Nebraska Equipment Maintenance Agreement with an Independent Sales Organization

Description

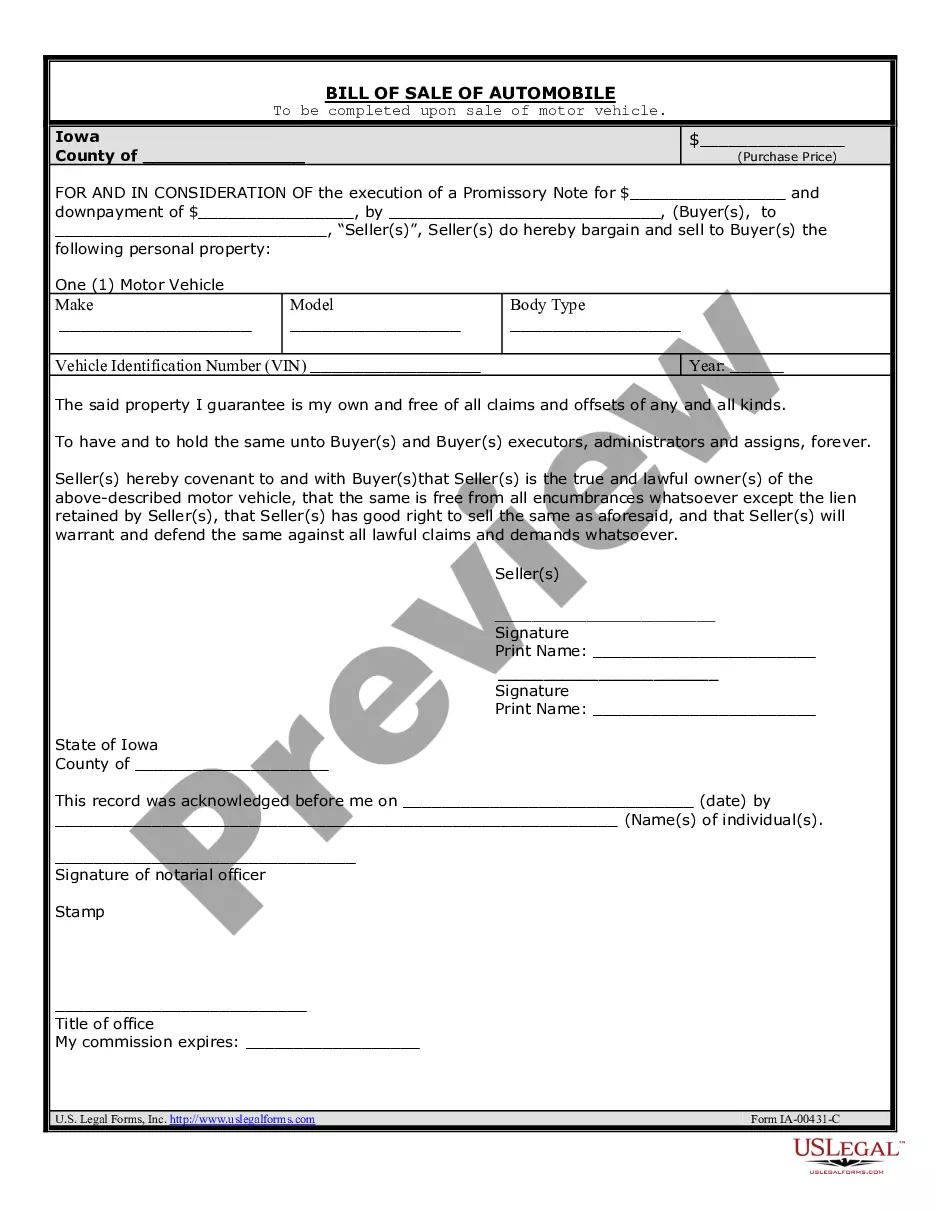

How to fill out Equipment Maintenance Agreement With An Independent Sales Organization?

If you need to full, download, or produce legal file themes, use US Legal Forms, the largest collection of legal forms, that can be found on the Internet. Use the site`s easy and convenient look for to obtain the documents you want. Different themes for enterprise and person functions are categorized by classes and says, or key phrases. Use US Legal Forms to obtain the Nebraska Equipment Maintenance Agreement with an Independent Sales Organization within a few clicks.

Should you be previously a US Legal Forms buyer, log in to your profile and click on the Download option to find the Nebraska Equipment Maintenance Agreement with an Independent Sales Organization. Also you can gain access to forms you formerly downloaded within the My Forms tab of the profile.

If you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Make sure you have selected the shape for that correct city/land.

- Step 2. Use the Review option to check out the form`s information. Never forget about to read the outline.

- Step 3. Should you be not happy together with the develop, make use of the Research industry towards the top of the screen to find other versions of the legal develop format.

- Step 4. After you have identified the shape you want, click on the Get now option. Pick the costs plan you like and put your credentials to sign up for an profile.

- Step 5. Method the deal. You may use your Мisa or Ьastercard or PayPal profile to finish the deal.

- Step 6. Choose the formatting of the legal develop and download it on your own product.

- Step 7. Complete, modify and produce or sign the Nebraska Equipment Maintenance Agreement with an Independent Sales Organization.

Each and every legal file format you get is yours permanently. You have acces to every single develop you downloaded in your acccount. Select the My Forms area and select a develop to produce or download once more.

Remain competitive and download, and produce the Nebraska Equipment Maintenance Agreement with an Independent Sales Organization with US Legal Forms. There are many specialist and status-certain forms you can use for the enterprise or person requirements.

Form popularity

FAQ

Traditional Goods or Services Goods that are subject to sales tax in Nebraska include physical property, like furniture, home appliances, and motor vehicles. Medicine, groceries, and gasoline are all tax-exempt. Some services in Nebraska are subject to sales tax.

However, in California many types of labor charges are subject to tax. Tax applies to charges for producing, fabricating, or processing tangible personal property for your customers. Generally, if you perform taxable labor in California, you must obtain a seller's permit and report and pay tax on your taxable sales.

A contractor who elects Option 1 is a retailer of building materials and fixtures purchased and annexed to real estate.

Exempt Sales of Maintenance Agreements Sales of maintenance agreements covering only real estate, fixtures, or structures are sales tax exempt.

Goods that are subject to sales tax in Nebraska include physical property, like furniture, home appliances, and motor vehicles. Medicine, groceries, and gasoline are all tax-exempt. Some services in Nebraska are subject to sales tax.

Option 3 contractors are consumers of all manufacturing machinery and equipment purchased and annexed by them. Option 3 contractors must pay tax on purchases of machinery and equipment even if the machinery and equipment will be used by a manufacturer.

A contractor who elects Option 2 is the consumer of building materials and fixtures purchased and annexed to real estate. Option 2 contractors must: 2714 Obtain a Nebraska Sales Tax Permit by filing a Nebraska. Tax Application, Form 20, provided the Option 2. contractor makes over-the-counter retail sales or sales.

Charges for production and assembly labor are taxable. Charges for repair and installation labor are taxable when the property being repaired, replaced, or installed is taxable. See Sales and Use Tax Regulation 1-082, Labor Charges.

The labor charge is not subject to tax, provided it is separately stated on the invoice (an Option 1 contractor does not charge tax on contractor labor charges that are itemized separately). An Option 1 contractor is required to hold a Nebraska Sales Tax Permit.