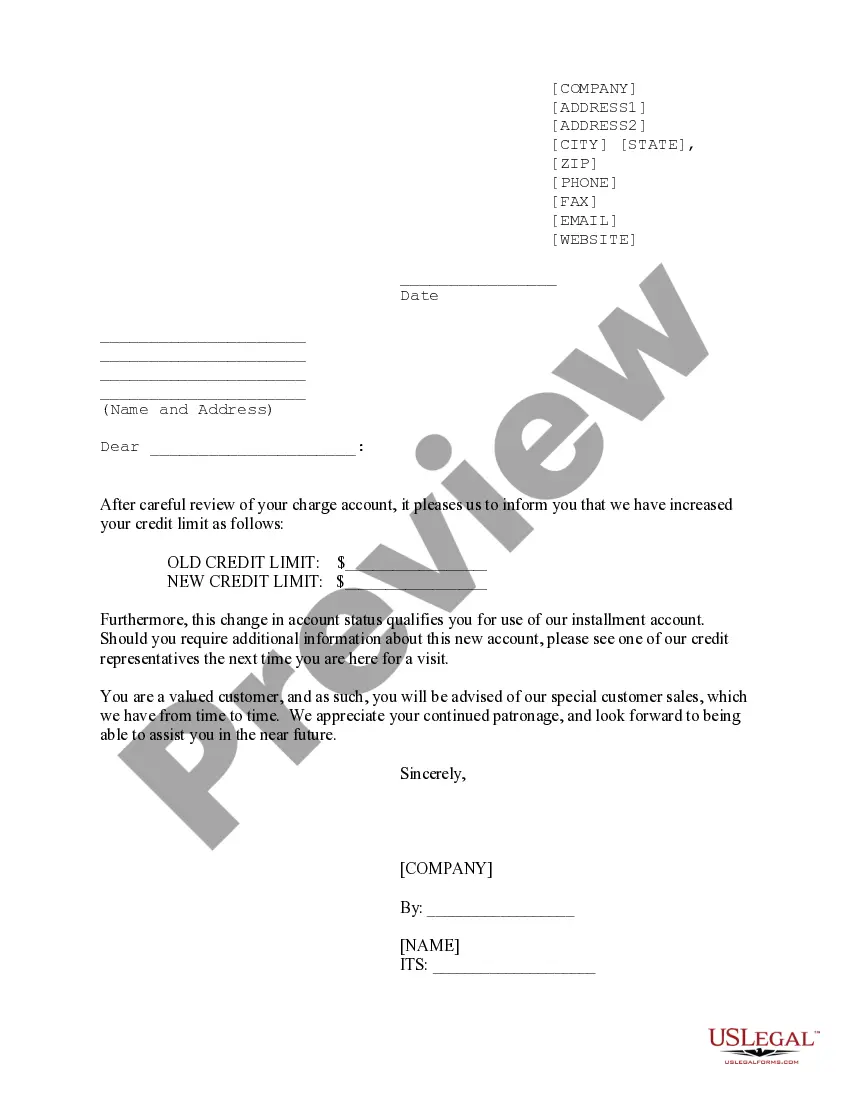

Nebraska Sample Letter for Notice of Charge Account Credit Limit Raise

Description

How to fill out Sample Letter For Notice Of Charge Account Credit Limit Raise?

You can invest time on the Internet searching for the valid document template that meets the federal and state requirements you need.

US Legal Forms provides a vast selection of valid forms that have been reviewed by specialists.

You can download or print the Nebraska Sample Letter for Notice of Charge Account Credit Limit Increase from the services.

If available, utilize the Review option to check the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Obtain option.

- After that, you can complete, modify, print, or sign the Nebraska Sample Letter for Notice of Charge Account Credit Limit Increase.

- Each valid document template you purchase is yours indefinitely.

- To receive another copy of any acquired form, go to the My documents tab and click the corresponding option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the appropriate document template for the state/city you choose.

- Review the form description to confirm you have selected the correct document.

Form popularity

FAQ

Although a credit limit increase is generally good for your credit, requesting one could temporarily ding your score. That's because credit card issuers will sometimes perform a hard pull on your credit to verify you meet their standards for the higher limit.

Respected Sir/ Madam, My name is (Name) and I do hold a cash credit limit in your branch i.e. (Branch Name) bearing account number (Account number). I look forward to your kind and quick support. In case of any queries, you may contact me at (Contact number).

I am writing to request an increase of $5,000.00 in my credit limit with Doe. My current limit is insufficient to cover my monthly purchases at your firm. As you know, my credit history with you is spotless. I have always made payments on time, so I do not anticipate problems handling the increased limit.

Respected Sir/Madam, I like to state that my name is (Name) and, I hold a (name of credit card) credit card with your bank having credit card number (credit card number). I am writing this letter to ask you to kindly increase the limit of my credit card.

Increasing your credit limit can lower credit utilization, potentially boosting your credit score. A credit score is an important metric lenders use to determine a borrower's ability to repay. A higher credit limit can also be an efficient way to make large purchases and provide a source of emergency funds.

Options for getting a higher credit limitMake a request online. Many credit card issuers allow their cardholders to ask for a credit limit increase online.Call your card issuer.Look for automatic increases.Apply for a new card.

Credit cards with a $3,000 credit limit often require at least good credit. If your credit score is on the low side, your best bet is to open a secured credit card account and put down a $3,000 deposit. Your credit limit is equal to the amount of the security deposit.

At the same time, you don't want to ask for too much or seem too confident. For example, don't insist the rep double your credit limit. Instead, ask for 10 to 25% more up to $250 for every $1,000 in credit you already have. If you have excellent or even good credit, you may be able to ask for more.

According to Experian data from the second quarter of 2019, the average credit card limit in America is $31,015. This is a $834 increase from 2018 and a $3,049 increase over the previous five years.

A cardholder can also request the issuing bank for a hike in credit limit. There is usually no additional cost involved, though an increase through a card upgrade may attract charges. A lower credit utilisation ratio improves the card holder's credit score, making him a less risky customer in the eyes of the lender.