profile to complete the purchase.

- Select the file format and down load the form in your device.

- Make changes. Fill up, edit and print out and indication the acquired Nebraska Statement of Social Security Number.

Every web template you included in your bank account does not have an expiry day and is the one you have for a long time. So, if you want to down load or print out another copy, just visit the My Forms segment and click on on the form you will need.

Obtain access to the Nebraska Statement of Social Security Number with US Legal Forms, probably the most comprehensive collection of legitimate papers web templates. Use 1000s of expert and express-particular web templates that satisfy your small business or specific requirements and demands.

Form popularity

FAQ

Nebraska tax on retirement income: Nebraska is one of the 11 states that still tax Social Security retirement benefits. However, this tax will be repealed in 2025. Military retirement income and Railroad Retirement benefits are tax-exempt.

If you already have a Nebraska Identification Number, you can find it on previous correspondence from the Nebraska Department of Revenue, by contacting the agency at 800-742-7474, or by visiting their Contact Us page for email.

The standard deduction in Nebraska is $7,350 for single filers and $14,700 for joint filers. You can claim a larger standard deduction if you or your spouse is over age 65 or blind.

Some of you have to pay federal income taxes on your Social Security benefits. This usually happens only if you have other substantial income in addition to your benefits (such as wages, self-employment, interest, dividends and other taxable income that must be reported on your tax return).

You must mail Form SS-5 and your supporting documents to your nearest Social Security office or take them there in person. While you can get a copy of Form SS-5 online?and even fill it out on your computer?you cannot submit the form online.

Documents you can use include: U.S. Social Security card. DD214 with full SSN. NGB 22 with full SSN. W-2 Form with full SSN (including W-2C, W-2G, etc.) SSA-1099 Form with full SSN (including SSA-1099-SM, SSA-1099-R-OP1, etc.) Non-SSA 1099 Form with full SSN (including 1099-DIV, 1099-MISC, etc.)

For taxable years beginning on or after January 1, 2021, federal adjusted gross income (AGI) is reduced by a percentage of the social security benefits that are received and included in federal AGI. For tax year 2021, the percentage reduction is 5%.

Reduces the top individual and business income tax rates to 3.99% by tax year 2027. Delivers full tax exemption for Social Security benefits a year early in 2024. Provides tax credits related to child care, for families and providers.