Nebraska Authorization of Consumer Report

Description

How to fill out Authorization Of Consumer Report?

Finding the appropriate legitimate document template can be quite a challenge.

Of course, there are numerous templates available online, but how do you obtain the valid document you need.

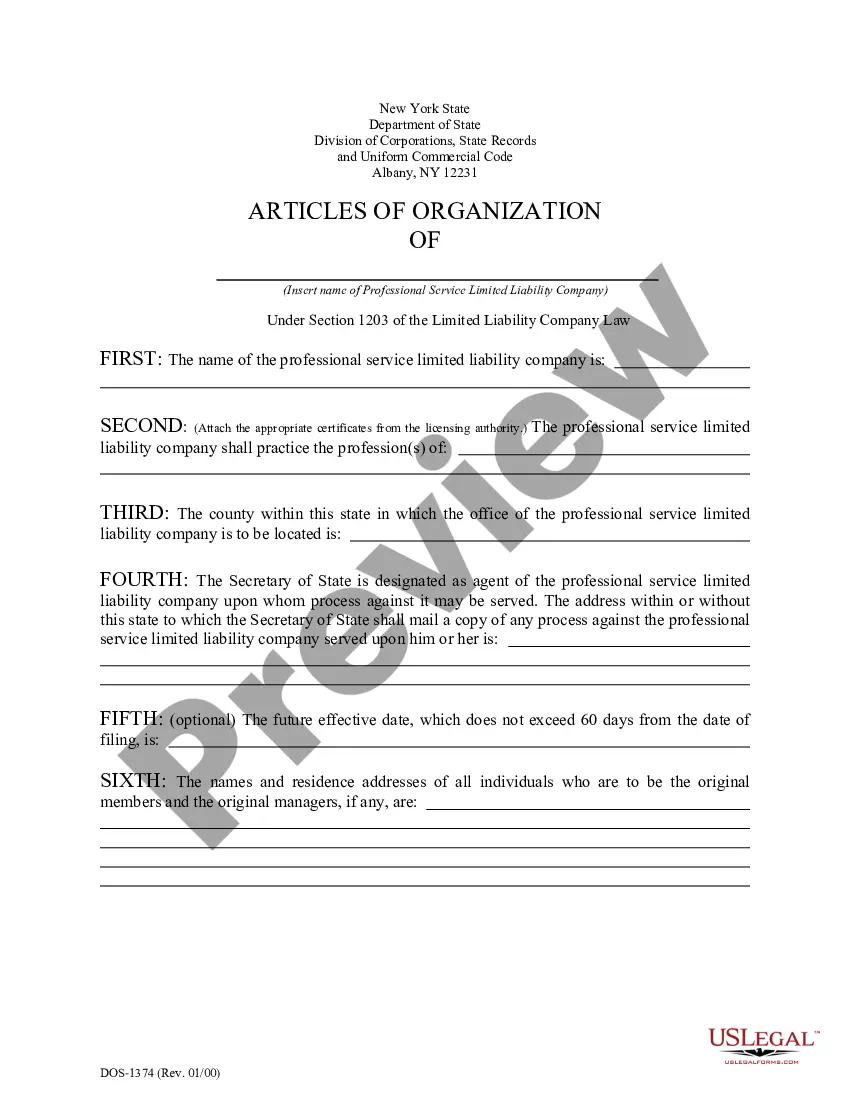

Utilize the US Legal Forms website. The service provides thousands of templates, including the Nebraska Authorization of Consumer Report, that can be utilized for business and personal purposes.

First, ensure you have selected the correct form for your city/state. You may preview the form using the Preview option and review the form details to confirm it is suitable for you.

- All of the forms are verified by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Obtain option to find the Nebraska Authorization of Consumer Report.

- Use your account to search through the legal forms you may have purchased earlier.

- Visit the My documents section of your account and acquire another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

Form popularity

FAQ

When you formally reject the applicant, you would be required to provide an adverse action notice. The applicants for a sensitive financial position have authorized you to obtain credit reports.

To dispute inaccurate information on your checking account consumer report, you should file a dispute with the checking account reporting company that compiled the report. You should also file a dispute with the bank, credit union, or company that provided the information to the checking account reporting company.

Under the FCRA, a background check report is called a "consumer report." This is the same "official" name given to your credit report, and the same limits on disclosure apply.

Information excluded from consumer reports further include: Arrest records more than 7 years old. Items of adverse information, except criminal convictions older than 7 years. Negative credit data, civil judgments, paid tax liens, and/or collections accounts older than 7 years.

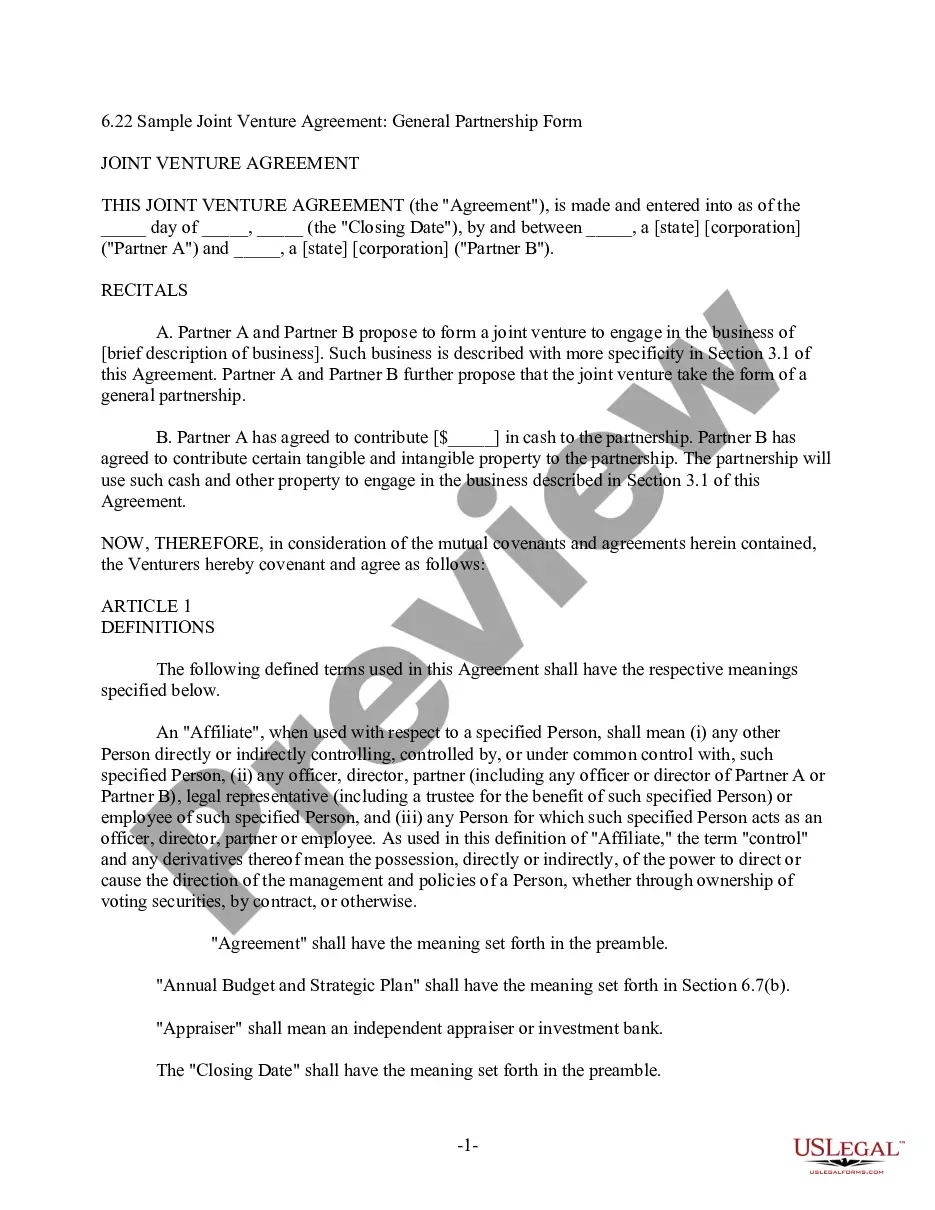

The applicant or employee must agree in writing to the release of the report to the employer. This written permission may be given on the notice itself.

Unlike federal law, California law also requires new consent each time an investigative report is sought during employment if the report is for purposes other than suspicion of wrongdoing or misconduct. Employers must provide the applicant or employee with the opportunity to request a copy of the report.

You must give your consent for reports to be provided to employers. A consumer reporting agency may not give out information about you to your employer, or a potential employer, without your written consent given to the employer. Written consent generally is not required in the trucking industry.

Get written permission from the applicant or employee. This can be part of the document you use to notify the person that you will get a consumer report. If you want the authorization to allow you to get consumer reports throughout the person's employment, make sure you say so clearly and conspicuously.

FCRA Authorization: Obtain Permission for a Background Check A compliant FCRA authorization form is an acknowledgement that a pre-employment background check will be conducted. It can be presented as a self-contained document or jointly with an FCRA disclosure form.

A consumer disclosure is the long version of your credit report that contains all credit inquiries and suppressed information not found in your standard credit report, as well as the normal credit report records of balances, payment history, personal information, etc.