Nebraska Worksheet Analyzing a Self-Employed Independent Contractor

Description

How to fill out Worksheet Analyzing A Self-Employed Independent Contractor?

Are you presently in a situation where you require documents for either organizational or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can trust isn’t straightforward.

US Legal Forms provides thousands of form templates, such as the Nebraska Worksheet Analyzing a Self-Employed Independent Contractor, which are designed to adhere to federal and state regulations.

If you identify the appropriate form, click on Get now.

Select the pricing plan you desire, fill in the necessary information to create your account, and pay for the transaction using your PayPal or Visa/Mastercard. Choose a convenient document format and download your version.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Nebraska Worksheet Analyzing a Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you require and ensure it is appropriate for the correct area/county.

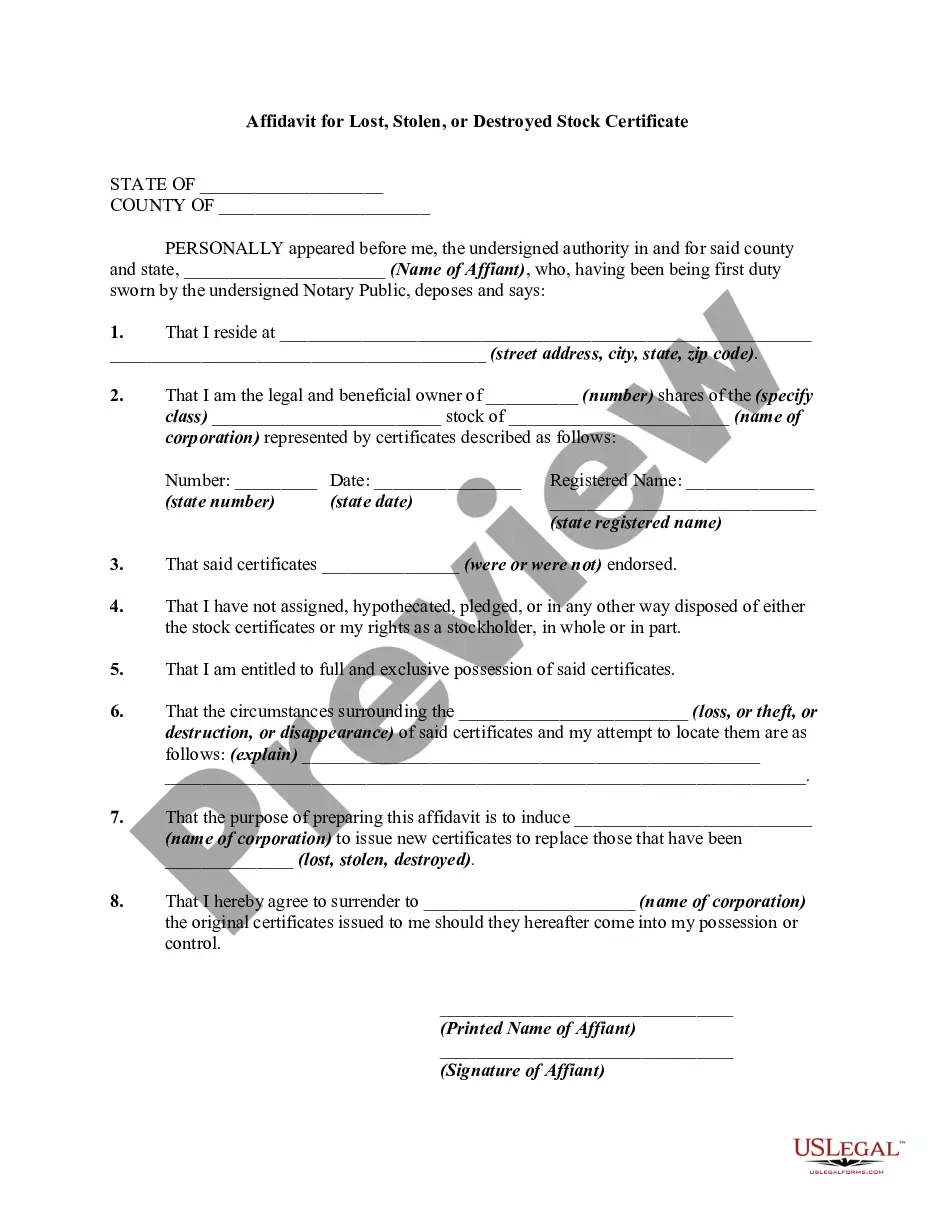

- Use the Preview button to take a look at the form.

- Review the details to confirm that you have chosen the right form.

- In case the form isn’t what you’re searching for, utilize the Search field to locate the form that fits your needs.

Form popularity

FAQ

Self-employed people are those who own their own businesses and work for themselves. According to the IRS, you are self-employed if you act as a sole proprietor or independent contractor, or if you own an unincorporated business.

A worker does not have to meet all 20 criteria to qualify as an employee or independent contractor, and no single factor is decisive in determining a worker's status. The individual circumstances of each case determine the weight IRS assigns different factors.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

The Common Law Test is a guide used by the IRS to determine if a worker should be classified as an employee or an independent contractor. The standard Common Law test indicates a worker is likely an employee if the employer has control over what work is to be done and how to get it done.

Terms in this set (20) What does the IRS look at in determining whether the worker is an employee or an independent contractor? the degree of control you have over the worker.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.