Nebraska Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator

Description

How to fill out Agreement To Devise Or Bequeath Property To Grantors Who Convey Property To Testator?

Are you currently in a location where you frequently require documents for either business or personal matters every day.

There are numerous legal document templates available online, but locating reliable ones isn't easy.

US Legal Forms offers a vast array of document templates, such as the Nebraska Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator, designed to meet federal and state requirements.

Select a convenient file format and download your copy.

You can find all the document templates you have purchased in the My documents section. You can download an additional copy of the Nebraska Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator at any time if needed. Just select the required document to obtain or print the file template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Nebraska Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and confirm it is for the correct city/county.

- Use the Review button to inspect the form.

- Read the description to ensure you have selected the correct document.

- If the document isn’t what you’re looking for, use the Search field to find the form that meets your needs and requirements.

- Once you have the right document, click Buy now.

- Choose the pricing plan you need, fill in the necessary details to create your account, and pay for the order using PayPal or credit card.

Form popularity

FAQ

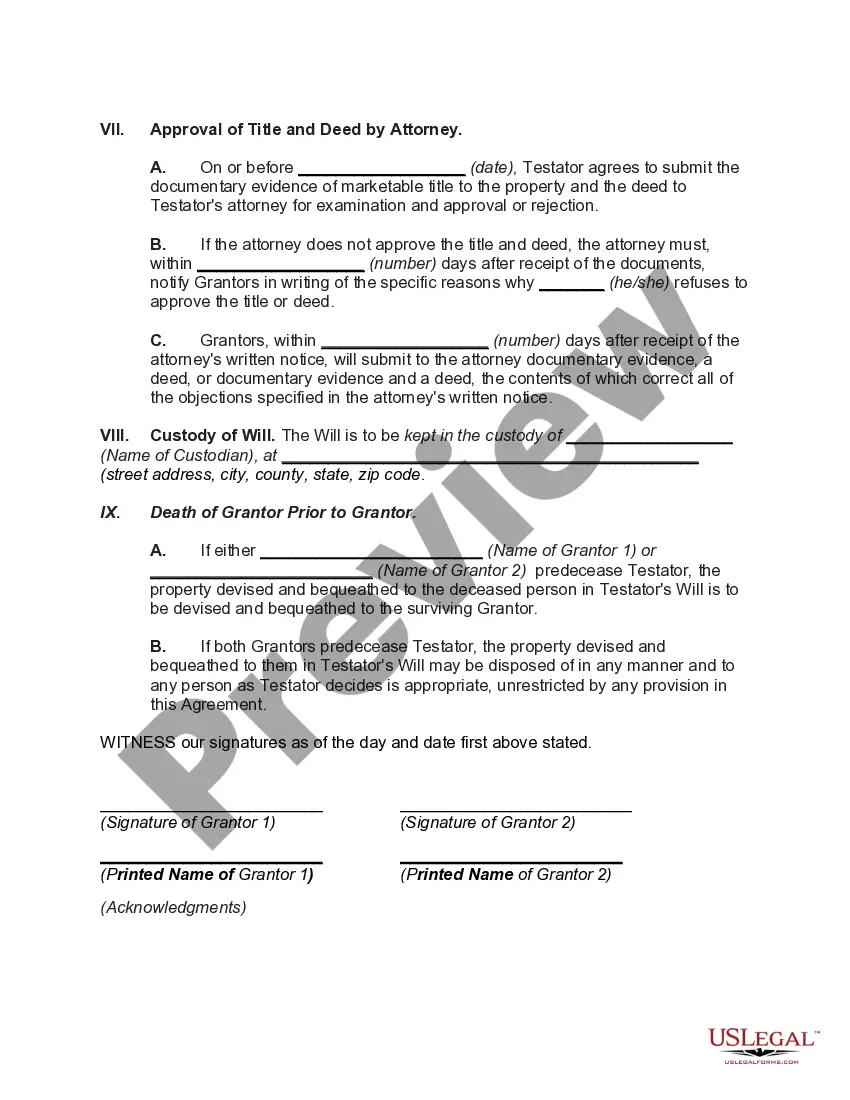

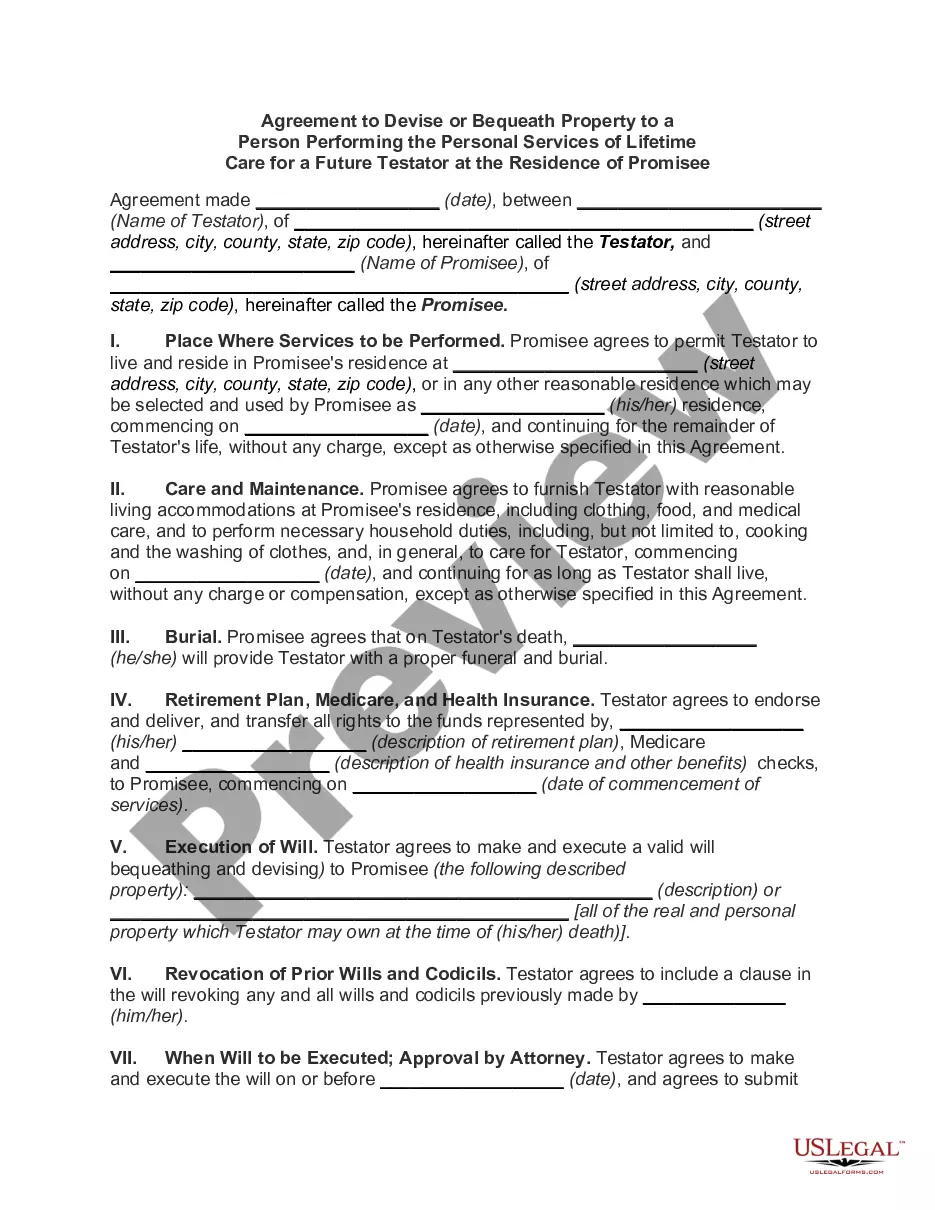

Statute 76-3410 in Nebraska defines the procedures and conditions under which real property may be transferred on death. It establishes the legal framework that supports the transfer on death deed and ensures that the transfer of property occurs seamlessly after the property owner’s death. This statute works in conjunction with the Nebraska Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator, simplifying the process of passing property to designated beneficiaries while bypassing probate issues.

Statute 30-24129 in Nebraska addresses the rights of individuals to devise property through will, specifically related to future interests. This statute helps clarify the legal framework around bequeathing property, ensuring that the wishes of the testator are upheld after death. It aligns with the provisions of the Nebraska Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator, guiding the proper execution of property transfers. Understanding this statute is crucial for anyone involved in estate planning in Nebraska.

Once they finalise the distribution, heirs can draw a family settlement deed where each member signs, which can then be registered for official records. To transfer property, you need to apply at the sub-registrar's office. You will need the ownership documents, the Will with probate or succession certificate.

The Act allows an individual to transfer property located in Nebraska to one or more beneficiaries effective at the transferor's death through the use of a special deed referred to as a Transfer on Death Deed.

Leaving Your Property Some Other Way Before you list those specific bequests, you will name a beneficiary or beneficiaries to get "everything else" in your estate-- that is, all of the property that is left over after the specific gifts are distributed.

Most estates will need to go through probate in Nebraska unless they meet one of a few exceptions, such as being in a living trust. However, Nebraska offers simplified probate procedures, which some estates will qualify for. To be eligible for simplified probate, the estate must be valued at less than $50,000.

A gift given by means of the will of a decedent of an interest in real property.

For a valid transfer, record the deed at the recording office in the county where the property is located. Contact the same office to confirm accepted forms of payment. All transfers of real property are subject to a documentary stamp tax. The tax is due at the time of recording.

Make sure you enter all the essential personal details, including name, address, place and date, correctly; put in the full name and relationship of beneficiaries; mention the assets precisely; have it done in the presence of two witnesses; and sign it along with the witnesses and their details.

1 : to give or leave by will (see will entry 2 sense 1) used especially of personal property a ring bequeathed to her by her grandmother. 2 : to hand down : transmit lessons bequeathed to future generations.