Nebraska Assignment of LLC Company Interest to Living Trust

Description

How to fill out Assignment Of LLC Company Interest To Living Trust?

If you want to be thorough, obtain, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the site's user-friendly and convenient search to find the documents you require.

Various templates for business and personal purposes are categorized by types and regions, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your credentials to sign up for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the payment.

- Utilize US Legal Forms to acquire the Nebraska Assignment of LLC Company Interest to Living Trust in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to retrieve the Nebraska Assignment of LLC Company Interest to Living Trust.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the template for the correct city/state.

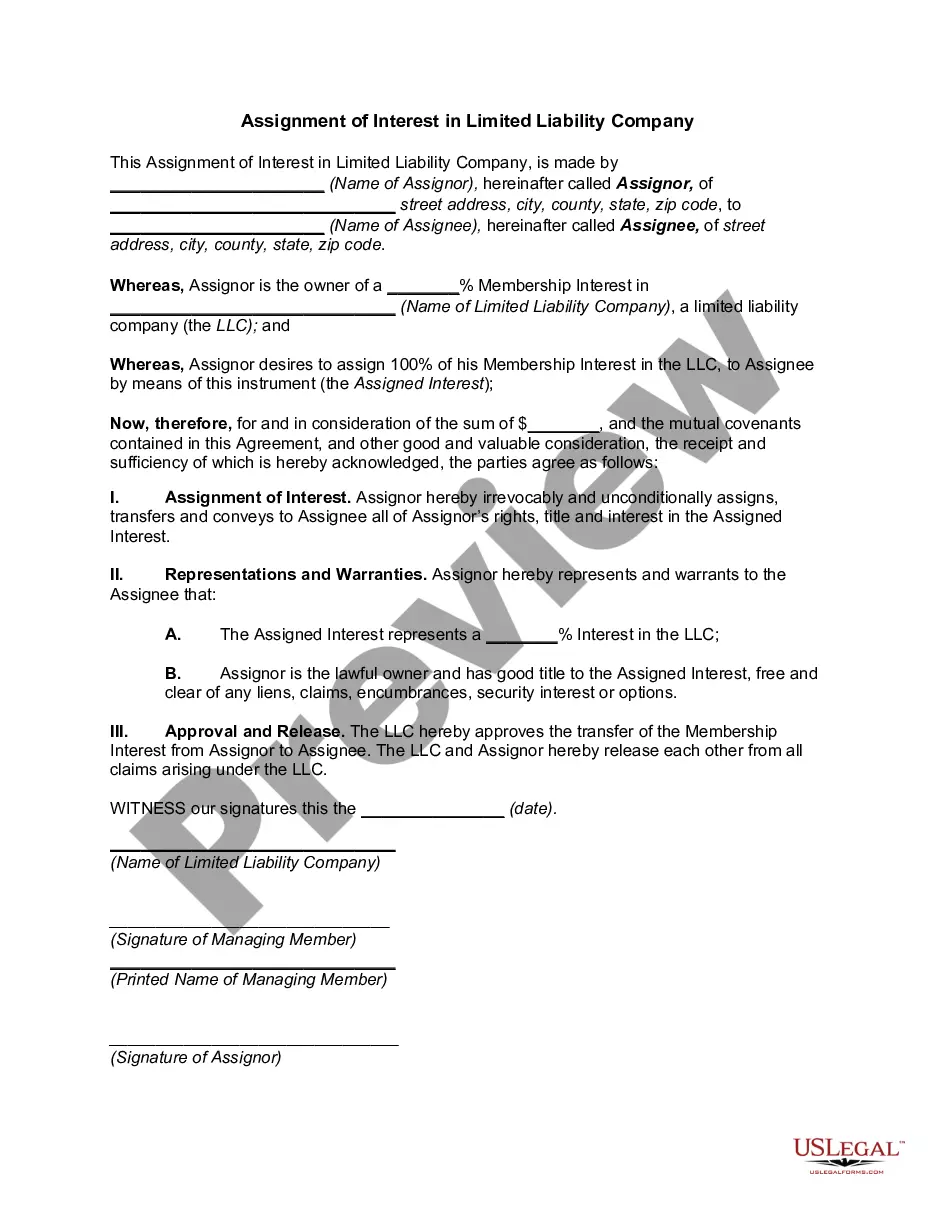

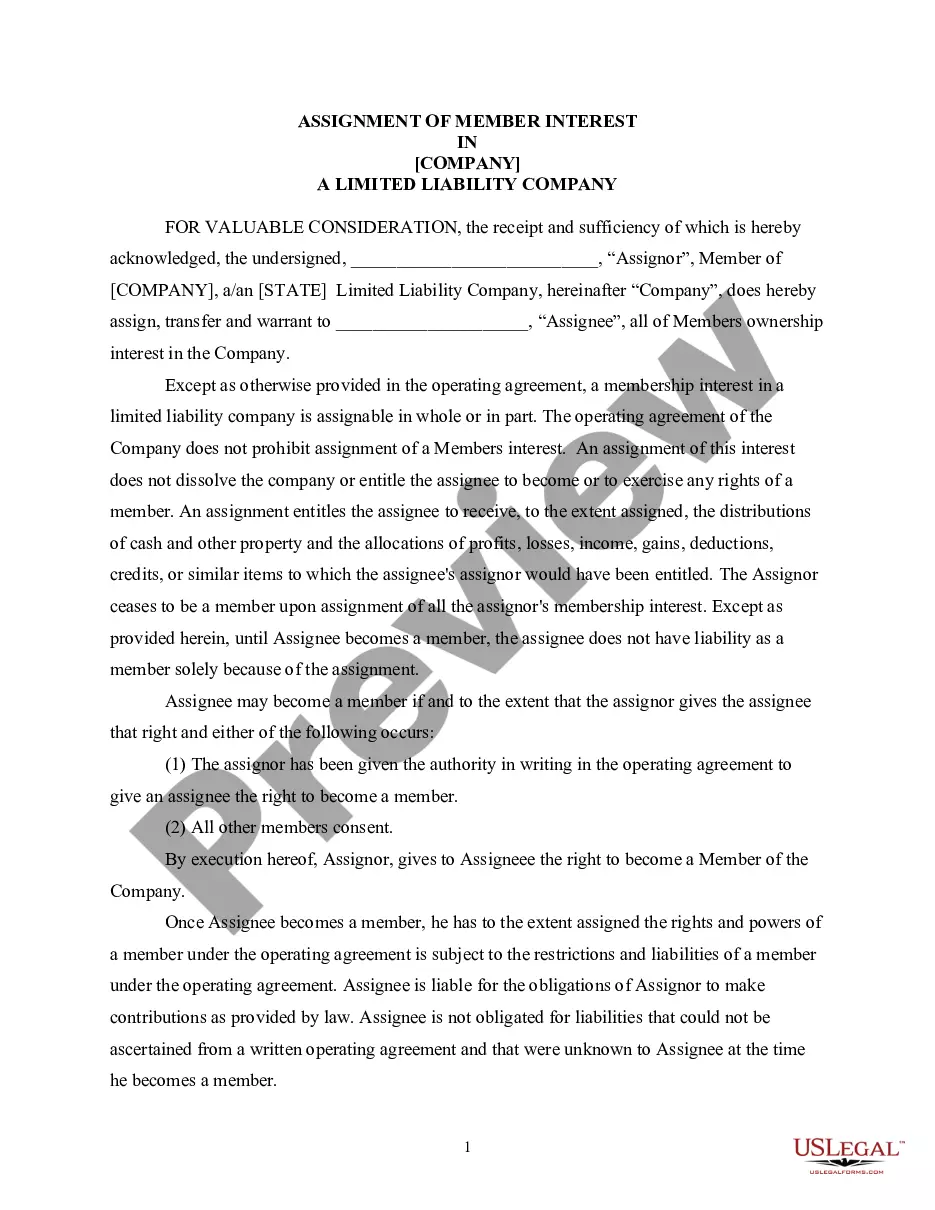

- Step 2. Use the Preview option to review the document's contents. Don't forget to read the description.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find alternative legal document templates.

Form popularity

FAQ

When it comes to owning and operating a business one of the most tax effective and flexible business structures is a discretionary family trust. It is not uncommon for a business to be started as a sole operator or a partnership of individuals, and then transfer the business to a family trust.

If an LLC member's interest is held in a trust, then the administrator, sometimes called a "trustee," will vote and otherwise exercise the duties and rights of the LLC member. Transferring the membership interest to the trust could require an official transfer document, which is similar to a bill of sale.

The answer is yes. First, trust law permits trusteeswho are acting on behalf of trusts, including revocable truststo own any asset, or almost any asset, that an individual can own, and this includes an interest in an LLC, which qualifies as an asset.

Unless the trust agreement explicitly prevents LLC ownership, then there is no law preventing an LLC from being owned by a trust. Most clients prefer their trust own the LLC for privacy, asset protection, avoiding probate and other reasons.

The answer is yes, a trust can own an LLC, either as the sole owner or as one of many owners.

If an LLC member's interest is held in a trust, then the administrator, sometimes called a "trustee," will vote and otherwise exercise the duties and rights of the LLC member. Transferring the membership interest to the trust could require an official transfer document, which is similar to a bill of sale.

Most LLC agreements have a rule that members cannot sell or otherwise transfer their LLC interests unless approved in advance (typically by the manager or some percentage of the members) or allowed under another provision of the transfer section, such as an ROFR or ROFO.

The answer is yes. First, trust law permits trusteeswho are acting on behalf of trusts, including revocable truststo own any asset, or almost any asset, that an individual can own, and this includes an interest in an LLC, which qualifies as an asset.