A nonprofit corporation is one that is organized for charitable or benevolent purposes. These corporations include certain hospitals, universities, churches, and other religious organizations. A nonprofit entity does not have to be a nonprofit corporation, however. Nonprofit corporations do not have shareholders, but have members or a perpetual board of directors or board of trustees.

Nebraska Articles of Incorporation for Non-Profit Organization, with Tax Provisions

Description

How to fill out Articles Of Incorporation For Non-Profit Organization, With Tax Provisions?

You can dedicate time online trying to locate the official document template that satisfies the federal and state requirements you will need.

US Legal Forms provides thousands of legal templates that can be reviewed by experts.

You can conveniently acquire or print the Nebraska Articles of Incorporation for Non-Profit Organization, with Tax Provisions through my assistance.

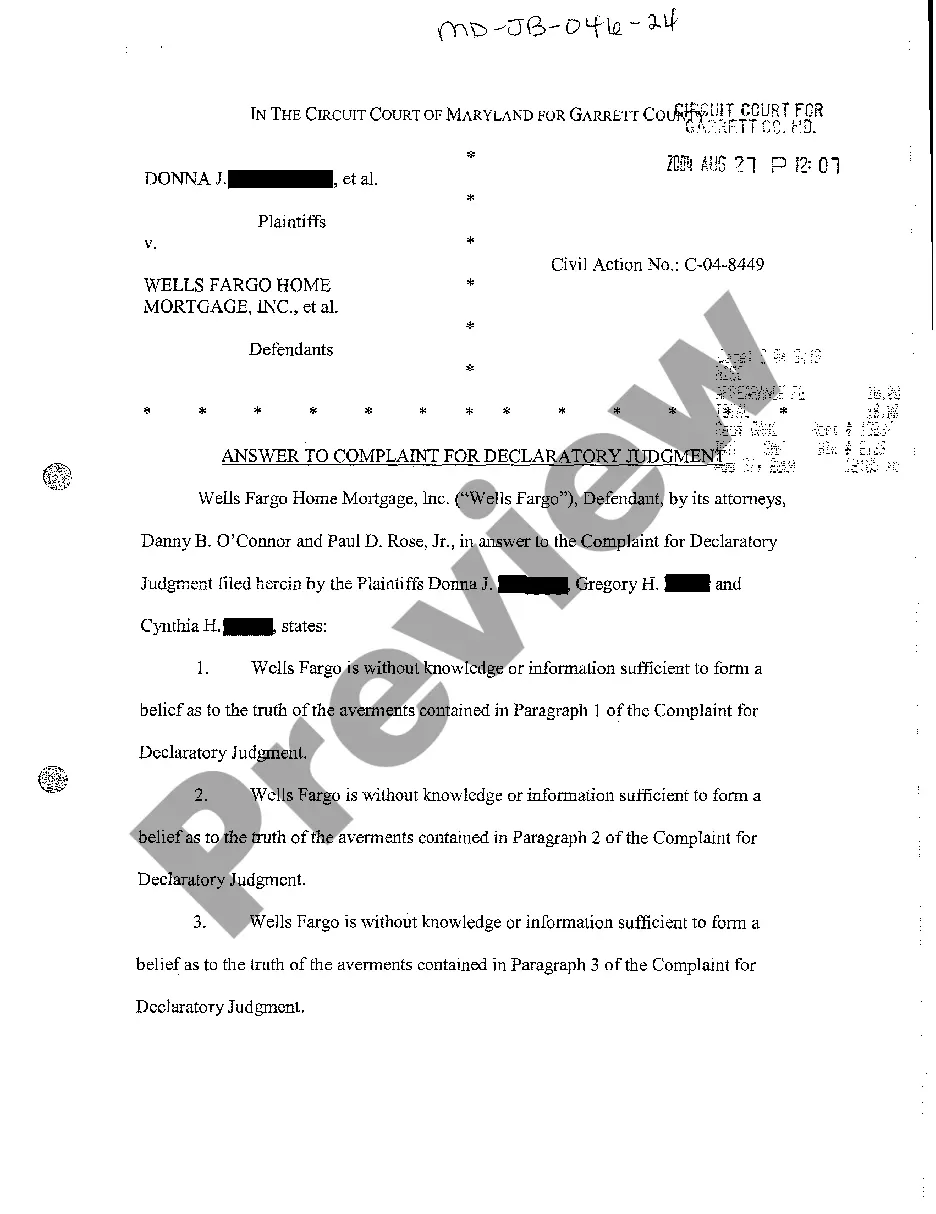

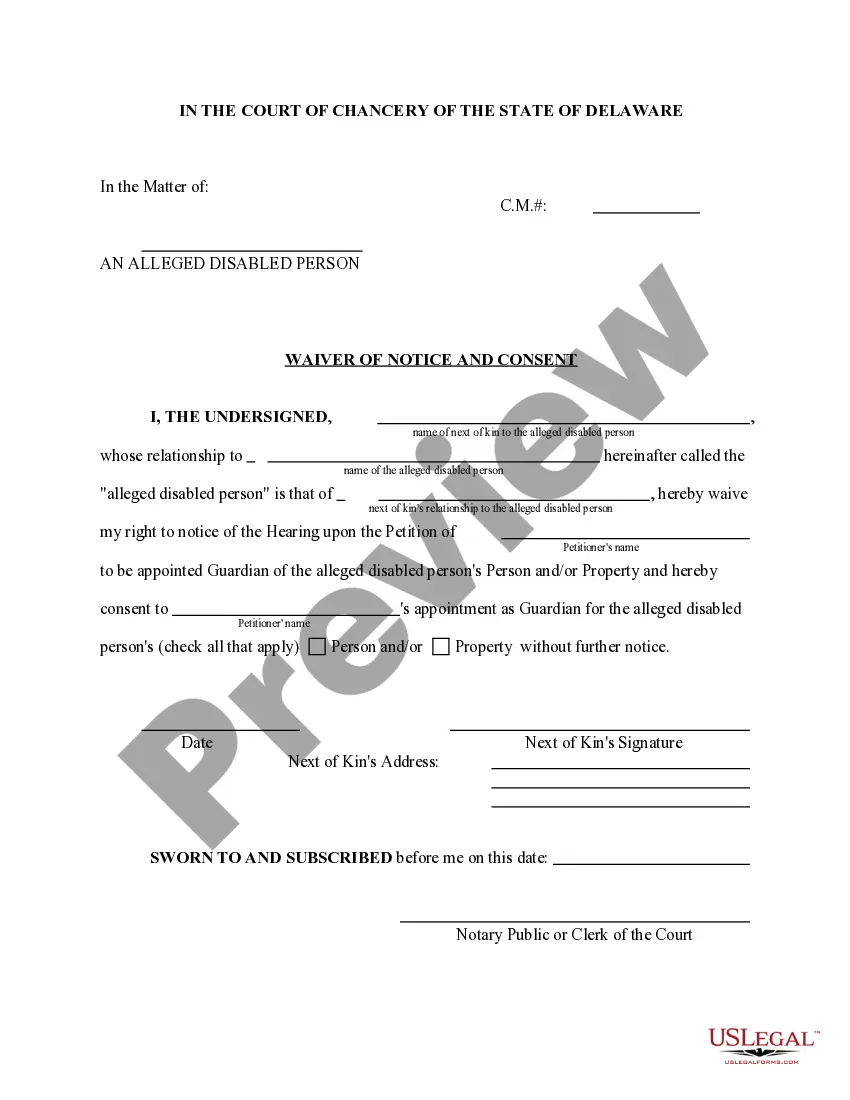

If available, utilize the Preview button to view the document template at the same time.

- If you already possess a US Legal Forms account, you can sign in and click the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Nebraska Articles of Incorporation for Non-Profit Organization, with Tax Provisions.

- Every legal document template you acquire is your property forever.

- To obtain another copy of a purchased form, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- Firstly, ensure that you have chosen the correct document template for the state/city of your preference.

- Review the form details to confirm you have selected the appropriate form.

Form popularity

FAQ

Yes, a 501(c)(3) organization must have articles of incorporation. These articles serve as the official record of your organization’s existence and outline its mission and structure. By properly drafting the Nebraska Articles of Incorporation for Non-Profit Organization, with Tax Provisions, you not only comply with legal requirements but also set a strong foundation for your organization’s future growth and impact.

The requirements for a 501(c)(3) organization include having a clear charitable purpose, conducting activities that further that purpose, and adhering to specific operational guidelines. Furthermore, your Nebraska Articles of Incorporation for Non-Profit Organization, with Tax Provisions, must meet state regulations to support your application for federal tax exemption. Ensure you seek legal advice or professional guidance when drafting these documents to avoid potential pitfalls.

To form a 501(c)(3) organization, you need to prepare several critical documents. The primary document is the Nebraska Articles of Incorporation for Non-Profit Organization, with Tax Provisions, which outlines your organization’s mission. You will also require bylaws that govern your organization and records of your board of directors’ meetings to establish transparency and compliance.

Yes, a 501(c)(3) organization needs articles of incorporation as a foundational document. The Nebraska Articles of Incorporation for Non-Profit Organization, with Tax Provisions, establish your organization legally and provide essential details such as the organization's purpose and structure. This step is crucial for obtaining tax-exempt status, as it demonstrates your commitment and readiness to operate as a non-profit.

Creating articles of incorporation for a non-profit involves several key steps. You need to define your organization's name, purpose, and structure in clear language. Consider using a reliable service like US Legal Forms to generate your Nebraska Articles of Incorporation for a Non-Profit Organization, with Tax Provisions efficiently. This will ensure your document is comprehensive and meets all legal requirements, saving you time and effort.

To obtain an articles of incorporation document for your non-profit, you can visit your state's Secretary of State website or utilize online platforms like US Legal Forms. These resources offer pre-prepared templates that simplify the process for you. Once you have your Nebraska Articles of Incorporation for a Non-Profit Organization, with Tax Provisions, follow the filing instructions provided by your state official's office.

The 33% rule is a guideline stating that a non-profit organization should allocate at least 33% of its total funds to charitable programs. This provision helps ensure that the majority of a non-profit's resources are directed towards its mission. Awareness of this rule is essential when drafting your Nebraska Articles of Incorporation for a Non-Profit Organization, with Tax Provisions. It illustrates your dedication to compliance and responsible fiscal management.

Yes, you can write your own Nebraska Articles of Incorporation for a Non-Profit Organization, with Tax Provisions. However, it is crucial to ensure that your document meets Nebraska's legal requirements. A poorly crafted article may lead to delays or complications in your non-profit status. Consider using the resources available on platforms like US Legal Forms to simplify the process.

An example of Nebraska Articles of Incorporation for a Non-Profit Organization includes sections that outline the organization's name, purpose, and the address of its principal office. Additionally, it contains information on the initial board of directors and any provisions regarding the distribution of assets upon dissolution. This structure not only satisfies legal requirements but also ensures your organization can operate smoothly while aligning with tax provisions. Accessing templates from US Legal Forms can give you a solid foundation for crafting your own articles.

To write Nebraska Articles of Incorporation for a Non-Profit Organization, start by gathering essential information like your organization's name, purpose, and registered agent. Clearly state your mission and ensure that it aligns with nonprofit guidelines. It is also important to include provisions for managing assets and addressing taxes, which are vital for maintaining your tax-exempt status. Using a reliable platform like US Legal Forms can simplify this process, providing templates that meet all legal requirements.